- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

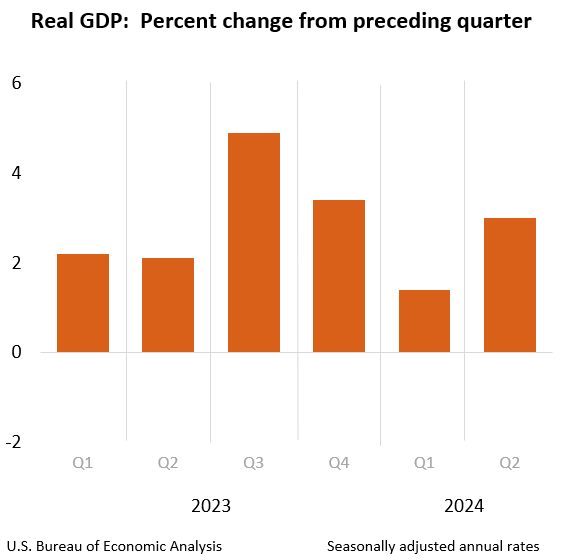

GDP for Q2: 3%

Posted on 8/30/24 at 10:10 am

Posted on 8/30/24 at 10:10 am

LINK

While we have UE going up and Inflation finally getting sub-3%, how much does such a strong GDP report impact the next Fed meeting? I think a .25 cut is still on the table (unless inflation goes back above 3% when the August numbers come in) but does GDP cool expectations of successive cuts?

quote:

Real gross domestic product (GDP) increased at an annual rate of 3.0 percent in the second quarter of 2024, according to the "second" estimate.

While we have UE going up and Inflation finally getting sub-3%, how much does such a strong GDP report impact the next Fed meeting? I think a .25 cut is still on the table (unless inflation goes back above 3% when the August numbers come in) but does GDP cool expectations of successive cuts?

Posted on 8/30/24 at 10:45 am to Bard

quote:

GDP for Q2: 3%

And that's "Real" GDP. Crazy, most people I know are tightening up, and yet the country as a whole seems to keep spending and letting the good times roll. How are the average credit card balances and debt loads looking? Maybe I'm just a pessimist/worrying for nothing.

Posted on 8/30/24 at 11:41 am to elposter

quote:

How are the average credit card balances and debt loads looking?

Continuing to rise.

quote:

Total household debt rose by $109 billion to reach $17.80 trillion, according to the latest Quarterly Report on Household Debt and Credit. Mortgage balances were up $77 billion to reach $12.52 trillion, while auto loans increased by $10 billion to reach $1.63 trillion and credit card balances increased by $27 billion to reach $1.14 trillion.

As one would expect, credit card delinquencies have continued to increase, bringing us back up to Q4 2011 levels (although it's still a little below the historical average of 3.733712). To understand what that means, it took almost a decade for this rate to go from it's point in Q4 2011 to the historic low in Q3 2021. In less than 3 years we've given up all that ground and this is now while inflation remains strong and unemployment is rising.

Posted on 8/30/24 at 11:51 am to elposter

quote:

Crazy, most people I know are tightening up, and yet the country as a whole seems to keep spending and letting the good times roll

It seems very localized. I'm in Nashville, where jobless rates are the lowest of any 1mm+ metro area at 2.9%. Things are booming here and show no signs of slowing down. Projects are coming out of the ground left and right. My company sells to other areas in the south and lower midwest, and sales have slowed or stopped in some of our other metro areas we sell to. For example, Atlanta has fallen off a cliff for us with several large projects put on hold. Louisville is another one. Western Tennessee has slowed, but Middle and Eastern Tennessee haven't missed a beat.

Posted on 8/30/24 at 11:59 am to Bard

Savings rate is at historical lows.

Posted on 8/30/24 at 12:30 pm to Ace Midnight

quote:

Savings rate is at historical lows.

Yep, that's another straw on the back of the economic camel. A recession in such a scenario (with all the things outlined thus far) would be brutal (and history pretty much mandates that a recession will happen not long after rates start getting cut).

Posted on 8/30/24 at 3:31 pm to Bard

Something tells me that a rate cut is not such a great idea

Posted on 8/30/24 at 4:07 pm to SlidellCajun

quote:Why? Real rates have been consistently positive for a year now, since at least April 2023 for both PCE and core PCE, and that gap has increased as both the effective fed funds rate is even higher and the PCE indexes are lower. There is >2.7% difference, and that’s been consistent for a few months now.

Something tells me that a rate cut is not such a great idea

In addition, job growth has decelerated, so while not to levels where you would expect the Fed to cut rates drastically, in combination with prices normalizing and the spread between the federal funds rate. Some gradual rate cuts are more than justified, especially given they’re both expected and Powell has now stated as much, confirming those expectations.

Changing course suddenly even if it’s not drastic, would probably do more harm than good, on top of being unnecessary.

Posted on 8/30/24 at 4:47 pm to Bard

quote:

Yep, that's another straw on the back of the economic camel. A recession in such a scenario (with all the things outlined thus far) would be brutal (and history pretty much mandates that a recession will happen not long after rates start getting cut).

I believe private debt to GDP is actually historically strong right now, but I could be wrong. Nominal debt is not a very useful indicator as it basically goes up in any economic expansion in US history.

Posted on 8/30/24 at 7:01 pm to slackster

quote:

I believe private debt to GDP is actually historically strong right now

It's about average for the last. 15-20 years LINK

I believe a lot (if not all) of the GDP growth we've seen over the last year or two is due to debt creation, which would be why it's coming in strong despite inflation being persistent and UE being higher than we have believed, and rising. If my hypothesis is true... yikes.

Posted on 8/30/24 at 7:55 pm to Bard

All these big spenders need to buy some US farm raised catfish cause our sales at the plant are abysmal and several farmers I know are on the verge of shutting down.

The problem is the restaurants and stores aren’t lowering prices at all even though our prices have been lowered. 2 years ago fish was 1.35 on pond bank, 100 dollars for 15 lb box of fillets from the plant. This led to prices at the stores of 9-14 dollars/lb which is of course high. This was post Covid when everything got fricked up. Now pond bank price is 1.10 and you can get a 15 lb box for 45-50 bucks. Store price should be 5-7 dollars lb but it’s still 10+ everywhere. Makes no sense because they can’t sell much volume. Hoping they drop it soon to increase volume cause the industry is sitting on huge inventory and many farmers are running out of money and can’t get sufficient cash flow

The problem is the restaurants and stores aren’t lowering prices at all even though our prices have been lowered. 2 years ago fish was 1.35 on pond bank, 100 dollars for 15 lb box of fillets from the plant. This led to prices at the stores of 9-14 dollars/lb which is of course high. This was post Covid when everything got fricked up. Now pond bank price is 1.10 and you can get a 15 lb box for 45-50 bucks. Store price should be 5-7 dollars lb but it’s still 10+ everywhere. Makes no sense because they can’t sell much volume. Hoping they drop it soon to increase volume cause the industry is sitting on huge inventory and many farmers are running out of money and can’t get sufficient cash flow

Posted on 8/30/24 at 8:16 pm to Bard

I’m sure it’ll be adjusted down after the election by 2%

Posted on 8/30/24 at 8:28 pm to Deuces

I don’t see how the economy is growing. Everyone I know in several different industries are struggling currently

Posted on 8/31/24 at 8:34 am to deltaland

The financial reporting of companies has been good all year. That drives a lot of economic numbers at the aggregate level.

Posted on 8/31/24 at 9:52 am to deltaland

quote:

I don’t see how the economy is growing. Everyone I know in several different industries are struggling currently

Most of the growth is in healthcare and government.

Posted on 8/31/24 at 10:49 am to Oenophile Brah

quote:

Most of the growth is in healthcare and government.

And it's a lagging indicator. That said, the expectation was that it should be slowing, not picking up. That uptick even while Inflation was still sticky at/above 3% and UE was ticking up is concerning.

Posted on 9/1/24 at 5:55 am to Bard

I can’t speak for everyone, but I personally have accepted the economy for what it is. I can’t sacrifice my quality of life much longer in hopes of better opportunities to spend. I have a hunch that many others that “suffered” through the covid era have the same mindset.

For example, we’re taking a financially irresponsible vacation in a couple weeks because if not now, then when?

For example, we’re taking a financially irresponsible vacation in a couple weeks because if not now, then when?

Posted on 9/1/24 at 10:44 am to buckeye_vol

Generally because the consumer debt level is historically high and I don’t see the economy slowing down to the point where we need to inject more money in

Popular

Back to top

5

5