- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 5/30/23 at 10:05 pm to Fe_Mike

Posted on 5/30/23 at 10:05 pm to Fe_Mike

I think I'm following. A lot of shorting (selling) floods the market so that drives down the price. This may be a dumb question but here goes. When a bunch of shorts happen, so do a bunch of buys, right? So the price would really come down to the sentiment more than just supply/demand?

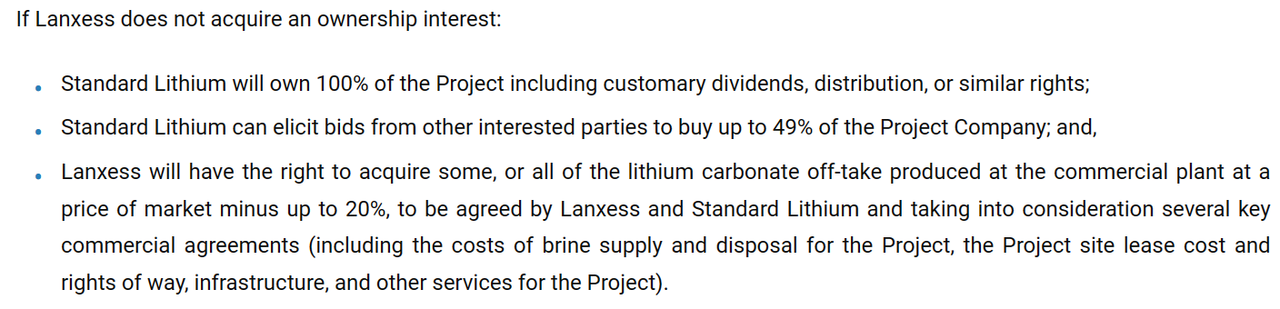

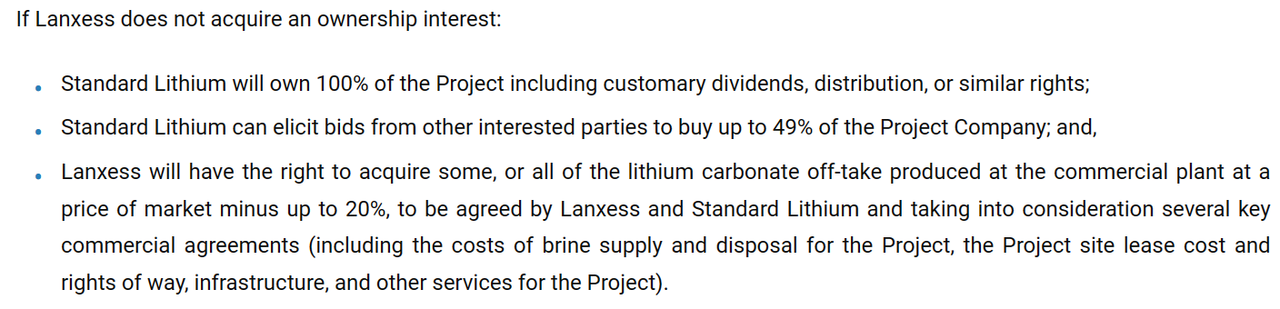

Also, sounds like Lanxess might still have the right to product discount even if they don't invest

Old SLI PR

Old SLI PR

Hoping the Lanxess DFS/FID and SWA PFS give us some momentum into construction.

Also, sounds like Lanxess might still have the right to product discount even if they don't invest

Old SLI PR

Old SLI PR Hoping the Lanxess DFS/FID and SWA PFS give us some momentum into construction.

Posted on 5/30/23 at 10:33 pm to Fe_Mike

Wow, thanks for this rundown. I had only read the Hindenburg report which succeeded in shaking my confidence in Mintak. Fortunately, we began getting some good PR before I could break even and run away, and I've since grown more confident with each PR. Enough about me.

I guess "Our research wasn't perfect" is a sufficient defense in this field. What a clever and wicked business to run. And even if an FeMike sends a certified (undeniable) letter laying out the canyon in their reasoning, their damage is already done as they walk to the bank.

The suit just begged the question, do these lawyers break into SLI periodically to disprove their tech? Why would a lawyer even take up such a flawed case? What a world.

I guess "Our research wasn't perfect" is a sufficient defense in this field. What a clever and wicked business to run. And even if an FeMike sends a certified (undeniable) letter laying out the canyon in their reasoning, their damage is already done as they walk to the bank.

The suit just begged the question, do these lawyers break into SLI periodically to disprove their tech? Why would a lawyer even take up such a flawed case? What a world.

Posted on 5/31/23 at 5:32 am to ev247

quote:

When a bunch of shorts happen, so do a bunch of buys, right?

Technically yes. Every seller must have a buyer. But not all are created equal. If more are selling than buying, the price will drop to find more buyers to equal the amount of sellers. There are two prices for a stock. The ‘bid’ and the ‘ask’. They are usually spread apart in value and different from the actual price the stock is trading at. So pretend there are two parties with interest in the stock. One is trying to buy a $1 stock and puts in a bid saying they will pay $0.99 for it. The other is trying to sell the same $1 stock and is ‘asking’ $1.01 for it.

If a trade is executed at the ‘ask’ it is considered a buy because the parties decided the value was $1.01 instead of $1; stock value is higher than market. If a trade is executed at the ‘bid’ level, it is generally considered a sale because at a simplified level it means the seller decided they couldn’t get the $1.01 they were asking and dropped the value to $0.99 so they could make the deal. Thus the value of the stock drops. This is generally what happens for a short sale.

This post was edited on 5/31/23 at 5:33 am

Posted on 5/31/23 at 3:58 pm to Fe_Mike

Interesting that it ended sideways today on a day the larger market took some hits. Had to slowly climb all day after profit takers early, interesting indeed...

Posted on 5/31/23 at 9:19 pm to Fe_Mike

Thank you for explaining, FeMike. This is much clearer now.

For fun, upcoming catalysts:

1. Lanxess DFS (estimated 6/31/23)

2. SWA PFS (estimated 6/31/23)

3. Lanxess FID (9/30/23?)

4. SWA offtake agreement(s) (2023?)

5. Lanxess 1a construction (2024?)

Missing anything?

For fun, upcoming catalysts:

1. Lanxess DFS (estimated 6/31/23)

2. SWA PFS (estimated 6/31/23)

3. Lanxess FID (9/30/23?)

4. SWA offtake agreement(s) (2023?)

5. Lanxess 1a construction (2024?)

Missing anything?

This post was edited on 5/31/23 at 9:38 pm

Posted on 6/1/23 at 1:01 am to ev247

Don’t overlook Koch’s continued involvement in the company. Wouldn’t be surprised if they take a larger stake.

Posted on 6/1/23 at 7:27 am to ev247

A federal government grant is a possibility too. I think Congressman Westerman visiting Standard Lithium was a good sign as far as that goes.

Posted on 6/1/23 at 7:52 am to Beerinthepocket

Good point. I remember someone on here saying that a project needed to be x far along to be grant eligible. I wonder what that point is, we can’t be too far off now..

Posted on 6/1/23 at 8:18 am to ev247

Also, just for fun:

2025- Commissioning/Startup- Catalina Wine Mixer

quote:

For fun, upcoming catalysts:

1. Lanxess DFS (estimated 6/31/23)- One Jetski

2. SWA PFS (estimated 6/31/23)- Dual Power poles on the boat

3. Lanxess FID (9/30/23?)- Second Jetski

4. SWA offtake agreement(s) (2023?) Tandem trailer for jetski's

5. Lanxess 1a construction (2024?) F250 W/ truck nuts

2025- Commissioning/Startup- Catalina Wine Mixer

This post was edited on 6/1/23 at 8:22 am

Posted on 6/1/23 at 11:40 am to Elusiveporpi

Realistically, what's the upside of the stock price? Are we talking $20, $50, $100? I need to see what type of F250 I'll be buying.

Posted on 6/1/23 at 12:44 pm to BigPerm30

IDK.

Looking back at the PFS, here are the numbers. Note that the #'s were based off of a selling price of $14,500 per ton. It has been up to $70,000 per ton and is currently at $30,000 per tonne.

IM sure someone knows how to evaluate a stock price from looking at the profit #'s.

Also keep in mind that this is one of several sites in the works.

Looking back at the PFS, here are the numbers. Note that the #'s were based off of a selling price of $14,500 per ton. It has been up to $70,000 per ton and is currently at $30,000 per tonne.

IM sure someone knows how to evaluate a stock price from looking at the profit #'s.

Also keep in mind that this is one of several sites in the works.

quote:

Table 1: PEA Highlights

Units Values

Average Annual Production (as LiOH•H2O) tpa[1] 30,000[2]

Plant Operation years 20

Total Capital Cost (CAPEX) US$ 869,868,000[3]

Operating Cost (OPEX) per year US$/yr 77,972,000[4]

OPEX per tonne US$/t 2,599

Initial Selling Price US$/t 14,500[5]

Average Annual Revenue US$ 570,076,000[6]

Discount Rate % 8.0

Net Present Value (NPV) Pre-Tax US$ 2,830,190,000

Net Present Value (NPV) Post-Tax US$ 1,965,427,000

Internal Rate of Return (IRR) Pre-Tax % 40.5

Internal Rate of Return (IRR) Post-Tax % 32.1

Posted on 6/1/23 at 1:12 pm to BigPerm30

quote:

Realistically, what's the upside of the stock price? Are we talking $20, $50, $100? I need to see what type of F250 I'll be buying.

exactly. lets cut the shite. how rich will I be in 2 years

Posted on 6/1/23 at 1:25 pm to jamiegla1

$33 per share with current lithium price in 2026.

IDK, I sure i would sell waayyyyy before it got that high

IDK, I sure i would sell waayyyyy before it got that high

Posted on 6/2/23 at 12:28 pm to Elusiveporpi

Has anyone looked at the debt ceiling bill to see energy funding?

The FB group dude is saying there’s expanded legislation that fits the bill for SLI.

The FB group dude is saying there’s expanded legislation that fits the bill for SLI.

Posted on 6/2/23 at 1:00 pm to Shepherd88

I didn't see anything in there about energy funding but there is a section that is supposed to streamline the environmental permitting process.

quote:

The package also includes new measures in the National Environmental Policy Act aimed at boosting the coordination, predictability and certainty associated with federal agency decision making, according to the White House source.

It will designate a single lead agency, charged with developing a single environmental review document, and also will require agencies to complete environmental reviews in one year, or two years for the most environmentally complex projects.

Posted on 6/2/23 at 1:01 pm to Shepherd88

WSJ: The Surprising New Source for Lithium Batteries

Don’t have WSJ but picture is of the SLI and they are mentioned.

Don’t have WSJ but picture is of the SLI and they are mentioned.

Posted on 6/2/23 at 1:05 pm to lighter345

Posted on 6/2/23 at 1:27 pm to lighter345

Holey sheeyut that’s awesome.

Posted on 6/2/23 at 2:23 pm to Shepherd88

Pulled my sell order on my October calls when I saw your WSJ story.

Posted on 6/2/23 at 2:45 pm to lighter345

All the sneaky stuff comes out on Fridays.

Popular

Back to top

1

1