- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Any way to get my name off a car loan and credit cards?

Posted on 8/16/23 at 1:15 pm

Posted on 8/16/23 at 1:15 pm

Going through a divorce.

I had a crazy drop in my credit score. I see that a car I financed for my wife is 6o days late and the credit card is between 30-60 days late.

I offered to help get the car current but she wants no help from me. Trying to act like she doesn't need my money. Which is fine. Uncontested divorce no payments. Good. The car I put $7k down on but she had made all the payments. She complained that the kids tuition of $2200 is more than half her monthly pay. Well that's not my fault. I'm not the one who left her for an older fatter poorer person.

Divorce not final yet, but I really want the car and card or of my name. I'm the #2 on both. I didn't think it could affect me this much. Now I'm worried she'll get a repo.

They are not my kids. They were step kids (as to why I'm not paying tuition) she wants me to buy a car for the kids. Which I already have but I'm not giving it to them because neither have said one word to me since the split.

Can I get my name off the car? After divorce or do I have to refinance it?

Do I sue to do that?

I had a crazy drop in my credit score. I see that a car I financed for my wife is 6o days late and the credit card is between 30-60 days late.

I offered to help get the car current but she wants no help from me. Trying to act like she doesn't need my money. Which is fine. Uncontested divorce no payments. Good. The car I put $7k down on but she had made all the payments. She complained that the kids tuition of $2200 is more than half her monthly pay. Well that's not my fault. I'm not the one who left her for an older fatter poorer person.

Divorce not final yet, but I really want the car and card or of my name. I'm the #2 on both. I didn't think it could affect me this much. Now I'm worried she'll get a repo.

They are not my kids. They were step kids (as to why I'm not paying tuition) she wants me to buy a car for the kids. Which I already have but I'm not giving it to them because neither have said one word to me since the split.

Can I get my name off the car? After divorce or do I have to refinance it?

Do I sue to do that?

Posted on 8/16/23 at 1:20 pm to Napoleon

quote:What?

I had a crazy drop in my credit score. I see that a car I financed for my wife is 6o days late and the credit card is between 30-60 days late.

I offered to help get the car current but she wants no help from me. Trying to act like she doesn't need my money. Which is fine. Uncontested divorce no payments. Good. The car I put $7k down on but she had made all the payments. She complained that the kids tuition of $2200 is more than half her monthly pay. Well that's not my fault. I'm not the one who left her for an older fatter poorer person.

Divorce not final yet, but I really want the car and card or of my name. I'm the #2 on both. I didn't think it could affect me this much. Now I'm worried she'll get a repo.

They are not my kids. They were step kids (as to why I'm not paying tuition) she wants me to buy a car for the kids. Which I already have but I'm not giving it to them because neither have said one word to me since the split.

Posted on 8/16/23 at 1:23 pm to Napoleon

Can’t you just sell the sailboat and pay all that debt off?

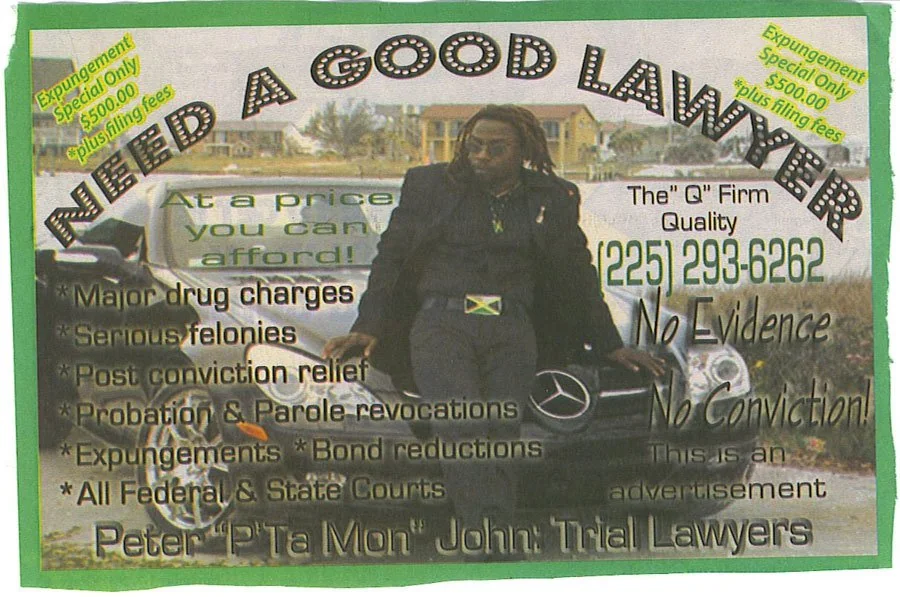

Just messing with you. Hope this all works out. Seems you need a good lawyer ASAP

Just messing with you. Hope this all works out. Seems you need a good lawyer ASAP

This post was edited on 8/16/23 at 2:14 pm

Posted on 8/16/23 at 1:55 pm to Napoleon

You must not have read my Getting Divorced Guide for OTers

Looks like you have not retained an attorney and are therefore experiencing the consequences of #8.

Looks like you have not retained an attorney and are therefore experiencing the consequences of #8.

quote:

My pager went off and I’m here to remind you of my rules for OTers getting divorced.

Here are my rules.

quote:

Getting Divorced Checklist

Retain an attorney. Again... Retain an attorney.

Immediate action items:

1) Secure and/or change all passwords. End all open sessions of social media. Make all of this private.

2) On your cell phone bill-if you have a joint account- pay the extra $ for detailed billing. Document communications with Jody.

3) If you are a W-9 employee and have direct deposit- change this. Open a new account at a different bank and deposit your salary there.Transfer money for shelter, transportation, children as necessary. Establish a new checking account with an address that is not your home address. (If she has access to your mail then you don’t have control)

4) Have a detailed copy of your tax returns going back 4-5 years.

5) Change mailing address/ enable paperless documents w/ new passwords for financial accounts.

6) Reduce/eliminate 401k contributions until judgement of divorce. IRA’s are ok to continue.

7) Inventory your home like you would for homeowners/flood insurance.

8) She has a window of opportunity to wreck your credit. Don’t let her.

9) Document, Document, Document Jody...even if it’s simply location tracking of her whereabouts. This will come into play for spousal support payments.

10) File first. Establish the date of separation... every day does count. This list is a 4:30 in the morning checklist and is put together from my own and friends experiences...it’s not meant to be complete- just a starting point. Divorce is about property, money and control. You gotta be on your toes or else you’ll get screwed.

It’s not a complete list but it covers the main things that you need to know.

Posted on 8/16/23 at 4:03 pm to Napoleon

You have a couple options, get an attorney immediately and have the issue rectified, but will take a while and your credit will continue to take a hit or make the payments yourself without her knowing until you get the situation resolved. No real easy solution.

You can’t just miraculously get removed as a borrower from an auto loan or credit card.

You can’t just miraculously get removed as a borrower from an auto loan or credit card.

Posted on 8/16/23 at 4:22 pm to Napoleon

Does she even have the financial ability to refinance into her name?

Friend of mine divorced 4 years ago. It was ugly. Still is ugly (kids involved). She bought a business while they were still married, she still owns it today. A $2M loan was taken out to finance the purchase of the business and the building.

Both spouses, along with the LLC, are named as co-borrowers (not just a personal guarantee, but a named co-borrower).

Part of the divorce settlement said she had to refinance and remove his name from the debt within 6 months of the date of signing. That was over 2.5 years ago. He is still listed on the debt.

He has sued her to enforce the agreement. She keeps saying she is trying but the bank won't agree to it, and she can't find another bank to do it (which is probably true... I have no concept how they got the loan in the first place).

Judge keeps saying, well as long as she's trying... nothing can be done.

How much are we talking? Can you just pay it off? Even if you have to borrow money yourself, just pay it off, and pay back your debt, and sleep better.

Friend of mine divorced 4 years ago. It was ugly. Still is ugly (kids involved). She bought a business while they were still married, she still owns it today. A $2M loan was taken out to finance the purchase of the business and the building.

Both spouses, along with the LLC, are named as co-borrowers (not just a personal guarantee, but a named co-borrower).

Part of the divorce settlement said she had to refinance and remove his name from the debt within 6 months of the date of signing. That was over 2.5 years ago. He is still listed on the debt.

He has sued her to enforce the agreement. She keeps saying she is trying but the bank won't agree to it, and she can't find another bank to do it (which is probably true... I have no concept how they got the loan in the first place).

Judge keeps saying, well as long as she's trying... nothing can be done.

How much are we talking? Can you just pay it off? Even if you have to borrow money yourself, just pay it off, and pay back your debt, and sleep better.

Posted on 8/16/23 at 4:31 pm to Napoleon

quote:

They are not my kids. They were step kids (as to why I'm not paying tuition) she wants me to buy a car for the kids. Which I already have but I'm not giving it to them because neither have said one word to me since the split.

LOL WUT....Sell that car and use it to retain a lawyer?

This post was edited on 8/16/23 at 4:33 pm

Posted on 8/16/23 at 7:26 pm to Napoleon

Trade her the kid’s car in exchange for removing your name from remaining liabilities ?

This post was edited on 8/16/23 at 7:29 pm

Posted on 8/16/23 at 7:48 pm to Napoleon

Never fricking co-sign on a debt which you do not take responsibility for paying and monitoring.

With a 50k take home, she probably can’t afford either debt repayment to be refinanced at current rates. That’s how you’re getting taken off before the court approves a settlement in two years.

If the car gets repossessed, a court is going to tell you to “maintain living standards” and make you provide her a comparable ride anyway until the divorce is finalized.

Don’t learn this expensive lesson again.

With a 50k take home, she probably can’t afford either debt repayment to be refinanced at current rates. That’s how you’re getting taken off before the court approves a settlement in two years.

If the car gets repossessed, a court is going to tell you to “maintain living standards” and make you provide her a comparable ride anyway until the divorce is finalized.

Don’t learn this expensive lesson again.

Posted on 8/16/23 at 7:52 pm to Napoleon

You chose poorly. No pussy is worth that crazy.

Posted on 8/16/23 at 7:53 pm to Napoleon

quote:

Well that's not my fault. I'm not the one who left her for an older fatter poorer person.

That' doesn't mean shite, you need a fricking attorny dude, she's gonna destroy you.

Posted on 8/17/23 at 7:21 am to bubbz

quote:

You have a couple options, get an attorney immediately and have the issue rectified, but will take a while and your credit will continue to take a hit or make the payments yourself without her knowing until you get the situation resolved. No real easy solution.

Sadly, this is correct. Bring the payments up to date, and continue to make payments to keep them up to date.

Document everything while doing this, and hire an attorney. In your divorce decree, ask/ensure that the court order states that she must repay this money back to you.

You should notify her that you are doing this (in writing), and even though I know she stated she wants no help from you, that doesn't matter. Your name is attached to the loan and credit cards, so you have a financial obligation to pay them back because if you don't, this will impact you negatively from a credit history standpoint.

Document. Paper trail. And get an attorney.

This post was edited on 8/17/23 at 7:23 am

Posted on 8/17/23 at 7:50 am to Napoleon

I have no advice but you just made me feel a whole lot better about the divorce I’m going through. Good lord man, prayers sent.

Posted on 8/17/23 at 2:13 pm to Will Cover

Only thing I'd add to this is

Do you have online access to the credit cards? If so, login, pay balance (document as Will suggested), and cancel cards immediately. You do not want a situation where you pay off the cards, and she just keeps using them.

quote:

Your name is attached to the loan and credit cards, so you have a financial obligation to pay them back because if you don't, this will impact you negatively from a credit history standpoint.

Do you have online access to the credit cards? If so, login, pay balance (document as Will suggested), and cancel cards immediately. You do not want a situation where you pay off the cards, and she just keeps using them.

This post was edited on 8/17/23 at 2:14 pm

Popular

Back to top

14

14