- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Ro Khanna Waves Off Looming Billionaire Exodus From Calif

Posted on 12/27/25 at 9:43 am

Posted on 12/27/25 at 9:43 am

Loading Twitter/X Embed...

If tweet fails to load, click here. Jared Walczak

@JaredWalczak

·

Follow

Not 1% for 5 years, but a 5% one-time (for now) tax on their entire net worth. Page, Thiel, and most others wouldn't be eligible for the 5-year payment option.

Just calling it a 1% (or 5%) tax, moreover, makes it sound akin to an income tax hike. It's on all assets, not income.

Garry Tan

@garrytan

·

Follow

A simpler explainer on the effects. It won’t just be Page and Thiel. It will stop future Googles and Nvidias from even starting in our state.

Why would you be for this?

Unrealized taxes on the fastest growing startups make sure the California dream ends for everyone

Posted on 12/27/25 at 9:53 am to Jbird

Taxes on net worth and unrealized gains should be fought with the same vigor as the taxes that started the American Revolution.

Posted on 12/27/25 at 9:53 am to Jbird

I hope those Commie idiots auger California straight into the ground.

Posted on 12/27/25 at 9:56 am to Jbird

He’s ridden them so long and mocking them. What will they do when they can’t take it away from others later

Posted on 12/27/25 at 10:04 am to Nosevens

quote:Exit tax to escape utopia.

He’s ridden them so long and mocking them. What will they do when they can’t take it away from others later

Posted on 12/27/25 at 10:25 am to Jbird

Do they have an exiting tax?

Posted on 12/27/25 at 10:26 am to BigTigerJoe

quote:They have floated the idea.

Do they have an exiting tax?

Posted on 12/27/25 at 10:30 am to Pvt Hudson

quote:

Taxes on net worth and unrealized gains should be fought with the same vigor as the taxes that started the American Revolution.

Property tax on the market value of your real estate (not your net but the gross value) is even more egregious, yet we all quietly pay 1%, 2%, and even 3% annually.

Posted on 12/27/25 at 10:38 am to Jbird

That’s when I’d resort to the FAFO method of paying an exit tax. I can’t comprehend how that is even remotely legal

Posted on 12/27/25 at 10:41 am to Pvt Hudson

quote:

Taxes on net worth and unrealized gains should be fought with the same vigor as the taxes that started the American Revolution.

Or just ask the Governor of New York how the post-pandemic loss of $13 billion in tax revenue has benefited New Yorkers. Ro is just posturing for the Eat the Rich constituents as he hopes to climb the ladder in his party.

Posted on 12/27/25 at 10:42 am to Jbird

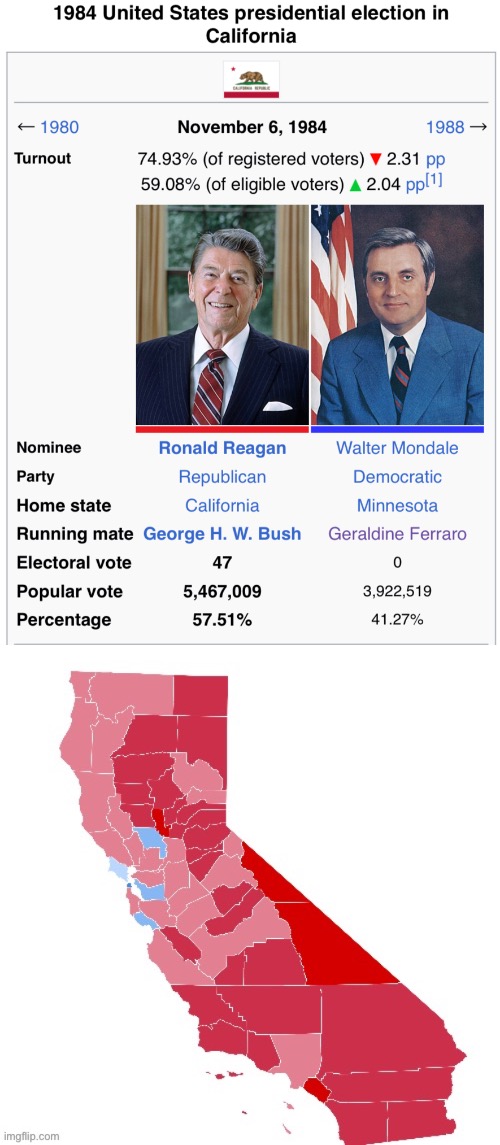

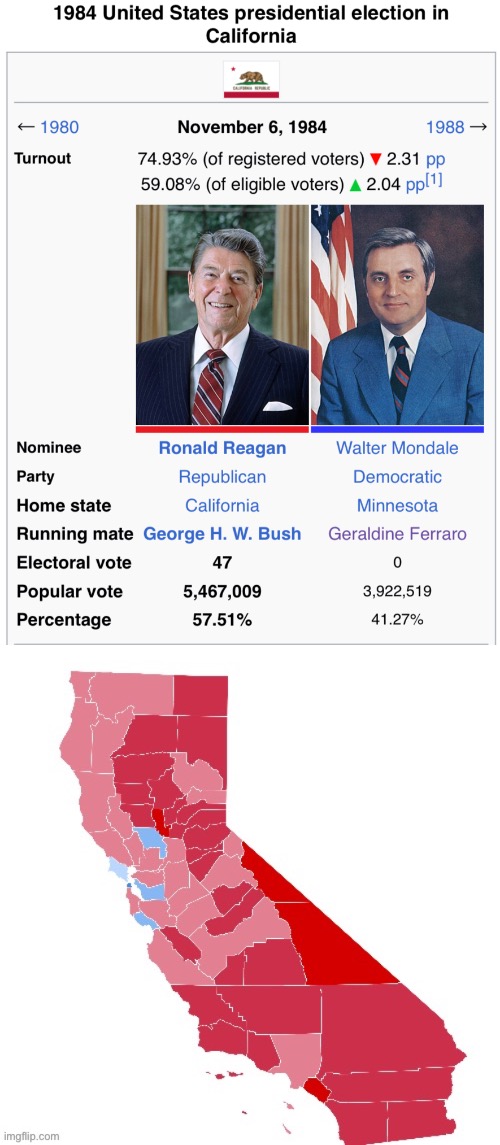

As an aside — and though it may be inconceivable to anyone born after 1980 — less than fifty years ago Ronald Reagan overwhelmingly carried his home state of California.

It not only was a different era, it was a different universe.

It not only was a different era, it was a different universe.

Posted on 12/27/25 at 10:42 am to Nosevens

quote:

LINK

quote:

The term “California exit tax” is a commonly searched phrase, reflecting a widespread concern among individuals considering a move out of the state. While no single, specific tax is officially named the “California exit tax,” the term generally refers to the various tax considerations and obligations individuals may encounter when changing their residency from California. These considerations involve existing California tax laws that become relevant due to the change in residency.

Posted on 12/27/25 at 10:48 am to BigTigerJoe

quote:

Do they have an exiting tax?

It’s unenforceable. As long as the exiting billionaire doesn’t own California bonds, he can just leave and go to another state. What are they going to do?

Posted on 12/27/25 at 10:49 am to Jbird

My question is why are Larry Page and Peter Thiel still there? Better late than never I guess.

Posted on 12/27/25 at 10:54 am to Pvt Hudson

quote:

Taxes on net worth and unrealized gains should be fought with the same vigor as the taxes that started the American Revolution.

George and the boys would be stacking bodies like cord wood.

Posted on 12/27/25 at 10:55 am to BigTigerJoe

quote:

Do they have an exiting tax?

IDK but I think Illinois tried this and the Supreme Court slapped it down.

Commie-fornia is sinking.

Yuge corporations have pulled out in the just the last few years, taking thousands of high paying jobs with them.

Silicon Valley is turning to ghost towns.

The only thing that is keeping California afloat right now is the MIC (military industrial Complex).

Between the ill-libreals and the illegals, they are destroying the Golden State.

Posted on 12/27/25 at 10:57 am to Jbird

This dudes more focused on Epstein then he is his own state sinking intonthe abyss

Posted on 12/27/25 at 11:39 am to Jbird

quote:

Peter Thiel is leaving California if we pass a 1% tax on billionaires for 5 years to pay for healthcare for the working class facing steep Medicaid cuts.

Where are all the other taxes going? This Massie bro needs to ask why this is needed, and how to stop hitting the same well.

This post was edited on 12/27/25 at 11:39 am

Posted on 12/27/25 at 11:42 am to Jbird

Of course he can be flippant about an eroding tax base, he’s not middle class and he doesn’t get crushed by the Democratic Kleptocracy, he profits from it.

Posted on 12/27/25 at 12:31 pm to Nosevens

quote:

That’s when I’d resort to the FAFO method of paying an exit tax. I can’t comprehend how that is even remotely legal

Didn't pelosi get one thru for Americans leaving America, back during the Obama yrs?

Popular

Back to top

19

19