- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

This market

Posted on 10/28/25 at 9:24 pm

Posted on 10/28/25 at 9:24 pm

Do we think the market keeps running?

I have been smiling while I log into my account!!

I have been smiling while I log into my account!!

Posted on 10/28/25 at 9:30 pm to Salty Spec

quote:

Do we think the market keeps running?

Yep sure looks like it..

Posted on 10/28/25 at 9:31 pm to Salty Spec

We are cutting interest rates in an inflationary environment , let it run . Cause you need the cash to buy $20 loaf of bread .

Posted on 10/28/25 at 11:32 pm to Salty Spec

This is the most hated bull run ever.

Many refused to trust the recover that started in May.

There’s currently more money on the sidelines than ever before. Bears have all but given up.

That money will be deployed in time.

I would expect a pull back in Jan/Feb but if we’re really in the fourth industrial revolution, I see no reason why we can’t continue upwards.

Watch Jensen Huang’s key note from earlier today and keep an eye out for the big boys’ earnings reports starting tomorrow afternoon.

Their spending and sentiment should tell us a lot.

And yes, you’re about to have a dovish Fed. There’s only one worry. Housing.

Many refused to trust the recover that started in May.

There’s currently more money on the sidelines than ever before. Bears have all but given up.

That money will be deployed in time.

I would expect a pull back in Jan/Feb but if we’re really in the fourth industrial revolution, I see no reason why we can’t continue upwards.

Watch Jensen Huang’s key note from earlier today and keep an eye out for the big boys’ earnings reports starting tomorrow afternoon.

Their spending and sentiment should tell us a lot.

And yes, you’re about to have a dovish Fed. There’s only one worry. Housing.

Posted on 10/29/25 at 4:40 am to Salty Spec

I've been saying for several years - this market is relatively immune to bad news. I don't know if COVID "provided some immunity" (  ) to downswings, but even the tariff dip in the spring was just a blip - a buying opportunity for traders and investors could average down on their DCA.

) to downswings, but even the tariff dip in the spring was just a blip - a buying opportunity for traders and investors could average down on their DCA.

Now, there is definitely an AI bubble. I'm not discounting that. It keeps my son (who is a casual trader) up at night. I'm not ready to call it the next "dot.com" or "housing" bubble quite yet, but you can see it on the charts.

The overall market is so diverse that I'm not sure any single leg can pull it down as dramatically as something like 9/11 (and we were already in a down market which made that more pronounced) or 2008 - 2009 (the market is EIGHT times what it was on 2/17/2009). But the AI bubble is the only thing that has that potential, IMHO.

Now, there is definitely an AI bubble. I'm not discounting that. It keeps my son (who is a casual trader) up at night. I'm not ready to call it the next "dot.com" or "housing" bubble quite yet, but you can see it on the charts.

The overall market is so diverse that I'm not sure any single leg can pull it down as dramatically as something like 9/11 (and we were already in a down market which made that more pronounced) or 2008 - 2009 (the market is EIGHT times what it was on 2/17/2009). But the AI bubble is the only thing that has that potential, IMHO.

Posted on 10/29/25 at 5:39 am to Ace Midnight

Watch Tom Lees latest … no Ai bubble

Posted on 10/29/25 at 6:39 am to Ace Midnight

quote:I really do believe that the advent of phone trading (Robinhood) and the democratization of information (Reddit, X, StockTwits) has changed the game for good.

this market is relatively immune to bad news. I don't know if COVID "provided some immunity" ( ) to downswings, but even the tariff dip in the spring was just a blip - a buying opportunity for traders and investors could average down on their DCA

This is THE most obvious area where the legacy institution were merely gatekeepers of wealth and information, and that wall has come down. Not even CNBC is what it used to be. Nowadays people watch YouTube live and listen to Spaces on X for ideas and market sentiment.

As a result of all that, you have buyers who step in with no fear on 20% dips and institutions who are shocked that things didn’t get worse, and then resent the V shaped recovery.

We’ve been trained to buy the dip.

Look at RGTI. It plunged, but not as far as it should have!

This post was edited on 10/29/25 at 6:42 am

Posted on 10/29/25 at 6:51 am to bayoubengals88

quote:

There’s only one worry. Housing.

I can think of 2 others.

The credit contagion spreading with more shaky loans. So far Western Alliance Bank an 5th Third have been most affected. No telling what might be lurking in PE portfolios. Secondly the shut down drags on longer well into the holiday season and consumer spending drops sharply.

Posted on 10/29/25 at 6:55 am to bayoubengals88

Posted on 10/29/25 at 6:59 am to bigjoe1

quote:Sure.

The credit contagion spreading with more shaky loans.

quote:That will be interesting to see. Mostly the question of, would the market even care. Retail names seem almost irrelevant right now. We shall see.

Secondly the shut down drags on longer well into the holiday season and consumer spending drops sharply.

Posted on 10/29/25 at 7:58 am to Salty Spec

The market isn’t going to fall until unemployment really spikes. As long as white-collar workers keep funneling 10–15% of their paychecks into 401(k)s, HSAs and brokerage accounts every two weeks, there’s a steady bid under equities. The real correction won’t come until that automatic inflow slows down.

This post was edited on 10/29/25 at 7:59 am

Posted on 10/29/25 at 8:03 am to IMSA_Fan

quote:

As long as white-collar workers keep funneling 10–15% of their paychecks into 401(k)s, HSAs and brokerage accounts every two weeks

Pretty much this.

Posted on 10/29/25 at 8:28 am to Salty Spec

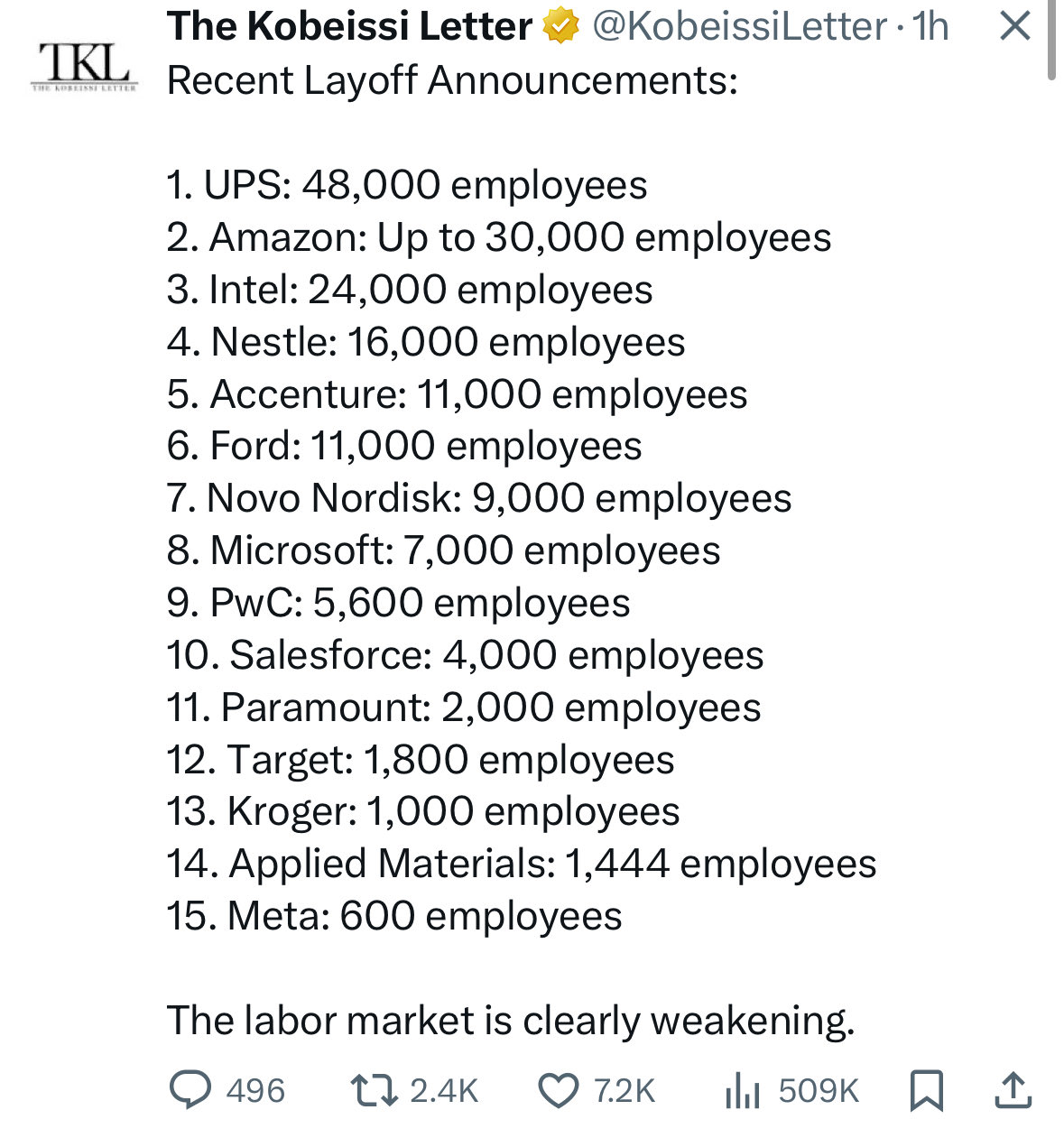

Loading Twitter/X Embed...

If tweet fails to load, click here.

This post was edited on 10/29/25 at 8:49 am

Posted on 10/29/25 at 8:56 am to IMSA_Fan

quote:

The market isn’t going to fall until unemployment really spikes. As long as white-collar workers keep funneling 10–15% of their paychecks into 401(k)s,

Are these the workers you're counting on pumping money into their 401k's ?

Artificial Intelligence is going to do to white collar jobs what offshoring did to blue collar jobs.

Posted on 10/29/25 at 10:19 am to Dot Com

The job market is not great right now but once you consider there are 163M people employed in the US, that chart only equates to small fractions of the total working population

Posted on 10/29/25 at 10:28 am to Dot Com

quote:

Dot Com

Bro, you have to change up your style if you are going to keep making alter accounts

Please do not forget to use your favorite image that busted you last time talking about our pending doom

This post was edited on 10/29/25 at 10:29 am

Posted on 10/29/25 at 10:36 am to bayoubengals88

quote:

This is the most hated bull run ever.

Many refused to trust the recover that started in May.

I'm pretty sure I know more people who lost their arse waiting for the "second crash" during the Obama administration than I do people who have lost their arse during this one. Certainly not saying they don't exist, but it doesn't feel as wide spread, at least anecdotally.

Posted on 10/29/25 at 10:40 am to Salty Spec

I was literally thinking of starting a thread with the exact same title and subject yesterday

I think that’s interesting. When people start thinking the market is overbought/overpriced- it could be nearing a top

That said, I watched a good segment on cnbc yesterday where their panel discussed it. They said there is a lot of momentum now and they don’t see it cooling until at least mid 2026 at the earliest. We haven’t even seen fhr benefits of lower rates

There’s the international issues of war, tarriffs or other unrest but things seem fairly stable

I think that’s interesting. When people start thinking the market is overbought/overpriced- it could be nearing a top

That said, I watched a good segment on cnbc yesterday where their panel discussed it. They said there is a lot of momentum now and they don’t see it cooling until at least mid 2026 at the earliest. We haven’t even seen fhr benefits of lower rates

There’s the international issues of war, tarriffs or other unrest but things seem fairly stable

Posted on 10/29/25 at 3:59 pm to Salty Spec

As long as we have a business minded president it will keep going.

Trump knows the market drives the country

Trump knows the market drives the country

Posted on 10/29/25 at 8:42 pm to Dot Com

Dan Nathan sucks. Investing consistent with his commentary will cost you.

Popular

Back to top

11

11