- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

All Things: Gold & Silver

Posted on 9/5/25 at 12:33 am

Posted on 9/5/25 at 12:33 am

Let's get a running thread going on TD

Umbrella: Really, any precious metals talk is welcome. Whether that's procurement strategies for physical bullion, junior mining stock speculation or wild-eyed claims that particle accelerators will render terrestrial mining operations obsolete.

Tangents into other metal/mining sectors like Copper, Nickel, Rare Earth Minerals, etc. should probably be expected.

FUN FACT: There are 8 precious metals: gold, silver, platinum, palladium, rhodium, ruthenium, iridium, and osmium.

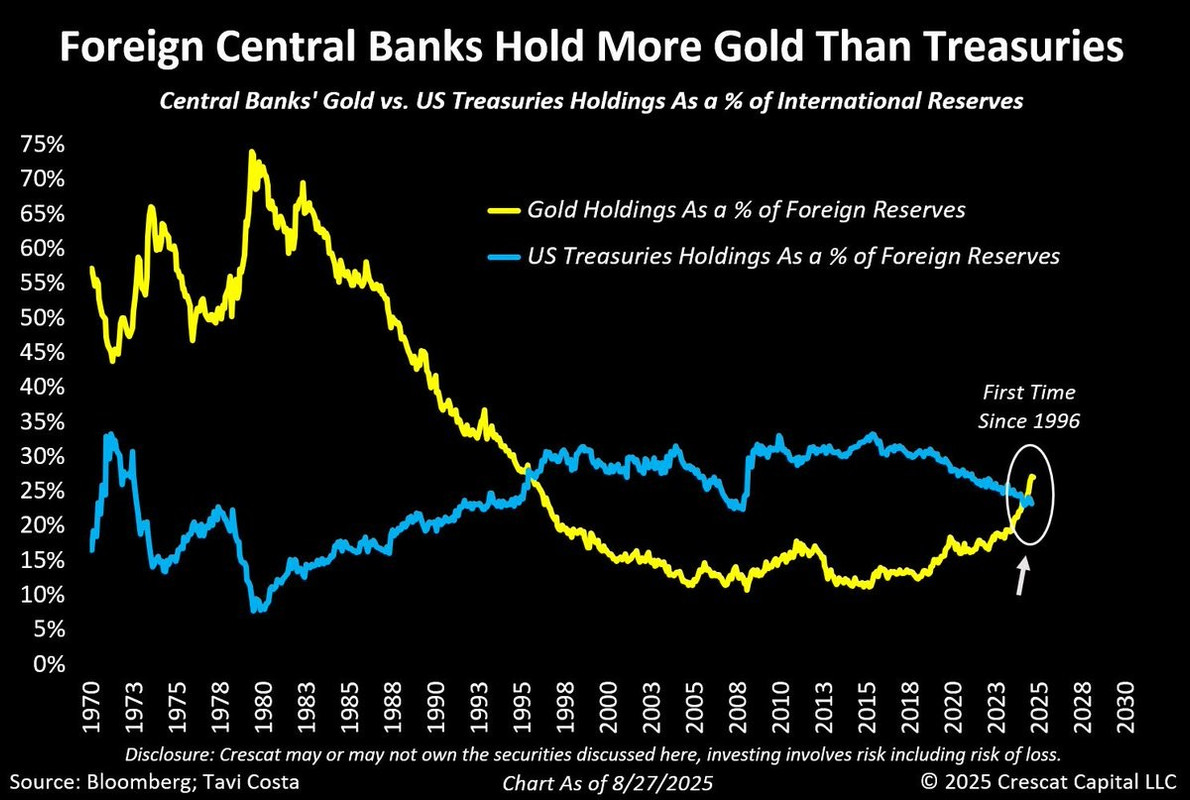

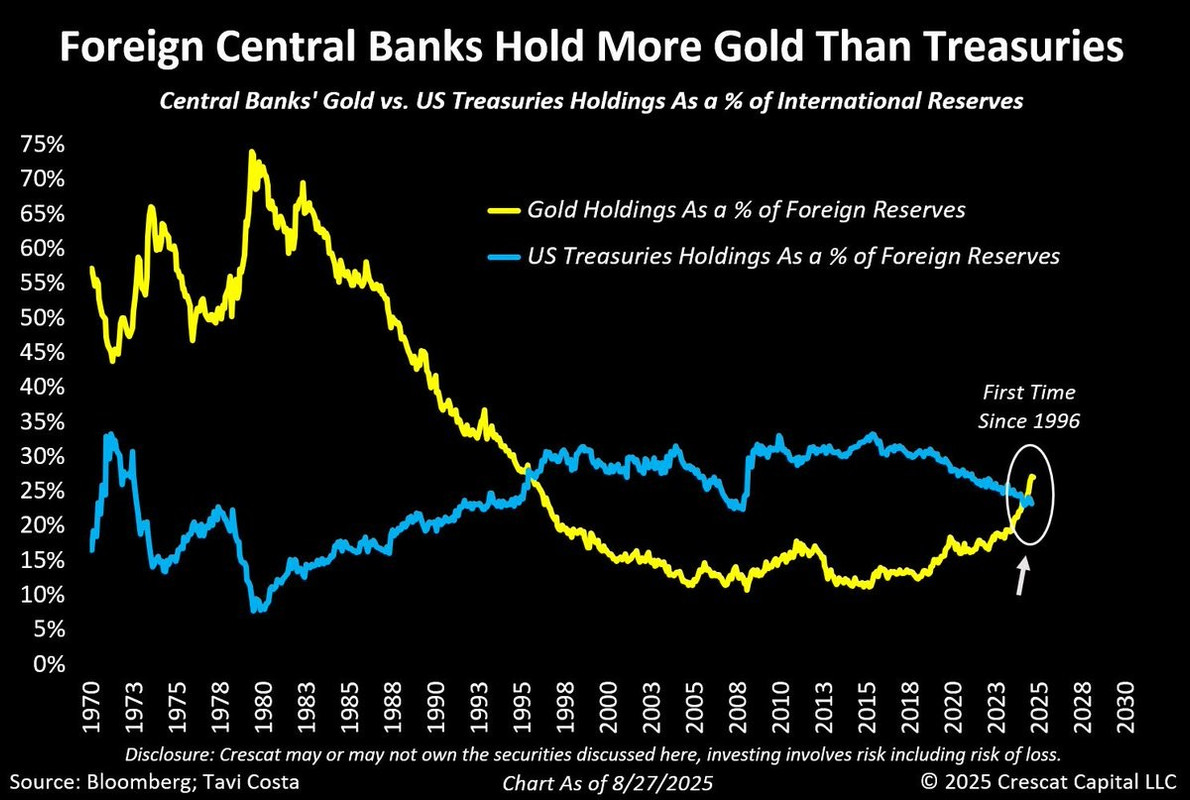

FUN FACT NUMBER 2 IN INFOGRAPHIC FORM

Umbrella: Really, any precious metals talk is welcome. Whether that's procurement strategies for physical bullion, junior mining stock speculation or wild-eyed claims that particle accelerators will render terrestrial mining operations obsolete.

Tangents into other metal/mining sectors like Copper, Nickel, Rare Earth Minerals, etc. should probably be expected.

FUN FACT: There are 8 precious metals: gold, silver, platinum, palladium, rhodium, ruthenium, iridium, and osmium.

FUN FACT NUMBER 2 IN INFOGRAPHIC FORM

This post was edited on 9/5/25 at 11:36 pm

Posted on 9/5/25 at 9:13 am to SPAGHETTI PLATE

I got a fairly significant holding of Perpetua Resources (PPTA). They have been working through the permitting and fund raising to restart the Stibnite Gold Project in Idaho. They are primarily after the gold and antimony, however I have been wondering if they will also go after the rare earth's from the tailings? I bought-in under $10 usd but have been debating about buying a larger position if it dips back below $17 usd.

This post was edited on 9/5/25 at 9:14 am

Posted on 9/5/25 at 10:13 am to SPAGHETTI PLATE

quote:

FUN FACT: There are 8 precious metals: gold, silver, platinum, palladium, rhodium, ruthenium, iridium, and osmium.

We may need to add uranium to that list as being "precious adjacent" as the growth of AI is going to pretty much mandate a return to pushing for more nuclear power (which is going to make uranium more valuable). For example, the AI center being built in Richland parish is expected to use about 2.5GW of power per year with the ability to expand to 5GW. 2.5GW is about 3x what was used for New Orleans last year.

Posted on 9/5/25 at 10:24 am to SPAGHETTI PLATE

I posted this in another thread. I find it interesting that the Fed is posting articles about the revaluation of Gold. Lots of movements in the Precious Metals space as of late.

FEDERAL RESERVE

FEDERAL RESERVE

Posted on 9/5/25 at 10:57 am to SPAGHETTI PLATE

PHYS is my preferred choice for physical gold as it’s liquid and can be traded. It’s run by Sprott and supposedly holds physical gold to support market cap. I’m sure there are some futures played but it’s the old Canadian Gold Trust that he acquired.

WPM is my best performing gold stock. They are a royalty company mostly IIRC and are up 81% YTD.

WPM is my best performing gold stock. They are a royalty company mostly IIRC and are up 81% YTD.

This post was edited on 9/5/25 at 10:59 am

Posted on 9/5/25 at 11:32 am to SquatchDawg

Sprott also has a fund that holds physical gold and silver in equal dollar amounts: a 50:50 value mix.

Posted on 9/5/25 at 12:52 pm to OccamsStubble

It was also part of that Canadian trust. One fund was 50:50 the other was all gold. Sprott has always been pretty adamant about physical over paper so this is as good as I’ve found short of loading up on Eagles.

Posted on 9/5/25 at 2:02 pm to SquatchDawg

Sprott has a fund that will let you take physical delivery when you decide to cash out.

Posted on 9/5/25 at 9:41 pm to SPAGHETTI PLATE

For anyone in need of a good documentary to add to your slate: This is part 1 of a very well done and entertaining 2 part series explaining the history of Gold.

"The Gold Standard didn't work because it didn't allow the spenders to plunder the savers..

- Rick Rule

"The Gold Standard didn't work because it didn't allow the spenders to plunder the savers..

- Rick Rule

Posted on 9/6/25 at 5:00 am to SPAGHETTI PLATE

Schiff disciple but I also subscribe to Doug Casey and Peter Krauth. The three metals poised for massive gains are gold, silver, and....Copper. The developing world will need alot of the last metal.

Posted on 9/6/25 at 5:01 am to FAT SEXY

Casey and Co. Said this was part of trump's plan months ago.

Posted on 9/6/25 at 5:03 am to SquatchDawg

WPM

AEM

Newmont

You can also do Gdx and gdxj. The biggest gains will be made by juniors as the big players aquire them for more metals.

AEM

Newmont

You can also do Gdx and gdxj. The biggest gains will be made by juniors as the big players aquire them for more metals.

This post was edited on 9/6/25 at 9:09 pm

Posted on 9/6/25 at 9:29 pm to SPAGHETTI PLATE

So what funds or stock would you fellas recommend? I am not going through the pain of physical gold just yet.

Posted on 9/6/25 at 9:42 pm to GREENHEAD22

quote:

So what funds or stock would you fellas recommend? I am not going through the pain of physical gold just yet.

If you're looking for a more hands off approach as far as mining stocks go, I'd recommend:

GDX

GDXJ

SILJ

COPX

These are all mining ETFs that will give you exposure to the sector without the stress of researching individual companies.

Posted on 9/6/25 at 10:03 pm to GREENHEAD22

I dumped most of my USAA funds, but I’m glad I held on to USAGX.

Posted on 9/7/25 at 8:54 am to SPAGHETTI PLATE

My biggest gains are in GLD @ 105%. It is top dog in my portfolio.

Posted on 9/8/25 at 10:19 am to FAT SEXY

I wonder how much it has to run?

Posted on 9/8/25 at 10:25 am to GREENHEAD22

I'm more curious about how much more Silver has to run. The Gold/Silver ratio is still high AF at 87

Popular

Back to top

16

16