- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

400K I need to find a home for; paying out 100K in 6 months.

Posted on 8/4/25 at 6:54 pm

Posted on 8/4/25 at 6:54 pm

I recently sold a business and have proceeds of a bit over 400K I need to do something with. In about 6 months, I will need to pay out about 100K of it to minority investors and taxes. I'd like to pay as much as I can of that out of returns in the meantime.

What would you do?

What would you do?

Posted on 8/4/25 at 7:02 pm to Ag Zwin

Man, I read that as 401k at first and I was so confused

Posted on 8/4/25 at 7:08 pm to castorinho

I'd say you need to separate them and let the 100k earn you a little over $1000 and have a completely different strategy with the rest...what that is, depends on what you already own.

Posted on 8/4/25 at 9:19 pm to Ag Zwin

STRC

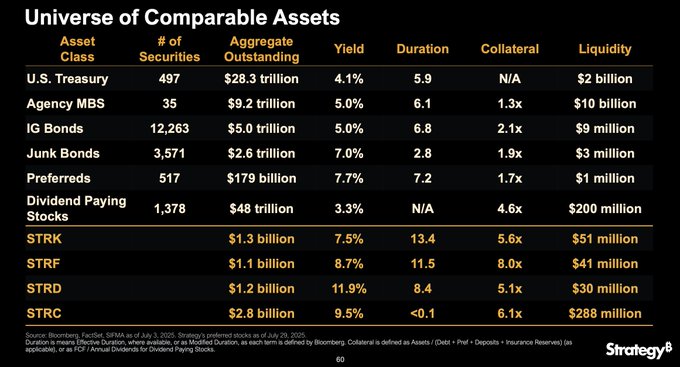

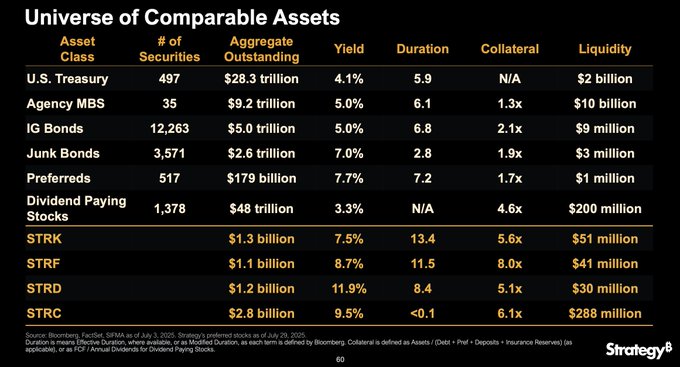

Preferred security with ~9% dividend and potential slim price appreciation (launched at $90 last month, $96.39 currently with desired peg between $99 and $101). Yield will increase 0.25% per month until it is in the desired $99-$101 range. If it ends up exceeding $101, yield will decrease 0.25% per month. The goal of this is targeting the money market/fixed income area of finance. Overcollateralized by the tune of 6.1x (i.e. bitcoin could fall by over 80% and this preferred is still collateralized fully by the assets on MSTR's balance sheet in a liquidation event). For comparison, Investment Grade bonds are usually around the 2.1x collateralization.

Preferred security with ~9% dividend and potential slim price appreciation (launched at $90 last month, $96.39 currently with desired peg between $99 and $101). Yield will increase 0.25% per month until it is in the desired $99-$101 range. If it ends up exceeding $101, yield will decrease 0.25% per month. The goal of this is targeting the money market/fixed income area of finance. Overcollateralized by the tune of 6.1x (i.e. bitcoin could fall by over 80% and this preferred is still collateralized fully by the assets on MSTR's balance sheet in a liquidation event). For comparison, Investment Grade bonds are usually around the 2.1x collateralization.

This post was edited on 8/4/25 at 9:22 pm

Posted on 8/5/25 at 10:22 am to TigerTatorTots

quote:

STRC

“This means that the issuer, MSTR, can continue to issue new debt and preferred shares on top of this offering. Additionally, MSTR doesn’t actually have the earnings to cover the dividend payments on STRC,” Miller said. “The assumption is that appreciation on the Bitcoin purchased will be sufficient to provide the cash needed, but this creates long-term risk for investors that the dividends could be cut or suspended if Bitcoin prices fall.”

Quote from first article that popped up on google. I see no problems with this

Posted on 8/5/25 at 11:18 am to Ag Zwin

Quite a risk scenario here.

Someone already suggested separating the 100k that you'll need to pay out and that is the best move. Take a different strategy with the other 300k.

What to do with that 100k? Since it's a known liability, you don't want to assume risk with it and end up losing money. Maybe go with with some sort of 6 month treasury security that are currently around 4%, pocket a couple grand and not put that 100k at risk. It may be conservative, but if I know it's a liability, I'm not getting cute with how I manage that money.

Someone already suggested separating the 100k that you'll need to pay out and that is the best move. Take a different strategy with the other 300k.

What to do with that 100k? Since it's a known liability, you don't want to assume risk with it and end up losing money. Maybe go with with some sort of 6 month treasury security that are currently around 4%, pocket a couple grand and not put that 100k at risk. It may be conservative, but if I know it's a liability, I'm not getting cute with how I manage that money.

Posted on 8/5/25 at 11:32 am to RolltidePA

Yeah, I'd be very conservative in this situation.

Posted on 8/5/25 at 11:39 am to Ag Zwin

treasury account with the fed and buy some T-bills that expire when you need the cash

Posted on 8/5/25 at 1:52 pm to Ag Zwin

Why not just a high yield savings to make 3% on the stuff you will need.

Posted on 8/5/25 at 2:01 pm to Ag Zwin

So what are you planning to do with 300k if you don’t need the money?

Posted on 8/5/25 at 3:42 pm to Sir Saint

quote:Why is this an issue? If STRC starts to become undercollateralized then move to cash? The demand for preferreds is not there yet for that to happen though. Would need a more senior offering to come out and issue to the market in the tune of like 20x the amount that STRC was issued at and that was already the largest IPO of the year.

This means that the issuer, MSTR, can continue to issue new debt and preferred shares on top of this offering

quote:I have zero issue with this at this point in bitcoin's life

. “The assumption is that appreciation on the Bitcoin purchased will be sufficient to provide the cash needed,

This post was edited on 8/5/25 at 3:45 pm

Posted on 8/5/25 at 4:20 pm to Sir Saint

quote:Make no mistake. It could absolutely collapse if/when the United States becomes fiscally responsible. Until then, it’s a lock.

Quote from first article that popped up on google. I see no problems with this

Posted on 8/5/25 at 4:33 pm to TigerTatorTots

I'm not knocking the fund. Im too retarded to understand what it even does. All I know is if I owed people $100k in 6 months I would not put it into some new microstrategy bitcoin collateralized fund that is supposedly "safe" but pays a 9% div which IMO does not compute. I'm putting that bit into a money market or HYSA and forgetting about it until I write the check.

Posted on 8/5/25 at 4:49 pm to Ag Zwin

How much of a problem would it be for you if, after you paid out the $100k, you had less than $300k left?

That should inform how much risk you're willing to take on.

That should inform how much risk you're willing to take on.

Posted on 8/5/25 at 10:42 pm to GeauxTigers123

quote:

Why not just a high yield savings to make 3% on the stuff you will need.

SWVXX at Schwab is paying just north of 4%. Could change I know, but so could a savings account.

Posted on 8/6/25 at 5:05 am to Ag Zwin

Me personally, just based on where i am…….I would split it into 4 separate $100k 3 mth cd’s, which thru my local bank is currently 4.15%. If needed, and you are married, do one under your name, her name, both names etc. for fed insurance protection. Or use another institution. Based on my own situation.

ETA: as far as the taxes go, just be careful re filing quarterlies as it applies to gains, but you probably know that.

ETA: as far as the taxes go, just be careful re filing quarterlies as it applies to gains, but you probably know that.

This post was edited on 8/6/25 at 5:21 am

Posted on 8/6/25 at 6:44 am to SloaneRanger

quote:

SWVXX at Schwab is paying just north of 4%. Could change I know, but so could a savings account.

Well yes. My high-yield savings account is paying three something but it’s only guaranteed for like 90 days at a time next month.

The benefit is is that it’s FDIC insured.

Posted on 8/6/25 at 6:53 pm to Ag Zwin

CONY. Buy two days before each monthly dividend.

I did the math on the last 6 months dividends. The next 6 will be different but there is a cushion.

I did the math on the last 6 months dividends. The next 6 will be different but there is a cushion.

Posted on 8/6/25 at 8:09 pm to Ag Zwin

if you put any part of the 100K you owe at risk you should have your head examined. Money market would be the only option I would consider

what you do with the 300K is up to you

what you do with the 300K is up to you

Popular

Back to top

10

10