- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

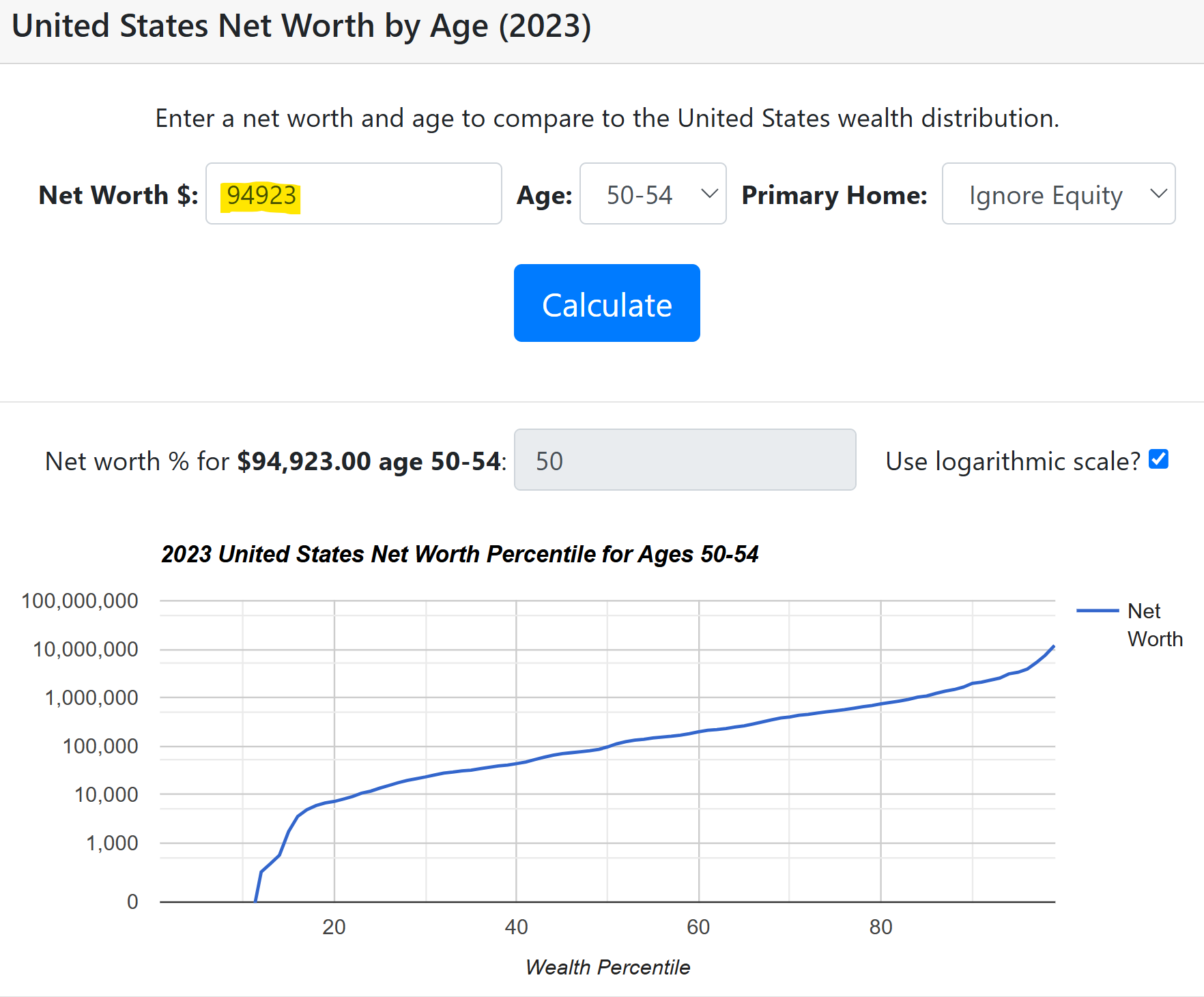

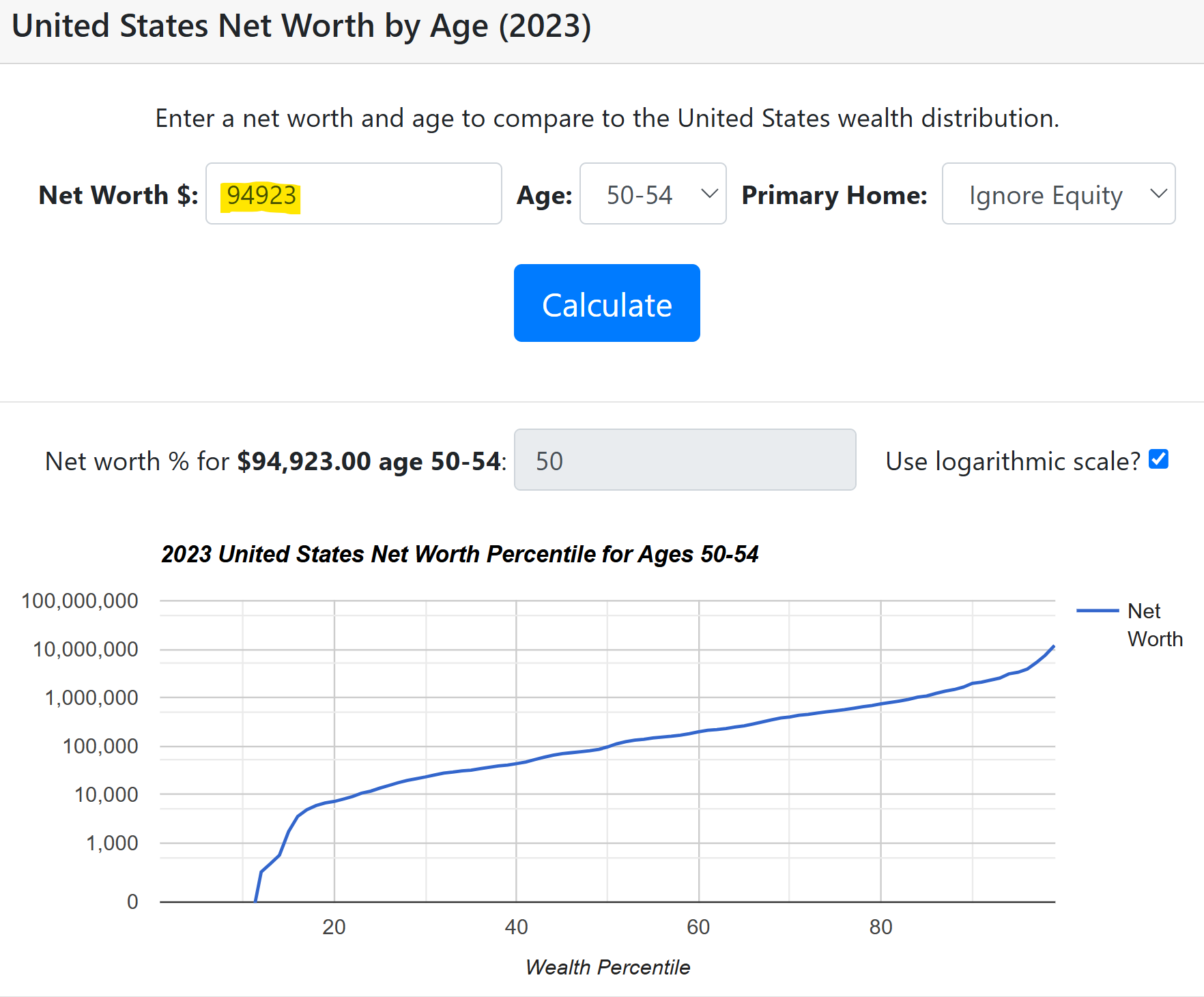

50% of Americana aged 45-54 have a $95K net worth or less

Posted on 3/26/25 at 8:06 am

Posted on 3/26/25 at 8:06 am

Is it unfair not to include home equity? I excluded it because unless you want to live in a van down by the river you have to have a roof over your head

It jumps to 60% in the 40-44 age range and drops to 45% in the 55-59 age group

LINK

It jumps to 60% in the 40-44 age range and drops to 45% in the 55-59 age group

LINK

Posted on 3/26/25 at 8:11 am to stout

quote:

Is it unfair not to include home equity?

No, you have to have somewhere to live and it’s isn’t liquid

Posted on 3/26/25 at 8:16 am to stout

Maybe the stats are slightly better now as 2024 was a great year in the market and those stats are from 2023. Sometimes I feel bad for folks that don't know how to save money and are addicted to dumb spending.

Posted on 3/26/25 at 8:16 am to stout

Hard to save much when the price of everything has gone up. Most of the $500/month I'd put in my Roth IRA is now going to my higher property tax, insurances, utilities, groceries, etc.

Posted on 3/26/25 at 8:17 am to stout

Does this include pension if you’re on a defined plan?

Posted on 3/26/25 at 8:18 am to Mingo Was His NameO

quote:

No, you have to have somewhere to live and it’s isn’t liquid

i mean im fine with it but net worth usually includes that. but the way he did it does tend to show who is over leveraged

I dont think it has to be liquid to be counted though. Know plenty of well off people that have 8-10 houses that wouldnt be liquid.

Posted on 3/26/25 at 8:18 am to Mingo Was His NameO

quote:

Is it unfair not to include home equity?

No, you have to have somewhere to live and it’s isn’t liquid

I disagree. Net worth should definitely include equity. Liquidity =/= value.

Posted on 3/26/25 at 8:20 am to yaboidarrell

quote:

Hard to save much when the price of everything has gone up. Most of the $500/month I'd put in my Roth IRA is now going to my higher property tax, insurances, utilities, groceries, etc.

Do you have a car payment?

Posted on 3/26/25 at 8:20 am to stout

And they all post on the Political Talk board!!!

Posted on 3/26/25 at 8:23 am to stout

All the OT baws renting and defending not buying a home will be very upset by this

Posted on 3/26/25 at 8:31 am to stout

Most people buy a house and a car within the top range of their affordable limits. And of course they finance it. So, a middle class family taking home 125k a year, lives in a 500k house with 2 kids and has 2 $700/month car notes wastes about $1,000 a month in interest alone compared to a more modest house and car. (very rough math). Add on extra taxes and fees associated with nicer things, You're looking at 15-20% of take home income wasted on unnecessary interest, taxes, and fees. How do you save when this has become the standard of living? Sure, maybe your house appreciates over time, but even if you put 20% down (which most don't) you've spent over 1.25 million on the 500k house.

Posted on 3/26/25 at 8:34 am to theliontamer

quote:

Most people buy a house and a car within the top range of their affordable limits.

Loading Twitter/X Embed...

If tweet fails to load, click here.Posted on 3/26/25 at 8:34 am to ronricks

quote:My 2016 Camry is paid off. Going to drive it until the wheels fall off.

Do you have a car payment?

Posted on 3/26/25 at 8:42 am to theliontamer

quote:

Most people buy a house and a car within the top range of their affordable limits. And of course they finance it. So, a middle class family taking home 125k a year, lives in a 500k house with 2 kids and has 2 $700/month car notes

Is this conjecture or verified?

My wife and I make $145k (without considering my side income) and have a $235k house we bought in late 2020. Birmingham area, so not country bumpkin prices but affordable midsized city. Car notes are $700/month total for two.

Even then, I feel cramped with the prices of everything plus making smart choices for future savings.

I could technically save on food, but we invest in our health and buy top quality fresh items. We spend around $1600/month on groceries for a family of four. Rarely eat out though.

Posted on 3/26/25 at 8:43 am to stout

quote:

Is it unfair not to include home equity?

So I did mine and its showing 70% of people have less than me at my age excluding equity. And 74% below with equity.

So nice to know I'm doing ok and average I guess.

Posted on 3/26/25 at 8:46 am to stout

Damn. I’ve already got that beat and I’m 30. Not even including my wife who makes more than me

Posted on 3/26/25 at 8:46 am to stout

The big life preserver for this generation will be inheritance. I know a lot of people who aren't properly saving for retirement because they know when their boomer parents die they will inherit a McMansion and a seven figure 401k plus a bunch of "stuff".. Why sacrifice and save now when you know the account will be topped up in the future?

Now some of them are going to get burned on this strategy when Dad clings to life into his 90s while a nursing home vacuums every cent out of his accounts. But a lot of them are going to get a nice fat bailout right about the time they want to retire.

Popular

Back to top

43

43