- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Costs to expect in retirement

Posted on 2/1/25 at 3:07 pm

Posted on 2/1/25 at 3:07 pm

It's hard not to think that once you get the house and the cars, everything else paid off, get the kids out of the house. That your expenses will just drop down to nothing, but I know that isn't the case.

Just medical costs, utilities, and all of the taxes will make a sizable chunk every months.

Please list the other costs that people wouldn't normally think of, and any guides for how much it really cost (even at bare minimum) to live in retirement. Thanks.

Just medical costs, utilities, and all of the taxes will make a sizable chunk every months.

Please list the other costs that people wouldn't normally think of, and any guides for how much it really cost (even at bare minimum) to live in retirement. Thanks.

Posted on 2/1/25 at 3:39 pm to Kingpenm3

I’m interested in this. I’m currently projecting over 100% of my current costs, including mortgage and kids’ school tuition and kids’ costs. I’m being way too conservative, but not sure what’s going to change in old age

Posted on 2/1/25 at 3:45 pm to Kingpenm3

If you have sizable mutual fund investments and the market soars, the IRMA tagged on to Medicare/Medicare Advantage premiums can be a surprise. There is a lag period so there is time to prepare, assuming you understand the mechanics behind the increase.

Posted on 2/1/25 at 4:19 pm to Kingpenm3

If you are in EBR Parish, constant increase in property taxes and homeowners insurance and inflation in general if we get another administration like the last.

This post was edited on 2/1/25 at 8:17 pm

Posted on 2/1/25 at 4:33 pm to Kingpenm3

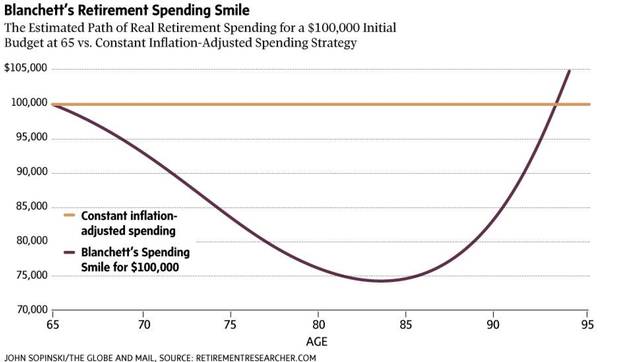

Go-go years (travel and entertainment), slow-go years (family oriented), no-go years (assisted living & end of life).

Posted on 2/1/25 at 4:52 pm to Kingpenm3

I've been looking at this but right now I'm pissed about the changes to 401k cathup contributions in 2026.

Posted on 2/1/25 at 5:54 pm to Kingpenm3

Everything you want to do because you now have more time, cost more. So any hobbies or things that you want to buy are more costly than you might imagine. Example, I am just getting done making modifications and upgrades to a boat I purchased a couple of months ago. It's cost a lot more than I anticipated. Not a big deal to me, but everything costs a lot more. I bought a winch and the related equipment I need to buy for it are a good bit more expensive than I expected. Fishing equipment, rods, reels, lures, etc. add up in a hurry.

Posted on 2/1/25 at 6:27 pm to 98eagle

quote:

Everything you want to do because you now have more time, cost more. So any hobbies or things that you want to buy are more costly than you might imagine. Example, I am just getting done making modifications and upgrades to a boat I purchased a couple of months ago. It's cost a lot more than I anticipated. Not a big deal to me, but everything costs a lot more. I bought a winch and the related equipment I need to buy for it are a good bit more expensive than I expected. Fishing equipment, rods, reels, lures, etc. add up in a hurry.

That's because your hobby involves a boat. The choice of hobby dictates the cost dramatically.

I love to bank fish and have gotten back into photography. I could effectively do these for free for years with existing baits and setup.

Similar to the boat example, I love to travel, especially abroad so I expect tos spend $25-50K a year in travel while physically able.

Posted on 2/1/25 at 6:58 pm to TigerAlum1982

quote:

constant increase in property taxes and homeowners insurance

If you think this is just a Baton Rouge problem then i got some ocean front property to sell you in Kansas.

Posted on 2/1/25 at 8:06 pm to FLObserver

Well, I live in EBR, so that’s what I’m basing my experience on.

Posted on 2/1/25 at 9:08 pm to Kingpenm3

Healthcare costs and supplementary health insurance

Posted on 2/1/25 at 9:40 pm to Thebuzz

I just signed up for boldin retirement. It does Irma etc.

Posted on 2/1/25 at 9:48 pm to IbalLSUfaninVA

quote:

I just signed up for boldin retirement. It does Irma etc.

I am interested to hear what you think about Boldin after a little while using the service. You doing the advisor route or just the planner plus route?

Posted on 2/1/25 at 11:20 pm to Kingpenm3

Travel can get expensive (but worth it). Several things have already been posted but one thing to remember is to file for a freeze on property taxes when you turn 65.

Posted on 2/2/25 at 5:07 am to Kingpenm3

At some point you may need to move from the house.

To independent living, assisted living, or a nursing home.

Each of these can be expensive.

To independent living, assisted living, or a nursing home.

Each of these can be expensive.

Posted on 2/2/25 at 6:19 am to Kingpenm3

Inflation is one of the worst

Posted on 2/2/25 at 8:24 am to Kingpenm3

we are selling our business in april and severing our income stream for “retirement”. I’m 58. We spend a lot of money each year but at least half of it is discretionary

I’ve run the numbers until I’m blue in the face. All I am confident in is that we can throttle back leisure spending at will, and that our fixed costs will increase. I also am confident that after 15 years from April I’ll probably not care about leisure spending anymore due to age/health

I’ve run the numbers until I’m blue in the face. All I am confident in is that we can throttle back leisure spending at will, and that our fixed costs will increase. I also am confident that after 15 years from April I’ll probably not care about leisure spending anymore due to age/health

Popular

Back to top

18

18