- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Debt Free Or Invest 100k

Posted on 1/7/25 at 11:57 am

Posted on 1/7/25 at 11:57 am

Wife and I are in our mid 40’s. She has great paying job and I’m bout to switch jobs as my current employer is selling out and I no longer want to continue in same field so little uncertainty there.

Would it be dumb to pay off everything we owe on or invest around 100k into my IRA?

This 100k will be more so a gift from current employer due to no retirement plan from them.

So what I’m asking is do I take this 100k and get rid of all non fixed bills or do we just keep trucking along and invest this 100k and keep paying our monthly notes as is? Thanks

Would it be dumb to pay off everything we owe on or invest around 100k into my IRA?

This 100k will be more so a gift from current employer due to no retirement plan from them.

So what I’m asking is do I take this 100k and get rid of all non fixed bills or do we just keep trucking along and invest this 100k and keep paying our monthly notes as is? Thanks

Posted on 1/7/25 at 11:59 am to WillFerrellisking

depends on the interest rate of the debt and the projected returns of what you invest in.

lot of variables in play.

for example, if it's all 0% unsecured CC debt or a 0% car loan originating in 2021, and you project 15% returns in the stock market, probably invest.

if its 29% APR CC debt with budget crushing minimums, pay off debt.

lot of variables in play.

for example, if it's all 0% unsecured CC debt or a 0% car loan originating in 2021, and you project 15% returns in the stock market, probably invest.

if its 29% APR CC debt with budget crushing minimums, pay off debt.

This post was edited on 1/7/25 at 12:02 pm

Posted on 1/7/25 at 12:16 pm to WillFerrellisking

Math may say one thing, but I think it's never wrong to pay off debt

Posted on 1/7/25 at 12:24 pm to WillFerrellisking

Maybe wait until you have some certainty with the new job before making a decision.

Posted on 1/7/25 at 12:30 pm to WillFerrellisking

I paid off my mortgage and eliminated all my debts a few years back. Sure; I may have missed out on some potential returns; but, the psychological benefit of knowing you are beholden to nobody is immeasurable.

Posted on 1/7/25 at 12:32 pm to WillFerrellisking

No debt is a sure thing.

Market growth the next few years is an unknown.

I'd eliminate all debt and invest the payments I'm no longer making.

Market growth the next few years is an unknown.

I'd eliminate all debt and invest the payments I'm no longer making.

Posted on 1/7/25 at 12:43 pm to WillFerrellisking

How much do you value the peace of mind knowing you're debt free?

Posted on 1/7/25 at 12:44 pm to WillFerrellisking

Well, for one only 8K can go into your IRA for the year (if over 50).Depending on what your emergency fund is at, with the uncertainty around your future, I would put some aside in a money market account for the time being and then pay the high interest debt off, and then see what remains. If you have sufficient cash on hand and the debt is all high interest, I would pay off the debt.

Posted on 1/7/25 at 12:53 pm to WillFerrellisking

Either is probably fine but something to consider is with less debt, you gain more freedom of salary in your search for a new job. You might find something you are very interested in but feel you have to pass it up because the monthly bills stretch the budget too thin.

I personally think everyone has a value to lower stress and financial freedom. You just have to take time to calculate that value for yourself. Many on this board dont believe in such things so you'll always get the "invest it" recommendations because math says so (incorrect math that is).

I personally think everyone has a value to lower stress and financial freedom. You just have to take time to calculate that value for yourself. Many on this board dont believe in such things so you'll always get the "invest it" recommendations because math says so (incorrect math that is).

Posted on 1/7/25 at 12:53 pm to jefforize

quote:

depends on the interest rate of the debt and the projected returns of what you invest in.

The investment would over take the debt interest quickly with compounding factor.

Posted on 1/7/25 at 12:58 pm to WillFerrellisking

Do you each have a Roth IRA? I’d max out last year and this year in both now. Then that will still leave you a lot to pay off or down on the high interest debit.

Posted on 1/7/25 at 1:15 pm to WillFerrellisking

First, I'd keep a large cash position on hand until career transition is complete and stable/predictable.

I wouldn't accelerate debt repayment on anything below ~6%. I regret paying off my first mortgage years ago at 5.5% missing years of market growth.

You can't contribute $100k to an IRA all in one year. Perhaps use the $ to free up cash flow so you can max employer plans (if hers and/or your new job offers one) for you and wife and Roth or traditional IRAs. Excess could be invested in taxable brokerage instead of retirement.

Is their "gift" considered compensation and taxed as such? If so, make sure to set taxes aside. If it's actually being characterized as a gift, I'd seek tax advice to be sure you aren't subject to income tax and FICA.

I wouldn't accelerate debt repayment on anything below ~6%. I regret paying off my first mortgage years ago at 5.5% missing years of market growth.

You can't contribute $100k to an IRA all in one year. Perhaps use the $ to free up cash flow so you can max employer plans (if hers and/or your new job offers one) for you and wife and Roth or traditional IRAs. Excess could be invested in taxable brokerage instead of retirement.

Is their "gift" considered compensation and taxed as such? If so, make sure to set taxes aside. If it's actually being characterized as a gift, I'd seek tax advice to be sure you aren't subject to income tax and FICA.

Posted on 1/7/25 at 1:28 pm to WillFerrellisking

Without any detail about your debts , assets, retirement objectives, risk tolerance, income vs expenses etc its not feasible to offer anything but generic advice that may not be suitable for your situation.

Posted on 1/7/25 at 1:45 pm to TorchtheFlyingTiger

Roughly 90k between house, 1 vehicle and a new boat (purchased last year) note. Boat being the highest interest and makes up majority of debt.

Would paying off those bills then taking money that was allocated to those notes and investing in some sort of IRA make sense? I have it in my head that being debt free and not owing anyone money is the correct way to go but also worried about my retirement which is almost nonexistent as of now.

Would paying off those bills then taking money that was allocated to those notes and investing in some sort of IRA make sense? I have it in my head that being debt free and not owing anyone money is the correct way to go but also worried about my retirement which is almost nonexistent as of now.

Posted on 1/7/25 at 2:08 pm to WillFerrellisking

quote:Yet, you bought a boat...and a substantial one at that.

I have it in my head that being debt free and not owing anyone money is the correct way to go but also worried about my retirement which is almost nonexistent as of now.

People are different.

Posted on 1/7/25 at 2:27 pm to WillFerrellisking

It doesn't have to be all or nothing; Spend most of it on the boat and invest the rest.

Posted on 1/7/25 at 2:27 pm to bayoubengals88

lol, I’m no where near retirement age and want to fish when I retire. This boat will last me till I die. Also want to fish before I die so I bought a boat. If I die tomorrow I don’t need the retirement money but would have fished outta new boat.

Now back to subject, debt free or invest?

Now back to subject, debt free or invest?

Posted on 1/7/25 at 2:39 pm to WillFerrellisking

Do you know then the interest rates off the top of your head?

You won't like this but if I had "almost nonexistent" retirement, I would sell the boat and throw the payment, insurance and running costs into investments. The time for toys is over until you catch up on responsible adulting. Good on you for taking first step asking for advice.

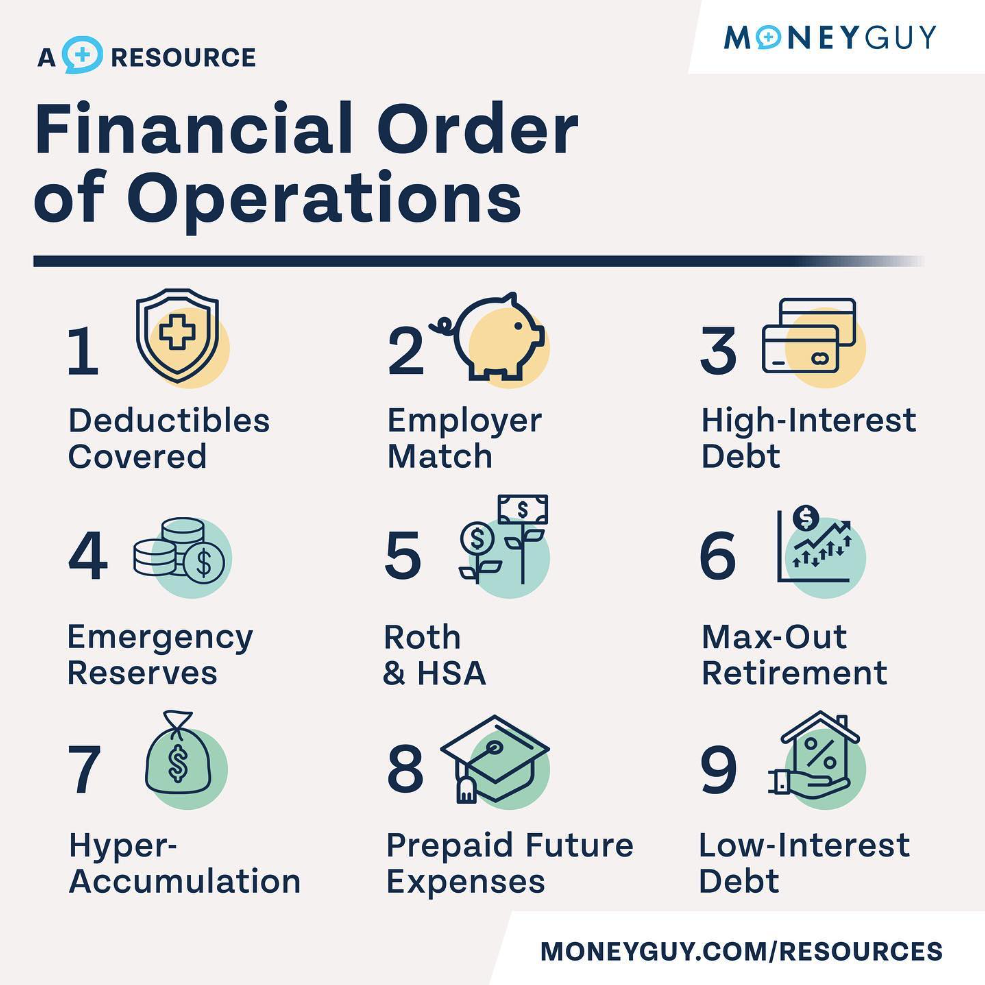

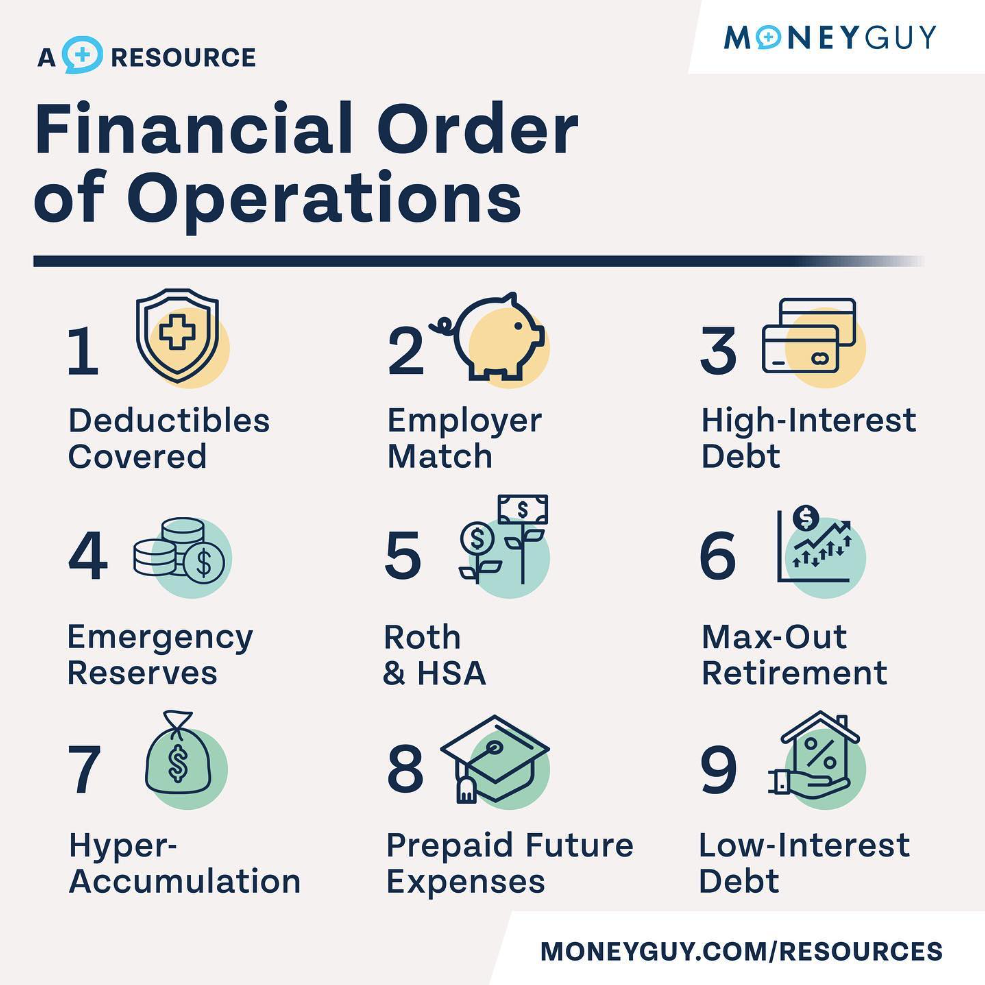

You could start by simply following this Financial Order of Operations from TheMoneyGuy

Financial Order of Operations from TheMoneyGuy

Also, read J.L. Collins' Simple Path to Wealth before blindly "investing in some sort of IRA" without knowing what you're getting into.

You won't like this but if I had "almost nonexistent" retirement, I would sell the boat and throw the payment, insurance and running costs into investments. The time for toys is over until you catch up on responsible adulting. Good on you for taking first step asking for advice.

You could start by simply following this

Financial Order of Operations from TheMoneyGuy

Financial Order of Operations from TheMoneyGuy Also, read J.L. Collins' Simple Path to Wealth before blindly "investing in some sort of IRA" without knowing what you're getting into.

This post was edited on 1/7/25 at 3:19 pm

Posted on 1/7/25 at 2:51 pm to WillFerrellisking

quote:Classic. I'm sure your wife would appreciate the payments.

If I die tomorrow I don’t need the retirement money but would have fished outta new boat.

I'd sell the boat and buy one when you can afford it.

But since that is unlikely, pay off the boat and invest the rest.

Just throw it in an IRA and buy SPY.

This post was edited on 1/7/25 at 2:52 pm

Posted on 1/7/25 at 2:55 pm to WillFerrellisking

quote:

Now back to subject, debt free or invest?

As people have said, your rates on your loans matter. Without knowing those details it is hard to say.

To be very generic though

A $100,000 with 10% yearly growth will be $259,374 in 10 years.

To pay off a $90,000 loan with a 10% interest rate over 10 years would $142,052 total. $1,183.77 a month payment.

Investing would net you a potential $159,000, but you would be paying interest on the debt so in the end a little over $100,000.

If you paid off debt and turn the debt payment into investing $1,183.77 monthly for 10 years at an average return of 10%, you’d have approximately $245,605.92.

Popular

Back to top

15

15