- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

The actual upcoming real estate crisis. CRE loans and vacant office buildings

Posted on 9/26/23 at 9:04 am

Posted on 9/26/23 at 9:04 am

quote:

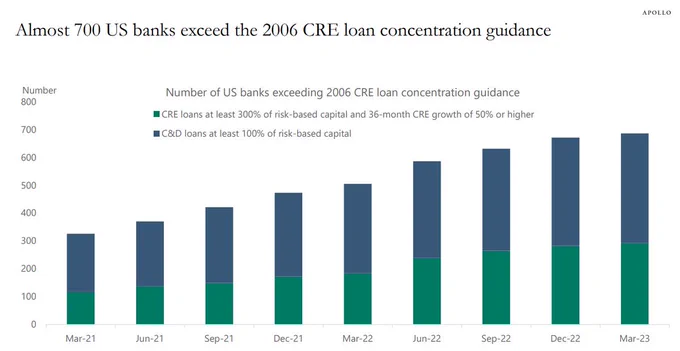

Nearly 700 US banks now exceed the 2006 Commercial Real Estate (CRE) loan concentration guidance.

What is the CRE loan concentration guidance?

It's guidance by the FDIC for the amount of exposure that small banks should have to CRE loans.

Currently, small banks hold over 70% of CRE loans which is $2 trillion worth of loans.

Meanwhile, $1.5 trillion of CRE loans are set to be refinanced at much higher rates by 2025.

All as office vacancies are at historic highs and CRE prices are in bear market territory.

The WSJ posted an article yesterday morning about the looming office doom in Atlanta

Even a Booming Economy Can’t Save Atlanta’s Office Market

San Fran is already experiencing it worse than Atlanta or any major city

KBS fund poised to surrender Downtown SF office building to lender

Swift defaults $62M loan tied to historic SF office building

Covid leading to more people WFH led us here but also the stupidity of the system. Many of these properties are financed on balloon loans and now those loans are all due within the next year or two. It wasn't really a concern in the past as at the end of the term it was easy to refinance or get a bridge loan to buy time to find another balloon loan or something more permanent.

Due to high vacancy rates banks are not looking to keep financing these deals with either a balloon or bridge loan. Also, the companies having to refi at higher rates is killing any cashflow on the buildings making them unattractive to keep or buy.

The fear is that as they all come due more and more buildings will go into default which will lead to more consolidation in the banking industry

This post was edited on 9/26/23 at 9:06 am

Posted on 9/26/23 at 9:06 am to stout

And now you have the real reason they want a return to the office. Workers who earned increased flexibility must sacrifice for the greater good to clean up the mistakes of idiot bankers.

Some things never change.

Some things never change.

Posted on 9/26/23 at 9:07 am to stout

(no message)

This post was edited on 1/18/25 at 1:18 pm

Posted on 9/26/23 at 9:11 am to lnomm34

Amazing that my wife can't find another office space in Pensacola.

Posted on 9/26/23 at 9:12 am to XenScott

quote:

Amazing that my wife can't find another office space in Pensacola.

There will always be exceptions to anything.

Posted on 9/26/23 at 9:13 am to XenScott

quote:

Amazing that my wife can't find another office space in Pensacola.

Amazing how one anecdote doesn't disprove OP's data.

Posted on 9/26/23 at 9:16 am to lnomm34

Well when people say, “I don’t care about politics, it doesn’t affect my daily life”.

Au contraire

Au contraire

Posted on 9/26/23 at 9:17 am to lnomm34

quote:

They remind me how crappy life is and how it really isn't worth living.

Would you rather be the frog in the pot not realizing you’re boiling until it’s too late?

Posted on 9/26/23 at 9:18 am to GetCocky11

quote:

Amazing how one anecdote doesn't disprove OP's data.

Yea not being able to find a small office to rent for a few thousand dollars for her small business isn't necessarily what this is about. A lot of this has to do with large corporations that usually rent multiple floors but are instead reducing their office footprint through WFH. I am not saying small offices aren't part of it but it's not the major issue.

Look how Elon gutteD Twitter and then basically forced his lease to be renegotiated. Just a small example.

This post was edited on 9/26/23 at 1:16 pm

Posted on 9/26/23 at 9:19 am to stout

I just got back from London and there is massive amounts of vacant commercial space. Entire office high rises, retail store space, food and bev space. It's shocking how you can't walk a single block without seeing Sales or For Lease spaces. Not sure if the UK leads or trails our domestic market.

Posted on 9/26/23 at 9:21 am to The Pirate King

(no message)

This post was edited on 1/18/25 at 1:17 pm

Posted on 9/26/23 at 9:25 am to stout

quote:

Look how Elon gutter Twitter and then basically forced his lease to be renegotiated. Just a small example

Office market dynamics have been changing for over a decade. Covid just accelerated the inevitable. Retail is following to a lesser degree. Industrial, MF and self storage will remain stable despite the market adjustments for interest rates and cap rates.

Posted on 9/26/23 at 9:27 am to The Pirate King

quote:

Would you rather be the frog in the pot not realizing you’re boiling until it’s too late?

Exactly.

quote:

STOUT

When I see a post from STOUT, it is always the first one I open on the entire site. I love real estate and everything associated with it. STOUT delivers solid info every time.

Posted on 9/26/23 at 9:28 am to stout

Many smaller banks have already had to pause commercial lending due to lack of deposits.

The middle class is running out of money

The middle class is running out of money

Posted on 9/26/23 at 9:30 am to lnomm34

I agree with you. This board is very negative now.

Posted on 9/26/23 at 9:33 am to stout

I wouldn't worry. Eventuallly it's going to affect the wrong person, and the government is gonna bail their asses out just like they do every time their big money donors are affected.

It's easier for them to continue screwing the middle class. Gotta protect the big boys.

It's easier for them to continue screwing the middle class. Gotta protect the big boys.

Posted on 9/26/23 at 9:34 am to jbgleason

quote:

I just got back from London

London was impacted by Brexit. For instance the EMA left an entire building in Canary Wharf. Not saying that there are not other impacts at play, but I am guessing will be a while before they get back to pre-Brexit capacity.

Posted on 9/26/23 at 9:35 am to dandyjohn

quote:

And now you have the real reason they want a return to the office.

Right now there’s IT groups with Humana they’re trying to push back into the office up to 3 days a week.

They had the audacity to say they weren’t productive from home and when asked for that data they couldn’t come up with it. Shortly after, they found out one of their higher ups was pushing for the return to justify a building they utilize.

Popular

Back to top

20

20