- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

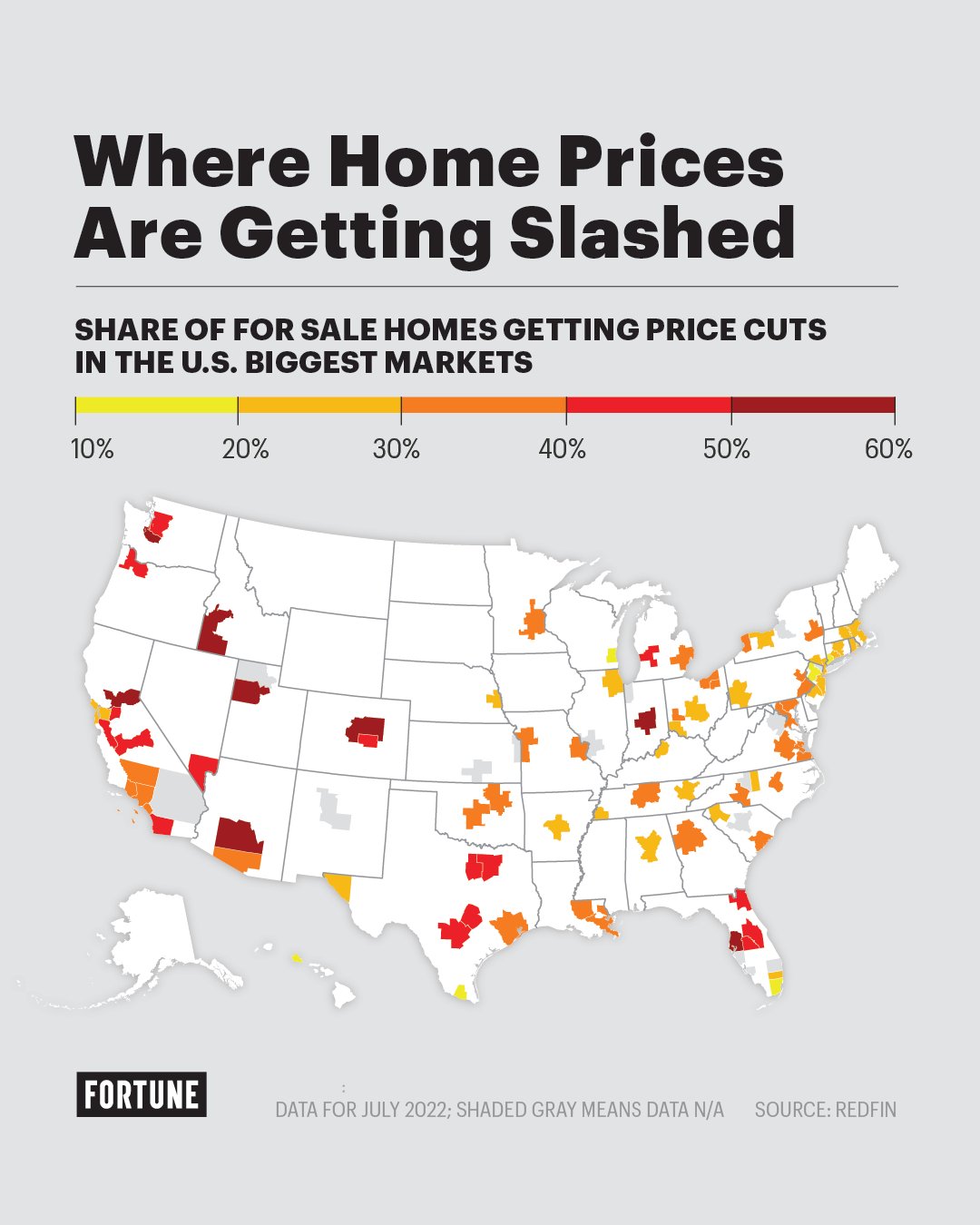

Map: How fast sellers are slashing home prices in America’s 97 biggest housing markets

Posted on 9/8/22 at 11:10 pm

Posted on 9/8/22 at 11:10 pm

quote:

The regional housing markets seeing the highest share of price cuts are in the very places that saw the biggest price gains during the pandemic. Just look at Boise. During the Pandemic Housing Boom, prices in Boise soared over 60%. But as the market shifted, Boise got hit the hardest. In July, 70% of home listings in Boise saw a price cut. That's up from 30% in July 2021.

quote:

It isn't just Boise. The West—the epicenter of the Pandemic Housing Boom—has shifted very fast. Just behind Boise are Denver (where 58% of listings saw a price cut in July), Salt Lake City (56%), and Tacoma (55%). Markets like Phoenix (where 50% of listings saw a price cut), San Diego (50%), and Stockton, Calif., (47%) also rank near the top.

quote:

Some firms—including John Burns Real Estate Consulting, Zonda, and Zelman & Associates—are already predicting that U.S. home prices in 2023 will post their first year-over-year decline of the post–Great Financial Crisis era. In a sharp housing downturn scenario, Fitch Ratings thinks a 10% to 15% national home price decline is possible. Not everyone agrees. Goldman Sachs and Zillow predict that U.S. home prices will rise another 1.8% and 2.4%, respectively, over the coming year.

LINK

Posted on 9/8/22 at 11:16 pm to hikingfan

As always, Slidell is dragging down St. Tammany.

Posted on 9/8/22 at 11:51 pm to hikingfan

quote:

San Diego (50%)

Im seeing 100k drops

This post was edited on 9/8/22 at 11:52 pm

Posted on 9/8/22 at 11:54 pm to SDVTiger

You misread the metrics.

50% OF houses on the market are getting the initial prices cut.

50% OF houses on the market are getting the initial prices cut.

Posted on 9/8/22 at 11:55 pm to hikingfan

A whole bunch of folks will be upside down in their mortgage in the next few months.

Posted on 9/8/22 at 11:56 pm to Eli Goldfinger

quote:

You misread the metrics.

I corrected

Posted on 9/8/22 at 11:59 pm to hikingfan

Chickens coming home to roost for all those people that paid too much for a lake house in North Central Alabama.

Been watching Lake Martin prices for the past year while shaking my head.

Been watching Lake Martin prices for the past year while shaking my head.

Posted on 9/9/22 at 12:01 am to hikingfan

The dumb F agents will say these are “price improvements”

Posted on 9/9/22 at 12:04 am to hikingfan

Surprised northern DFW is red. I'm still seeing price increases in Plano and Frisco.

Posted on 9/9/22 at 12:04 am to hikingfan

Thank goodness. Really hoping the bottom drops out of all of this soon because we need to buy another car.

Posted on 9/9/22 at 12:07 am to hikingfan

We’re still several years away from adequate inventory. Home prices/values more than likely won’t be rising exponentially like they have been doing the past couple of years. More than likely we are going to see a stabilization, if you will, and somewhere around 2-4% appreciation rates, maybe 4-7% in hotter markets.

Posted on 9/9/22 at 12:17 am to hikingfan

I need that little piece of land in the northwest corner of Arkansas to start dropping home prices fast.

Posted on 9/9/22 at 12:25 am to Paul Allen

quote:

We’re still several years away from adequate inventory. Home prices/values more than likely won’t be rising exponentially like they have been doing the past couple of years. More than likely we are going to see a stabilization, if you will, and somewhere around 2-4% appreciation rates, maybe 4-7% in hotter markets

You're forgetting two important considerations: rising interest rates and the onset of a recession.

If a large segment of people cant afford a house, demand will plummet.

Posted on 9/9/22 at 12:39 am to BurningHeart

quote:

You're forgetting two important considerations: rising interest rates and the onset of a recession. If a large segment of people cant afford a house, demand will plummet.

Lenders won’t mention the latter- sure you can afford a $300k house on $50k salary. Just send me your pay stubs and your tax returns, and we’ll get it done. Want to roll in closing costs? even better. No money out of your pocket at closing.

Seems like we’re basically back to 2008 in lending practices. It’s crazy, but it’s where we are again.

ETA: I’m not in a market where prices rose exponentially high, and we’ve been really lucky with our flips this year. We dug into some good ones that have made good profits for us. Hope it continues for a while.

This post was edited on 9/9/22 at 12:43 am

Posted on 9/9/22 at 6:47 am to hikingfan

Yet so little coverage of the bubble bursting. People still trying to pretend the market is just fine.

Posted on 9/9/22 at 6:50 am to hikingfan

I remember Las Vegas as one of the places hit hardest by the housing crash back in 2007/2008. Here they are in the purple again. Maybe Vegas isn't a good place to buy a home?

Posted on 9/9/22 at 6:50 am to Eli Goldfinger

quote:

A whole bunch of folks will be upside down in their mortgage in the next few months.

It’s going to be historic. I was getting outbid on houses by people offering 50k over asking for a middle class home. These people will be upside down for decades if the market corrects

Posted on 9/9/22 at 6:51 am to hikingfan

Holding out till next year or the next before buying my 2nd house (divorce got the first one).

Popular

Back to top

21

21