- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Financial advice for savings/investments

Posted on 1/8/22 at 10:13 pm

Posted on 1/8/22 at 10:13 pm

Need some quick financial advice moving forward.

Brief run down

Wife and I and a kid

Low 30s

We both make pretty solid money

I put 10% in employee Roth IRA every month

We have about 200k saved right now. 50k of that in robinhood safe stuff investment wise.

Only debt left is house (105k left)and one car note

I’m lost knowing what the next step is.

We want to build a forever nice home soon.

Our home now is very small and we ready to move.

So should I pay off house and car which are low interest rates.

Or keep saving and have more to put down for new house?

And most of savings is just sitting in normal savings account.

I’m just scared to put that all in robinhood.

I appreciate any help moving forward

Brief run down

Wife and I and a kid

Low 30s

We both make pretty solid money

I put 10% in employee Roth IRA every month

We have about 200k saved right now. 50k of that in robinhood safe stuff investment wise.

Only debt left is house (105k left)and one car note

I’m lost knowing what the next step is.

We want to build a forever nice home soon.

Our home now is very small and we ready to move.

So should I pay off house and car which are low interest rates.

Or keep saving and have more to put down for new house?

And most of savings is just sitting in normal savings account.

I’m just scared to put that all in robinhood.

I appreciate any help moving forward

Posted on 1/8/22 at 10:28 pm to JW6

quote:Because this is the MT board, I'm gonna need you to give me your definition of "safe".

50k of that in robinhood safe stuff investment wise.

quote:

So should I pay off house and car which are low interest rates.

Posted on 1/8/22 at 10:39 pm to JW6

Build the house. Put 20% in/down. Do whatever makes you feel comfortable with investments, but don't put your cash into the house. You can still make good returns with a more conservative approach to investing and always put some towards mortgage later if you choose.

How much is this forever home going to cost you? Pics of the wife?

How much is this forever home going to cost you? Pics of the wife?

Posted on 1/8/22 at 10:45 pm to UpstairsComputer

Prob 700k or so for house and land.

Both make together over 200k or more

We will sell house for around 150 or so. So got 40-50 eq in house.

So biggest thing is too invest then later add to mortgage on returns correct

And no pics sorry!’ Lol.

Most of my portfolio is VTI stock

Both make together over 200k or more

We will sell house for around 150 or so. So got 40-50 eq in house.

So biggest thing is too invest then later add to mortgage on returns correct

And no pics sorry!’ Lol.

Most of my portfolio is VTI stock

This post was edited on 1/8/22 at 10:48 pm

Posted on 1/8/22 at 10:51 pm to JW6

Invest in VTI or something similar. You need to be in more than cash and savings accounts are useless.

Posted on 1/9/22 at 2:40 am to JW6

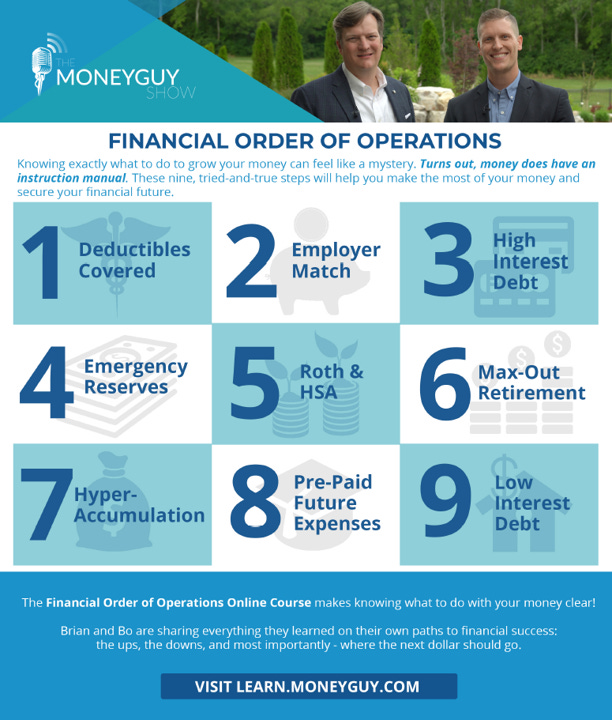

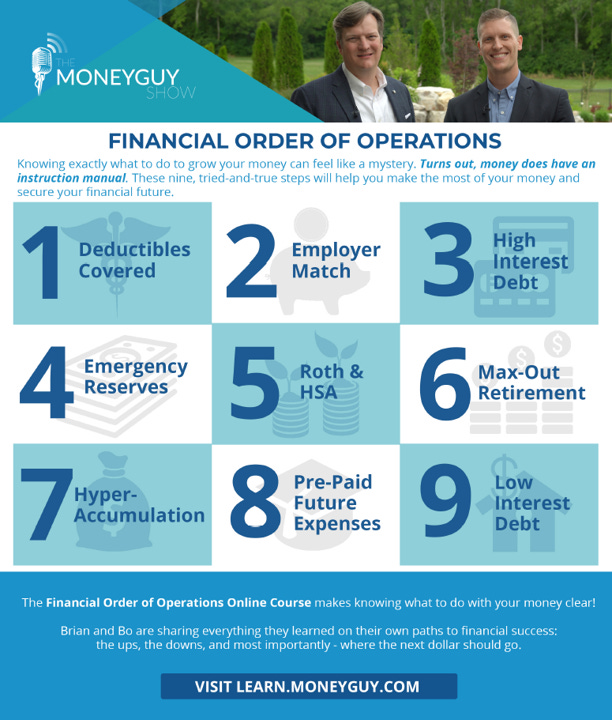

This financial order of operations is a useful model for what to do and in what order.

Which retirement/tax advantaged accounts do you actually have and are there others you have access to but haven't started (401k, 403b, HSA, 457 etc.)? By "employee Roth IRA" do you mean a Roth IRA or an employer Roth 401k?

10% into retirement probably ain't gonna cut it unless you have a pension. I'd aim to step that up by getting any employer match in 401k etc then fully funding Roth IRAs for yourself and spouse. Don't pay off low interest debt especially a mortgage on home you expect to sell soon. Aim to set aside 20% down to avoid PMI on next house and no more.

Index funds such as VTI are a good idea. Stick with what you're doing. You seem to be off to a good start ahead of most your age. Just ramp it up a bit and you'll really start gaining momentum as power of compounding kicks in.

Which retirement/tax advantaged accounts do you actually have and are there others you have access to but haven't started (401k, 403b, HSA, 457 etc.)? By "employee Roth IRA" do you mean a Roth IRA or an employer Roth 401k?

10% into retirement probably ain't gonna cut it unless you have a pension. I'd aim to step that up by getting any employer match in 401k etc then fully funding Roth IRAs for yourself and spouse. Don't pay off low interest debt especially a mortgage on home you expect to sell soon. Aim to set aside 20% down to avoid PMI on next house and no more.

Index funds such as VTI are a good idea. Stick with what you're doing. You seem to be off to a good start ahead of most your age. Just ramp it up a bit and you'll really start gaining momentum as power of compounding kicks in.

This post was edited on 1/9/22 at 3:10 am

Posted on 1/9/22 at 5:52 am to TorchtheFlyingTiger

Back door aside, wouldn’t he be phased out of the Roth 401k?

Posted on 1/9/22 at 6:48 am to CalcuttaTigah

Maybe, for 2022 married filing joint MAGI must be below $214k to contribute directly to Roth IRA. Even if combined income is above that, OP might bring it down w traditional 401k contributions etc.

Posted on 1/9/22 at 8:46 am to TorchtheFlyingTiger

Money guy is an awesome show. Highly recommend watching on YouTube for anyone that is trying to get a good understanding of financial management. They do a nice job of hitting on age specific shows as well as deep dive into common issues people are facing.

Posted on 1/9/22 at 9:01 am to lynxcat

Don’t pay off any low interest notes especially your house. Make sure you use credit wisely. Keep your credit score above 700 and pay off any credit cards monthly. Get a Heloc which will help manage debt and if available a health savings account health insurance plan. You are doing well for your early ‘30’s.

Do a 529 or ask your parents/ in laws to fund the 529 instead of buying the kid toys he doesn’t need.

Do a 529 or ask your parents/ in laws to fund the 529 instead of buying the kid toys he doesn’t need.

Posted on 1/9/22 at 9:15 am to JW6

Google “personal income financial flowsheet”. It’s a more detailed version of the order of operations posted earlier.

Posted on 1/9/22 at 9:56 am to saderade

I think the fact that you're asking these questions in your early 30s is a good sign. I didn't get serious about planning for retirement until I turned 38.

Do you not have access to a pre-tax 401k through your employer? Even if there's no company match like my employer, contributions there would at least allow for some tax-free growth.

I would not pay off low interest rate loans like the house and car. You can do better in market indexing ETFs, plus you can deduct the interest you pay on your house on your taxes.

The next step will depend on your risk aversion with regards to how much money you keep in a normal savings account. With inflation, you're actually losing money by keeping it there. At first I had my emergency funds in laddered CDs in a brokerage account, but that was when I was getting 2-3% on those. Eventually I moved them to index funds and have never looked back. Yes, if the market tanks, those will go down, but for me, I would rather that money grow at a higher rate for years than to keep it a savings account just on the off-chance I get laid off or have large medical bills. I'm not a financial expert by any means, but I'm sure you can come up with a diversified portfolio that will do better than a savings account while minimizing the risk of short-term market fluctuations in the off-chance you need the cash.

Do you not have access to a pre-tax 401k through your employer? Even if there's no company match like my employer, contributions there would at least allow for some tax-free growth.

I would not pay off low interest rate loans like the house and car. You can do better in market indexing ETFs, plus you can deduct the interest you pay on your house on your taxes.

The next step will depend on your risk aversion with regards to how much money you keep in a normal savings account. With inflation, you're actually losing money by keeping it there. At first I had my emergency funds in laddered CDs in a brokerage account, but that was when I was getting 2-3% on those. Eventually I moved them to index funds and have never looked back. Yes, if the market tanks, those will go down, but for me, I would rather that money grow at a higher rate for years than to keep it a savings account just on the off-chance I get laid off or have large medical bills. I'm not a financial expert by any means, but I'm sure you can come up with a diversified portfolio that will do better than a savings account while minimizing the risk of short-term market fluctuations in the off-chance you need the cash.

This post was edited on 1/9/22 at 9:57 am

Posted on 1/9/22 at 10:03 am to JW6

I don't know if this has been considered, but depending on the condition of your existing house, size of note, location, rental income potential, etc. you might want to look at seeing if you can swing keeping the existing and turning it into a rental

if the house is in decent shape and you know all the existing "issues" it may have, I'd try to trade the 40-50K equity you'd get out of selling it into just turning it into rental if at all possible and see if there aren't any other creative alternatives to getting that equity equivalent for your new house down payment

I'm not saying you should do it, but I'd definitely exhaust the possibilities...I passed up an opportunity to do this earlier in my life because I just glossed over it and really regret it today, but your situation might be different...all I'm saying is at least consider it and do due diligence to rule it out

if the house is in decent shape and you know all the existing "issues" it may have, I'd try to trade the 40-50K equity you'd get out of selling it into just turning it into rental if at all possible and see if there aren't any other creative alternatives to getting that equity equivalent for your new house down payment

I'm not saying you should do it, but I'd definitely exhaust the possibilities...I passed up an opportunity to do this earlier in my life because I just glossed over it and really regret it today, but your situation might be different...all I'm saying is at least consider it and do due diligence to rule it out

Posted on 1/9/22 at 2:13 pm to jlsufan

Yea I have a 401k employee retirement plan through secrurian. Where I add 10% every month and they match 2%. I go straight 10% roth.

I have about 60k in it now. Been putting in last 4-5 years.

So I feel like that should start compounding faster soon.

I just hope in 20 years or more of 10%. That will be enough in the future. I’m not sure the math on it thou.

And yea good idea. We thought about renting the existing house just got for iur kids future possibly and getting the note paid for.

It’s definitely a nice start up home that was just redone last 5-6 years.

I have about 60k in it now. Been putting in last 4-5 years.

So I feel like that should start compounding faster soon.

I just hope in 20 years or more of 10%. That will be enough in the future. I’m not sure the math on it thou.

And yea good idea. We thought about renting the existing house just got for iur kids future possibly and getting the note paid for.

It’s definitely a nice start up home that was just redone last 5-6 years.

Posted on 1/9/22 at 3:50 pm to JW6

You may want to consider traditional 401k instead of Roth 401k. If you expect to be in a lower tax bracket in retirement it could be better to save on income tax now. Open Roth IRAs. If you're over income limit, either do a back door Roth or use traditional 401k to reduce income.

Posted on 1/10/22 at 8:00 am to JW6

quote:

Prob 700k or so for house and land.

Both make together over 200k or more

That's a ton of house for that income..

Posted on 1/10/22 at 10:38 pm to reds on reds on reds

quote:Agreed. No more than 3x annual income for a house is a good rule to follow.

Prob 700k or so for house and land.

Both make together over 200k or more

That's a ton of house for that income..

Posted on 1/11/22 at 8:48 am to JW6

quote:

So should I pay off house and car which are low interest rates.

To quote Dave Ramsey..."if you pay off your house and absolutely hate being debt free, you can always go get another mortgage on it"

Popular

Back to top

7

7