- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

U.S. Oil Refiners Are More Profitable Than Before The Pandemic

Posted on 12/15/22 at 9:55 am

Posted on 12/15/22 at 9:55 am

quote:

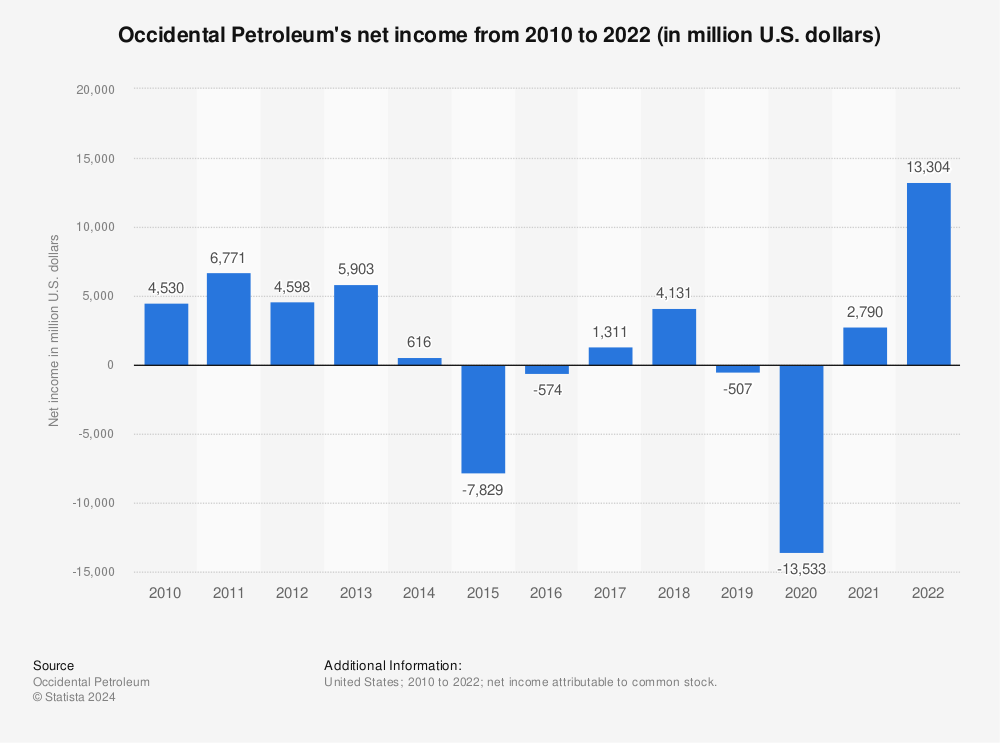

The top U.S. refiners have posted record quarterly profits this year amid high refining margins and reduced operational capacity in America, more than recovering the hefty losses from 2020, when the pandemic hit fuel demand.

The biggest refiners, Marathon Petroleum, Valero, and Phillips 66, have raked in more cash flows this year than in 2019, an analysis of financial reports by Reuters shows.

quote:

The top U.S. refiners reported slightly lower profits and refining margins for the third quarter compared to the record-breaking earnings for the second quarter. Yet, the Q3 earnings and refining margins were still much higher than in 2021 and the pre-pandemic levels. For example, Valero’s refining margin per barrel was at $21.34 for the third quarter, double the $10.07 margin for the same quarter last year. Marathon Petroleum’s refining and marketing margin more than doubled to $30.21 per barrel from $14.51 per barrel.

“Refining fundamentals remain strong as product demand through our system has surpassed 2019 levels, while global product supply remains constrained due to capacity reductions and high natural gas prices in Europe are setting a higher floor on margins,” Valero’s chairman and CEO Joe Gorder said in the Q3 release.

Earnings at the U.S. refiners are likely headed lower next year, compared to the record levels in 2022, Fitch Ratings said in a report last month. The rating agency expects U.S. refining crack spreads to fall by between 30% and 50% next year from unsustainably high current levels, “driven by refiner output mix adjustments, increasing Chinese exports, global refining capacity additions and weaker global economic growth.”

LINK

Posted on 12/15/22 at 9:56 am to ragincajun03

quote:

U.S. Oil Refiners Are More Profitable Than Before The Pandemic

aka they are actually making a profit

Posted on 12/15/22 at 9:59 am to ragincajun03

They are officially in "get what we can before the government kills us" mode

Posted on 12/15/22 at 9:59 am to hubertcumberdale

CORPORATE NUTS: [ON] off

Posted on 12/15/22 at 10:00 am to ragincajun03

They got lean during the downturn, oil is a cyclical business.

Posted on 12/15/22 at 10:01 am to ragincajun03

Good thing Shell shut down convent

Posted on 12/15/22 at 10:02 am to MrWalkingMan

quote:

CORPORATE NUTS: [ON] off

just stating most oil companies were operating at a loss for the ~5 years before covid

Posted on 12/15/22 at 10:03 am to ragincajun03

quote:

U.S. Oil Refiners Are More Profitable Than Before The Pandemic

Oh no, a private company is making a profit! The horror!

Posted on 12/15/22 at 10:03 am to wileyjones

quote:

Good thing Shell shut down convent

Removing supply has definitely helped make them more profitable.

Posted on 12/15/22 at 10:04 am to ragincajun03

What are the crack speads currently?

Posted on 12/15/22 at 10:05 am to wileyjones

quote:

Good thing Shell shut down convent

That refinery would probably still be in the negative

Posted on 12/15/22 at 10:08 am to hubertcumberdale

quote:

aka they are actually making a profit

So wait.. You are saying they are actually making a profit because before they were not?

I got to hear this one. Explain it to us.

Posted on 12/15/22 at 10:10 am to UltimaParadox

quote:

They got lean during the downturn, oil is a cyclical business.

quote:

Before The Pandemic

Posted on 12/15/22 at 10:11 am to OweO

quote:

You are saying they are actually making a profit because before they were not?

I got to hear this one. Explain it to us.

Yes.

Often times refiners lose money for weeks/months/years between periods of making money.

Posted on 12/15/22 at 10:11 am to OweO

This post was edited on 12/15/22 at 10:13 am

Posted on 12/15/22 at 10:11 am to OweO

“recovering the hefty losses from 2020, when the pandemic hit fuel demand.”

Reading is hard

Reading is hard

Posted on 12/15/22 at 10:11 am to ragincajun03

Good, means my company and me make more money.

Posted on 12/15/22 at 10:12 am to Powerman

quote:

They got lean during the downturn, oil is a cyclical business.

Before The Pandemic

How dense are you? He's saying they cut operating costs when supply tanked and now that supply has returned they meet it leaner than before. Do you not see how that can lead to record profits?

Posted on 12/15/22 at 10:13 am to back9Tiger

Too bad everybodys goin' electric! We are, right?

Popular

Back to top

22

22