- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

It turns out letting anyone with a pulse purchase Gucci bags on BNPL is a bad idea

Posted on 5/20/25 at 7:56 am

Posted on 5/20/25 at 7:56 am

Loading Twitter/X Embed...

If tweet fails to load, click here. Wonder how this will affect those using BNPL on their DoorDash orders.

LINK

According to the article, this is Trump's fault and not at all the fault of poor financial decisions.

quote:

Klarna’s net loss more than doubled in the first quarter as more consumers failed to repay loans from the Swedish “buy now, pay later” lender as concerns rose about the financial health of US consumers.

The fintech, which offers interest-free consumer loans to allow customers to make retail purchases, on Monday reported a net loss of $99mn for the three months to March, up from $47mn a year earlier.

The company, which makes money by charging fees to merchants and to consumers who fail to repay on time, said its customer credit losses had risen to $136mn, a 17 per cent year-on-year increase.

The increased failure to repay comes on the back of gloomy economic sentiment in the US, where a closely watched measure of consumers’ confidence last week fell to its second-lowest level on record. US President Donald Trump’s trade war has driven expectations of higher inflation.

Klarna’s results come weeks after the Swedish group was forced to pause its plan for a long-awaited stock market listing in New York as Trump’s sweeping tariffs announcements upended markets.

Klarna has focused on growing aggressively in the US in recent years, signing partnerships with merchants including DoorDash, Walmart and eBay. The push into America has raised concerns about the group’s vulnerability to a US recession.

Klarna said it was “closely monitoring changes in the macroeconomic environment” and “remains well-positioned to adapt swiftly if required”.

It said the short duration of its loans — 83 per cent of its loan book refreshes within three months — allowed it “to respond rapidly to evolving market conditions”.

Klarna’s credit loss rate as a percentage of its total payment volumes remains relatively low at 0.54 per cent, up from 0.51 per cent a year ago.

Revenues in the first quarter rose 13 per cent year-on-year to $701mn as the company counted 99mn active customers.

Posted on 5/20/25 at 7:59 am to stout

Predatory lenders getting what they had coming to them.

Posted on 5/20/25 at 7:59 am to stout

Sounds like a shitty business model to me

Posted on 5/20/25 at 8:00 am to stout

I understand the premise behind this but whoever thought this business model was sustainable was an idiot... These types of programs also ensure folks do not learn the difference between a want and a need...

Some hard lessons coming for many in this country...

Some hard lessons coming for many in this country...

Posted on 5/20/25 at 8:02 am to Bourre

quote:

Sounds like a shitty business model to me

they didnt analyze the risk correctly......

Posted on 5/20/25 at 8:03 am to The Maj

Horrible business model.

I don't think you can shop online without seeing a BNPL offer. Affirm is huge and people with already maxed credit cards are willing to dive into BNPL as they have zero control.

Liz Warren and the CFPB want to regulate it more instead of just letting people learn a hard lesson.

I don't think you can shop online without seeing a BNPL offer. Affirm is huge and people with already maxed credit cards are willing to dive into BNPL as they have zero control.

Liz Warren and the CFPB want to regulate it more instead of just letting people learn a hard lesson.

Posted on 5/20/25 at 8:05 am to stout

quote:

regulate it more instead of just letting people learn a hard lesson.

The lesson will be learned eventually, the longer they drag it out, the harder the lesson will be for all involved... The idea that government can protect people from being stupid is one of the key issues pushing government overreach into our lives...

Let the stupid suffer the consequences because lessons learned in pain tend to the be the lasting lessons...

Posted on 5/20/25 at 8:06 am to The Maj

quote:

These types of programs also ensure folks do not learn the difference between a want and a need...

There are people that take out loans for Christmas and vacations. I mean, we forgot the difference between a want and a need a long frickin time ago.

Posted on 5/20/25 at 8:11 am to Ten Bears

quote:

we forgot the difference between a want and a need a long frickin time ago.

Many have... all have not and I have certainly taught my children the difference between a want and a need... I also taught them how to manage their money and make smart decisions... Unfortunately, parents are more interested in being their kids' friends than being a responsible parent...

Posted on 5/20/25 at 8:22 am to stout

quote:Would have better luck legislating stupidity out of existence.

Liz Warren and the CFPB want to regulate it more instead of just letting people learn a hard lesson.

Posted on 5/20/25 at 8:24 am to The Maj

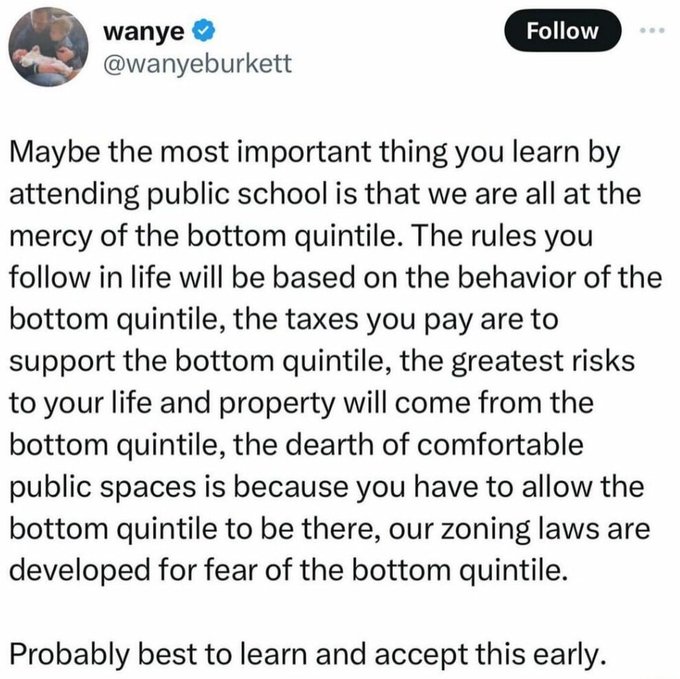

quote:Im so sick of running the world so the lowest common denominator is pain-free. We cater to the ignorant, while the smart and intelligent people suffer.

Let the stupid suffer the consequences because lessons learned in pain tend to the be the lasting lessons...

Posted on 5/20/25 at 8:32 am to Taxing Authority

quote:

Im so sick of running the world so the lowest common denominator is pain-free. We cater to the ignorant, while the smart and intelligent people suffer.

Posted on 5/20/25 at 8:44 am to Rex Feral

This reminds me of the stupid idea to put poor people in homes they couldn't afford by giving them interest only loans for five years. The answer to what brought about the 2008 financial meltdown.

Who is the Barney Frank and Christopher Dodd of Gucci bags?

Who is the Barney Frank and Christopher Dodd of Gucci bags?

Posted on 5/20/25 at 8:44 am to stout

Is this like Fingerhut (which seems like every crackhead is in collections to)?

Posted on 5/20/25 at 8:46 am to stout

What’s the collateral?

Are you really filing suit to collect the $500 the customer skipped out in?

I don’t understand how the economics of the business work at scale.

Are you really filing suit to collect the $500 the customer skipped out in?

I don’t understand how the economics of the business work at scale.

Posted on 5/20/25 at 9:29 am to boosiebadazz

quote:

Are you really filing suit to collect the $500 the customer skipped out in?

You should take a deep dive into how buying and selling debt works. I wanted to start a collection agency and buy portfolios. There are brokers who will sell you massive amounts of consumer debt for pennies on the dollar. The debt has been charged off, but is still collectible. The agencies (often owned by attorneys) then only have to collect partial payments on a small percentage of those loans to make that portfolio purchase profitable. One way to collect is to mass file suits and hope people don't push back.

Debt for sale

Posted on 5/20/25 at 9:29 am to stout

quote:

Klarna’s net loss more than doubled in the first quarter

US President Donald Trump’s trade war has driven expectations of higher inflation

Are they blaming the rising losses on his media threats about the tariffs? Unless I have my dates off a little, majority of the tariffs didn't start until April (after Q1) and those that started earlier were in March.

Posted on 5/20/25 at 9:39 am to stout

Would be curious as to the demographics on the delinquents

Posted on 5/20/25 at 9:40 am to stout

Who could have seen this coming?!

Popular

Back to top

8

8