- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

CBO claims rescinding the 87k additional IRS agents will add $115 billion to the deficit.

Posted on 1/9/23 at 10:45 pm

Posted on 1/9/23 at 10:45 pm

Can someone explain this? The only thing I can think of is the CBO is calculating the amount of taxes and penalties that will not be realized by 87k rabid IRS agents shaking down unsuspecting middle class Americans......with Boomers being the primary targets.

Posted on 1/9/23 at 10:46 pm to Bass Tiger

And just like that Dems became austere fiscal hawks.

Posted on 1/9/23 at 10:46 pm to Bass Tiger

Sounds like each agent essentially has a quota tax to gather

Posted on 1/9/23 at 10:50 pm to HailToTheChiz

quote:

Sounds like each agent essentially has a quota tax to gather

It's exactly what the CBO is thinking.....each new agent will generate and additional $100k in tax revenue above their salary and benefits cost to the government.

Posted on 1/9/23 at 10:56 pm to Bass Tiger

So just print 115billion more dollars that’s what they do for every other bullshite bill they want money for

Posted on 1/9/23 at 11:01 pm to Bass Tiger

quote:

The only thing I can think of is the CBO is calculating the amount of taxes and penalties that will not be realized by 87k rabid IRS agents shaking down unsuspecting middle class Americans

Pretty sure that's it

Posted on 1/9/23 at 11:02 pm to Bass Tiger

Those agents will be a $10 billion/year burden until they all die, hell probably longer and more expensive as they get replaced.

Posted on 1/9/23 at 11:05 pm to Bass Tiger

So, 115 Billion we won't waste or send to Ukraine.

Posted on 1/9/23 at 11:10 pm to mb6355

quote:

115 Billion we won't waste or send to Ukraine

Not like it going to stop any of that, it's a deficit for a reason.

Posted on 1/9/23 at 11:12 pm to Bass Tiger

Correct me if I'm wrong, but didn't the bill that authorized them pass through reconciliation? If so, that means that the bill had to be revenue neutral. So did the CBO score this provision of the original bill as +115B? If so, the bill is going to cost the American people severely. If not, they are spouting BS now.

Posted on 1/9/23 at 11:27 pm to Bass Tiger

And people wonder why no one trusts the CBO?

Posted on 1/10/23 at 12:00 am to Bass Tiger

quote:

exactly what the CBO is thinking.....each new agent will generate and additional $100k in tax revenue above their salary and benefits cost to the government.

So eliminating them doesn't add to a deficit? Why would Democrats lie about something?

Posted on 1/10/23 at 12:09 am to Bass Tiger

IRS audits require additional agents. Less people getting away with tax fraud results in more tax revenue.

Don’t get me wrong I’m not for higher taxation. I just think the so called "fiscal conservatives" target the wrong things. Attack spending first not taxes. It’s like they want their cake and to eat it too to borrow an old cliche. We must pay for the things we spend and not simply put it on our children’s credit card.

Trump came into office and cut little things but they were just a drop in the overall bucket, the large items weren’t barely touched or worse increased. These "fiscal conservatives" shout praises to the tax cuts but mention social security reform and they’re up in arms because "we’re promised" and such, never mind if it’s sinking the ship.

Don’t get me wrong I’m not for higher taxation. I just think the so called "fiscal conservatives" target the wrong things. Attack spending first not taxes. It’s like they want their cake and to eat it too to borrow an old cliche. We must pay for the things we spend and not simply put it on our children’s credit card.

Trump came into office and cut little things but they were just a drop in the overall bucket, the large items weren’t barely touched or worse increased. These "fiscal conservatives" shout praises to the tax cuts but mention social security reform and they’re up in arms because "we’re promised" and such, never mind if it’s sinking the ship.

Posted on 1/10/23 at 12:10 am to Bass Tiger

This makes no sense. I thought the CBO was a neutral organization. Doesn't sound like it from these numbers.

87k employees will cost at least $200k/yr for each one, when you look at salary, benefits, office equipment, travel and so forth. That's $17B/yr. Let's call it $15B.

That's a loss. For the program to incur a $115B deficit upon termination, then the program must be estimated to pull in $130B per year in additional revenue.

That comes out to around $1.5M per year in additional tax revenue per agent. Let's say the average 'target' for these agents is someone making about $100k/yr, that is a tax liability of, at most, $40k - let's say they can cull $20k from each of these people.

These agents must all get $20k from 75 people each year, which is about 6.25 per week, at a minimum, when you then look at vacation time. That's a lot of additional tax and that will require a lot of work to verify various deductions and so forth.

We are to believe they can audit and close out accounts at this rate? I'm not buying that at all.

If they are just going through files and getting $1k here and there, they have to find, document, send letters etc for 1500 people per year, that's 30/wk, 6/day, or about 1hr/each. And this does not account for all the cases they will look through and find no discrepancies.

This is utter nonsense.

87k employees will cost at least $200k/yr for each one, when you look at salary, benefits, office equipment, travel and so forth. That's $17B/yr. Let's call it $15B.

That's a loss. For the program to incur a $115B deficit upon termination, then the program must be estimated to pull in $130B per year in additional revenue.

That comes out to around $1.5M per year in additional tax revenue per agent. Let's say the average 'target' for these agents is someone making about $100k/yr, that is a tax liability of, at most, $40k - let's say they can cull $20k from each of these people.

These agents must all get $20k from 75 people each year, which is about 6.25 per week, at a minimum, when you then look at vacation time. That's a lot of additional tax and that will require a lot of work to verify various deductions and so forth.

We are to believe they can audit and close out accounts at this rate? I'm not buying that at all.

If they are just going through files and getting $1k here and there, they have to find, document, send letters etc for 1500 people per year, that's 30/wk, 6/day, or about 1hr/each. And this does not account for all the cases they will look through and find no discrepancies.

This is utter nonsense.

Posted on 1/10/23 at 12:16 am to POTUS2024

Take into account the numbers that are retiring which is substantial. And that most audits would be high net worth individuals and more importantly corporations with complex tax accounting schemes.

Posted on 1/10/23 at 12:27 am to DavidTheGnome

quote:

Take into account the numbers that are retiring which is substantial. And that most audits would be high net worth individuals and more importantly corporations with complex tax accounting schemes.

I'll believe the retirements when I see them - the federal workforce is getting older and older, with a massive number retirement eligible, but they don't retire. And in this economy, I don't think they will.

Reports have said these auditors are targeting middle class people, not high earners.

Complex filings like with businesses, I get that - but that requires a lot of time to sort through.

This just seems like a complete fabrication from CBO.

Posted on 1/10/23 at 12:29 am to POTUS2024

quote:

Reports have said these auditors are targeting middle class people, not high earners.

Show me

Posted on 1/10/23 at 12:55 am to DavidTheGnome

quote:Thank gawd we got rid of him and elected the fiscally responsible Biden administration! *phew* really dodged one there.

Trump came into office and cut little things but they were just a drop in the overall bucket, the large items weren’t barely touched or worse increased.

quote:

These "fiscal conservatives" shout praises to the tax cuts but mention social security reform and they’re up in arms because "we’re promised" and such, never mind if it’s sinking the ship.

This post was edited on 1/10/23 at 12:57 am

Posted on 1/10/23 at 1:02 am to Bass Tiger

Good.

frick the deficit. I’d rather add to the deficit than auditing 10 % of the people who already pay taxes and giving our tax dollars to bums and wokes

frick the deficit. I’d rather add to the deficit than auditing 10 % of the people who already pay taxes and giving our tax dollars to bums and wokes

Posted on 1/10/23 at 1:05 am to DavidTheGnome

quote:

Show me

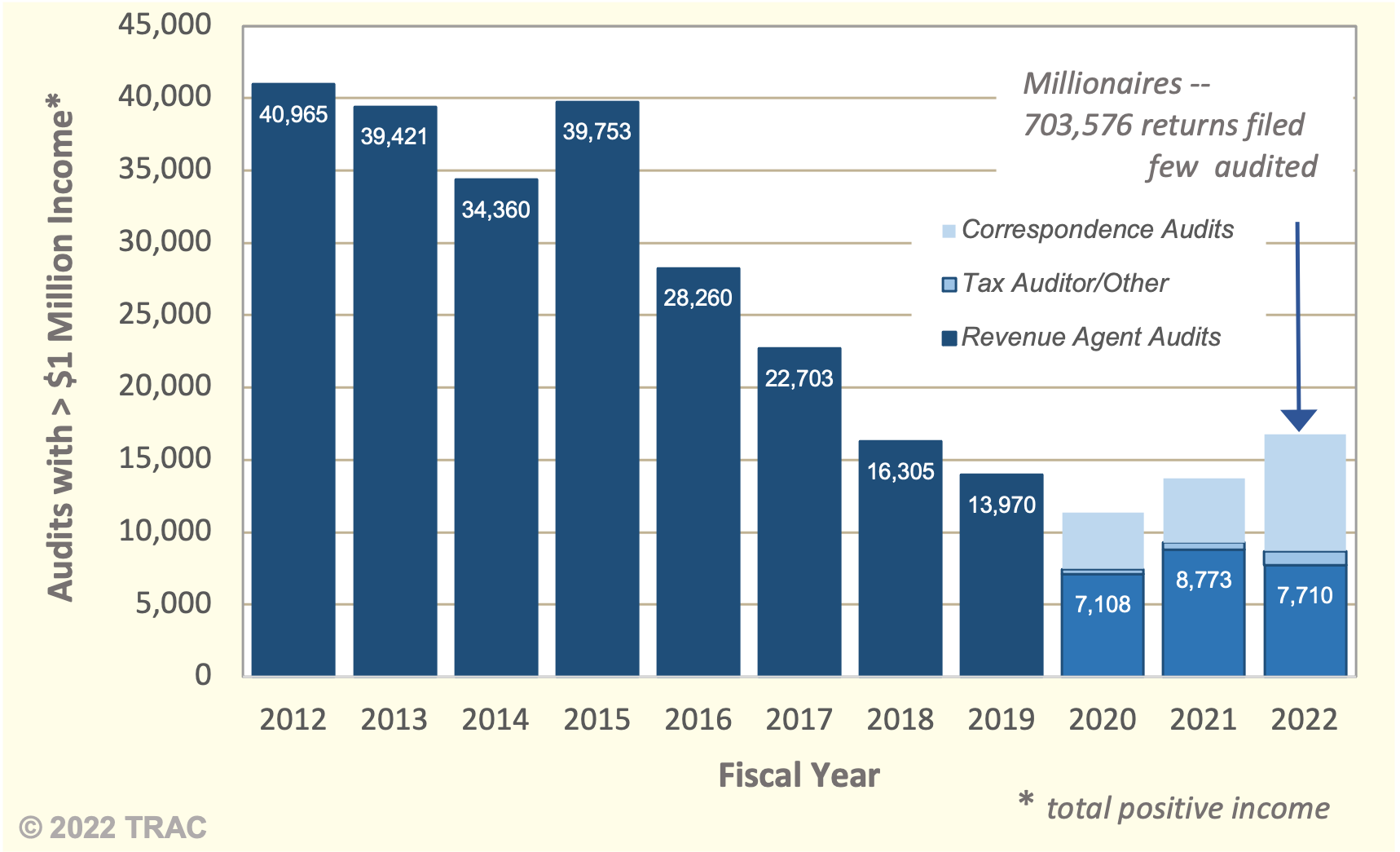

LINKto full detailed analysis

I’m sure next time it will be different.

There’s roughly about 700,000 filers >$1 million income. Do you really think they need an additional auditor for every 10 filers?

This post was edited on 1/10/23 at 1:08 am

Back to top

26

26