- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

WSJ: String of Firms That Imploded Have Something in Common: Ernst & Young Audited Them

Posted on 10/16/20 at 4:18 pm

Posted on 10/16/20 at 4:18 pm

Any EY auditors on the OT?

What happened to EY's auditing practice and why does it appear to suck?

quote:

Big Four accounting concern reviewed the books of several companies where investors lost billions when scandals emerged. The firm says it uncovered some of the problems at its clients.

WSJ

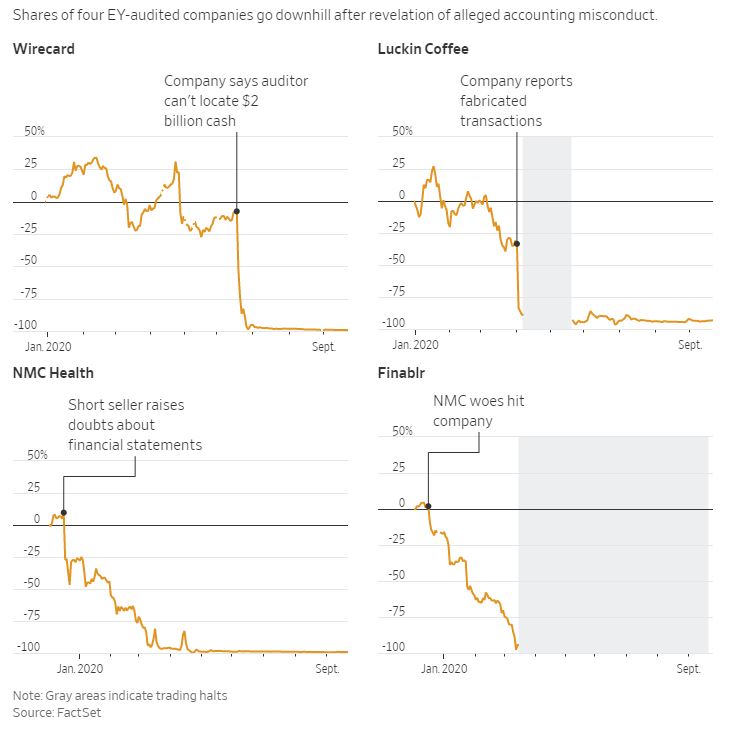

This year, $2 billion is missing at a German fintech company, $300 million of sales has been found to be fabricated at a Chinese coffee chain and $5 billion in undisclosed debt has been uncovered at two related companies listed in the U.K. Together, the incidents cost shareholders of the companies roughly $30 billion.

All had been audited by Ernst & Young. Last year, EY also audited office-space company WeWork, which nearly collapsed after fumbling a planned initial public offering.

EY is one of the Big Four accounting firms, whose audits are meant to give investors confidence in companies’ figures. EY missed red flags or failed to aggressively pursue them at some of the companies ahead of their scandals, and for the most part it was outsiders who raised questions first, a review based on publicly available documents and interviews with people close to the events shows. Now, regulators are scrutinizing EY’s work.

EY says it stands by its work and has high global audit standards. The firm says it played key roles in uncovering fraud at two of the companies, and it says China’s regulator has found it to be prudent and independent.

“We take all issues extremely seriously,” said Andy Baldwin , EY’s global client service managing partner, who said EY conducts around 150,000 audits annually.

The firm also recently said that auditors must play a bigger role in detecting fraud at companies, which would represent a U-turn in an industry that for long has denied that was part of its job.

While it wasn’t possible to pinpoint why EY has had so many recent audit clients with financial scandals, certain elements of EY’s business strategy might help explain the cluster of blowups.

EY had ties with executives and board members at some of its troubled audit clients. In some cases, former EY partners sat on the companies’ boards, including on their audit committees.

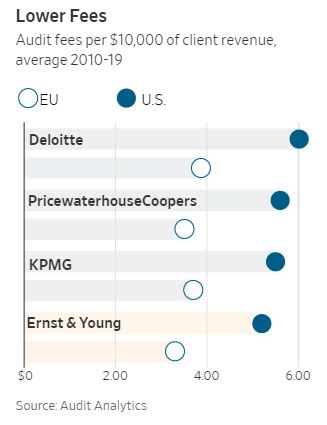

EY charges lower fees for audits, which are labor intensive and time consuming, than other Big Four firms in the U.S. and Europe on average, an analysis of data from research firm Audit Analytics shows.

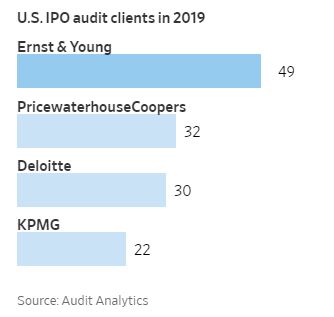

EY also focuses more than other firms on auditing young, fast-growing technology companies. All of the recent troubled clients portrayed themselves as tech-driven industry disrupters. EY helped some prepare for IPOs. Among mature tech companies, EY audits Google parent Alphabet Inc., Amazon.com Inc., Apple Inc., Facebook Inc. and Netflix Inc., having worked with several since they went public.

EY has a history of trying to attract companies gearing up to go public, developing relationships with venture-capital firms that fund them, said Lynn Turner , a former U.S. Securities and Exchange Commission chief accountant. EY prices its audits “exceedingly competitively low to attract these companies with the hope that when they go public, they will make up for the initial discounts of audit fees,” he added.

quote:

One of the biggest blowups at EY-audited companies this year involved Wirecard. The payments processor first hired EY back in 2008 to look into shareholder allegations that Wirecard counted customer deposits as its own cash and that margins were suspiciously high. EY found nothing wrong and the next year became Wirecard’s auditor.

Suspicions, including whistleblower allegations, continued to follow Wirecard for years, and in June the company collapsed after some $2 billion it claimed to have in trustee-controlled bank accounts in Asia couldn’t be found.

Much of the cash was supposedly held by Citadelle Corporate Services in Singapore until late 2019. EY, in auditing Wirecard’s books, failed to notice that Citadelle wasn’t licensed to operate a trust business, something that can be checked on a Singapore government website. Singapore authorities have charged the owner of Citadelle with falsifying letters confirming bank balances. The owner, R. Shanmugaratnam , couldn’t be reached for comment. A lawyer for him previously declined to comment.

EY declined to comment on the trustee’s license. It also declined to say whether it had asked the Singapore bank listed by Wirecard as holding the trust accounts to confirm their existence.

EY eventually realized that the money, by then supposedly held by another trustee, was missing. This followed alerts raised by another audit firm, KPMG LLP, which was doing an in-depth look at accounts at Wirecard’s request.

EY has said it had been provided with false bank confirmations and statements pertaining to Wirecard escrow accounts for the 2019 audit. “It was ultimately the work of EY Germany that exposed a fraud expertly designed to circumvent all the checks and balances,” EY said.

quote:

EY also had a relationship, via one of its former managers, with audit client WeWork, the provider of shared office space.

The former EY manager, Artie Minson , was WeWork’s president and chief financial officer in 2017. That year, he appeared in an EY promotional video on Twitter talking about connections among EY employees and alumni, who often work for companies audited by the firm.

“As I was making different career choices, there were a number of EY alumni that I bounced ideas off or gave me advice or frankly hired me....People are really happy to help EY alumni as they move through their careers,” Mr. Minson said in the video.

Asked if that reflected on the auditor’s independence, EY had no comment. Mr. Minson declined to comment.

EY signed off on WeWork parent We Co.’s accounts before its plan to go public a year ago. But investors grew alarmed about spotty financial disclosures, the company’s valuation tumbled, and it canceled the IPO.

quote:

EY also had ties, via former personnel, to two U.K.-listed companies with operations in the United Arab Emirates that ran into trouble this year. They were NMC Health and Finablr—companies that had the same founder, many shareholders in common and CEOs who were brothers.

Both companies’ boards contained two directors who were former EY partners. Each of their audit committees had a former EY partner on it.

Muddy Waters in December questioned NMC’s financial statements, including its reported debt level. NMC initially issued a rebuttal. A couple of months later, it said an independent review had uncovered undisclosed debt, in an amount eventually put at around $4 billion.

What happened to EY's auditing practice and why does it appear to suck?

This post was edited on 10/16/20 at 4:25 pm

Posted on 10/16/20 at 4:20 pm to dewster

That’s a lot of words for something that should be on the Money board...

Posted on 10/16/20 at 4:20 pm to dewster

That’s not going to be good for business

Posted on 10/16/20 at 4:28 pm to dewster

quote:

EY, in auditing Wirecard’s books, failed to notice that Citadelle wasn’t licensed to operate a trust business, something that can be checked on a Singapore government website.

Wow. Some Texas A&M auditors made it all the way to Singapore!

Posted on 10/16/20 at 4:28 pm to dewster

quote:

What happened to EY's auditing practice and why does it appear to suck?

Alright, kids. Let me tell you about financial incentives...

Posted on 10/16/20 at 4:28 pm to dewster

This is the so called Swamp that needs to be drained. Banking, Finance and Wall Street are crooked as frick. Hard working small money citizens don't have a chance against this type of looting.

Posted on 10/16/20 at 4:32 pm to Sao

quote:

This is the so called Swamp that needs to be drained. Banking, Finance and Wall Street are crooked as frick. Hard working small money citizens don't have a chance against this type of looting.

EY's auditing practice is supposed to sniff out this kind of shady activity before it becomes metastatic corruption that hurts shareholders like you. I'm just curious as to how many Arthur Anderson alumni are now EY partners.

Usually this type of corruption and incompetence is only seen among politicians or, lately, the FBI. EY can hire the world's best if they wanted to.

This post was edited on 10/16/20 at 4:40 pm

Posted on 10/16/20 at 4:36 pm to dewster

quote:

I'm just curious as to how many Arthur Anderson alumni are now EY partners

That’s a good question. There are definitely some.

Let’s also not lose sight of the fact that 23 year old college kids and slave wage paid Indian and South Americans are doing the bulk of the work here.

This post was edited on 10/16/20 at 4:42 pm

Posted on 10/16/20 at 4:38 pm to jclem11

quote:

Let’s also not lose sight of the fact that 23 year old college kids and slave wage paid Indian and South Americans are doing the bulk of the world here.

Lowest rates of the Big 4.

Posted on 10/16/20 at 4:41 pm to dewster

quote:

Lowest rates of the Big 4.

I know. You are only strengthening my point.

You get what you pay for.

Posted on 10/16/20 at 4:48 pm to jclem11

I think some companies are on with shitty audits.

Posted on 10/16/20 at 5:07 pm to dewster

quote:

EY has said it had been provided with false bank confirmations and statements pertaining to Wirecard escrow accounts for the 2019 audit.

How is this even possible unless the bank was complicit in Wirecard's fraudulent cash reporting?

Posted on 10/16/20 at 5:30 pm to dewster

Don't know if it is mentioned in the article, but EY was also the auditor at HealthSouth while Richard Scrushy was doing his thing. Their conduct there was horrific. Scrushy was giving them so much BS consulting type work that it totally compromised their independence. Seems like they need to just shut down their audit practice. Don't know why anyone would rely on anything they have to say.

Posted on 10/16/20 at 5:31 pm to dewster

quote:

China’s regulator has found it to be prudent and independent.

Good enough for me.

Posted on 10/16/20 at 5:31 pm to FinleyStreet

Banks can be.corrupted

See First NBC

See First NBC

Posted on 10/16/20 at 5:32 pm to dewster

quote:

Ernst & Young

Picked up a lot of Anderson folks post Enron in Houston

PwC alumni here and they also picked up some Anderson folks but not nearly as many.

They have a trash training program as compared to the other 3. Deloitte takes the cake with the Dallas hub. KPMG & PwC have solid training and on boarding programs.

I wouldn’t work for EY nor recommend anyone to work for EY.

Posted on 10/16/20 at 5:35 pm to dewster

Can you explain this to a 8th grader?

Posted on 10/16/20 at 5:39 pm to dewster

quote:

Lowest rates of the Big 4

Shouldn’t it be the opposite? If I owned a shady company, I’d hire the auditor that provided the least resistance.

Popular

Back to top

17

17