- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

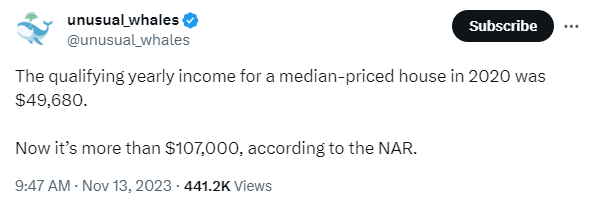

The qualifying yearly income for a median-priced house in 2020 was $49,680.

Posted on 11/13/23 at 1:34 pm

Posted on 11/13/23 at 1:34 pm

Posted on 11/13/23 at 1:35 pm to GumboPot

The great reset is inching closer.

Posted on 11/13/23 at 1:36 pm to GumboPot

quote:

for a median-priced house

Did they mean medium priced?

Posted on 11/13/23 at 1:36 pm to GumboPot

I saw this in the thread about it the other day.

Posted on 11/13/23 at 1:37 pm to GumboPot

This has more to do with interest rates than home price.

Posted on 11/13/23 at 1:38 pm to BeepNode

quote:

Blackrock staaacked.

Yes, except for the part of their portfolio where they paid a premium for real estate the last few years. They are going to have to sit on that portfolio for good while, unless they want to take a major haircut.

Posted on 11/13/23 at 1:39 pm to HubbaBubba

quote:

This has more to do with interest rates than home price.

Yes.

Posted on 11/13/23 at 1:40 pm to HubbaBubba

quote:

This has more to do with interest rates than home price.

Doesn't make it any less shocking for a first time home buyer

Posted on 11/13/23 at 1:43 pm to GumboPot

Cares Act + Inflation reduction act

Posted on 11/13/23 at 1:44 pm to HubbaBubba

quote:

This has more to do with interest rates than home price.

True, but its not like interest rates now are high.

They are historically normal.

Posted on 11/13/23 at 1:46 pm to GumboPot

quote:

Yes, except for the part of their portfolio where they paid a premium for real estate the last few years. They are going to have to sit on that portfolio for good while, unless they want to take a major haircut.

Nope. It may look like a haircut for tax purposes but this all helps with the push towards these types of companies owning everything.

It must have been annoying for them to get into bidding wards with regular goys for properties due to low interest rates and disposable incomes. That's getting addressed.

This post was edited on 11/13/23 at 1:48 pm

Posted on 11/13/23 at 1:51 pm to HubbaBubba

quote:yup.

This has more to do with interest rates than home price.

but some areas (like middle tn) have gotten out of control on home prices too

Posted on 11/13/23 at 1:54 pm to OysterPoBoy

quote:

Did they mean medium priced?

They did not.

Posted on 11/13/23 at 1:54 pm to HubbaBubba

The interest rate in 2020 averaged 3.11% - on an average $240k house that is: $1026.00

Today, at 8.4% that is $1829.00

So, an additional $803 a month. Add 30% to that to cover income taxes, and you have a total additional income needed of about $1050.

At twelve months, that's an additional $12,600.

But, the median price, as an example, in DFW, went up $90,000. At 8.4%, that's an additional $686.00 a month, plus tack on 30% for taxes and you have $891.00, which is $10,962.

So $10,962 + $12,600 = $23,562 more of your income is required every year now for the same home.

So how do they get from a needed income of $49,680 to $107,000 when you only needed to add $23,562, which is $73,242 annually.

Today, at 8.4% that is $1829.00

So, an additional $803 a month. Add 30% to that to cover income taxes, and you have a total additional income needed of about $1050.

At twelve months, that's an additional $12,600.

But, the median price, as an example, in DFW, went up $90,000. At 8.4%, that's an additional $686.00 a month, plus tack on 30% for taxes and you have $891.00, which is $10,962.

So $10,962 + $12,600 = $23,562 more of your income is required every year now for the same home.

So how do they get from a needed income of $49,680 to $107,000 when you only needed to add $23,562, which is $73,242 annually.

Posted on 11/13/23 at 2:01 pm to HubbaBubba

quote:

So how do they get from a needed income of $49,680 to $107,000 when you only needed to add $23,562, which is $73,242 annually.

You need to consider debt to income ratio, not just additional income needed.

Posted on 11/13/23 at 2:03 pm to HubbaBubba

Homes are about 30% higher to build than pre Covid.

Posted on 11/13/23 at 2:07 pm to BeepNode

quote:

Blackrock staaacked.

Institutional investors are probably the most fricked, actually.

Popular

Back to top

16

16