- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

LA, MS, & AL lead the nation in people facing foreclosure percentage wise

Posted on 12/20/23 at 8:35 am

Posted on 12/20/23 at 8:35 am

Of course, bigger states have more foreclosures overall...

1 in 4,300 Homes at Risk of Foreclosure

....but LA, MS, and AL lead the nation in a few concerning categories

Foreclosure Starts Rose in October, but Remain at Historically Low Levels

Report: How Many U.S. Home Mortgages Are Performing?

Some interesting tidbits from the above article

18% that left forbearance but didn't make all payments or get a plan put in place might be something to watch

Some other interesting developments

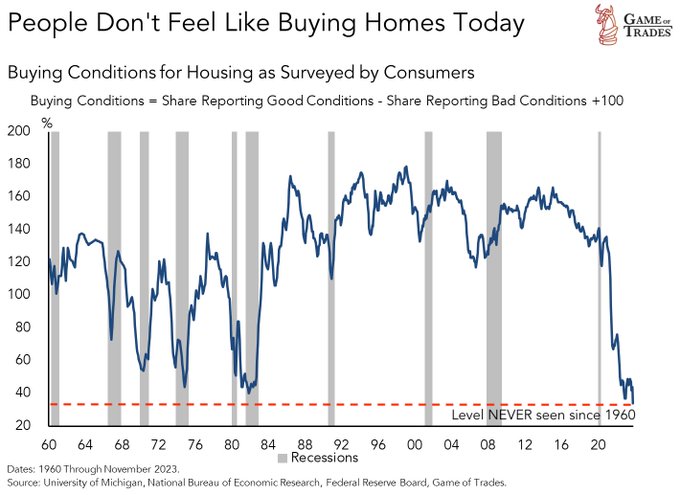

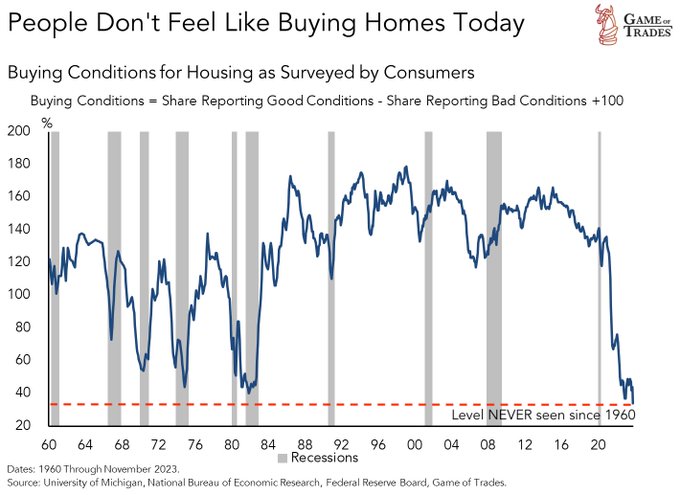

US housing market keeps getting worse

Home buying conditions are at levels NEVER seen since 1960

US Housing Starts Unexpectedly Rise to a Six-Month High

- Construction of new houses jumped almost 15% in November

- Starts of single-family houses rose to highest since 2022

quote:

Though, the greatest number of foreclosures starts still remain in the red-hot real estate markets of California, Florida, and Texas.

States that had the greatest number of foreclosure starts in November 2023 again included: Texas (2,702 foreclosure starts); California (2,495); Florida (2,078); New York (1,450); and Ohio (1,069).

Those major metropolitan areas with a population greater than 1 million that had the greatest number of foreclosure starts in November 2023 included: New York, New York (1,516 foreclosure starts); Houston, Texas (969); Philadelphia, Pennsylvania (733); Chicago, Illinois (673); and Miami, Florida (669).

1 in 4,300 Homes at Risk of Foreclosure

....but LA, MS, and AL lead the nation in a few concerning categories

quote:

Top 5 States by Non-Current Percentage

Mississippi: 7.91%

Louisiana: 7.46%

Alabama: 5.60%

Indiana: 5.11%

Arkansas: 5.03%

quote:

Top 5 States by 90+ Days Delinquent Percentage

Mississippi: 2.11%

Louisiana: 1.81%

Alabama: 1.43%

Arkansas: 1.24%

Georgia: 1.17%

Foreclosure Starts Rose in October, but Remain at Historically Low Levels

quote:

The five states with the lowest share of loans that were current as a percent of servicing portfolio included:

Louisiana

Mississippi

Indiana

New York

Illinois

Report: How Many U.S. Home Mortgages Are Performing?

Some interesting tidbits from the above article

quote:

The Mortgage Bankers Association’s (MBA) latest Loan Monitoring Survey shows that the total number of loans now in forbearance decreased by three basis points from 0.29% of servicers’ portfolio volume in the prior month to 0.26% as of November 30, 2023.

According to MBA’s estimate, 130,000 homeowners are currently in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.

In November 2023, the share of GSE loans (Fannie Mae and Freddie Mac) in forbearance declined two basis points from 0.18% to 0.16%. Ginnie Mae loans in forbearance decreased five basis points from 0.52% to 0.47%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased two basis points from 0.32% to 0.30%.

“Nearly 96% of all home mortgages are performing, which underscores how strong servicing portfolio performance is right now with the same resilience seen in the U.S. labor market,” said Marina B. Walsh, CMB, MBA’s VP of Industry Analysis. “Meanwhile, the performance of loan workouts is solid, but declined last month. Roughly 70% of loan workouts initiated since 2020 are current.”

By reason, 53.6% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability; while 34.3% of borrowers are in forbearance because of COVID-19. Another 12.1% were in forbearance due to a natural disaster.

By stage, 49.0% of total loans in forbearance are in the initial forbearance plan stage, while 35.1% are in a forbearance extension. The remaining 15.8% are forbearance re-entries, including re-entries with extensions.

“MBA forecasts an economic downturn in 2024, and there are signs of early distress in other credit types such as car loans and credit cards,” added Walsh. “Those borrowers who struggled in making their mortgage payments in the past may find themselves in similar situations in a softening economy and rising unemployment.”

According to Bureau of Labor Statistics (BLS), total nonfarm payroll employment increased by 199,000 in November, and the unemployment rate edged down to 3.7%. Job gains occurred in healthcare and government. Employment also increased in manufacturing, reflecting the return of workers from a strike. Employment in retail trade declined.

Of the cumulative forbearance exits for the period from July 1, 2020, through November 30, 2023, at the time of forbearance exit:

29.4% resulted in a loan deferral/partial claim.

17.7% represented borrowers who continued to make their monthly payments during their forbearance period.

18.4% represented borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet.

16.1% resulted in a loan modification or trial loan modification.

10.8% resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

6.5% resulted in loans paid off through either a refinance or by selling the home.

The remaining 1.2% resulted in repayment plans, short sales, deed-in-lieus or other reasons.

18% that left forbearance but didn't make all payments or get a plan put in place might be something to watch

Some other interesting developments

US housing market keeps getting worse

Home buying conditions are at levels NEVER seen since 1960

US Housing Starts Unexpectedly Rise to a Six-Month High

- Construction of new houses jumped almost 15% in November

- Starts of single-family houses rose to highest since 2022

This post was edited on 12/20/23 at 9:02 am

Posted on 12/20/23 at 8:40 am to stout

1,450 foreclosures is practically nothing in a city like NYC where the metro population is over 5,000,000 people

This post was edited on 12/20/23 at 8:41 am

Posted on 12/20/23 at 8:43 am to stout

The housing market will never crash

If houses were cheap a millenial might be able to buy one and the globalists won’t let that happen

If houses were cheap a millenial might be able to buy one and the globalists won’t let that happen

Posted on 12/20/23 at 8:44 am to JasonDBlaha

That is foreclosure starts in November only. That means 1450 more added that month to what was already in foreclosure previously.

What matters is if that number exceeds how many properties that have already gone through the process and are now REO are being sold. AKA if they are taking in more than they are getting off the books.

Only time will tell if that is the case.

What matters is if that number exceeds how many properties that have already gone through the process and are now REO are being sold. AKA if they are taking in more than they are getting off the books.

Only time will tell if that is the case.

This post was edited on 12/20/23 at 8:46 am

Posted on 12/20/23 at 8:50 am to stout

quote:

Top 5 States by 90+ Days Delinquent Percentage

Mississippi: 2.11%

Louisiana: 1.81%

Alabama: 1.43%

Arkansas: 1.24%

Georgia: 1.17%

That is an interesting stat. Has anyone done a study on why this may be the case? Geography? Or is there something else those 5 states might have in common

Posted on 12/20/23 at 8:50 am to stout

It really doesn't surprise me. When I read this board and see what people are paying for houses (not land just structure) for a house is crazy.

I'd wager that more of the OT has more money in their house than I do. (Again, not land my land is where the value is) People are mortgaged out.

I'd wager that more of the OT has more money in their house than I do. (Again, not land my land is where the value is) People are mortgaged out.

Posted on 12/20/23 at 8:51 am to stout

Is there a good resource to find upcoming foreclosures? I’d like to get another junk house and fix it up into a rental

Posted on 12/20/23 at 8:53 am to El Segundo Guy

I priced having my house dozed and a new construction house at 2600 sf. I said nope and contracted a remodel on my 1800 sf.

Posted on 12/20/23 at 8:53 am to stout

quote:

States that had the greatest number of foreclosure starts in November 2023 again included: New York (1,450)

quote:

Those major metropolitan areas with a population greater than 1 million that had the greatest number of foreclosure starts in November 2023 included: New York, New York (1,516 foreclosure starts)

Hmmmm...something seems incorrect here.

Posted on 12/20/23 at 8:57 am to Alt26

quote:Ten Poorest States in the U.S.: Mississippi, Louisiana, West Virginia, New Mexico, Arkansas, Kentucky, Alabama, Oklahoma, Texas, and New Yorkquote:That is an interesting stat. Has anyone done a study on why this may be the case? Geography? Or is there something else those 5 states might have in common

Top 5 States by 90+ Days Delinquent Percentage

Mississippi: 2.11%

Louisiana: 1.81%

Alabama: 1.43%

Arkansas: 1.24%

Georgia: 1.17%

Posted on 12/20/23 at 8:58 am to MardiGrasCajun

quote:

Hmmmm...something seems incorrect here.

I’m guessing that the NYC metropolitan statistical area includes suburbs in neighboring states.

Posted on 12/20/23 at 8:58 am to el Gaucho

quote:

Is there a good resource to find upcoming foreclosures? I’d like to get another junk house and fix it up into a rental

There is no way to get an "upcoming foreclosure" unless you can buy directly from the owner. Often when they are at that point there are other liens against the property, or you have to work out a short sale with the owner and bank, or a couple is in the middle of a nasty divorce.

Often it's best to let them go to the Sheriff's sale and buy there to get a clean title.

Also check out Auction.com, Xome.com, etc. Those are the auction sites used by HUD and financial institutions to sell off the houses they get conveyed back to them.

I tried to buy a house from a couple divorcing about 6 months ago. The husband was not cooperative despite the wife trying just to get from under it. I now have a client (the bank) who wants a remodel done on the house as the bank completed the foreclosure process and owns it.

The couple could have put some money in their pocket and not had a foreclosure on their credit but the husband chose not to out of spite. People are nuts.

This post was edited on 12/20/23 at 9:00 am

Posted on 12/20/23 at 9:01 am to MardiGrasCajun

quote:

Hmmmm...something seems incorrect here.

There are a few different companies that track foreclosure data. CoreLogic is the biggest. There will be some margin of error between them.

Posted on 12/20/23 at 9:24 am to stout

bidenomics is ruining the American dream

Posted on 12/20/23 at 9:44 am to stout

quote:

I tried to buy a house from a couple divorcing about 6 months ago. The husband was not cooperative despite the wife trying just to get from under it. I now have a client (the bank) who wants a remodel done on the house as the bank completed the foreclosure process and owns it.

Idk man it probably makes sense for the dude if he’s about to stuck with child support

Posted on 12/20/23 at 9:45 am to stout

quote:

According to MBA’s estimate, 130,000 homeowners are currently in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.1 million borrowers since March 2020.

In November 2023, the share of GSE loans (Fannie Mae and Freddie Mac) in forbearance declined two basis points from 0.18% to 0.16%. Ginnie Mae loans in forbearance decreased five basis points from 0.52% to 0.47%, and the forbearance share for portfolio loans and private-label securities (PLS) decreased two basis points from 0.32% to 0.30%.

“Nearly 96% of all home mortgages are performing, which underscores how strong servicing portfolio performance is right now with the same resilience seen in the U.S. labor market,” said Marina B. Walsh, CMB, MBA’s VP of Industry Analysis. “Meanwhile, the performance of loan workouts is solid, but declined last month. Roughly 70% of loan workouts initiated since 2020 are current.”

By reason, 53.6% of borrowers are in forbearance for reasons such as a temporary hardship caused by job loss, death, divorce, or disability; while 34.3% of borrowers are in forbearance because of COVID-19. Another 12.1% were in forbearance due to a natural disaster.

By stage, 49.0% of total loans in forbearance are in the initial forbearance plan stage, while 35.1% are in a forbearance extension. The remaining 15.8% are forbearance re-entries, including re-entries with extensions.

“MBA forecasts an economic downturn in 2024, and there are signs of early distress in other credit types such as car loans and credit cards,” added Walsh. “Those borrowers who struggled in making their mortgage payments in the past may find themselves in similar situations in a softening economy and rising unemployment.”

Posted on 12/20/23 at 9:51 am to stout

Now THIS is what Build Back Better is all about.

Posted on 12/20/23 at 10:34 am to JasonDBlaha

quote:

NYC where the metro population is over 5,000,000 people

The metro is more like 18 million.

And overall those delinquency rates don’t seem too extreme. We keep hearing about times being tough and what a terrible economy, but everyone seems to be buying overpriced homes and trucks and the travel industry has had a record year. The stock market is at an all time high.

Sometimes reality is way different than what our little echo chambers have is believe.

Posted on 12/20/23 at 10:52 am to stout

One more question

What’s the best way to buy these old people houses that need major renovations for cheap? There’s got to be a system to it right? Tearing out pink tile is good for the soul

What’s the best way to buy these old people houses that need major renovations for cheap? There’s got to be a system to it right? Tearing out pink tile is good for the soul

Popular

Back to top

12

12