- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Here's the new tax brackets in case you're wondering.

Posted on 12/21/17 at 8:58 am to jdeval1

Posted on 12/21/17 at 8:58 am to jdeval1

quote:Exactly. I meant to say I don't know if more or less itemized deductions will be allowed but you're right most wont even need to now.

You can still itemize but far fewer people will need to.

Posted on 12/21/17 at 8:59 am to GEAUXT

maybe if healthcare would just list their prices like every other service industry people wouldn't feel the need to buy expensive insurance policies all the time?

they would actually know how much stuff cost and how much they needed to save

or is that just too much common sense?

they would actually know how much stuff cost and how much they needed to save

or is that just too much common sense?

Posted on 12/21/17 at 9:00 am to Pectus

quote:

Why does a single person pay more taxes when they are already paying city taxes for couples that have kids that go to school.

I don't personally know you however most couples that have children were once single with no children. I assume when you do have children you want there to be good schools with quality teachers there to teach your children? There are times in life when we must "pay forward" in order to reap future benefits. If the community as a whole doesn't pay taxes to support the education of it's future leaders and citizens, then you end up with a failing society. Even if you never have children, the educating of children is still very important to you as a citizen. If you don't believe me, go spend some time in North Baton Rouge.

Posted on 12/21/17 at 9:00 am to The Mick

quote:

Exactly. I meant to say I don't know if more or less itemized deductions will be allowed but you're right most wont even need to now.

Mostly the same, but SALT deductions are capped at 10k and HELOC interest is no longer deductable. Also mortgages are capped at 750k (which obviously affects every OT'er)

Posted on 12/21/17 at 9:00 am to 50_Tiger

quote:

This is essentially the government bribing the constituency to have kids.

Posted on 12/21/17 at 9:02 am to Mingo Was His NameO

quote:

and HELOC interest is no longer deductable.

well goddammit

Posted on 12/21/17 at 9:03 am to Salmon

quote:

maybe if healthcare would just list their prices like every other service industry

Public knowledge of medical costs would work in some minor circumstances, but it's not 100% fluid.

Posted on 12/21/17 at 9:03 am to Salmon

quote:

Companies with the biggest tax subsidies over the eight years, the institute’s report said, included:

¦ AT&T ($38.1 billion)

¦ Wells Fargo ($31.4 billion)

¦ JPMorgan Chase ($22.2 billion)

¦ Verizon ($21.1 billion)

¦ IBM ($17.8 billion)

¦ General Electric ($15.4 billion)

¦ Exxon Mobil ($12.9 billion)

¦ Boeing ($11.9 billion)

¦ Procter & Gamble ($8.5 billion)

¦ Twenty-First Century Fox ($7.6 billion)

¦ Time Warner ($6.7 billion)

¦ Goldman Sachs ($5.5 billion)

LINK /

Posted on 12/21/17 at 9:04 am to Salmon

quote:

maybe if healthcare would just list their prices like every other service industry people wouldn't feel the need to buy expensive insurance policies all the time?

they would actually know how much stuff cost and how much they needed to save

or is that just too much common sense?

If the business was cash pay then this would absolutely be the case. Also, patients see the cost of services on their EOB.

The problem is that each insurer pays different amounts for the same service, and that amount varies from provider to provider.

I can charge $10000000 for bunion surgery, but what I get paid depends on the insurance contract. There's no continuity to it.

If medicine was cash pay it would be this is how much X surgery costs. No clandestine billing and reimbursements.

It would also lower costs by forcing hospitals and physicians to be competitive in their prices.

Posted on 12/21/17 at 9:06 am to The Mick

quote:

Correct me if I'm wrong but it appears that literally everyone is getting a tax break except for couples who earned between 400k-424k

apparently not

quote:

For Single Filers:

quote:

32% $157,500-$200,000 | 33% $195,450-$424,950

35% $200,000-$500,000 | 35% $424,950-$426,700

so I just went from 33% to 35% that sucks

Posted on 12/21/17 at 9:07 am to jlovel7

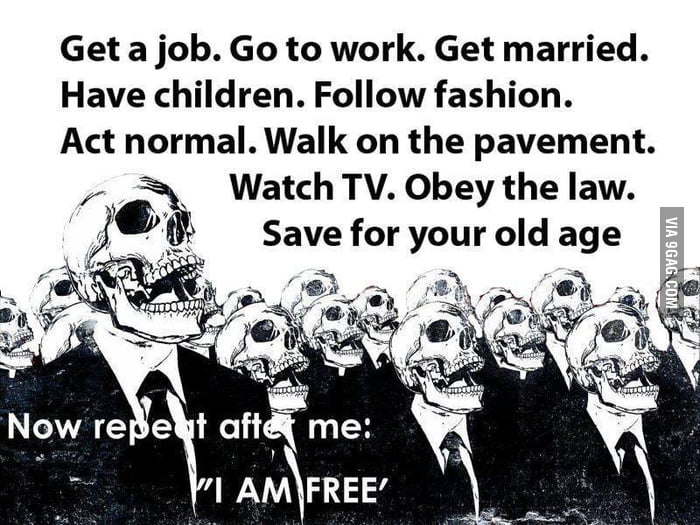

That is the dumbest argument I've ever heard wrt to taxes are needed for education. Public "education" doesn't mean you're educated it jusr means you've been programmed to function best as a worker bee for the State.

Posted on 12/21/17 at 9:08 am to ultratiger89

quote:

so I just went from 33% to 35% that sucks

I get it, but also

Posted on 12/21/17 at 9:09 am to TJGator1215

quote:

That is the dumbest argument I've ever heard wrt to taxes are needed for education. Public "education" doesn't mean you're educated it jusr means you've been programmed to function best as a worker bee for the State.

Pretty much every study ever concludes the more educated the society the better. It's more stable economically, there's less crime, more money, more predictable leading to better policies and more accurate outlooks, etc, etc.

Posted on 12/21/17 at 9:10 am to Pectus

I wish I was gay. It'd be so much easier...

#gayprivilege

#gayprivilege

Posted on 12/21/17 at 9:11 am to ultratiger89

quote:Of course you did, you're on the OT !!!!!

so I just went from 33% to 35% that sucks

ps - only 1.5% of the entire American population earns 200k+. Watch how many post here.

This post was edited on 12/21/17 at 9:13 am

Posted on 12/21/17 at 9:15 am to TJGator1215

So the largest US companies with the most revenue and income are able to use the tax code to the largest scale? Makes a lot of sense to me.

Posted on 12/21/17 at 9:17 am to Salmon

quote:

maybe if healthcare would just list their prices like every other service industry people wouldn't feel the need to buy expensive insurance policies all the time?

I work in healthcare, specifically the revenue cycle. This is literally impossible. And I'm using the correct form of the word literally.

Posted on 12/21/17 at 9:17 am to The Mick

quote:

only 1.5% of the entire American population earns 200k+. Watch how many post here.

Its really not hard to do in a 2 income household.

Posted on 12/21/17 at 9:19 am to tgrbaitn08

quote:

Its really not hard to do in a 2 income household.

For the average American, yes it really is. Which is why only a sliver of people do.

This post was edited on 12/21/17 at 9:20 am

Posted on 12/21/17 at 9:21 am to The Mick

quote:

or married couples filing jointly, here’s how the proposed rates work out under the GOP tax bill:

New Rate New Income Bracket | Old Rate Old Income Bracket

10% Up to $19,050 | 10% Up to $19,050

12% $19,050-$77,400 | 15% $19,050-$77,400

22% $77,400-$165,000 | 25% $77,400-$156,150

24% $165,000-$315,000 | 28% $156,150-$237,950

32% $315,000-$400,000 | 33% $237,950-$424,950

35% $400,000-$600,000 | 35% $424,950-$480,050

37% $600,000+ | 39.6% $480,050+

***Correct me if I'm wrong but it appears that literally everyone is getting a tax break except for couples who earned between 400k-424k. They were in the 33% bracket previously and now will be in the 35%. Everyone else has a lower bracket now. (Am I looking at that correctly?)

Damn i went from 39.6% to 37%

Lol i wish

Popular

Back to top

2

2