- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Cost to buy = $2,700/month. Cost to rent = $1,850/month

Posted on 5/24/23 at 12:33 pm to Klark Kent

Posted on 5/24/23 at 12:33 pm to Klark Kent

quote:Marraine always said to not pick on the retards me

yeah. you’re one of the OT’s moderates who conveniently only attacks one side….

Posted on 5/24/23 at 12:37 pm to upgrayedd

quote:

The idea of buying a house, starting a family, and being financially stable in the long term before 30 is becoming less and less attainable even for people who work hard.

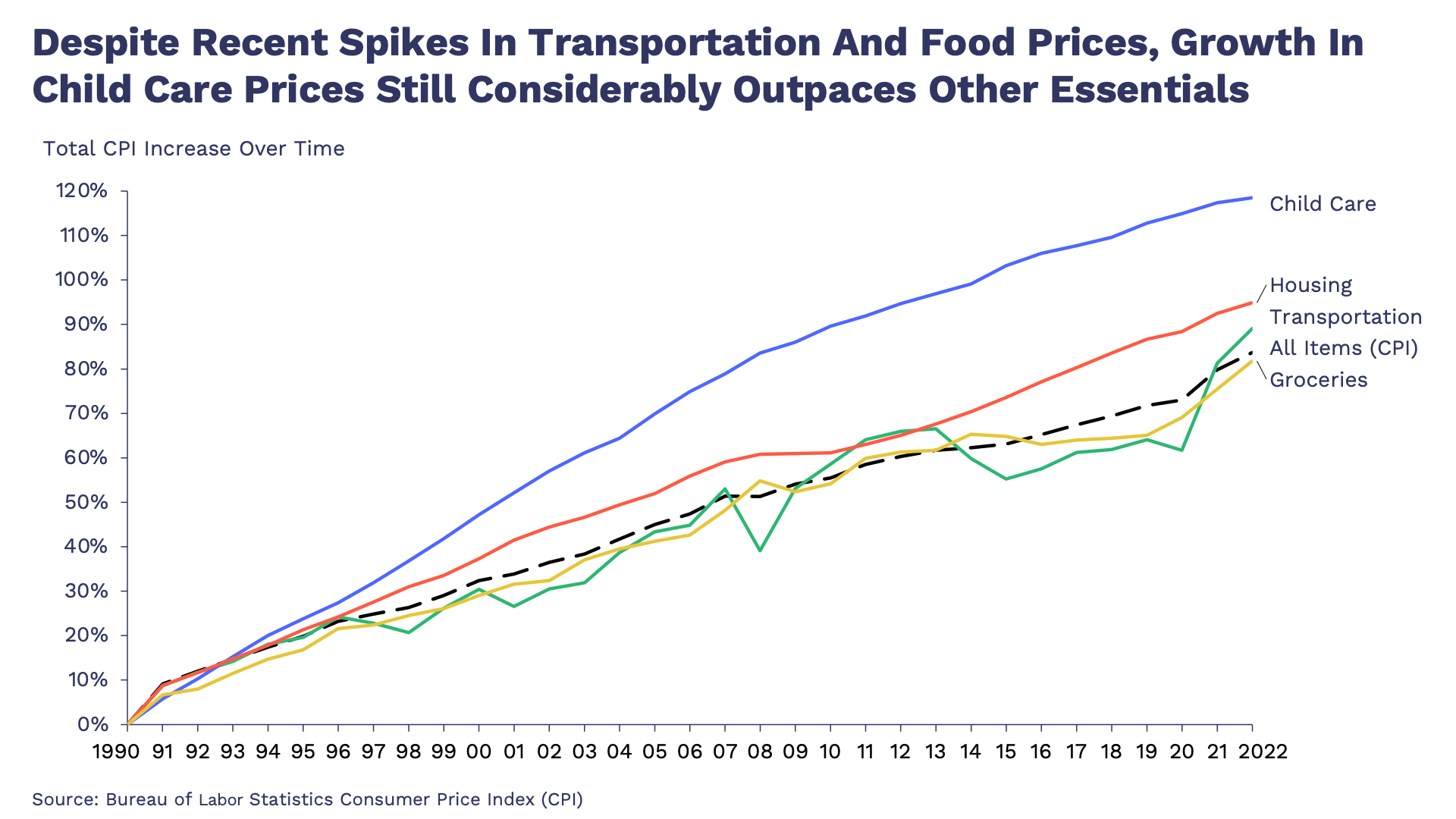

I’m 35, have worked my arse off, and made it to senior management for a top 30 Fortune 500 company. I just bought my first home and my wife is currently expecting our first child. I would have done all of this earlier but it just wasn’t feasible. Sure, you can still follow that traditional timeline but your outlook and quality of life is not what it was 20+ years ago. There are plenty of statistics that I’ve posted before that put this into perspective, but I like what one poster said earlier: “they view it as a right of passage”. They absolutely did have to work to get where they are and have what they have, but they can’t accept that it’s harder.

This post was edited on 5/24/23 at 12:39 pm

Posted on 5/24/23 at 12:39 pm to Klark Kent

quote:You can make up all the things to "notice" that you want.

yeah. you’re one of the OT’s moderates who conveniently only attacks one side….but we’re not supposed to notice that, right?

Posted on 5/24/23 at 12:40 pm to sidewalkside

quote:

Plus homeowners are much more qualified than they were in the 07/08 meltdown so you won't see massive foreclosures due to people with 0% down payment loans.

This gets overstated way too much regarding 2006-2009.

Every loan was at risk of foreclosure back then because households were severely unemployed or underemployed.

It doesn't matter if you put 20% down-payment, had an 800 credit score, and did a Fannie loan... if you are unemployed/underemployed for a year, the bills are going to get sketchy and that includes the home loan.

So long as employment is strong, there won't be a significant burst to the housing bubble. But if employment hits a profound change, inflation and all of the 2 working households are going to feel the hurt that much quicker this time.

Posted on 5/24/23 at 12:41 pm to jizzle6609

quote:

People need to live within their means

Muh boot straps

Posted on 5/24/23 at 12:44 pm to SuperSaint

quote:

Marraine always said to not pick on the retards me

yeah, k

Posted on 5/24/23 at 12:48 pm to GoCrazyAuburn

quote:

There was a 1200 sq. ft house that sold for almost $500k

What part of town ?

Posted on 5/24/23 at 12:49 pm to danilo

I tried buying one that was 90k a few years ago, they don't want less than $130k.

Gassed. Up.

Gassed. Up.

Posted on 5/24/23 at 12:53 pm to SuperSaint

quote:

and this is the positives in city ordinances and strong HOAs

Did you think I said he was in the city limits? He is more rural, like you, before you moved to N.O.

Posted on 5/24/23 at 12:55 pm to Nelson Biederman IV

quote:

I just bought my first home and my wife is currently expecting our first child

get ready for the kick in the dick baw

Posted on 5/24/23 at 1:01 pm to stout

Theres a couple of problems with the numbers above:

1)Renting has exactly 0% return on investment. You're never going to get that money back.

2)Inflation actually helps current mortgage holders, simply because while the rest of the market keeps inflating, that mortgage payment stays the same assuming you have a fixed rate mortgage.

3)When you buy property, typically property inflates with the market, meaning that if inflation is 10%, you're house is going to appreciate as well.

1)Renting has exactly 0% return on investment. You're never going to get that money back.

2)Inflation actually helps current mortgage holders, simply because while the rest of the market keeps inflating, that mortgage payment stays the same assuming you have a fixed rate mortgage.

3)When you buy property, typically property inflates with the market, meaning that if inflation is 10%, you're house is going to appreciate as well.

Posted on 5/24/23 at 1:03 pm to stout

"You will own nothing and love it."

Posted on 5/24/23 at 1:08 pm to lsufan112001

quote:bullshite

You can thank Ftard Biden

interest rates should be 10% minimum

if I borrow money I should have to pay for it

if I loan you money I should get paid for it

everyone here 40 and younger has grown up in a fantasyland of zero/single digit cost to borrow.

Posted on 5/24/23 at 1:08 pm to NYNolaguy1

quote:

1)Renting has exactly 0% return on investment

There are pros to renting vs. buying:

1. Maintenance. You aren't forking out $15k for a brand new A/C unit when the one in your apartment goes out. Appliances are generally newer and will also be upgraded if something goes out, at the expense of the landlord.

2. Basic upkeep of the house (minor fixes, lawncare, etc.) are generally paid by the landlord.

3. You are not having to worry about resale on your "investment" because you can search for a new property in the future.

4. You are paying significantly less than what you would pay on a mortgage. That money you have can go towards other things that you need to pay for. It's not all about making a home an investment portfolio.

quote:

2)Inflation actually helps current mortgage holders, simply because while the rest of the market keeps inflating, that mortgage payment stays the same assuming you have a fixed rate mortgage.

Rates are dogshit right now. Why would someone lock into a 7%+ interest rate for the foreseeable future? You can rent now, take a hit on equity, and make it back later on. There's no reason to rush into buying a house, especially when value and interest rates are bound to drop.

quote:

3)When you buy property, typically property inflates with the market, meaning that if inflation is 10%, you're house is going to appreciate as well.

Houses don't automatically appreciate if you don't take care of them. The current housing inflation is because rates were good, people were selling for high, buying for high. The housing market is coming down. Also, this fixed inflation you came up with doesn't apply everywhere. Life does not just simply work the way you are describing.

Posted on 5/24/23 at 1:11 pm to cgrand

quote:

interest rates should be 10% minimum

quote:

cgrand

Posted on 5/24/23 at 1:12 pm to Ace Midnight

quote:

"You will own nothing and love it."

my favorite is "You should just live within your means".

Yeah...well the means keep shrinking year after year.

Posted on 5/24/23 at 1:23 pm to Ace Midnight

quote:Yeah - rates were historically low for like a decade, but somehow, that's your takeaway?

"You will own nothing and love it."

Posted on 5/24/23 at 1:23 pm to pankReb

quote:

my favorite is "You should just live within your means".

For real, just chill below the poverty line for a while, sleep, work, and merely exist. ??

Posted on 5/24/23 at 1:25 pm to lsufan112001

quote:

You can thank Ftard Biden

The fed has been kicking the can down the road for decades. The time to pay the piper has come.

Posted on 5/24/23 at 1:27 pm to NYNolaguy1

quote:

1)Renting has exactly 0% return on investment. You're never going to get that money back.

Complete myth. Renting delivers huge returns in a bubble when that bubble bursts. We're in for the mother of all bursts too. Should've happened 15 years ago but at the first sign of it the gov't quickly reinflated it by printing more. I don't think they can now but even if they try it will have much less effect.

quote:

2)Inflation actually helps current mortgage holders, simply because while the rest of the market keeps inflating, that mortgage payment stays the same assuming you have a fixed rate mortgage.

Not when your property value decreases enough that it doesn't make sense to continue paying your fixed mortgage.

Popular

Back to top

1

1