- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Banks lending appears to be low enough to indicate we are in a recession.

Posted on 12/5/23 at 2:24 pm

Posted on 12/5/23 at 2:24 pm

It's not perfectly correlated but generally the steep decline in bank lending precedes recession:

LINK

LINK

Posted on 12/5/23 at 2:28 pm to GumboPot

And the administration will move the goalposts for what constitutes a recession again shortly.

Posted on 12/5/23 at 2:29 pm to GumboPot

you cant be in a recession under a democrat presidency. everyone knows that.

Posted on 12/5/23 at 2:32 pm to teke184

quote:

And the administration will move the goalposts for what constitutes a recession again shortly.

They're just going to gaslight and then double down on gaslighting. These people think words dictate reality so they'll keep repeating what they want you to believe instead of what is reality.

Posted on 12/5/23 at 2:34 pm to GumboPot

We are not in a recession, I repeat we are not…

*hey look at this shiny thing over here!*

*hey look at this shiny thing over here!*

Posted on 12/5/23 at 2:36 pm to GumboPot

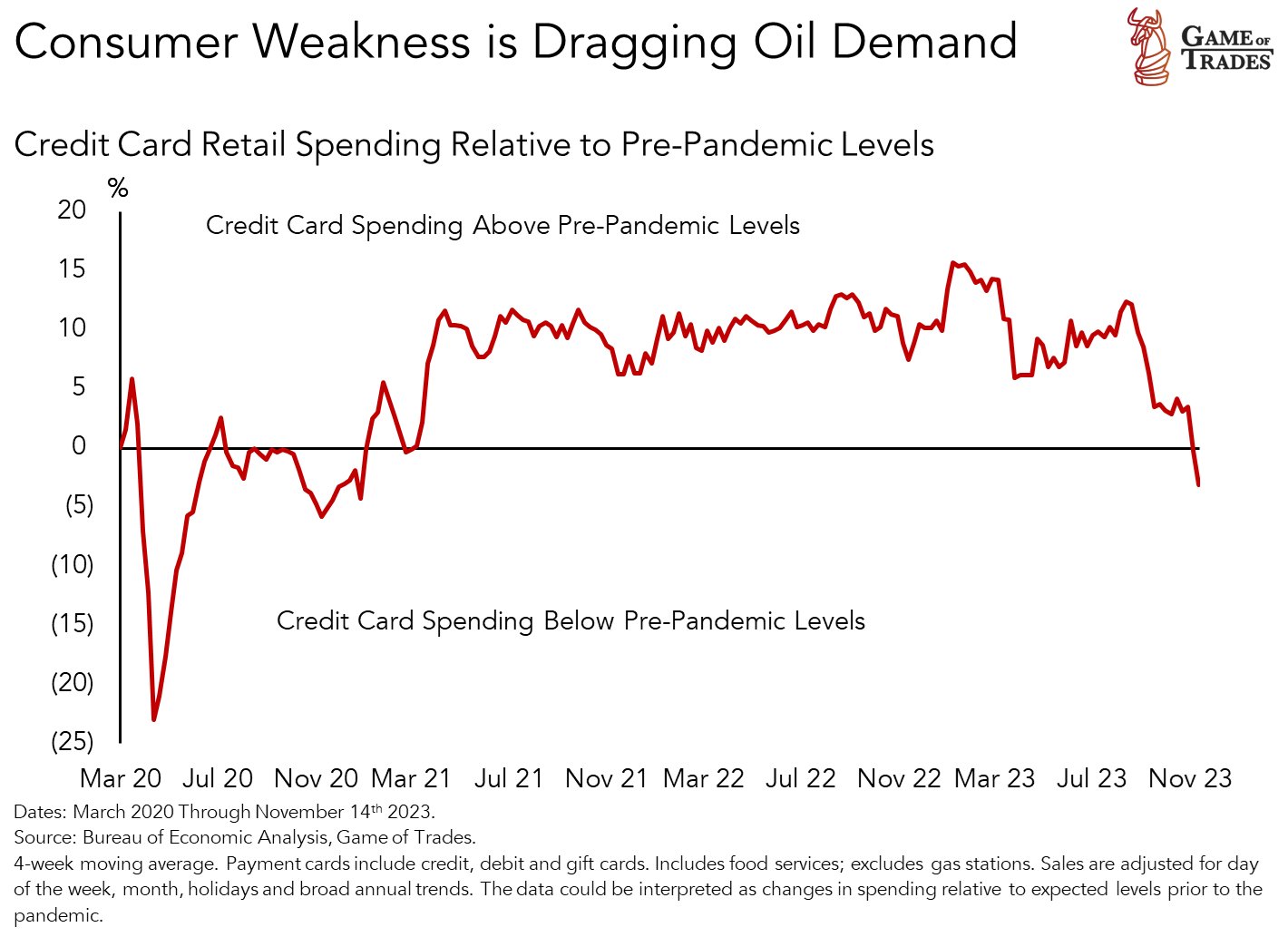

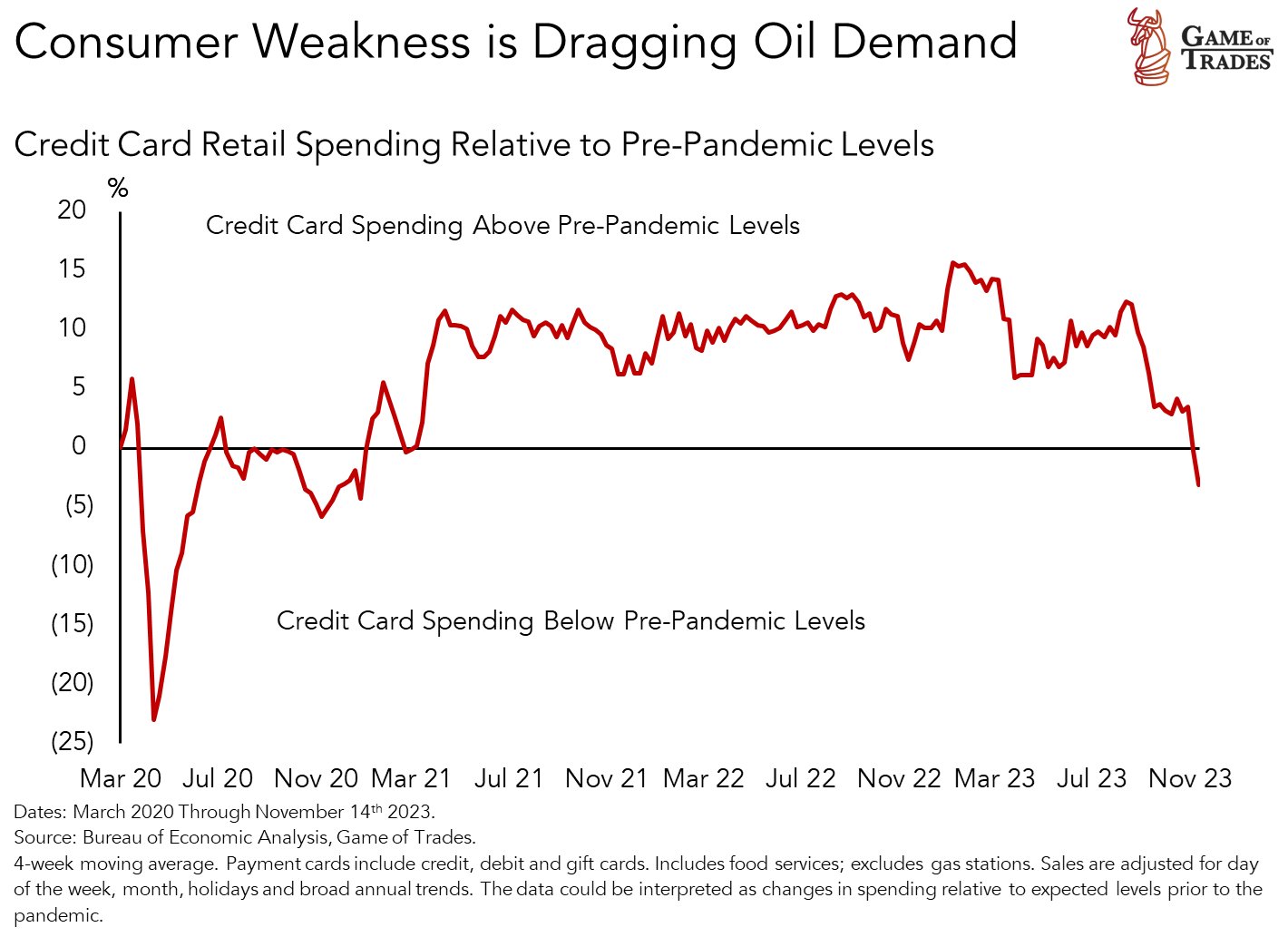

Credit card spending has collapsed

And has officially entered contraction territory

And has officially entered contraction territory

Posted on 12/5/23 at 2:36 pm to GumboPot

There is one economic measure that cannot easily be gamed: tax revenue collections. Look around and see how that’s going.

Posted on 12/5/23 at 2:39 pm to SloaneRanger

quote:Good point.

There is one economic measure that cannot easily be gamed: tax revenue collections.

Posted on 12/5/23 at 2:40 pm to GumboPot

It's a leading indicator of disinflation/deflation which means lower growth. Fun part is the US Treasury is crowding out private sector investment right because risk free rates are higher than they've been in quite a while so the issue is going to be way worse than it typically should be.

Posted on 12/5/23 at 2:45 pm to wutangfinancial

I could have told you we are in a recession.

Posted on 12/5/23 at 2:48 pm to GumboPot

That’s impossible. The definition of a recession is negative growth 2 quarters in a row when the president is a Republican.

Posted on 12/5/23 at 2:54 pm to GumboPot

It's almost like higher interest rates result in less borrowing. Someone should do a podcast about that.

Posted on 12/5/23 at 3:04 pm to stout

quote:

Credit card spending has collapsed

My wife is doing her part to help reverse this

Posted on 12/5/23 at 3:06 pm to H2O Tiger

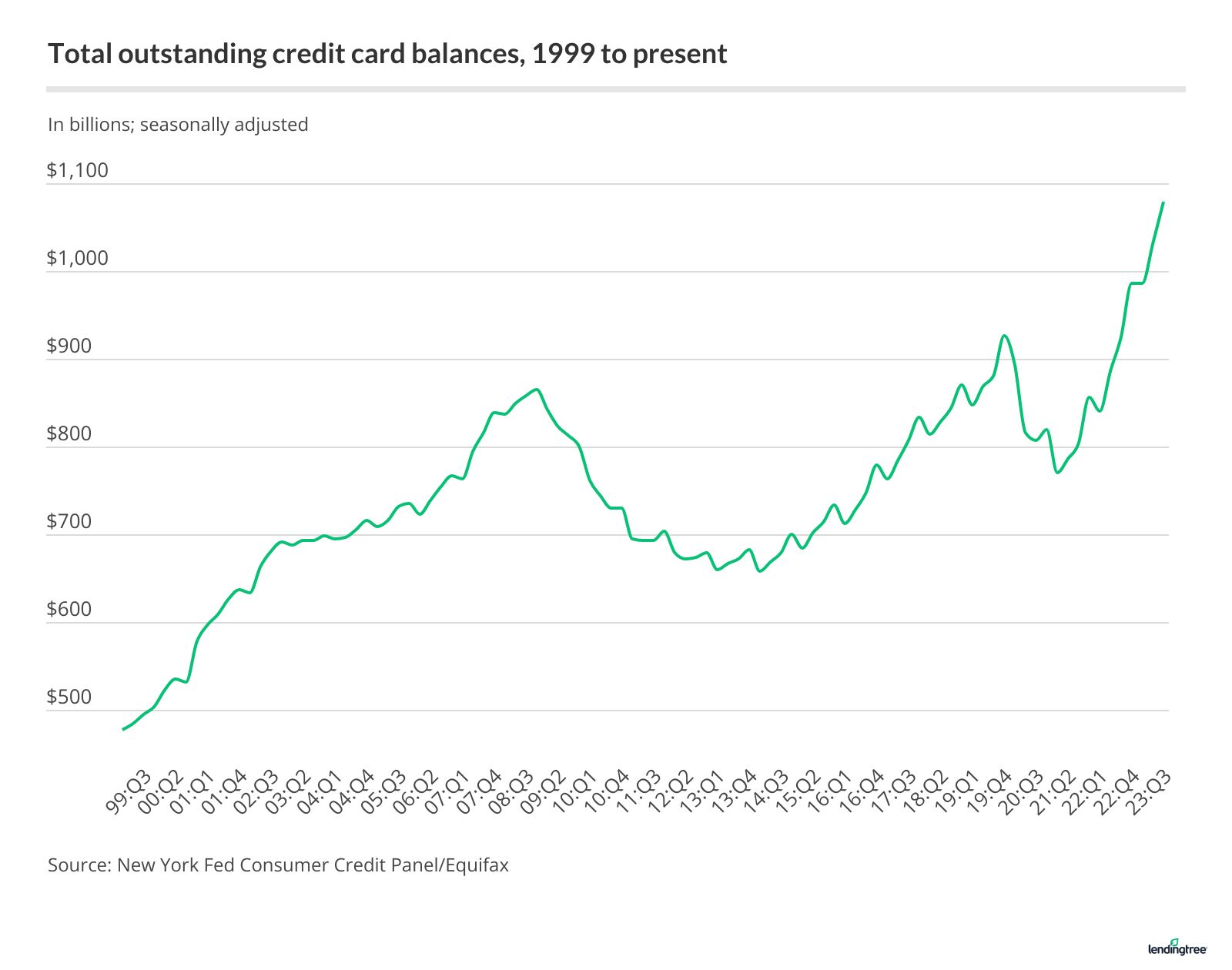

Can’t spend if you have reached or breached the limit.

Posted on 12/5/23 at 3:14 pm to GumboPot

Glad to hear where about to find out more about aliens.

Posted on 12/5/23 at 3:16 pm to teke184

quote:

And the administration will move the goalposts for what constitutes a recession again shortly.

we've been in a recession for the better part of the last couple of years, by the literal definition and what most people are feeling in the pocket books.

people just don't want to admit it.

Posted on 12/5/23 at 3:19 pm to stout

quote:

Credit card spending has collapsed

Maybe, but maybe not.

Consumers are still buying, but the rise in card delinquencies may be a signal that such buying levels are coming to an end (at least for a little while) as consumers face ~20% interest rates on those cards plus many having to resume their student loan repayments.

As someone else posted, the real tell is going to be tax revenues: currently they look to be ~5%-~6% lower than this time last year.

This post was edited on 12/5/23 at 3:21 pm

Popular

Back to top

9

9