- My Forums

- Tiger Rant

- LSU Score Board

- LSU Recruiting

- SEC Rant

- SEC Score Board

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: What’s your credit score?

Posted on 5/24/24 at 10:29 am to BabyTac

Posted on 5/24/24 at 10:29 am to BabyTac

quote:

That blows my mind as well. My wife hasn’t worked in prob 5-6 years and all bills we’ve had are in my name yet her score remains higher than mine.

Maybe you should learn how your score is actually calculated and it might not blow your mind.

This post was edited on 5/24/24 at 12:11 pm

Posted on 5/24/24 at 10:29 am to BabyTac

Mine is 765. It was 785 3 months ago and it dropped when I paid off a 19k loan. Make it make sense.

Posted on 5/24/24 at 10:31 am to NATidefan

quote:

Maybe you should learn how your score is actually calculated, and it might not blow your mind.

Stop pretending like you know how they calculate that shite.

Posted on 5/24/24 at 10:36 am to GRTiger

quote:

Stop pretending like you know how they calculate that shite.

I know it has nothing to do with whether you work or not and nothing to do with what bills are in your name (unless they are loans, mortgage, etc).

So, I know more than he does.

Most CC apps explain exactly what factors into it and what percentage it weighs, it may not give a formula... but it'll tell you what matters for sure.

If you want to get really into it watch some John Ulzheimer videos on youtube.

This post was edited on 5/24/24 at 11:09 am

Posted on 5/24/24 at 10:36 am to NATidefan

quote:

Maybe you should learn how your score is actually calculated

I’m guessing the score is meant to lean towards information to maximize the lender’s experience:

If you’re the type of person that never makes a late payment but goes the full length of the loan, that is ideal for a lender.

You pay shite off early…good but not ideal for a lender.

You consistently make late payments, carry over balances, and maximize interest…best case scenario for a lender.

You can’t make payment and repossession occurs…worst case for lender.

Still with that mindset, the numbers don’t make sense.

Posted on 5/24/24 at 10:52 am to BabyTac

826 FICO

Doesn't matter since I don't borrow money.

Doesn't matter since I don't borrow money.

Posted on 5/24/24 at 10:55 am to BabyTac

Here is a break down of what factors in and how much.

Payment History - Just make your full monthly payments and you'll be perfect here. Paying off early doesn't affect this at all, but will affect your length of history.

Amounts owed - This is your utlization %. To keep it simple, lets say you have two credit cards with $900 limit on one and a $100 limit on the other. So 1000 limit total. They check how much you owe on all of them once a month. So if you have 100 dollar balance between the two cards when they check you will have a 10% utilization. If you pay your cards off daily you will always have a 0% utilization. If you figure out what day of the month they check it and pay it off in full the day before, you will have 0% utilization.

Length of History - Basically the average of how long you have had credit. This is where not having credit cards hurts people. Because it's revolving credit that you can keep forever if you don't close the card. Once accounts are closed (car loans, mortgages, credit cards, etc) they fall off eventually and your history will go down. So, paying off early hurts your history if it makes your car loan fall off. But just thinking about credit cards, say you opened one 10 years ago and one today, now you have (10 years+0 year)/2 accounts = 5 year credit history. That means you really don't want to close old accounts, or any unless it just makes sense to otherwise.

Types of credit - they want to see diversity. Mortage, car loans, installment loans, credit card, etc.

New credit - This is what hurts you a bit when you do hard pulls when applying for new cards, loans, etc. But it falls off after 2 years.

None of this has to do with whether you work or if you pay the utility and phone bill. And if you pay everything in cash and never take out loans... well your credit history is lacking and that's going to affect your score.

The score and what they consider is all a way of measuring how trust worthy and potentially risky you are with borrowing money. If you have borrowed lots in the past and always paid off responsibly you are more trustworthy than someone that never or rarely borrows it. etc. If you are opening new cards constantly it seems you are hurting for money, so risky, etc. and on and on.

Payment History - Just make your full monthly payments and you'll be perfect here. Paying off early doesn't affect this at all, but will affect your length of history.

quote:- that'll tank your score quick.

You consistently make late payments, carry over balances, and maximize interest…best case scenario for a lender.

Amounts owed - This is your utlization %. To keep it simple, lets say you have two credit cards with $900 limit on one and a $100 limit on the other. So 1000 limit total. They check how much you owe on all of them once a month. So if you have 100 dollar balance between the two cards when they check you will have a 10% utilization. If you pay your cards off daily you will always have a 0% utilization. If you figure out what day of the month they check it and pay it off in full the day before, you will have 0% utilization.

Length of History - Basically the average of how long you have had credit. This is where not having credit cards hurts people. Because it's revolving credit that you can keep forever if you don't close the card. Once accounts are closed (car loans, mortgages, credit cards, etc) they fall off eventually and your history will go down. So, paying off early hurts your history if it makes your car loan fall off. But just thinking about credit cards, say you opened one 10 years ago and one today, now you have (10 years+0 year)/2 accounts = 5 year credit history. That means you really don't want to close old accounts, or any unless it just makes sense to otherwise.

Types of credit - they want to see diversity. Mortage, car loans, installment loans, credit card, etc.

New credit - This is what hurts you a bit when you do hard pulls when applying for new cards, loans, etc. But it falls off after 2 years.

None of this has to do with whether you work or if you pay the utility and phone bill. And if you pay everything in cash and never take out loans... well your credit history is lacking and that's going to affect your score.

The score and what they consider is all a way of measuring how trust worthy and potentially risky you are with borrowing money. If you have borrowed lots in the past and always paid off responsibly you are more trustworthy than someone that never or rarely borrows it. etc. If you are opening new cards constantly it seems you are hurting for money, so risky, etc. and on and on.

This post was edited on 5/24/24 at 12:13 pm

Posted on 5/24/24 at 11:06 am to BabyTac

821, it peaked at 843 at one point

Carmax offered me a rate well lower than advertised because of it and I took it even though I had cash if needed.

Carmax offered me a rate well lower than advertised because of it and I took it even though I had cash if needed.

This post was edited on 5/24/24 at 11:08 am

Posted on 5/24/24 at 11:44 am to BabyTac

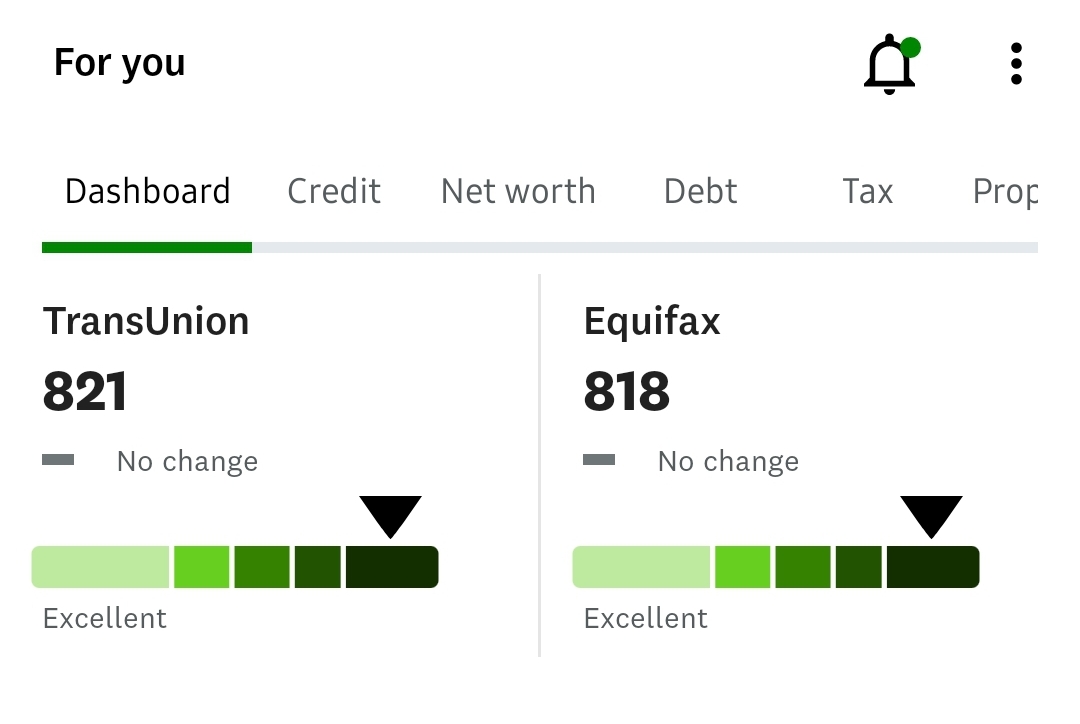

Per Credit Karma

TransUnion: 769

Equifax: 757

Took about a 20 point hit recently after closing on a mortgage for rural property.

TransUnion: 769

Equifax: 757

Took about a 20 point hit recently after closing on a mortgage for rural property.

Posted on 5/24/24 at 12:15 pm to BabyTac

quote:you guys focus on a specific name too much. score just means debt in that name gets paid or doesnt get paid as expected. funny thing is most of you would also say housewife is a legitimate job but cant mentally link she gets paid.

That blows my mind as well. My wife hasn’t worked in prob 5-6 years and all bills we’ve had are in my name yet her score remains higher than mine.

Posted on 5/24/24 at 12:25 pm to NATidefan

Thanks for the breakdown

Posted on 5/24/24 at 1:34 pm to MrJimBeam

quote:

Thanks for the breakdown

No problem. Like I said most CC apps and bank apps break this down for you and will show you information on what's affecting your particular score. You can usually find your utilization percentage, length of history, etc. Some give more info than others. My Sofi bank app actually gives lots of info on all my accounts, whether they are closed or not, etc.

And if you really want to know alot, check out John Ulzheimer.

Main thing is:

1. Pay it off in full

2. Keep Utilization low (increase your cc limits with requests every 6 months to help with this)

3. Don't close old accounts unless you just really need to.

4. Only open a few accounts a year (not a huge deal, just don't go crazy)

5. Have a few different types of loans.

Do all that and you will eventually have a great credit score, don't do number 1 alot and it will take time to get it back in good shape. The rest can be fixed pretty quickly outside of length of history which just takes time to build.

This post was edited on 5/24/24 at 1:50 pm

Posted on 5/24/24 at 1:52 pm to jcaz

quote:

Dave Ramsey isn't lurking here.... who you trying to impress?

Dave Ramsey brags about having a zero credit score.

He’d be disappointed in you for even having a score. Pay cash for everything is his philosophy.

Posted on 5/24/24 at 2:11 pm to Weagle25

Dave Ramsey 's advice is only good for the irresponsible. It's terrible for everyone else.

Posted on 5/24/24 at 3:40 pm to NATidefan

It’s not terrible for anybody. If anybody followed it, they would be successful.

It’s just limiting. But if you’re financially sophisticated enough to know that then you probably aren’t looking for his advice anyways.

It’s just limiting. But if you’re financially sophisticated enough to know that then you probably aren’t looking for his advice anyways.

Posted on 5/24/24 at 3:44 pm to Weagle25

807ish. it was around 820ish, but dropped some when I paid my truck loan off a couple months ago.

Posted on 5/24/24 at 4:37 pm to BabyTac

quote:

What you got on BabyTac, OT?

stay on the cesspool aka OT. stop bringing that shite here.

Popular

Back to top

2

2