- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Time for a poll, will things level off or are we toast.

Posted on 3/18/23 at 9:33 pm

Posted on 3/18/23 at 9:33 pm

So down vote if you think we are at the start of some real pain. By that I mean 08 or worse.

Up vote if you think it may be rocky but not a total meltdown. Pretty much status quo for how it has been the past 8 months or so.

Up vote if you think it may be rocky but not a total meltdown. Pretty much status quo for how it has been the past 8 months or so.

This post was edited on 3/18/23 at 10:21 pm

Posted on 3/18/23 at 10:04 pm to GREENHEAD22

Pain in what the markets?

Posted on 3/18/23 at 10:18 pm to GREENHEAD22

I down voted bc this post is dumb as frick.

Posted on 3/18/23 at 10:21 pm to UltimaParadox

If there is an 08 or worse scenario pain will be widespread.

Posted on 3/18/23 at 11:24 pm to GREENHEAD22

This situation is nothing like 08 imo. We had some poorly mismanaged banks that were awfully positioned for rapid rate increases. I'm sure there will be more. But global financial meltdown? I'm just not seeing that on the table at this point.

That will come when countries start defaulting on their debt, including the US.

That will come when countries start defaulting on their debt, including the US.

This post was edited on 3/18/23 at 11:25 pm

Posted on 3/19/23 at 1:15 am to fallguy_1978

quote:

That will come when countries start defaulting on their debt, including the US.

What are the chances the Republican House allows the US to default?

Posted on 3/19/23 at 4:25 am to GREENHEAD22

Not like 08 but think new lows in the sp500 are coming. Fed will push the economy into a recession. Just my guess.

This post was edited on 3/19/23 at 4:31 am

Posted on 3/19/23 at 6:57 am to saintforlife1

0.000000000000000000000000000000%

Posted on 3/19/23 at 9:25 am to GREENHEAD22

I for one, do think something larger is happening. No one singular event leads me to believe this but looking at things from a 40K ft view you'd be crazy not to think something larger wasn't in play.

The world unpegging from the Petro dollar

BRICS

ISO 20022

China's turmoil

The war on crypto

bank failures

banks demanding liquidity guarantee from FDIC

That's just off the top of my head.

The world unpegging from the Petro dollar

BRICS

ISO 20022

China's turmoil

The war on crypto

bank failures

banks demanding liquidity guarantee from FDIC

That's just off the top of my head.

This post was edited on 3/19/23 at 9:38 am

Posted on 3/19/23 at 9:50 am to saintforlife1

quote:

What are the chances the Republican House allows the US to default?

None. Defaulting is pretty much the choice between "die now" versus "die at some ambiguous point in the future". If it comes down to that, Congress will always pick the latter.

A lesser version of that "kill your re-election chances now" versus "kill your re-election chances at some ambiguous point in the future" is why politicians only talk about cutting spending but haven't actually done it in over 20 years (and will continue to not do it). It would take ~20%-25% cut to total spending (ie: to everything, both discretionary and mandatory) just to balance FY2022's budget.

Anyone voting for that level of cuts to the VA, military pay, National Parks Service, Medicare, Social Security, etc. will likely get their asses handed to them in their next re-election bid (especially if it somehow passed both chambers and was signed into law).

Posted on 3/19/23 at 10:35 am to fallguy_1978

I agree with you, at least for SVB it was not like 08 but shear lack of risk management and just piss poor management overall. I am not as familiar with Republic or Signature if it was a similar case in that they got caught by the rising rates.

What has really concerned me is the reaction from the government. Under normal circumstances SVB would have been sold off to other banks. This was actually lined up and depositors OVER 250k were still going to get .95% on the dollar. At the last minute the Biden administration shut it down and bailed out the fricks. The precedent is now set and the FDIC has no way to actually ensure all depositors.

frick Yellen and Biden

What has really concerned me is the reaction from the government. Under normal circumstances SVB would have been sold off to other banks. This was actually lined up and depositors OVER 250k were still going to get .95% on the dollar. At the last minute the Biden administration shut it down and bailed out the fricks. The precedent is now set and the FDIC has no way to actually ensure all depositors.

frick Yellen and Biden

Posted on 3/19/23 at 10:54 am to GREENHEAD22

LINK

quote:

FXHedge

@Fxhedgers

SWISS GOVERNMENT TO HOLD IMPORTANT PRESS CONFERENCE LATER SUNDAY

10:11 AM · Mar 19, 2023

·

45.5K

Views

47

Retweets

16

Quotes

234

Likes

Posted on 3/19/23 at 11:16 am to bamarep

quote:

banks demanding liquidity guarantee from FDIC

This one has me a little nervous. The government really fricked up with how they handled SVB. now every bank and person in the US is going to expect 100% c9verage on deposits or lose their ever loving minds if they don't get it when the shite inevitably hits the fan.

Posted on 3/19/23 at 11:17 am to GREENHEAD22

Posted on 3/19/23 at 11:21 am to TigerFanatic99

quote:

This one has me a little nervous. The government really fricked up with how they handled SVB. now every bank and person in the US is going to expect 100% c9verage on deposits or lose their ever loving minds if they don't get it when the shite inevitably hits the fan.

There are some serious head in sand Paulinas on this thread and the Money board. I hope for the best, but man things are currently jacked up and those making decisions are spineless and greedy.

I think things are about to get a lot worse.

Posted on 3/19/23 at 11:30 am to GhostOfFreedom

LINK

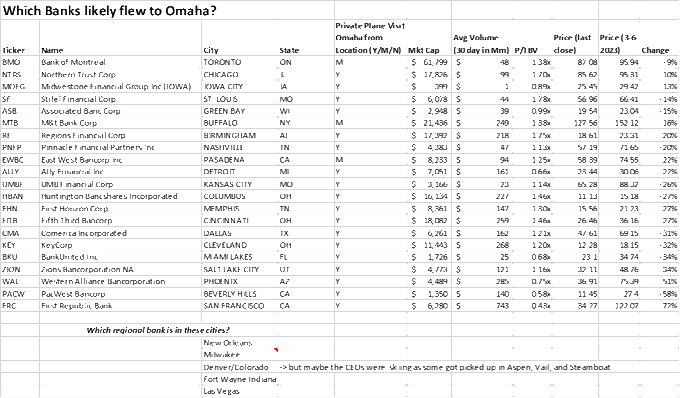

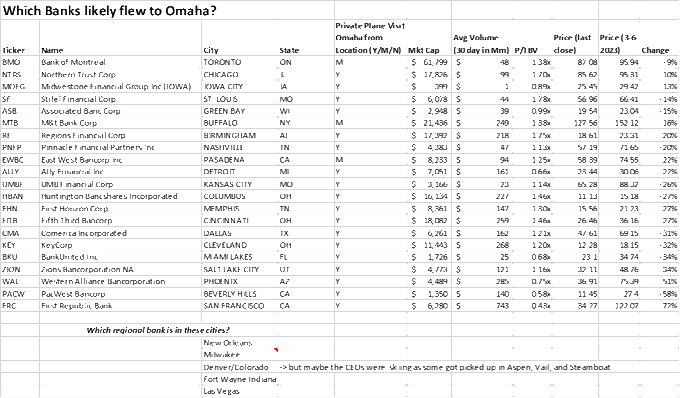

After meeting with the Biden Admin, Buffet flew a bunch of bank official to Omaha

Something is up

quote:

Berkshire Hathaway Inc.’s Warren Buffett has been in touch with senior officials in President Joe Biden’s administration in recent days as the regional banking crisis unfolds.

There have been multiple conversations between Biden’s team and Buffett in the past week, according to people familiar with the matter, who asked not to be identified because the information is private. The calls have centered around Buffett possibly investing in the US regional banking sector in some way, but the billionaire has also given advice and guidance more broadly about the current turmoil.

After meeting with the Biden Admin, Buffet flew a bunch of bank official to Omaha

Something is up

Posted on 3/19/23 at 12:04 pm to GREENHEAD22

quote:

At the last minute the Biden administration shut it down and bailed out the fricks

These were rich, connected PE and Silicon Valley types. No doubt a lot of phone calls were made and the DC grifters took over.

I promise you if this were a bunch of farmers in Nebraska they’d be screwed.

Posted on 3/19/23 at 12:04 pm to bamarep

When these people tell us everything is fine and to relax, it should cause the hair on the back of your neck to stand up.

Posted on 3/19/23 at 12:34 pm to GREENHEAD22

Level off with no growth for a several year period

Posted on 3/19/23 at 12:39 pm to SquatchDawg

Initially, Yellen came out and said they were not going to bail out SVB. Over 40B came out of SVB in a day or two. Afterwards, (not being able to find a buyer) they were led to believe if they didn't, there could be a panic or bank run Monday on all the mid-banks and below. Pilling all their cash in the big 3 (JPM, Citi and BOA). There were no favors done. They were force to act imo.

Back to top

7

7