- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: There are some major issues lurking in the US financial markets

Posted on 1/19/19 at 3:30 pm to LSURussian

Posted on 1/19/19 at 3:30 pm to LSURussian

I just hate when I go to a place that's supposed to have a great selection of regional craft beer and it's 80% IPA

And there is always some hipster with a man bun working there. Ask him about any beer and all they ever say is "it's really hoppy..."

Thanks for the useless information!

And there is always some hipster with a man bun working there. Ask him about any beer and all they ever say is "it's really hoppy..."

Thanks for the useless information!

Posted on 1/19/19 at 4:06 pm to Powerman

I hope you can survive this IPA crises you are dealing with. LOL

Posted on 1/21/19 at 7:15 am to Doc Fenton

quote:

Over in the U.S., we've had recent comments from Bostic ( on Jan. 7) and Yellen ( on Monday) indicating that the Fed may not hike rates at all in 2019.

And John Williams joined the chorus too.

CNBC: " Fed’s Williams calls for ‘patience and good judgment’ before raising rates"

So now we've had Powell (1/4), Bostic (1/7), Yellen (1/14), and Williams (1/18) from the Fed all making somewhat dovish remarks to soothe the markets.

It may not be loosening, but markets are forward-looking, and it's shifting expectations for 2019 toward a looser direction than what had been expected before.

More dramatically, we've had the PBoC execute some shock-and-awe measures early last week.

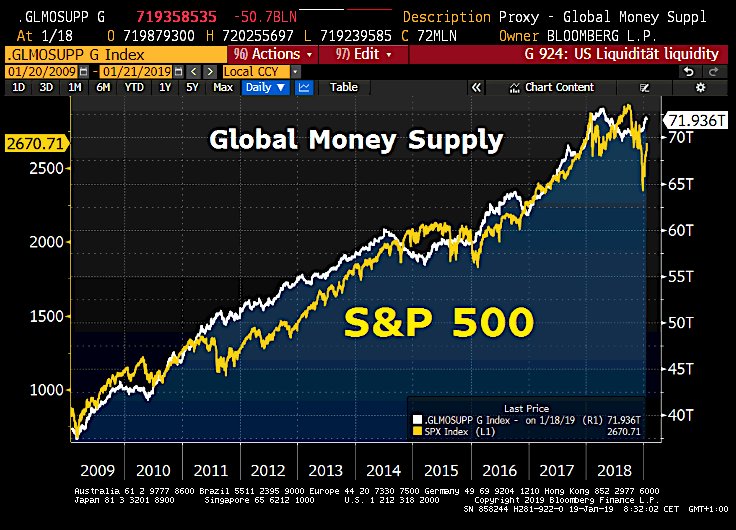

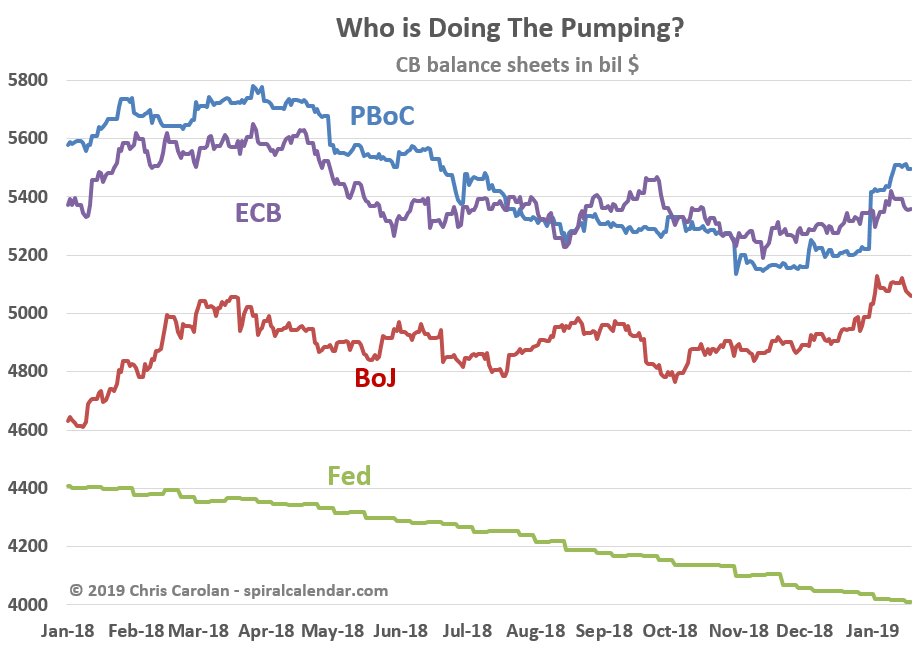

Here are a couple of illustrative charts from the financial Twittersphere:

It shows that the FRB, ECB, and BoJ are all in tightening phases, but that the PBoC is doing heavy lifting in the other direction.

The question is whether China's short-term money supply boost will be an ephemeral flare, or transition into enough of a steady flow to overpower Powell's "autopilot" balance sheet reductions. I think the PBoC's actions dominated action last week, but that the Fed's actions will predominate over the PBoC for most of the remainder of 2019.

Posted on 1/21/19 at 9:27 am to Doc Fenton

quote:Nope.

It shows that the FRB, ECB, and BoJ are all in tightening phases

Only the Fed has an established trend of shrinking its balance sheet thereby in a 'tightening phase.'

The BoJ has grown its balance sheet year-over-year and over the last three months.

The ECB has kept its balance sheet stable ending 2018 almost exactly where it was from one year ago. It has actually grown its balance sheet over the last two months.

quote:If by 'heavy lifting' you mean it has grown its balance sheet back to where it was just six months ago, then you're correct. From nine months ago it has actually shrunk its balance sheet significantly.

but that the PBoC is doing heavy lifting in the other direction.

I'm not sure why you're obviously distorting the facts.

Posted on 1/21/19 at 5:37 pm to LSURussian

quote:

distorting the facts

Posted on 1/23/19 at 7:12 am to Doc Fenton

quote:

I can't stand Elon Musk either, but really, it's Deutsche Bank that I most want to go under this time around.

Daily Beast: " Fed to Probe Deutsche Bank Over Suspicious Danske Billions"

quote:

The U.S. central bank is examining whether Deutsche Bank in New York properly scrutinized the transfer of billions of dollars that it carried out on behalf of Danske Bank’s Estonia branch, the report says. Danske has already admitted that much of some $230 billion that flowed through the Estonian outpost may have been laundered from clients across the former Soviet Union. Correspondent banks such as Deutsche were used to move money abroad.

Posted on 1/27/19 at 9:59 pm to Doc Fenton

Some thoughts on the past few days going into the new week:

#1. Hints of Fed Unwinding Adjustments. The big story last week centered around reports indicating that the Fed was planning to adjust the target end-level for its balance sheet unwinding program. The Fed will give the usual song and dance about how they never committed to any target, and how this is just an ongoing conversation for the next several months, but I think it moved markets. When the runoff began in October 2017, people were speculating that the $4.5 trillion b.s. could get tapered down to as low as $1.5 trillion ( LINK), but now people are speculating that the target will be at the high end of the range, around $3.5 trillion LINK). This is after only $400 billion in unwinding so far, down to about $4.1 trillion.

Anyway, there's a lot of gray area here, but the main take-away is that the Fed is offering a lot of flexibility to adjust both the rate and planned extent of its balance sheet unwinding. I think the markets took that as the receipt of an additional safety blanket.

#2. The Temporary End of the Shutdown Didn't Seem to Have That Big of an Effect. That's about what I predicted, although as an interesting side-note (h/t to Guy LeBas), one of the quirky effects of the shutdown is that it drove up demand for USD as the U.S. Treasury paid out less of its revenues deposited at the Fed, thus causing a small boost to the Fed's balance sheet.

#3. A U.S.-China Trade Breakthrough Is Nowhere In Sight. I'll have to admit to being completely wrong on my hunches about how the timing of this would play out in 2019. What I once saw as an obvious strategic move to occur within days or weeks, seems to have developed into an uncertain wild card that will play out over a matter of months. Lighthizer, Navarro, & Ross seem to be running the show for the moment, with Ross making that " miles and miles" comment on Thursday. Sheesh.

I was thinking that the elusive "Point G" might have occurred on Friday, January 18, but I'll admit that we've shown no signs of having reached it yet. However, I still feel okay about my short positions, because...

#4. There Is Starting to Be Some Ugly Slippage in Anticipated Revenue Growth. Apple, Microsoft, and Amazon are on deck for next week ( LINK), and could move markets significantly, but people are starting to worry about revenue growth. A particularly jarring chart below comes from Charlotte Lane:

I've often linked to S&P 500 historical earnings by year, but the table for sales is arguably more interesting. It shows a rate of annualized sales growth of only about 1.85% from 2007 to 2017--not exactly what you'd want to depend on as the story for why the stock market has risen so much the past several years.

#5. The China Story Isn't Going Away. Here's a recent anecdotal video from Bloomberg from Thursday now up on YouTube: " Inside China's High-Tech Dystopia." Over the weekend, I think Ken Rogoff made some comments about China in the press, and there was also a special feature in Barron's about how China's slowdown is just beginning.

In a related vein to tech dystopia comes the continuing epic ongoing implosion of Facebook, with an article coming out in Medium on Saturday about how " The fall of Facebook has only begun."

Ouch.

#1. Hints of Fed Unwinding Adjustments. The big story last week centered around reports indicating that the Fed was planning to adjust the target end-level for its balance sheet unwinding program. The Fed will give the usual song and dance about how they never committed to any target, and how this is just an ongoing conversation for the next several months, but I think it moved markets. When the runoff began in October 2017, people were speculating that the $4.5 trillion b.s. could get tapered down to as low as $1.5 trillion ( LINK), but now people are speculating that the target will be at the high end of the range, around $3.5 trillion LINK). This is after only $400 billion in unwinding so far, down to about $4.1 trillion.

Anyway, there's a lot of gray area here, but the main take-away is that the Fed is offering a lot of flexibility to adjust both the rate and planned extent of its balance sheet unwinding. I think the markets took that as the receipt of an additional safety blanket.

#2. The Temporary End of the Shutdown Didn't Seem to Have That Big of an Effect. That's about what I predicted, although as an interesting side-note (h/t to Guy LeBas), one of the quirky effects of the shutdown is that it drove up demand for USD as the U.S. Treasury paid out less of its revenues deposited at the Fed, thus causing a small boost to the Fed's balance sheet.

#3. A U.S.-China Trade Breakthrough Is Nowhere In Sight. I'll have to admit to being completely wrong on my hunches about how the timing of this would play out in 2019. What I once saw as an obvious strategic move to occur within days or weeks, seems to have developed into an uncertain wild card that will play out over a matter of months. Lighthizer, Navarro, & Ross seem to be running the show for the moment, with Ross making that " miles and miles" comment on Thursday. Sheesh.

I was thinking that the elusive "Point G" might have occurred on Friday, January 18, but I'll admit that we've shown no signs of having reached it yet. However, I still feel okay about my short positions, because...

#4. There Is Starting to Be Some Ugly Slippage in Anticipated Revenue Growth. Apple, Microsoft, and Amazon are on deck for next week ( LINK), and could move markets significantly, but people are starting to worry about revenue growth. A particularly jarring chart below comes from Charlotte Lane:

I've often linked to S&P 500 historical earnings by year, but the table for sales is arguably more interesting. It shows a rate of annualized sales growth of only about 1.85% from 2007 to 2017--not exactly what you'd want to depend on as the story for why the stock market has risen so much the past several years.

#5. The China Story Isn't Going Away. Here's a recent anecdotal video from Bloomberg from Thursday now up on YouTube: " Inside China's High-Tech Dystopia." Over the weekend, I think Ken Rogoff made some comments about China in the press, and there was also a special feature in Barron's about how China's slowdown is just beginning.

In a related vein to tech dystopia comes the continuing epic ongoing implosion of Facebook, with an article coming out in Medium on Saturday about how " The fall of Facebook has only begun."

quote:

According to data recently released by Statcounter, Facebook’s global social media market share dropped from 75.5% in December 2017 to 66.3% in December 2018. The biggest drop was in the U.S., from 76% to 52%. As Cowen survey results released this week suggest, these engagement declines will continue to depress the company’s earnings. Surveying 50 senior U.S. ad buyers controlling a combined $14 billion in digital ad budgets in 2018, 18% said they were decreasing their spend on Facebook. As a result, Cowen estimates the Facebook platform will lose 3% of its market share.

No doubt Facebook’s struggles are not just about the headline scandals. For years, one innovation priority after another has fallen flat, from VR to its video push to its laggard position in the digital-assistant race. The company’s most significant “innovation” success of the past few years was copying the innovation of a competitor?—?pilfering Snapchat’s ephemerality for its “moments” feature.

However, it’s the scandals that have most crippled the company’s brand and revealed the cultural rot trickling down from its senior ranks.

Ouch.

Posted on 1/27/19 at 10:24 pm to Doc Fenton

quote:Maybe the stock market has gone up because, as your link says, sales growth for the S&P500 for the past 2 years has been 6% & 9% per year. 9% sales growth is, to paraphrase Les Miles, “damn strong.” At 9% sales growth compounded annually, sales will double every 8 years.

but the table for sales is arguably more interesting. It shows a rate of annualized sales growth of only about 1.85% from 2007 to 2017–not exactly what you'd want to depend on as the story for why the stock market has risen so much the past several years.

What sales growth was in 2007, 2008 & 2009 is irrelevant because sales were declining then and so were stock prices until March, 2009.

This post was edited on 1/27/19 at 10:47 pm

Posted on 2/5/19 at 9:25 am to LSURussian

Boy this thread really died

Posted on 2/5/19 at 9:42 am to Hussss

quote:

Don't leave out the other ones with 2700 in them. I know you like to cherry pick.

Can we get Hussss back in here to say 2800 is now when we reach the top of the roller coaster?

Posted on 2/5/19 at 12:40 pm to Thib-a-doe Tiger

Lest we forget, it was one year ago today that the Dow Jones Average dropped -1,175 points in what is still the biggest one day point decline in the DJ Average.

The usual suspects on this board started crowing how it was the death of the bull market.

The usual suspects on this board started crowing how it was the death of the bull market.

This post was edited on 2/5/19 at 2:54 pm

Posted on 2/5/19 at 2:13 pm to LSURussian

And here we sit, 5% off all time highs

Posted on 2/5/19 at 5:29 pm to Thib-a-doe Tiger

I'm seeing the S&P 500 at 6.91% below its intraday high on 9/21/2018 from 4.5 months ago, 4.71% below its intraday high on 1/26/2018 from 12.5 months ago, and fwiw, just a hair below the market close on 10/23/2018 when this thread was created 3.5 months ago, so it's not exactly a bull rout yet.

That being said, yeah, I'm feeling the crunch from this epic short squeeze. It is not a pleasant experience.

I think Hussss said his exit point was at around 2700, so he might be out, but I'm dug in a little deeper than him with a more long-term position. It just goes to show that perfect timing is impossible. I'm glad I waited for the market to rise 10.5% over 18 days before entering my position, but the subsequent rise of 5.6% over the past 25 days has been bloody awful. I sure wish I could have stuck to my original plan to wait until a U.S.-China trade breakthrough was announced.

I was thinking of posting a summary Sunday night going into this week, but you know... Super Bowl parties and whatnot. Honestly, though, not much has changed in terms of the arguments on both sides for bulls and bears.

The Powell liftoff has been much wider than I think anyone could have anticipated, but on the bright side (for bears), the Fed's ammunition is now completely exhausted, and it cannot stop what's coming. Plus, the technicals of a 16.7% run-up in about 6 weeks are just awful. I don't see how anyone can view what's just happened as a sign of a healthy market, especially when taken in conjunction with both high-yield and long-term bond yields. It's bananas.

It doesn't seem to matter if quarterly earnings reports for companies are good or bad... most stocks have been popping on release regardless, even while earnings projections for 1Q-2019 continue to drop.

I hesitate to speculate on what's been driving the recent insanity, but I don't think Powell's statements and good 4Q corporate numbers are a full explanation. My gut tells me that insiders are speculating on a U.S.-China breakthrough to be hinted at during the SOTU address, which could potentially make this short squeeze even more painful.

Even if a trade deal is announced (and I still think it will be well before March 1) though, I think it's likely that most of that is already priced into the recent runup. We'll see.

That being said, yeah, I'm feeling the crunch from this epic short squeeze. It is not a pleasant experience.

I think Hussss said his exit point was at around 2700, so he might be out, but I'm dug in a little deeper than him with a more long-term position. It just goes to show that perfect timing is impossible. I'm glad I waited for the market to rise 10.5% over 18 days before entering my position, but the subsequent rise of 5.6% over the past 25 days has been bloody awful. I sure wish I could have stuck to my original plan to wait until a U.S.-China trade breakthrough was announced.

I was thinking of posting a summary Sunday night going into this week, but you know... Super Bowl parties and whatnot. Honestly, though, not much has changed in terms of the arguments on both sides for bulls and bears.

The Powell liftoff has been much wider than I think anyone could have anticipated, but on the bright side (for bears), the Fed's ammunition is now completely exhausted, and it cannot stop what's coming. Plus, the technicals of a 16.7% run-up in about 6 weeks are just awful. I don't see how anyone can view what's just happened as a sign of a healthy market, especially when taken in conjunction with both high-yield and long-term bond yields. It's bananas.

It doesn't seem to matter if quarterly earnings reports for companies are good or bad... most stocks have been popping on release regardless, even while earnings projections for 1Q-2019 continue to drop.

I hesitate to speculate on what's been driving the recent insanity, but I don't think Powell's statements and good 4Q corporate numbers are a full explanation. My gut tells me that insiders are speculating on a U.S.-China breakthrough to be hinted at during the SOTU address, which could potentially make this short squeeze even more painful.

Even if a trade deal is announced (and I still think it will be well before March 1) though, I think it's likely that most of that is already priced into the recent runup. We'll see.

Posted on 2/5/19 at 8:13 pm to Doc Fenton

One of us lives in an alternate reality...

Besides, what does the Fed need ammunition for? All economic fundamentals remain positive.

quote:Not even close to being accurate. The Fed has plenty of ammunition to spare.

Fed's ammunition is now completely exhausted

Besides, what does the Fed need ammunition for? All economic fundamentals remain positive.

quote:Alphabet, Amazon, XOM, AT&T to name just a few disagree. They all got crushed upon announcing their earnings.

It doesn't seem to matter if quarterly earnings reports for companies are good or bad... most stocks have been popping on release regardless,

Posted on 2/5/19 at 11:23 pm to LSURussian

Russia

What DR references in the 1 point is what I was talking about the other day btw in regards to the fed raising the balance sheet limit.

What DR references in the 1 point is what I was talking about the other day btw in regards to the fed raising the balance sheet limit.

Posted on 2/6/19 at 2:25 pm to Doc Fenton

quote:

I'm seeing the S&P 500 at 6.91% below its intraday high on 9/21/2018 from 4.5 months ago, 4.71% below its intraday high on 1/26/2018 from 12.5 months ago, and fwiw, just a hair below the market close on 10/23/2018 when this thread was created 3.5 months ago, so it's not exactly a bull rout yet.

So we’re down 5% from all time highs, and that’s a win for bears?

Can I ask you a serious question: what’s it like being on the losing side of stock market history?

Posted on 2/7/19 at 7:17 pm to Hussss

quote:

Hussss

If you're still out there reading, these two links are for you, since I know you love Sven and his Northman Trader stuff...

MarketWatch (Sat., 2/2/19): " The evidence is in: Stocks are in a ‘bull trap’" by Sven Henrich

CNBC (this morning): " After markets go from one extreme to another, one technician sees an 'inflection point'"

CNBC actually constructed an article around Sven's tweet from Wednesday morning:

quote:

$NDX components above their 50MA: Went from 3 to 93 in a matter of 6.5 weeks, the fastest move from extreme low to extreme high ever.

Nasdaq is not really my thing, but it does make for a striking visual.

Sven is also still talking about his Fibonacci numbers, but that's where I draw the line... haha. I don't want to end up like that crazy math guy from Darren Aronofsky's "Pi."

Posted on 2/7/19 at 7:23 pm to Doc Fenton

In more serious news, the recession storylines coming out of Germany, Italy, and Spain are much worse than anticipated, and there isn't anything new to make Baltic trade or Korean trade or China look any better. (It'll be interesting to see what Chinese markets do next Monday after the long holiday.)

Additionally, the advance indicators in the U.S. aren't looking too hot either. In recent days, a lot of focus has been on banks and tightening credit standards, and lower demand for consumer credit.

Today, of course, we got the rare occurrence of whatever you call the opposite of a Kudlow Bounce... I guess a Kudlow Thud. You can't give too much weight to it, I suppose, but we may have broken the trend for the post-Christmas rally.

Additionally, the advance indicators in the U.S. aren't looking too hot either. In recent days, a lot of focus has been on banks and tightening credit standards, and lower demand for consumer credit.

Today, of course, we got the rare occurrence of whatever you call the opposite of a Kudlow Bounce... I guess a Kudlow Thud. You can't give too much weight to it, I suppose, but we may have broken the trend for the post-Christmas rally.

Posted on 2/8/19 at 11:30 am to Doc Fenton

I actually looked for this thread just to see if you have commented on Germany yet. Check out industrial production last quarter, all negative postings. Their yield curve is also inverted out to 10 years on the term structure and the 30s are yielding 1%. Doc, you have a ton of haters on here but I think you're closer to reality than the MMT permabulls.

I will say that the Fed isn't out of options. They can drop rates to zero at the signs of economic contraction or start QE4?5? (can't remember what round it would be) and blast off risky assets prices. The dollar outlook does not look good in that scenario. Especially when you think about the risks of a Democrat controlled government. Unfortunately as we creep closer to November 2020 I have a feeling this will be the most probably scenario.

I will say that the Fed isn't out of options. They can drop rates to zero at the signs of economic contraction or start QE4?5? (can't remember what round it would be) and blast off risky assets prices. The dollar outlook does not look good in that scenario. Especially when you think about the risks of a Democrat controlled government. Unfortunately as we creep closer to November 2020 I have a feeling this will be the most probably scenario.

Posted on 2/8/19 at 11:48 am to wutangfinancial

quote:

Check out industrial production last quarter, all negative postings. Their yield curve is also inverted out to 10 years on the term structure and the 30s are yielding 1%.

Yeah. Bill Gross announced his retirement just a few days ago, and if I'm not mistaken, in part it was hastened by the poor performance of his last big strategic play--shorting the German bund and going long U.S. bonds (betting that the spread between the two will narrow).

Eventually, though, I think his wisdom will prove correct here... although of course that doesn't matter much if the timing is wrong.

quote:

I will say that the Fed isn't out of options. They can drop rates to zero at the signs of economic contraction

Yep. I sometimes type a lot of stuff quickly and make off-the-cuff remarks that are overbroad, and don't quite capture the context of my intended message.

When I claimed that the Fed is out of ammunition, I meant that in the context of having ammunition to prevent the onset of a bear market, since at some juncture, we reach a tipping point where dovish actions by the Fed signals an economic contraction, and thus will tend to have the bad-economic-signals bear effects start to outweigh the looser-monetary-policy bull effects, in terms of moving the market up or down in short-term response.

If and when signs of economic contraction arrive, then yes, the Fed will take consequential actions that have significant effects on the market (although they will have less room to maneuver than they did in 2001 and 2008). I'm just saying that we may have reached the point where the Fed can only mitigate a bear market, not prevent it from occurring.

Popular

Back to top

1

1