- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Q4 GDP blows past expectations - 3.3% vs 2% expectations

Posted on 1/25/24 at 7:54 am

Posted on 1/25/24 at 7:54 am

CNBC

Try to keep all of your “yeah, but…” comments in this thread. Thanks.

quote:

The U.S. economy for all of 2023 accelerated at a 2.5% annualized pace, well ahead of the Wall Street outlook at the beginning of the year for few if any gains.

As had been the case through the year, a strong pace of consumer spending helped drive the expansion. Personal consumption expenditures increased 2.8% for the quarter, down just slightly from the previous period. State and local government spending also contributed, up 3.7%, as did a 2.5% increase in federal government expenditures. Gross private domestic investment rose 2.1%, another significant factor for the robust quarter.

On the inflation front, the price index for personal consumption expenditures rose 2.7% on an annual basis, down from 5.9% a year ago, while the core figure excluding food and energy posted a 3.2% increase annually, compared to 5.1%.

However, the inflation rates both were much lower in a quarterly basis. Core prices, which the Federal Reserve prefers as a longer-term inflation measure, rose 2% for the period, while the headline rate was 1.7%.

Try to keep all of your “yeah, but…” comments in this thread. Thanks.

This post was edited on 1/25/24 at 7:56 am

Posted on 1/25/24 at 8:06 am to slackster

What would this mean for short-term (1-3 months) of mortgage rates?

Better economy means that fed has no need to lower rates right? which keeps mortgage rates higher?

Better economy means that fed has no need to lower rates right? which keeps mortgage rates higher?

Posted on 1/25/24 at 8:08 am to slackster

So the economy has digested rate hikes and now the Fed can add more.

Posted on 1/25/24 at 8:15 am to slackster

How’s the deficit coming along? How long before interest payments on the debt surpass tax revenues?

Posted on 1/25/24 at 8:19 am to SloaneRanger

quote:Not a single person we elect gives a damn about deficit.

How’s the deficit coming along?

Neither side will ever do anything about it.

Posted on 1/25/24 at 8:20 am to slackster

Damn! Now no rate cutes this year.

Posted on 1/25/24 at 8:30 am to slackster

Yes everything is sunshine and rainbows in our economy

Posted on 1/25/24 at 9:26 am to slackster

quote:

On the inflation front, the price index for personal consumption expenditures rose 2.7% on an annual basis, down from 5.9% a year ago, while the core figure excluding food and energy posted a 3.2% increase annually

Posted on 1/25/24 at 9:34 am to Civildawg

quote:It is so much better than it was 24 months ago.

Yes everything is sunshine and rainbows in our economy

Posted on 1/25/24 at 9:35 am to slackster

quote:

Try to keep all of your “yeah, but…” comments in this thread. Thanks.

I'm sure you'll be back to update us on revisions

Posted on 1/25/24 at 9:56 am to SloaneRanger

quote:We live in a world where this no longer matters

How’s the deficit coming along? How long before interest payments on the debt surpass tax revenues?

Posted on 1/25/24 at 10:16 am to TigerTatorTots

quote:Until it does.

We live in a world where this no longer matters

Posted on 1/25/24 at 10:21 am to tissle

quote:

Better economy means that fed has no need to lower rates right? which keeps mortgage rates higher?

The bond market doesn't think it's a better economy so mortgage rates will fall with the ten year. The Fed has no say in it. All they can do is inject volatility into bills markets.

Posted on 1/25/24 at 10:33 am to RoyalWe

quote:

Until it does.

Correct

Posted on 1/25/24 at 11:28 am to slackster

If you hear a whistling sound, that's the sound of the falling probability of the Fed dropping rates in March.

MoM PPI is down slightly, but continues to be up YoY (preliminary numbers). CPI continued to run positive. PCE releases tomorrow, it's been trending down but like CPI the brunt of the current drop is due to energy.

Meanwhile, jobless claims are barely moving, Unemployment is stuck at 3.7% and it's hard to know exactly how trustworthy employment numbers are because... mathz r hard.

MoM PPI is down slightly, but continues to be up YoY (preliminary numbers). CPI continued to run positive. PCE releases tomorrow, it's been trending down but like CPI the brunt of the current drop is due to energy.

Meanwhile, jobless claims are barely moving, Unemployment is stuck at 3.7% and it's hard to know exactly how trustworthy employment numbers are because... mathz r hard.

quote:

The government quietly erased 439,000 jobs through November 2023, a closer look at the numbers from the Bureau of Labor Statistics shows.

That means its initial jobs results were inflated by 439,000 positions, and the job market is not as healthy as the government suggests.

Since the government wiped out 439,000 jobs after the fact, the total percentage of jobs created by the government last year is even higher. Increased government hiring has been driving the jobs numbers higher.

Posted on 1/25/24 at 11:48 am to Bard

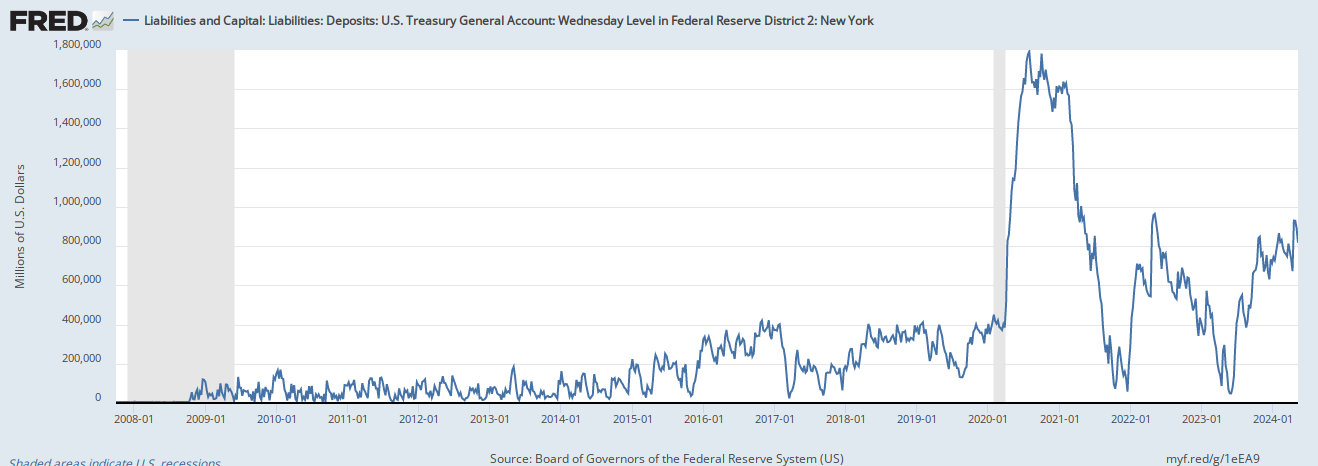

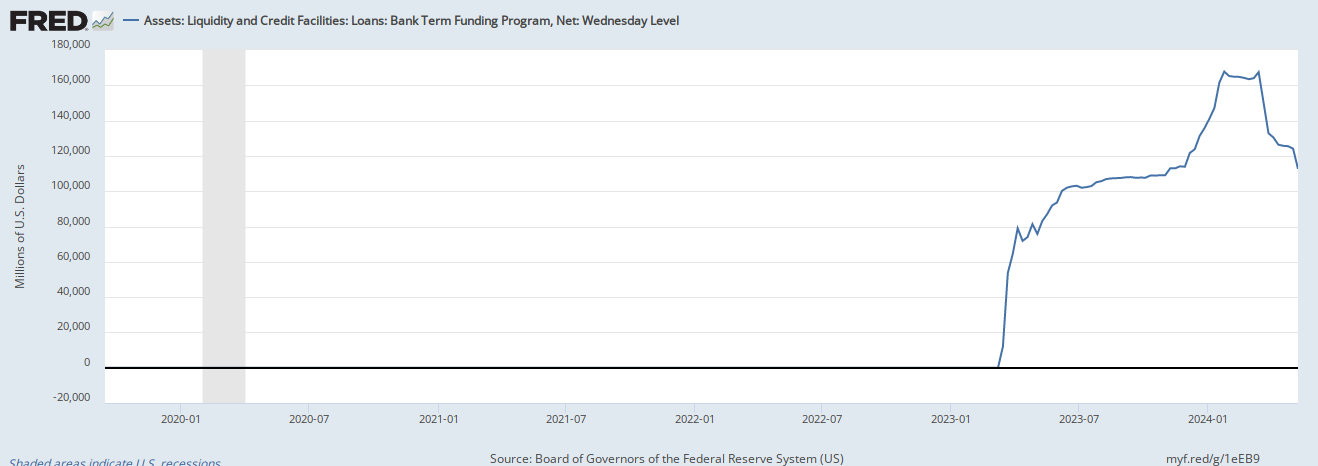

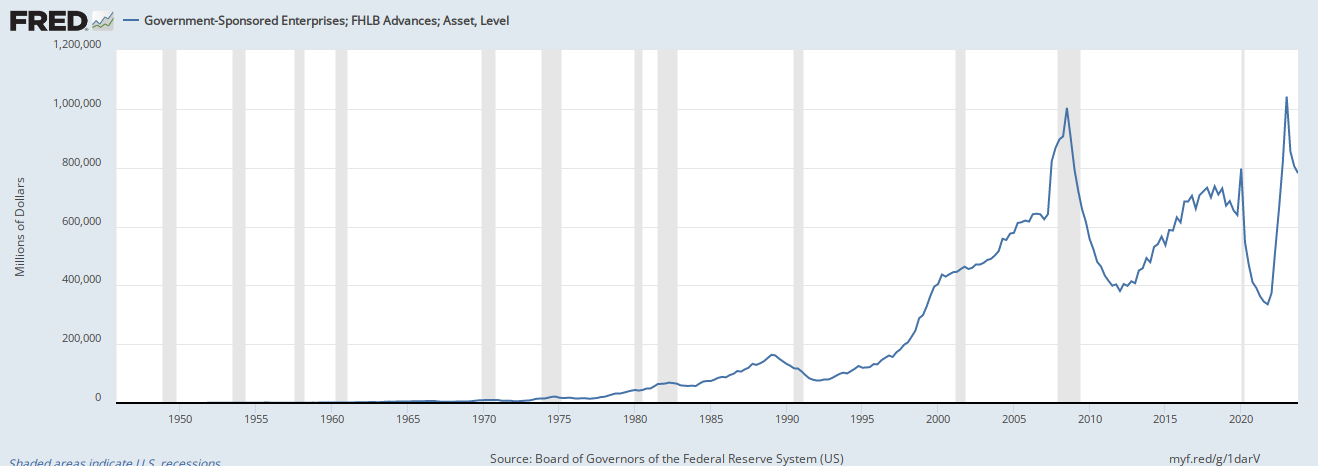

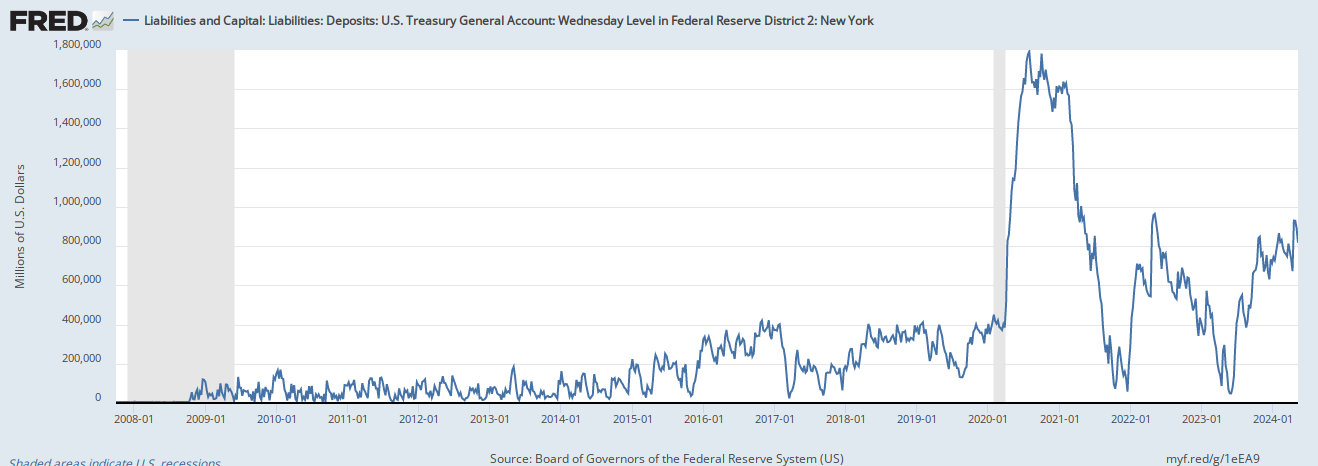

Go look at MoM state unemployment changes that past few months. It's the federal government blowing their wad with extended stimulus and national defense spending. They pulled us out of recession last year for Q3 and it has only accelerated.

Total Gov: 2.9 5.3 4.8 3.3 5.8 3.3

Fed Gov: 1.2 9.8 5.2 1.1 7.1 2.5

Defense:-0.3 7.7 1.9 2.3 8.4 0.9

Non-Def: 3.3 12.6 9.5-0.4 5.5 4.6

States: 3.8 2.8 4.6 4.7 5.0 3.7

These are retarded numbers considering the comps they had to meet. If you work in or adjacent to the government like in healthcare or draw a check from them, you're feeling euphoric about the economy. And it's going to continue:

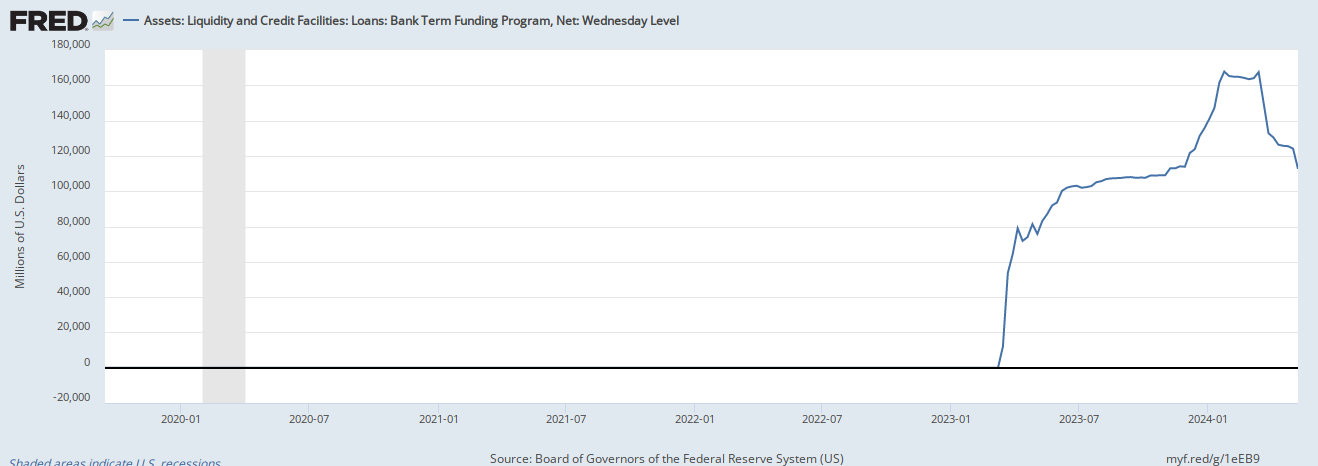

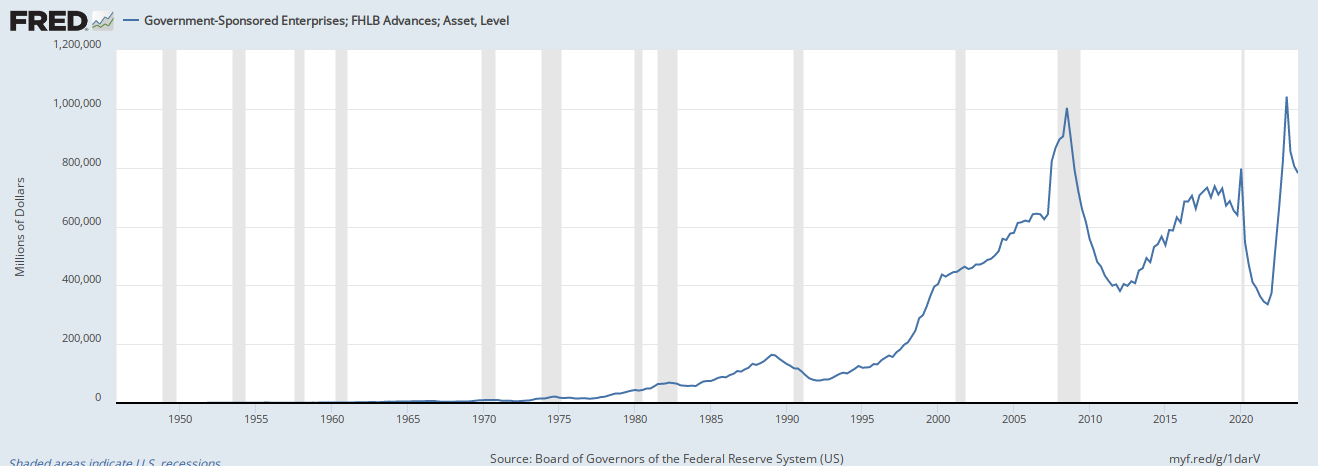

And I would expect this to re-accelerate:

Corporate spreads are going down we'll see how they react to the maturity wall this year

Total Gov: 2.9 5.3 4.8 3.3 5.8 3.3

Fed Gov: 1.2 9.8 5.2 1.1 7.1 2.5

Defense:-0.3 7.7 1.9 2.3 8.4 0.9

Non-Def: 3.3 12.6 9.5-0.4 5.5 4.6

States: 3.8 2.8 4.6 4.7 5.0 3.7

These are retarded numbers considering the comps they had to meet. If you work in or adjacent to the government like in healthcare or draw a check from them, you're feeling euphoric about the economy. And it's going to continue:

And I would expect this to re-accelerate:

Corporate spreads are going down we'll see how they react to the maturity wall this year

Posted on 1/25/24 at 12:55 pm to wutangfinancial

January yoy inflation could be surprisingly low. December yoy was flat because energy prices dipped for a month in December 2022 but popped back up in January. The overall trend has been downward and if that continues in Jan and Feb the FOMC meeting in March could be interesting.

This post was edited on 1/25/24 at 12:57 pm

Posted on 1/25/24 at 2:10 pm to slackster

quote:

On the inflation front, the price index for personal consumption expenditures rose 2.7% on an annual basis, down from 5.9% a year ago, while the core figure excluding food and energy posted a 3.2% increase annually, compared to 5.1%.

So still inflation rising but not as fast. People just loading up credit cards

Posted on 1/25/24 at 4:09 pm to wutangfinancial

quote:

It's the federal government blowing their wad with extended stimulus and national defense spending. They pulled us out of recession last year for Q3 and it has only accelerated.

And let's not forget the increased debt servicing. Increasing the interest on the debt while astronomically increasing the debt has created a snowball effect. We have to borrow more to pay for the extra borrowing in order to borrow more to pay for the extra borrowing in order to borrow more to... etc.

Current estimates for FY2023 are for ~$100B less in revenues that FY2022 yet ~$200B more in deficit spending. That's a swing of an extra $300B in annual debt in just one year.

quote:

These are retarded numbers considering the comps they had to meet. If you work in or adjacent to the government like in healthcare or draw a check from them, you're feeling euphoric about the economy.

Money is just like anything else, in order for it to be "free" for one person, it has to cost someone else at some point.

Posted on 1/25/24 at 4:21 pm to HailToTheChiz

quote:

So still inflation rising but not as fast. People just loading up credit cards

That's putting it mildly.

Consumer credit card debt:

Credit card interest rates:

Credit card delinquency rate:

Consumers have been offsetting more and more inflation onto their credit cards for almost two years now. High card rates plus continued rising inflation means it's going to end up being a race for many consumers to see if they can avoid defaulting long enough for inflation and interest rates to come back down to manageable levels (assuming their pay increases) so they can at least service their debt without accruing more (this is also compounded by student loan repayments for those who have them, but they have a little breathing room as those won't be considered to be in default until September).

As I posted in another thread, it has me holding my breath to see if the consumer credit bubble pops or quietly deflates.

Popular

Back to top

10

10