- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 8/5/23 at 8:08 am to BatonRougeBuckeye

I’ve met people who own physical gold and silver as a hedge against financial calamity. I’ve always been hesitant to buy because I haven’t met anyone who has walked me through a personal experience of selling any. Before I would buy any, I would like to know there is liquidity for its real value (near spot). If there is not liquidity near spot, then it’s real value is obviously less.

This post was edited on 8/5/23 at 8:10 am

Posted on 8/5/23 at 6:19 pm to Semper Gumby

SG … it’s reasonably straightforward.

In order of consumer demand, the general hierarchy, …. most desirable to least desirable:

Numismatics - collectible coins with known mintages, rare coins

US Government minted Coins .9999 purity

Government minted Coins .999 (UK, Can, Aus, Mex)

Government minted bullion bars , bullion ( .999, numbered)

US Government 90% coinage .900

Private mint rounds .999 bullion

Private mint bars .999 bullion

Other government 90% coinage

Other collectables - varies widely

The higher on the list, the more likely and easily you’ll be able to liquidate at Spot or above.

It also pays to have a relationship with one or more local coin dealers that can help. I’ve sold to several of the online dealers and had good results. A little slow because of shipping, but that’s to be expected.

Industry shows, like The Money Show referenced above, are a great place to meet and speak with all of the major online Buyers …. G/L

In order of consumer demand, the general hierarchy, …. most desirable to least desirable:

Numismatics - collectible coins with known mintages, rare coins

US Government minted Coins .9999 purity

Government minted Coins .999 (UK, Can, Aus, Mex)

Government minted bullion bars , bullion ( .999, numbered)

US Government 90% coinage .900

Private mint rounds .999 bullion

Private mint bars .999 bullion

Other government 90% coinage

Other collectables - varies widely

The higher on the list, the more likely and easily you’ll be able to liquidate at Spot or above.

It also pays to have a relationship with one or more local coin dealers that can help. I’ve sold to several of the online dealers and had good results. A little slow because of shipping, but that’s to be expected.

Industry shows, like The Money Show referenced above, are a great place to meet and speak with all of the major online Buyers …. G/L

This post was edited on 8/6/23 at 2:49 pm

Posted on 8/12/23 at 8:42 am to BatonRougeBuckeye

Let's say dollar crashes and i have 100,000 in gold. How do I use gold to pay for gas? Insurance? Utilities? My gold won't last forever because I don't have millions in gold. I'm back at square 1, because during that time I wasn't being paid in gold in employment earnings.

For all you precious metal holders, the government can make it illegal to own at the stroke of a pen. The only way to prevent that, is to store your metals in another country. Good luck with that

For all you precious metal holders, the government can make it illegal to own at the stroke of a pen. The only way to prevent that, is to store your metals in another country. Good luck with that

Posted on 8/12/23 at 1:19 pm to Twenty 49

quote:

The Washington Post

is a fricking trash commie rag.

and no i do not advocate for those gold IRAs either.

here you reference that trash rag again. wow tells me all i need to know about you commie.

LINK

and you post on the cesspool aka OT?

This post was edited on 8/12/23 at 1:26 pm

Posted on 8/12/23 at 3:50 pm to Enadious

quote:

Let's say dollar crashes and i have 100,000 in gold. How do I use gold to pay for gas? Insurance? Utilities? My gold won't last forever because I don't have millions in gold. I'm back at square 1, because during that time I wasn't being paid in gold in employment earnings. For all you precious metal holders, the government can make it illegal to own at the stroke of a pen. The only way to prevent that, is to store your metals in another country. Good luck with that

There are currently 11 states where gold and silver are used as legal tender ….. another 7 that have started the process. Some states, like Texas, have started their own bullion depository and mint.

The US government has never confiscated silver. And they were only slightly more successful at confiscating gold. Most coin collectors have pre-confiscation gold in their collections, and it is commonly traded.

Storage in Singapore or Dubai is straightforward and secure ….. Canada or Switzerland less so.

If you don’t own precious metals , you might consider adding some as part of a healthy, diversified asset portfolio. 10% is a good guide ….

Either way, backing a fiat currency with metal is undoubtedly a smart policy ……

Posted on 8/12/23 at 5:38 pm to cadillacattack

quote:

Either way, backing a fiat currency with metal is undoubtedly a smart policy ……

IF this was the case, why not back it with something that actually universally useful, like oil?

Posted on 8/14/23 at 6:49 pm to slackster

Excerpt:

quote:

Why did gold become the standard for money? Why not copper or platinum or argon? A chemical engineer explains. An element must meet four qualities to stand alone as a premium currency, Sanat Kumar, the chair of the chemical engineering department at Columbia University told NPR.

First, it can't be a gas — gases simply are not practical for currency exchange. That knocks out a bunch of contenders from the right side of the periodic table, including the Noble gases, which would meet the other three qualifications.

Second, it can't be corrosive or reactive — pure lithium, for example, ignites when exposed to water or air. Iron rusts. This qualification knocks out 38 elements.

Third, it can't be radioactive. For one thing, your money would eventually radiate away to nothing . For another, Kumar pointed out, the radiation would eventually kill you . This eliminates the two rows that are separate from table, the elements known as actinides and lanthanides.

Any of the 30 or so remaining elements would make nice, stable forms of currency if they met the fourth qualification: They must be rare enough to be valuable, but not so rare that it's impossible to find .

That brings us to five elements, according to Kumar: rhodium, palladium, platinum, silver and gold. Although silver has been used for currency, it tarnishes easily, so it's out. Rhodium and palladium were discovered only in the 1800s, so they'd have been of no use to early civilizations. That leaves gold and platinum. Platinum, however, has a melting point around 3,000 degrees Fahrenheit (about 1,600 degrees Celsius), which, Kumar noted, could only be attained in a modern furnace, so early civilizations would not have been able to conveniently shape it into uniform units.

That leaves gold, which is solid but malleable, doesn't react, and won't kill you. It is truly the gold standard.

Posted on 8/15/23 at 10:49 am to BatonRougeBuckeye

Ask yourself this question. If we reach such a state of economic turmoil that cash and credit are no longer viable, why will anyone want gold?

If we reach that situation, you will need food, water, shelter, protection, and things that help you to achieve those goals.

If we reach that situation, you will need food, water, shelter, protection, and things that help you to achieve those goals.

Posted on 8/15/23 at 11:52 pm to BatonRougeBuckeye

Storage is the hidden costs of gold. You need a safe or a safe deposit box. And if this is really a hedge against a currency failure, maybe you should collect silver by the ounce from a reputable mint since that would be far easier to barter for basic necessities.

And maybe add some ammo to your metal collection.

For gold….buy from a reputable dealer. I bought via APMEX before their fees went sky high. Now I don’t bother with them and go through GSM or Scottsdale on the rare occasion that I buy anymore. They take longer to fill an order but their prices are fair.

And maybe add some ammo to your metal collection.

For gold….buy from a reputable dealer. I bought via APMEX before their fees went sky high. Now I don’t bother with them and go through GSM or Scottsdale on the rare occasion that I buy anymore. They take longer to fill an order but their prices are fair.

This post was edited on 8/15/23 at 11:58 pm

Posted on 8/16/23 at 7:25 am to dewster

good points, dewster.

Storage is a challenge , to one varying degree or another.

Home safes are a security risk for all but small amounts.

Bank deposit boxes are definitely not safe from government risk and seizure.

Storing in other countries is very easy, and not as expensive as you might think, … but I imagine it would be difficult to get to in the event of a crisis.

I use a private vault service in Atlanta that I can get to in short order. It isn’t cheap, but neither is it expensive …..but we use it for many things. We use it for household documents, deeds, wills, PM’s,, and a few heirloom valuables …. things like that.

Premiums are currently half of what they were a month ago … even at Apmex. They are still high IMO ….. $2.50-$3.00/ oz for silver bullion is still “high” to me …. It telegraphs that dealers are trying to lighten their inventory prior to an anticipated pullback is spot prices (silver)

The trick will be to wait for the pullback ( gold target $1870 spot) and grab physical while the premiums are discounted, and before the dealer’s physical inventory is depleted. In my experience, this period lasts only about a week. That’s what I’m watching for …..

There is a very strong level of support at $1820 for gold, but if you wait until it bounces off $1820 there likely won’t be any physical inventory remaining at the majority of dealers.

Be safe out there, …. and good luck to all ….

Storage is a challenge , to one varying degree or another.

Home safes are a security risk for all but small amounts.

Bank deposit boxes are definitely not safe from government risk and seizure.

Storing in other countries is very easy, and not as expensive as you might think, … but I imagine it would be difficult to get to in the event of a crisis.

I use a private vault service in Atlanta that I can get to in short order. It isn’t cheap, but neither is it expensive …..but we use it for many things. We use it for household documents, deeds, wills, PM’s,, and a few heirloom valuables …. things like that.

Premiums are currently half of what they were a month ago … even at Apmex. They are still high IMO ….. $2.50-$3.00/ oz for silver bullion is still “high” to me …. It telegraphs that dealers are trying to lighten their inventory prior to an anticipated pullback is spot prices (silver)

The trick will be to wait for the pullback ( gold target $1870 spot) and grab physical while the premiums are discounted, and before the dealer’s physical inventory is depleted. In my experience, this period lasts only about a week. That’s what I’m watching for …..

There is a very strong level of support at $1820 for gold, but if you wait until it bounces off $1820 there likely won’t be any physical inventory remaining at the majority of dealers.

Be safe out there, …. and good luck to all ….

This post was edited on 8/16/23 at 7:46 am

Posted on 8/16/23 at 9:01 am to CamdenTiger

quote:

it. Instead, I just buy bullets, cause if it gets that bad, at least I’ll have bullets..

Best investment advice ever. If the country completely tanks and the $ is worthless whos going to buy your gold? Ammo and can goods will hold the most value.

Posted on 8/16/23 at 10:35 am to jmarto1

quote:Deflation.

It creates its own type of inflation when the supply runs short.

Under the gold standard, a finite amount of gold in an expanding economy and/or population forces prices down.

It was a source of social unrest during the robber baron era (between the California and Klondike Gold Rushes). Even though the price of goods declined, so dollars went further, with a finite gold supply companies concomitantly forced salaries down, which played poorly with workers.

This post was edited on 8/16/23 at 10:42 am

Posted on 8/16/23 at 12:29 pm to NC_Tigah

On storage issues...

Back in 2001 or so I got the silver bug and bought a 200-ounce hand poured bar for around $5/ounce. The wife thought I was crazy because we didn't have a safe at the time.

I took it out to my shed and spray painted it flat black. I then used it as a door stop inside the house.

It sat on the floor collecting dust until prices began to run up after the 2008 banking crisis.

In 2010 I picked it up, broke out some paint thinner and cleaned it. I then went and sold it for $29 / ounce.

I don't recommend my storage system or buying such large pieces. LOL

Back in 2001 or so I got the silver bug and bought a 200-ounce hand poured bar for around $5/ounce. The wife thought I was crazy because we didn't have a safe at the time.

I took it out to my shed and spray painted it flat black. I then used it as a door stop inside the house.

It sat on the floor collecting dust until prices began to run up after the 2008 banking crisis.

In 2010 I picked it up, broke out some paint thinner and cleaned it. I then went and sold it for $29 / ounce.

I don't recommend my storage system or buying such large pieces. LOL

This post was edited on 8/16/23 at 12:30 pm

Posted on 8/17/23 at 10:11 pm to SalE

I had mild success last year when I bought 400 ounces of silver at about $18/ounce and one ounce of gold at $1815. Sold it all of it this spring on a significant bounce. Netted just above $500.

Nothing to crow about but it was fun for a while. Didn’t have the patience that metals require.

If you do buy metals, silver in particular, try to stick with 1 oz rounds because they sell back for more. I bought several kilo bars and they did not fetch what the smaller rounds do.

Also, hold off on buying Silver Eagles right now, the premium is ridiculous.

Bullion Exchange has best prices right now. All of them ship slow right now.

Nothing to crow about but it was fun for a while. Didn’t have the patience that metals require.

If you do buy metals, silver in particular, try to stick with 1 oz rounds because they sell back for more. I bought several kilo bars and they did not fetch what the smaller rounds do.

Also, hold off on buying Silver Eagles right now, the premium is ridiculous.

Bullion Exchange has best prices right now. All of them ship slow right now.

Posted on 8/25/23 at 7:19 pm to MDB

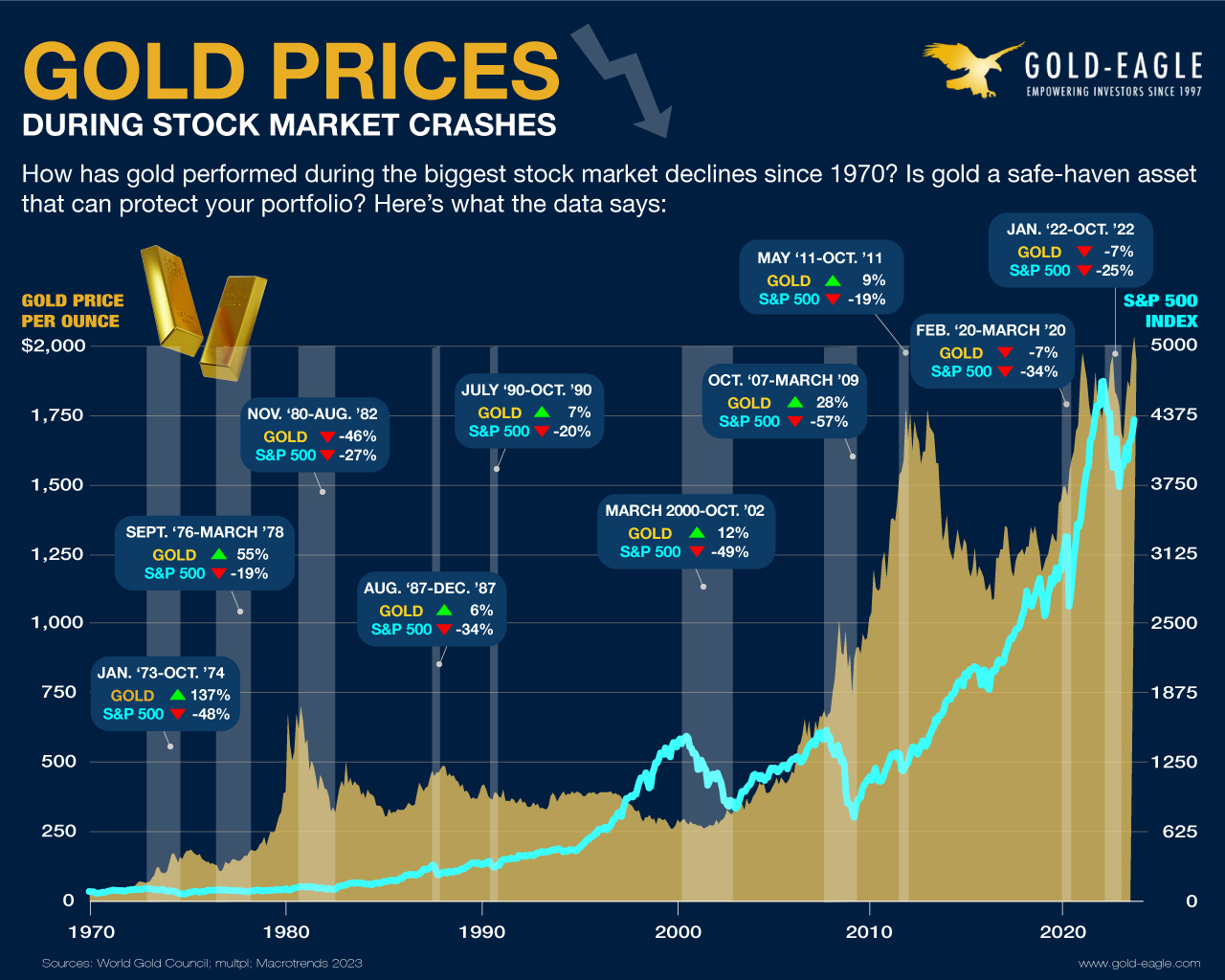

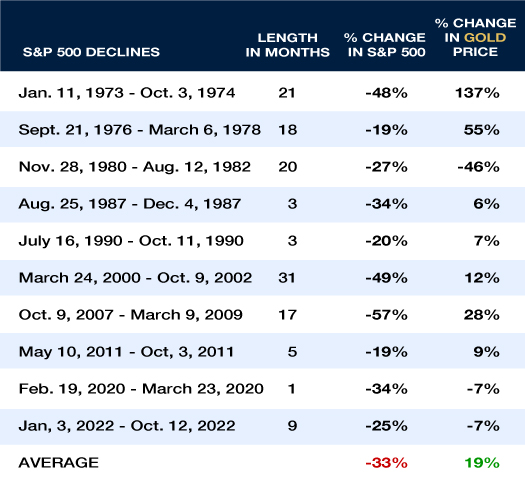

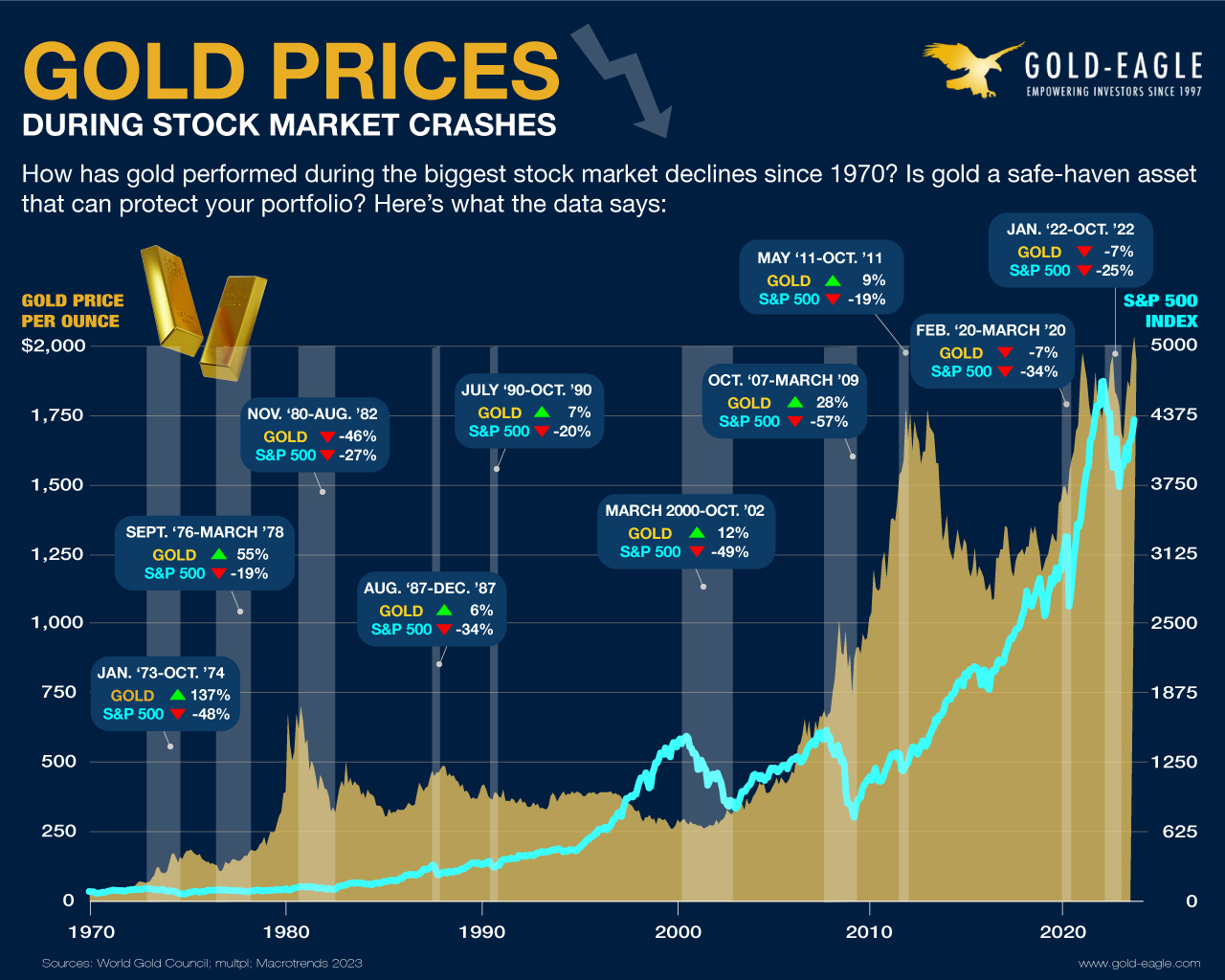

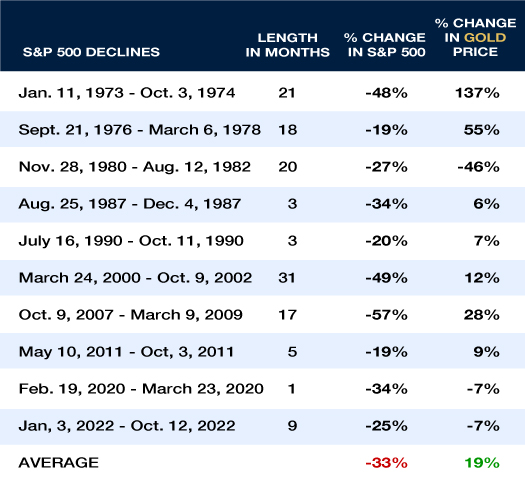

Regarding the performance of Gold during prior stock crashes ……

This post was edited on 8/25/23 at 7:21 pm

Posted on 8/26/23 at 12:04 am to cadillacattack

quote:

Regarding the performance of Gold during prior stock crashes ……

What about gold performance as an investment itself? How did it do between say Oct 2011 and now, how’d the S&P do?

Posted on 8/26/23 at 8:13 am to cadillacattack

That is the strangest dataset ever created.

Posted on 8/26/23 at 1:41 pm to Pendulum

quote:

That is the strangest dataset ever created.

It’s an infographic in response to the question whether Gold is a meaningful hedge during established market crashes. Just some interesting info, among many, many pieces.

IMO … gold will soon be headed down, taking silver with it …. so I’m out of my paper gold/silver positions …. jumping back in after the expected downdraft

This post was edited on 8/27/23 at 10:51 pm

Popular

Back to top

0

0