- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

How is this market sustainable (long term outlook)?

Posted on 11/7/19 at 1:59 pm

Posted on 11/7/19 at 1:59 pm

1. I am not a "doomsdayer."

2. I do not try to time the market

3. I am not sitting on cash

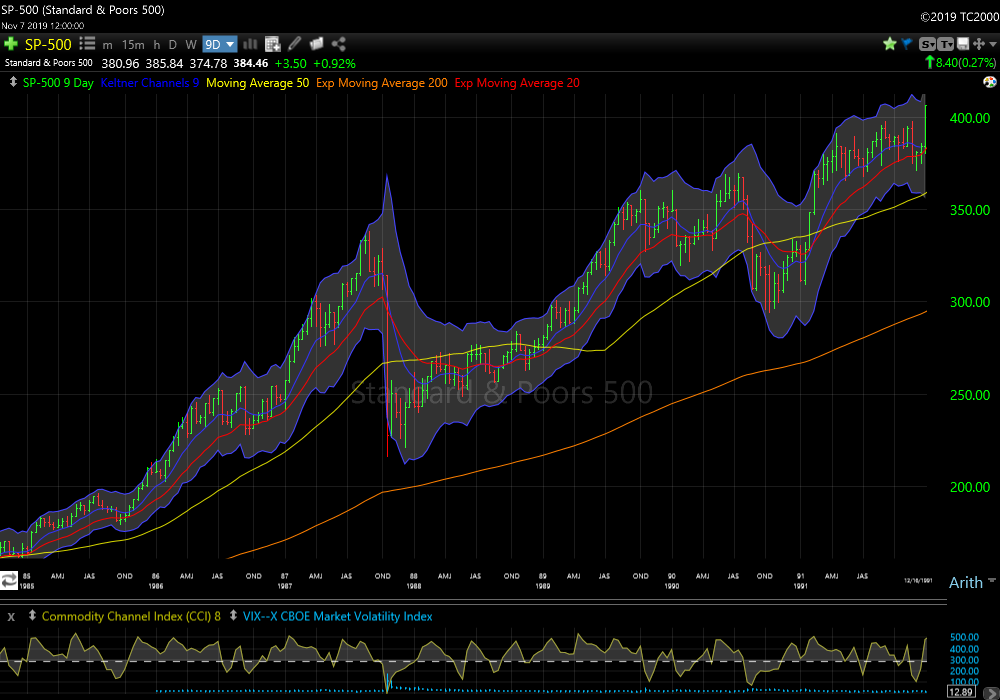

But hot damn! Just look at the chart! Both the dotcom and the housing bubbles peaked at S&P 1500. What are we doing hanging out above 3000? Are we not due something??

2. I do not try to time the market

3. I am not sitting on cash

But hot damn! Just look at the chart! Both the dotcom and the housing bubbles peaked at S&P 1500. What are we doing hanging out above 3000? Are we not due something??

Posted on 11/7/19 at 2:02 pm to bayoubengals88

P/E?

This post was edited on 11/7/19 at 2:03 pm

Posted on 11/7/19 at 2:13 pm to bayoubengals88

buybacks, fed propping.

Posted on 11/7/19 at 2:36 pm to bayoubengals88

There’s literally nowhere else to invest. Even tangible assets like art and collectibles are at high valuations.

When Europe gets their shite together and interest rates begin to rise again then we will prob see a good correction just from folks rebalancing.

When Europe gets their shite together and interest rates begin to rise again then we will prob see a good correction just from folks rebalancing.

Posted on 11/7/19 at 2:45 pm to Shepherd88

quote:

When Europe gets their shite together

When? I’m feeling like it’s more of an “if” at this point.

The U.S. is at ~1% non-performing loans, btw.

This post was edited on 11/7/19 at 2:48 pm

Posted on 11/7/19 at 2:53 pm to b-rab2

quote:

buybacks, fed propping.

buy during dips where everyone is scared the world will end... then sell and play options when you see "new highs" on the teli

Posted on 11/7/19 at 3:05 pm to bayoubengals88

Look at your own chart. You see any major dips from 1975 to 1999?

This chart means nothing as far as potential for a recession.

This chart means nothing as far as potential for a recession.

Posted on 11/7/19 at 3:42 pm to jimbeam

quote:

P/E?

Exactly the P/E is low historically speaking right now.

Posted on 11/7/19 at 3:49 pm to barry

not sure if serious...

..but posted chart anyways.

i'm certain anyone on this thread can see the dips or figure out where they should buy/sell. (if unsure google "chart reading")

i said nothing about "calling" recessions..

i tried to say..buy when on sale.. and then sell when overpriced.

in a true free market... we're gonns have booms and busts.

its ok.

recession:

quote:

In economics, a recession is a business cycle contraction which results in a general slowdown in economic activity.

quote:

In the United Kingdom, it is defined as a negative economic growth for two consecutive quarters.

This post was edited on 11/7/19 at 4:34 pm

Posted on 11/7/19 at 4:19 pm to bayoubengals88

It’s all relative.

Check historic PE ratio’s, divident yields, etc.

We’re not at historic levels.... yet

Check historic PE ratio’s, divident yields, etc.

We’re not at historic levels.... yet

Posted on 11/7/19 at 5:29 pm to SlidellCajun

Posted on 11/7/19 at 5:33 pm to Decisions

I don’t disagree. I feel like the socialist governments that are implemented in Europe are really being overlooked at how it’s hurt their economy as well.

Posted on 11/7/19 at 5:43 pm to bayoubengals88

That chart looks to me like a market that is beginning a new leg up.

Posted on 11/7/19 at 5:59 pm to Shepherd88

Britain and Greece were only the beginning, IMO.

The lack of currency control (i.e. debasing) is only going to hurt worse for Greece and the other debtors moving forward. They’re not going to continue to take austerity measures in perpetuity and will likely leave prior to being forced out.

On the flip side Germany/France/etc are only going to grow more tired and less able to foot the bill of the debtors as their native populations age into net takers, not earners (this is true across ALL of Europe and most of the first world. Age demographics will be awful very shortly)

The lack of currency control (i.e. debasing) is only going to hurt worse for Greece and the other debtors moving forward. They’re not going to continue to take austerity measures in perpetuity and will likely leave prior to being forced out.

On the flip side Germany/France/etc are only going to grow more tired and less able to foot the bill of the debtors as their native populations age into net takers, not earners (this is true across ALL of Europe and most of the first world. Age demographics will be awful very shortly)

This post was edited on 11/7/19 at 6:04 pm

Posted on 11/8/19 at 7:46 am to bayoubengals88

I don't know of a growth of any kind that is sustainable.

Posted on 11/8/19 at 7:52 am to bayoubengals88

As primarily a buy/hold long-term investor, times like this kinda suck. Maxed out my retirement account contributions for the year, I won't sell and realize the gains, and at the same time I can't get a good deal on anything for my other brokerage accounts

A big red day would actually be nice to scoop up some stuff on the cheap.

A big red day would actually be nice to scoop up some stuff on the cheap.

Posted on 11/9/19 at 4:55 pm to Boring

quote:

As primarily a buy/hold long-term investor, times like this kinda suck.

A friend of mine is much like you. I've been helping him to understand the benefits of selling puts at/under prices that he'd be content to pay for certain equities. If the short puts don't hit, he keeps the premiums... and does it again. If they do hit, that's where he'd have bought anyway... AND he keeps the premiums.

Other than not having an understanding of the options market, I can't understand why buy & hold type investors don't do more of this.

Posted on 11/9/19 at 6:52 pm to Boring

Sell put options.

Edit****

See Jag for rationale

Edit****

See Jag for rationale

This post was edited on 11/9/19 at 6:54 pm

Posted on 11/10/19 at 7:15 pm to bayoubengals88

Professional worriers will always find a way to worry. If it's not inverted yield curves then it's rebounding term premiums.

The "all time highs" is another angle that is not supported by data. Strategas Research Partners' analysis found that in the six months following record highs, declines of 10% or more happened in less than 5% of observations since 1950. Mebane Faber at Cambria Investment Management researched the topic back in the 1920s and found the concern to be unfounded acknowledging that 'all time highs' are nothing to be afraid of. Suck it, bears.

The "all time highs" is another angle that is not supported by data. Strategas Research Partners' analysis found that in the six months following record highs, declines of 10% or more happened in less than 5% of observations since 1950. Mebane Faber at Cambria Investment Management researched the topic back in the 1920s and found the concern to be unfounded acknowledging that 'all time highs' are nothing to be afraid of. Suck it, bears.

Posted on 11/12/19 at 10:05 am to jimbeam

P/E at 26 not historical average at 16.8

Popular

Back to top

9

9