- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 2/15/24 at 10:26 am to bet84

Posted on 2/15/24 at 10:26 am to bet84

This is a worthwhile article. Didn't realize how far west they've gone

"Through shell companies with names such as Cass County Brine and Lonestar Brine, Standard Lithium spent $20 million on Northeast Texas mineral leases between 2020 and 2023. A small army of landmen approached property owners with brine mining contracts. The company locked down more than 20,000 mineral acres in Cass County alone during that period."

“The founders liken what we’re doing in East Texas to what Standard Oil did in the 20th century," said Alyssa Howell, Standard Lithium’s vice president of corporate communications. “We haven't shared a lot about what we’re doing in Texas, and that’s by design. We don’t want to compete for land.”

"In 2022, Standard brought in lobbyists Lauren Spreen and Eric Mahroum, who was former President Donald Trump’s campaign deputy director in North Texas, to communicate its vision to those in power."

"Through shell companies with names such as Cass County Brine and Lonestar Brine, Standard Lithium spent $20 million on Northeast Texas mineral leases between 2020 and 2023. A small army of landmen approached property owners with brine mining contracts. The company locked down more than 20,000 mineral acres in Cass County alone during that period."

“The founders liken what we’re doing in East Texas to what Standard Oil did in the 20th century," said Alyssa Howell, Standard Lithium’s vice president of corporate communications. “We haven't shared a lot about what we’re doing in Texas, and that’s by design. We don’t want to compete for land.”

"In 2022, Standard brought in lobbyists Lauren Spreen and Eric Mahroum, who was former President Donald Trump’s campaign deputy director in North Texas, to communicate its vision to those in power."

Posted on 2/15/24 at 10:32 am to ev247

Link Free article from yesterday (author asked like 4 questions in the earnings call and owns shares, according to the disclaimer at the bottom of this article)

My main takeaway is that the 60:1 scale-up ratio is "routine for industrial projects. Some DLE technologies are facing scale-up factors of > 1,000:1."

He also mentions that the WSJ and Bloomberg News will be at the Arkansas Lithium Innovation Summit, which is today and tomorrow.

Will be on the lookout for coverage from them

My main takeaway is that the 60:1 scale-up ratio is "routine for industrial projects. Some DLE technologies are facing scale-up factors of > 1,000:1."

He also mentions that the WSJ and Bloomberg News will be at the Arkansas Lithium Innovation Summit, which is today and tomorrow.

Will be on the lookout for coverage from them

Posted on 2/15/24 at 2:54 pm to ev247

Thank you for the highlights from the article. Someone had blogged that SLI was negotiating leases in Franklin County as I mentioned in a post on 8/30/23.

I researched mineral leases online and believe I have the shell company name for the Franklin County leases, but SLI is trying to be "secretive" about the Texas leases according to a Facebook post. So maybe I shouldn't share the name. I'm sure Exxon and others already know, since it was easy for me to figure out.

I researched mineral leases online and believe I have the shell company name for the Franklin County leases, but SLI is trying to be "secretive" about the Texas leases according to a Facebook post. So maybe I shouldn't share the name. I'm sure Exxon and others already know, since it was easy for me to figure out.

Posted on 2/15/24 at 4:18 pm to bet84

Man I missed your post on Franklin County from August.

I'm curious how they kept the leases/options secret at all. I mean, did people have to sign NDA's with them?

Any idea how big their territory in Franklin County is? I remember tallying the Cass County options back when you shared those

I'm curious how they kept the leases/options secret at all. I mean, did people have to sign NDA's with them?

Any idea how big their territory in Franklin County is? I remember tallying the Cass County options back when you shared those

Posted on 2/15/24 at 5:01 pm to ev247

quote:

Lanxess and Arkansas Lithium appeared before the Oil & Gas Commission and met most of the requirements of the commission except for one. So the matter has been postponed or rescheduled for April 23 of this year.” Wonder what that one requirement is.

This is when you slip a Manila envelope of cash under the table of the commission. These fricks don’t how things operate down here

Posted on 2/15/24 at 5:19 pm to ev247

My search produced 75 leases, but some look like several family members signing leases for the same number of acres. Possibly undivided interests in the same acreage? So I don't know how to calculate total acres. I looked at a few of the leases and they are five year Brine leases with a 10 year option.

Posted on 2/15/24 at 5:59 pm to bet84

Could be siblings who inherited equal undivided interests?

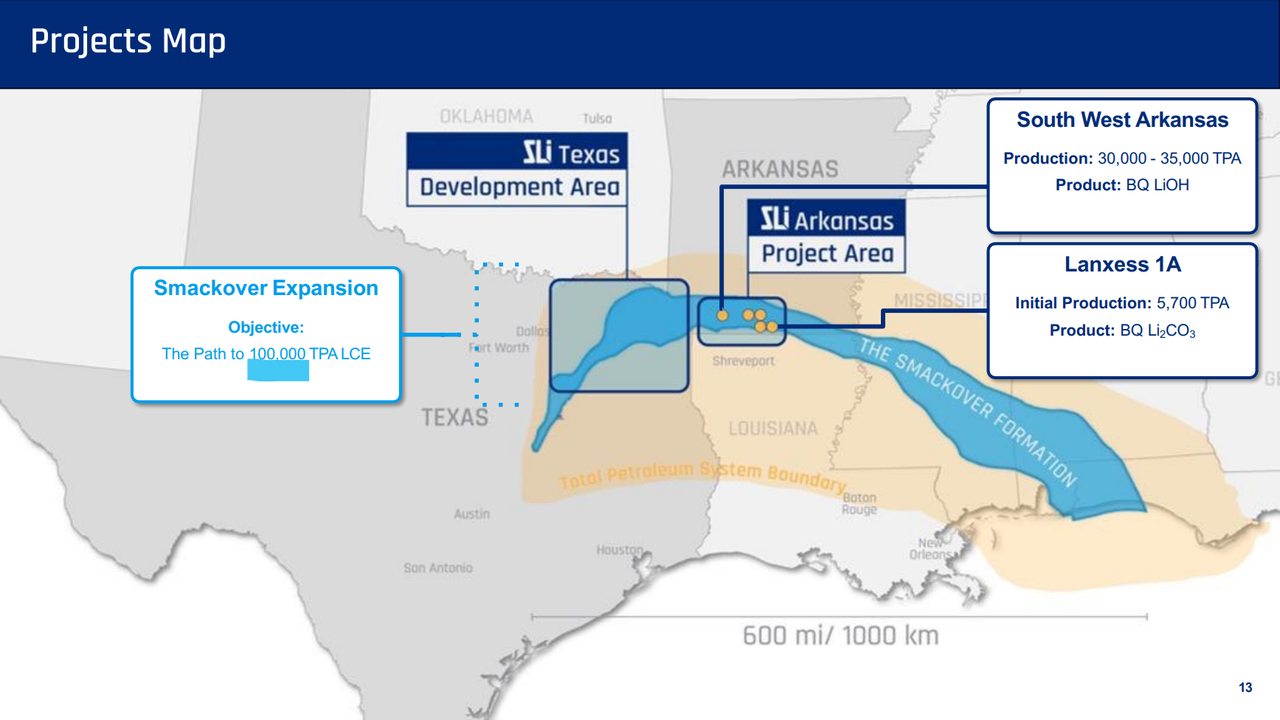

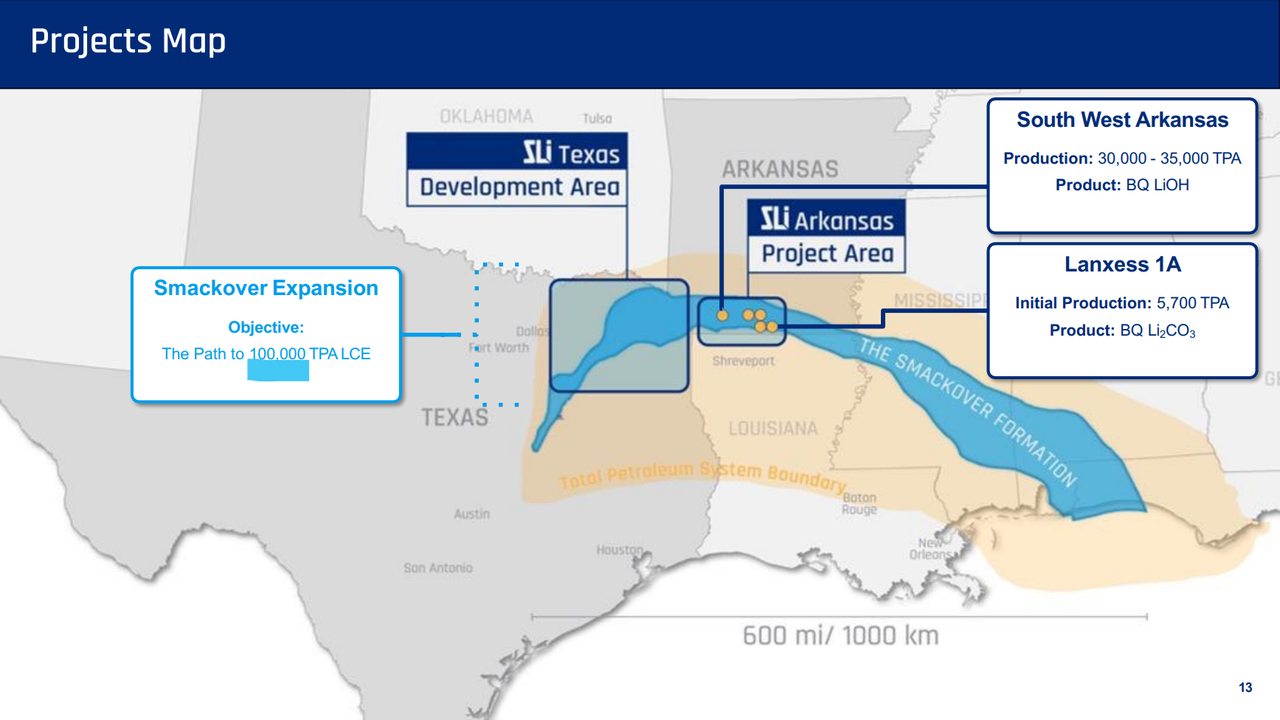

Looking at this picture from the Nov presentation I can't understand how Robinson is characterizing the scale of East TX as "many x" of SWA

Looks like roughly 3-4x scale to me

Looking at this picture from the Nov presentation I can't understand how Robinson is characterizing the scale of East TX as "many x" of SWA

Looks like roughly 3-4x scale to me

Posted on 2/15/24 at 6:13 pm to ev247

If they ever produce, before a new technology, maybe we buy lambo

Posted on 2/16/24 at 8:00 am to ev247

East TX also has higher concentrations though, so I'm sure that factors into the 'scale'.

Unrelated, ETrade just alerted me that SLI has been initiated as outperform.

I put that into google translate and it said it means "to the moon". Pretty sure.

Unrelated, ETrade just alerted me that SLI has been initiated as outperform.

I put that into google translate and it said it means "to the moon". Pretty sure.

Posted on 2/16/24 at 8:20 am to Fe_Mike

Ohh damn, do I buy some more and try to average down on 70+% in the hole position??? Nah, frick that shite.

Posted on 2/16/24 at 9:22 am to GREENHEAD22

its definitely outperformed my worst expectations

Posted on 2/16/24 at 12:22 pm to Lanitrofish

They have had five or six job openings over the last couple months for this project.

Posted on 2/16/24 at 5:15 pm to ev247

If they just start producing battery grade lithium continually at the demo plant, even if they can't sell it, it would blow away the skeptics and Mintak's haunting past. Then maybe they wouldn't have to dilute with a price of <$2.

Posted on 2/17/24 at 2:50 pm to Auburn1968

Austin Craig review of lithium companies under the current downturn in lithium prices.

Elon Musk Is Betting On Lithium And I Am Too With Lithium Argentina

Austin Craig

https://seekingalpha.com/article/4671002-elon-musk-is-betting-on-lithium-i-am-too-with-lithium-argentina?mailingid=34376300&messageid=2850&serial=34376300.472

Elon Musk Is Betting On Lithium And I Am Too With Lithium Argentina

Austin Craig

quote:

5. Standard Lithium (SLI) - Standard is one of my favorite lithium projects being that the project is in water rich Arkansas. Ample infrastructure from power, transportation, rail, and a very supportive community beckon me to increase my position therein. A lithium summit (Feb 15th-16th) should provide ample new information to ponder. Do note the increasing grades of lithium brine as the company projects move west.

https://seekingalpha.com/article/4671002-elon-musk-is-betting-on-lithium-i-am-too-with-lithium-argentina?mailingid=34376300&messageid=2850&serial=34376300.472

Posted on 2/17/24 at 5:04 pm to Auburn1968

Who was one through four?

Posted on 2/17/24 at 11:00 pm to GREENHEAD22

quote:

Who was one through four?

Don't matter. I have more shares than GS's. Insignificant buy. Some is better than none, but I've bought as much as GS did in a day before.

Posted on 2/20/24 at 9:23 am to GREENHEAD22

quote:

Who was one through four?

1. Lithium Argentina (LAAC) - With limited production having occurred and the bulk of ramping lithium production is near term, I view the company as exceptionally low risk from a business standpoint and LAAC sports a rich war chest. It doesn't hurt that, from a long term standpoint, they have plenty of projects and land on which to expand.

2. Nano One (NNOMF) - The company has several agreements with various unnamed car makers that may or may not ever germinate into massive revenue-producing agreements. Nano One also has a Canadian cathode plant which they are using to test and optimize patented lithium "One-Pot process" which improves lithium longevity. Combine that with a very friendly and financially supportive Canadian government and I think they are worth a roll of the dice. A healthy treasury does not hurt either.

3. Lithium Americas (LAC) - Having recently written on LAC, the short story is they have a monstrous war chest of capital and land in Nevada. Combine that with a deep pocket partner in General Motors (who are eying a second investment in the company) along with potential government loans to the tune of around $1 billion and I think we have a winner. Recent court victories only add icing on the white lithium cake. Below we can see some construction progress at Thacker Pass. Click to expand.

4. Century Lithium (OTCQX:CYDVF) - Century is a project that is getting very little love at the moment. While they possess a small war chest, they really need to accelerate the pacing. The DFS (definitive study of the project) has been delayed time and time again. The reason for the delays is logical as they have entered into a collaboration with none other than powerhouse KOCH. KOCH has brought optimizations into the direct lithium extraction (DLE) process which has resulted in some impressive results. Yet this and brining in other companies such as Saltworks has led to delay after delay in publishing the DFS. I understand that you only get one chance to get it right, but few speculators have patience and this has impacted the share price. One might argue that this creates opportunity though, and maybe it does to some extent, but at some point the company simply has to finish the DFS and enlist the help of financial institutions for funding to move the project forward (much like LAC did). On a bright note, the company did announce they are looking into selling a by-product of lye to increase the potential revenue and marketability of the project.

5. Standard Lithium (SLI) - Standard is one of my favorite lithium projects being that the project is in water rich Arkansas. Ample infrastructure from power, transportation, rail, and a very supportive community beckon me to increase my position therein. A lithium summit (Feb 15th-16th) should provide ample new information to ponder. Do note the increasing grades of lithium brine as the company projects move west.

Posted on 2/21/24 at 4:01 pm to JDPndahizzy

Just to keep the important information flowing....

SLI announced 3 upcoming conferences. Florida, Colorado and California. No word if Mintak and entourage will be domiciling at a super 8 to minimize investor impact.

SLI announced 3 upcoming conferences. Florida, Colorado and California. No word if Mintak and entourage will be domiciling at a super 8 to minimize investor impact.

Posted on 2/21/24 at 10:44 pm to Wraytex

im starting to think Mintak is just financing boondoggles

Popular

Back to top

2

2