- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 8/8/23 at 9:20 am to Auburn1968

Posted on 8/8/23 at 9:20 am to Auburn1968

Whats your analysis 1968?

This post was edited on 8/8/23 at 9:23 am

Posted on 8/8/23 at 9:20 am to Auburn1968

I imagine there were some heated discussions and hurt feelings re the technology chosen

Posted on 8/8/23 at 9:40 am to jamiegla1

From LinkedIn: LINK

quote:

Today we shared the promising results of our Preliminary Feasibility Study for our South West Arkansas project: $3.1B NPV, operating life of 20+ years, 30ktpa of battery-quality lithium hydroxide, and higher Li grades in the updated resource. Learn more: www.standardlithium.com

Posted on 8/8/23 at 10:04 am to jamiegla1

I forget that both techs were invented by the same guy. Either way, I guess we can put to bed the idea that SLI will be licensing its tech all over the Smackover. It would be funny if SLI ends up using Koch's DLE and licensing its own more expensive process to someone else though

Posted on 8/8/23 at 10:43 am to ev247

quote:

forget that both techs were invented by the same guy

I didnt realize that. Good catch.

quote:

It would be funny if SLI ends up using Koch's DLE and licensing its own more expensive process to someone else though

that would be awesome

Posted on 8/8/23 at 12:24 pm to jamiegla1

quote:

PFS Highlights:

Lithium brine project in southwestern Arkansas. PFS indicates base case production of 30,000 tonnes per annum (“tpa”) battery-quality lithium hydroxide monohydrate (“LHM”); upside case of 35,000 tpa

20-year plus operating life. Upgraded mineral resource averaging 437 mg/L underpins a minimum 20-year operating life

Robust project economics. Base case after-tax NPV $3.1 billion and IRR of 32.8% and upside case after-tax NPV $3.7 billion and IRR of 35.4%, assuming production of 30,000 tpa and 35,000 tpa, respectively, and both assuming discount rate of 8% and a long-term price of $30,000/t for battery-quality LHM

Competitive operating costs. Average annual operating costs of $4,073/t of LHM over the operating life

CAPEX of $1.3 billion. Total capex estimate of $1.3 billion includes conservative 20% contingency

Increased lithium grades support larger resource. Upper Smackover Indicated and Middle Smackover Inferred Resource of 1.4 Mt and 0.4 Mt lithium carbonate equivalent (“LCE”), respectively, with an average lithium concentration of 437 mg/L and maximum reported lithium grade of 597 mg/L

Posted on 8/8/23 at 1:51 pm to LChama

quote:

Whats your analysis 1968?

I don't know how broad or narrow their patents are. If they're broad and become the standard everyone wants to use, licensing is worth a fortune with little cost overhead. If it is narrow to affect only tail brine, it wouldn't be worth much.

Posted on 8/8/23 at 2:00 pm to Auburn1968

I guess we're assuming that they will be using the Koch tech at the Lanxess site also?

ETA: What about it Hawg? What was the lunch gossip?

ETA: What about it Hawg? What was the lunch gossip?

This post was edited on 8/8/23 at 2:17 pm

Posted on 8/8/23 at 3:01 pm to Grassy1

Yahoo didn't link to any puff pieces yet. I expect a few over the next week or so. I need to move the needle north of 5$ for my oct calls.

Posted on 8/8/23 at 9:13 pm to Wraytex

Just thinking out loud here.. with the Lanxess DFS study due imminently.

One would think if that news happened to be not so positive then they would have released it first and followed it up with the positive SWA news released today..

So.. let’s ride?!

One would think if that news happened to be not so positive then they would have released it first and followed it up with the positive SWA news released today..

So.. let’s ride?!

Posted on 8/8/23 at 10:47 pm to Shepherd88

I'm with your philosophy.

Also, I had some time this evening so,

warning, napkin math below.

Using updated Net Present Values, SLI shares outstanding, SLI's timeline projections, and a remarkably simplistic mind to draw a parallel between Albemarle's acquisition offer of Liontown from March and a possible SLI acquisition offer from 2026.

A proportional offer for SLI in 2026 would amount to $5.1B, or $29.5/share.

I use 2026 because when Liontown was offered, they were an estimated 1 year from production and 18 months removed from their DFS. Yesterday's report quotes Mintak saying that SWA first production is targeted for 2027.

Share price between now and 2026? I can't help you.

Also, I had some time this evening so,

warning, napkin math below.

Using updated Net Present Values, SLI shares outstanding, SLI's timeline projections, and a remarkably simplistic mind to draw a parallel between Albemarle's acquisition offer of Liontown from March and a possible SLI acquisition offer from 2026.

A proportional offer for SLI in 2026 would amount to $5.1B, or $29.5/share.

I use 2026 because when Liontown was offered, they were an estimated 1 year from production and 18 months removed from their DFS. Yesterday's report quotes Mintak saying that SWA first production is targeted for 2027.

Share price between now and 2026? I can't help you.

This post was edited on 8/8/23 at 10:51 pm

Posted on 8/9/23 at 3:27 pm to Fe_Mike

Mike, do you think the DFS will excite the market more than the PFS just did? What about the FID? I'm wanting to learn if the market is more sophisticated than "good PR" or "bad PR" and actually cares that the next project to be reported should translate to revenue soon(ish).

Hope your buddy is enjoying his birthday

Hope your buddy is enjoying his birthday

Posted on 8/9/23 at 4:49 pm to ev247

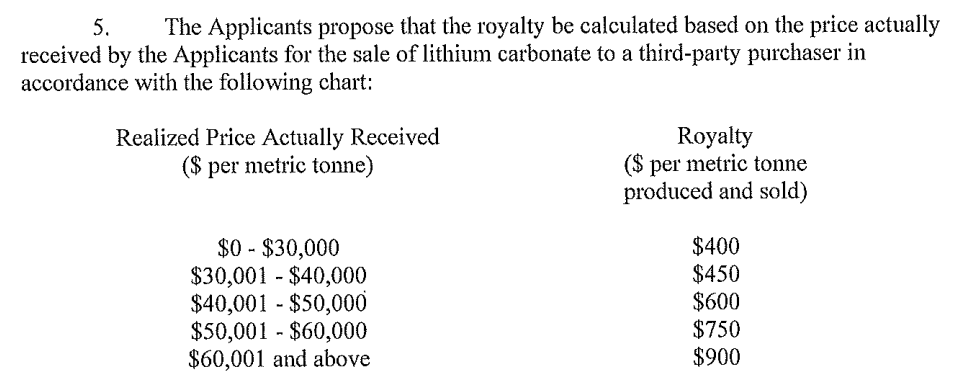

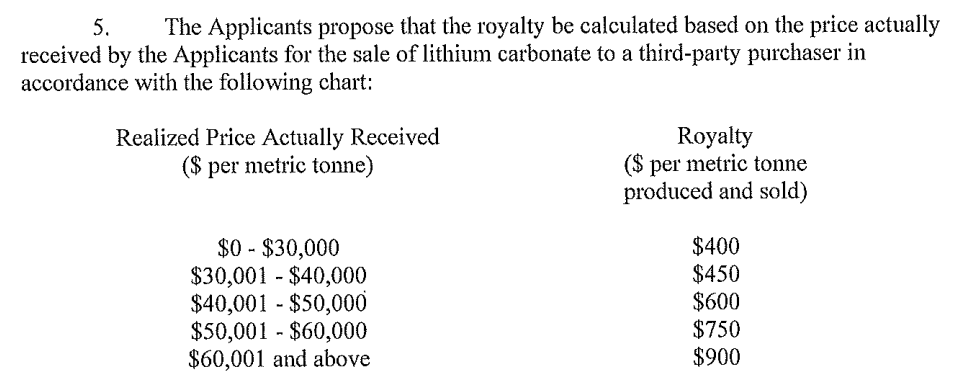

Re royalty determination, new SLI filing with the AOGC. (It's the third to last link under August 2023)

Highlights:

1. Requesting authority to continue pilot plant beyond current deadline of 9/26/23.

2. "If final products should be produced by the Pilot Plant and sold by the Applicants royalties shall be paid on such sales in accordance with the Orders of the AOGC." (Might we see a little revenue before Lanxess 1A? Hmm)

3. SLI has now proposed a royalty range based on the price they receive per ton.

If Lanxess 1A is only 6,000 tons, that translates to $2.4M in royalties for mineral owners. Hopefully this $2.4M decision isn't holding up the DFS.

(This request was filed 7/28/23)

Highlights:

1. Requesting authority to continue pilot plant beyond current deadline of 9/26/23.

2. "If final products should be produced by the Pilot Plant and sold by the Applicants royalties shall be paid on such sales in accordance with the Orders of the AOGC." (Might we see a little revenue before Lanxess 1A? Hmm)

3. SLI has now proposed a royalty range based on the price they receive per ton.

If Lanxess 1A is only 6,000 tons, that translates to $2.4M in royalties for mineral owners. Hopefully this $2.4M decision isn't holding up the DFS.

(This request was filed 7/28/23)

This post was edited on 8/10/23 at 12:31 am

Posted on 8/9/23 at 7:03 pm to ev247

Good find. I like the approach of aligning the royalty pymts to a tier structure based on actual pricing. I'm not sure how these rates compare to existing royalty arrangements, particularly in Arkansas, but will try to do some analysis at some point in the next week.

Posted on 8/9/23 at 7:06 pm to ApexHunterNetcode

Glad to see the Royalty info. One more road block removed.

Weren't there some literal road blocks in Canada at the start of this thread?

Weren't there some literal road blocks in Canada at the start of this thread?

Posted on 8/10/23 at 8:00 am to ev247

quote:

Mike, do you think the DFS will excite the market more than the PFS just did?

To an extent, yes. I don't think it will be a binary catalyst that makes it run 30% over a few days or anything. But I do think the market will respond much better than to the PFS (we didn't even hit average daily volume that day

What I think the DFS will do is start a decisive uptrend. I'm not sure whether SLI will mention it in the PR (I hope they do, but could see reasons they wouldn't) but the DFS is only actionable for 90 days once it is filed. An FID must be made within that time frame. So as soon as the DFS drops, you've got a concrete window of big FID news. As that drop dead date gets closer, you're only going to get more FOMO buying and price rising. It's hard to find a binary event with a guaranteed 'news no later than' date in the pre-revenue space. Investors like that.

Keep in mind, that also generally breeds a larger 'sell the news' event. So FID might be a little of a disappointment depending on how late into the 90 day window it goes. FID could very well surprise and drop 30 days after DFS; then it'd probably cause a spike as well. They've had plenty of time to look at the data and start plans/negotiations/term sheets if necessary.

This post was edited on 8/10/23 at 8:04 am

Posted on 8/10/23 at 8:15 am to Fe_Mike

Doing some additional background research, I came across a job opening posted by Tesla, while they are always hiring, the position opening (Chem E at a Tx Lithium refinery) had me go in a different direction and I found the attached article. I'm no frequent reader of Dallas Federal Reserve Bank, but the article is well written.

It's cold water for our little pet project here because, from this perspective, you can see how quickly bigger players are getting into position, while we flounder around missed deadlines.

Tesla Tx Lithium Refinery

FYI - Tesla is currently hiring staff for the facility in this article.

It's cold water for our little pet project here because, from this perspective, you can see how quickly bigger players are getting into position, while we flounder around missed deadlines.

Tesla Tx Lithium Refinery

FYI - Tesla is currently hiring staff for the facility in this article.

Posted on 8/10/23 at 9:24 am to Dock Holiday

We seem to have really established support in the $4.30s-4.40s. Been accumulating in this zone for over 2 months now.

Posted on 8/10/23 at 10:07 am to Neauxla_Tiger

I started a position in my HSA account when it was in the $6-7 range, so this $4.3-4.50 range has allowed me to bring my cost basis into the low $5s, where I feel more comfortable for the foreseeable future.

My Roth still has those sweet STLHF priced shares so I just leave that one alone.

My Roth still has those sweet STLHF priced shares so I just leave that one alone.

Posted on 8/10/23 at 11:09 am to Fe_Mike

Thanks for this breakdown. It'll be nice to sit there knowing that SLI has to meet a deadline. Is the FEED study usually part of the DFS?

I hope the royalty situation is worked out soon. I saw the hearing application was filed on 7/28 and the next hearing (8/22) was cancelled. The next hearing isn't until 9/26. Maybe there will be a "special" hearing of some sort to resolve this before then.

Actually, the pilot plant is only authorized through 9/26 as it stands so they'll definitely have to address at least that part of the application before the 9/26 hearing date. It'll be nice if they end up selling from the pilot plant while Lanxess 1A is under construction.

I hope the royalty situation is worked out soon. I saw the hearing application was filed on 7/28 and the next hearing (8/22) was cancelled. The next hearing isn't until 9/26. Maybe there will be a "special" hearing of some sort to resolve this before then.

Actually, the pilot plant is only authorized through 9/26 as it stands so they'll definitely have to address at least that part of the application before the 9/26 hearing date. It'll be nice if they end up selling from the pilot plant while Lanxess 1A is under construction.

Popular

Back to top

1

1