- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 8/4/23 at 9:05 am to ThermoDynamicTiger

Posted on 8/4/23 at 9:05 am to ThermoDynamicTiger

yeah we need some pictures of Mintak and the SLI boys at the bar, celebrating bc they know things that we dont

Posted on 8/4/23 at 10:23 am to jamiegla1

"Hey Mintakinator, did you see your email? We just got accepted at another conference! That sweet sweet per diem. Cheers boys!"

Posted on 8/4/23 at 12:05 pm to VOL IN

Mintak is probably throwing back Zimas if I had to guess.

Posted on 8/4/23 at 5:41 pm to ThermoDynamicTiger

quote:

Mintak is probably throwing back Zimas if I had to guess.

He's a wine afficionado.

Posted on 8/4/23 at 5:43 pm to ThermoDynamicTiger

Just got $3,369 on my full paid lending the lion's share of it SLI. Nice Friday afternoon surprise. Etrade usually doesn't pony up until the 7th or 8th.

Posted on 8/4/23 at 9:39 pm to Auburn1968

SLI is going to absolutely ruin me on FPL and my investment thesis when looking at speculative plays.

Like why go for a blue chip with dividends when I can buy a butt load of $4 pre revenue company and get 0.05% daily?

Oh, cause that prerevenue company could drop 50% in a day. That’s right. SLI spoiling me.

Like why go for a blue chip with dividends when I can buy a butt load of $4 pre revenue company and get 0.05% daily?

Oh, cause that prerevenue company could drop 50% in a day. That’s right. SLI spoiling me.

Posted on 8/5/23 at 6:47 am to Fe_Mike

Been considering something about Exxon entering the area.

If lithium becomes a commodity chemical, like gas, it could go into the open lithium market with all other producers, as long as it met the general specification. In that sense, there is room for smaller manufacturers. The only thing affecting them would be controlling their own costs. Maybe this is why Placid can operate a tiny refinery across the river from Exxon BR. Doesn't matter who makes it. It just goes into a tank farm and then to gas stations.

But because of the promise of extracting lithium using proprietary technology, it has the specialty chemical feel, at. least until the technology becomes standardized. Sort of like what membrane electrochemical cells were to chlorine when they first came out. Now membrane cells are the technology of choice. You just have to pick your technology supplier. Diaphragm and mercury cells are dinosaurs. Chlorine is a commodity.

So for the short term, a company with massive resources like Exxon just has to have the technology and be first to market. If they can get the off take partners solidified, does anyone else really have a chance, locally? All things being equal, why would a lithium buyer choose SLI over Exxon? Exxon will surely outproduce anyone else. They'll have the means to build infrastructure that others couldnt afford.

I find it almost impossible that Exxon hasn't been in touch with SLI about their technology. SLI has done the hard work and demonstrated it for years as far as we know. Their tech is suited for the brine that Exxon now has as a feedstock. Could Exxon do what SLI has done in a shorter time? Are they willing to gamble on other technologies or develop their own and waste time getting it to production? Why havent we heard any rumors of this? Does the DFS completely change if there was a possible buyout? Of course it does.

Im pretty puckered up about this since the deadline was missed. Dont know if I should get out now or hold off for something possibly great.

ETA Exxon doesnt have the same feedstock that SLI does. SLI has tail brine that has been treated in some way through Lanxess. Im sure thats a crucial step to the Lanxess brine and affects the exchange technology. But SLI will have to deal with raw brine at some point which should be close what Exxon would use

If lithium becomes a commodity chemical, like gas, it could go into the open lithium market with all other producers, as long as it met the general specification. In that sense, there is room for smaller manufacturers. The only thing affecting them would be controlling their own costs. Maybe this is why Placid can operate a tiny refinery across the river from Exxon BR. Doesn't matter who makes it. It just goes into a tank farm and then to gas stations.

But because of the promise of extracting lithium using proprietary technology, it has the specialty chemical feel, at. least until the technology becomes standardized. Sort of like what membrane electrochemical cells were to chlorine when they first came out. Now membrane cells are the technology of choice. You just have to pick your technology supplier. Diaphragm and mercury cells are dinosaurs. Chlorine is a commodity.

So for the short term, a company with massive resources like Exxon just has to have the technology and be first to market. If they can get the off take partners solidified, does anyone else really have a chance, locally? All things being equal, why would a lithium buyer choose SLI over Exxon? Exxon will surely outproduce anyone else. They'll have the means to build infrastructure that others couldnt afford.

I find it almost impossible that Exxon hasn't been in touch with SLI about their technology. SLI has done the hard work and demonstrated it for years as far as we know. Their tech is suited for the brine that Exxon now has as a feedstock. Could Exxon do what SLI has done in a shorter time? Are they willing to gamble on other technologies or develop their own and waste time getting it to production? Why havent we heard any rumors of this? Does the DFS completely change if there was a possible buyout? Of course it does.

Im pretty puckered up about this since the deadline was missed. Dont know if I should get out now or hold off for something possibly great.

ETA Exxon doesnt have the same feedstock that SLI does. SLI has tail brine that has been treated in some way through Lanxess. Im sure thats a crucial step to the Lanxess brine and affects the exchange technology. But SLI will have to deal with raw brine at some point which should be close what Exxon would use

This post was edited on 8/5/23 at 11:41 am

Posted on 8/5/23 at 10:28 am to Santiago_Dunbar

I won’t touch Albemarle because in my (amateur) analysis I don’t know what to do with its average free cash flow growth of -183% over the last 10 years. If I’m gonna disregard my little formula it has to be for something with better upside. I wouldn’t be prepared to argue my position in court though so I’m no advice giver..

Posted on 8/5/23 at 11:52 am to jamiegla1

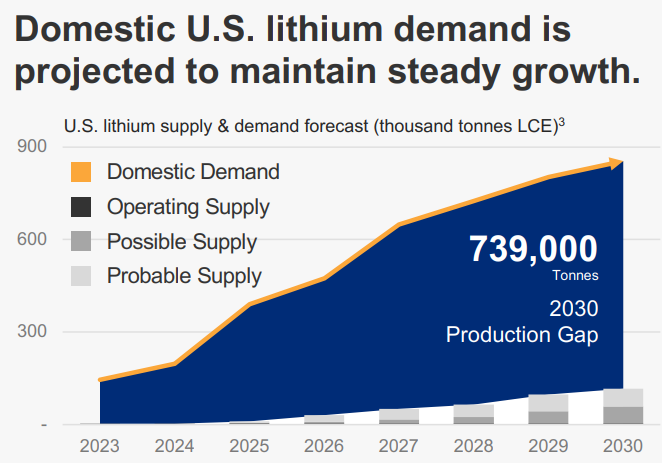

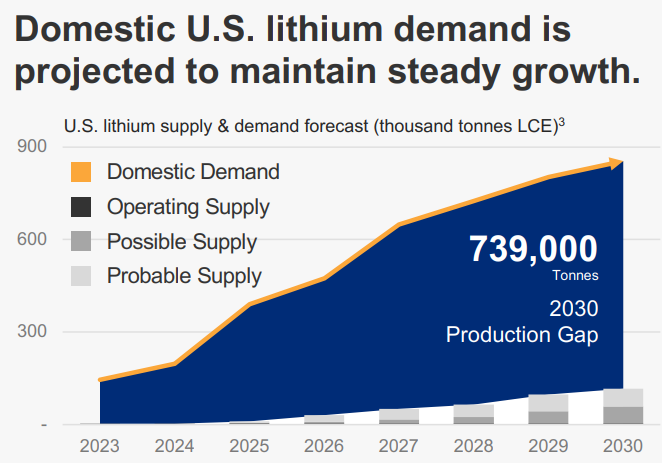

How long does it take for something to become a commodity? After one or two rounds of offtake agreements? If SLI's demand forecast is to be taken seriously...

I'm not sure SLI would be stuck without a buyer for the first two projects since Lanxess has the right to buy the LanxProject lithium at like a 20% discount and Koch Minerals probably has a sweet deal for SWA offtake. Who knows what will come of the East Texas expansion.

I feel uneasy about the study delays but am having a hard time articulating the bear/bull case for them. Anybody?

In the SWA Project right? It hadn't really crossed my mind that the two projects' brines will be different. Wonder how far along they are in testing the unchanged brine.

quote:

All things being equal, why would a lithium buyer choose SLI over Exxon?

I'm not sure SLI would be stuck without a buyer for the first two projects since Lanxess has the right to buy the LanxProject lithium at like a 20% discount and Koch Minerals probably has a sweet deal for SWA offtake. Who knows what will come of the East Texas expansion.

I feel uneasy about the study delays but am having a hard time articulating the bear/bull case for them. Anybody?

quote:

But SLI will have to deal with raw brine at some point which should be close what Exxon would use

In the SWA Project right? It hadn't really crossed my mind that the two projects' brines will be different. Wonder how far along they are in testing the unchanged brine.

Posted on 8/5/23 at 5:53 pm to jamiegla1

I'm glad SLI got its patents. I've worked on a number of patent cases mostly doing the upscale demonstratives and simulations. Worked with one lead lawyer who just didn't lose. He was a great communicator who got it right and people liked him right away.

Wish he hadn't moved to Palo Alto.

Wish he hadn't moved to Palo Alto.

Posted on 8/5/23 at 7:08 pm to ev247

The brines are similar however SLI is processing the DLE off the tail water from lanxess.

Lanxess is initially processing the brines for bromine I believe then reinjecting the tail water as a waste.

The tail waters are more concentrated and Albemarle should have a similar stream from their magnolia plant.

Lanxess is initially processing the brines for bromine I believe then reinjecting the tail water as a waste.

The tail waters are more concentrated and Albemarle should have a similar stream from their magnolia plant.

Posted on 8/5/23 at 7:46 pm to eng08

Seems like there would be the removal of additional metals by Lanxess. I’m not familiar with the process to remove bromine. Does Lanxess remove the calcium, mag, iron, potassium, etc? Does SLI get “clean” brine from Lanxess and then extract the lithium? Whatever Lanxess currently removes, SLI will eventually have to remove from raw brine

Posted on 8/5/23 at 9:42 pm to ev247

editing to add from my previous post:

The Lanxess and SW projects are both 30,000 TPY LCE each. Exxon aims to produce 100,000 TPY. So only the SW project brine would probably be comparable to the Exxon brine. The key would be to know that SLI's tech works on the SW brine.

I guess this also comes down to funding the project(s). SLI will have to convince investors to choose them over Exxon. I dont know that Exxon needs to convince anyone if they can come up with a technology that works.

The Lanxess and SW projects are both 30,000 TPY LCE each. Exxon aims to produce 100,000 TPY. So only the SW project brine would probably be comparable to the Exxon brine. The key would be to know that SLI's tech works on the SW brine.

I guess this also comes down to funding the project(s). SLI will have to convince investors to choose them over Exxon. I dont know that Exxon needs to convince anyone if they can come up with a technology that works.

Posted on 8/5/23 at 11:15 pm to jamiegla1

It will be depressing if Mintak snatches defeat from the jaws of victory.

Posted on 8/6/23 at 1:02 pm to Wraytex

quote:

It will be depressing if Mintak snatches defeat from the jaws of victory.

You really think Mintak is still running shite? He did go out and get funding from Koch. Nobody had heard of STLHF 3-4 years ago but now they're being mention in the WSJ, Fox business, Cramer etc. South Arkansas is suddenly the potential epicenter of lithium production in the future with the world's largest energy producer trying to get a piece of the pie by leasing up inferior brine for $100 million. Albermarle trying to get back in the game after shitting their pants in DLE and abandoning it. Tetra selling off rights to 27,000 acres so they could come back in later and lease 6,700 later at a much higher price than the peanuts they were paying previously?

SLI and Mintak saw the potential here before anyone else. They have been extracting lithium and gathering data for at least 3 years now, despite COVID shutdowns, border closings and Lanxess shitting the bed as a partner. Their stock price was $.37 March 2020. It was $.51/share when it was first mentioned on this board. Sorry some bought late and didn't take profits when I told them I was. I felt like it was dead money for a couple of years, but still re-invested over $250k the day of Blue Orca attack. In fact, that buy is what sent it back up. Then we had war in the Ukraine, market crash that has been harsh on pre-revenue small caps and Joe fricking Biden.

I think I'll keep riding with the OG's of SLI and wait for the others to pay them a premium for their tech. I think Exxon, Tetra, Albermarle is bluffing and trying to license SLI's tech at a bargain by threatening to develop their own DLE. That's what I'd do.

Don't forget Mintak secretly drilling wells further west that have 3 times the lithium concentration of the best sites here locally. He hasn't been sitting around with his thumb up his arse. One of the founders just bought close to a half million in shares. I think that all bodes well.

Posted on 8/6/23 at 1:57 pm to SmackoverHawg

Thanks. I needed a little bit of hopium

Posted on 8/6/23 at 2:01 pm to SmackoverHawg

For all our sake, I hope you are legit and not some deep undercover pumper.

This post was edited on 8/6/23 at 4:22 pm

Posted on 8/6/23 at 2:54 pm to GREENHEAD22

Smack’s local, and our best source of coffee shop scuttlebutt. Thanks for the rehash. Apologies for bagging on Mintak. I blame the ghost of gaucho.

Popular

Back to top

1

1