- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Discussion of Fed Liquidity’s Impact on Equity Markets

Posted on 9/2/20 at 11:41 am to wutangfinancial

Posted on 9/2/20 at 11:41 am to wutangfinancial

I'll definitely check out that podcast. There is one more Mike Green podcast on Real Vision as well that came out last week (haven't listened to it yet).

Same here. I've got a massive cash pile burning a hole in my pocket and the question I keep coming back to is where to deploy it if we have a deflationary period. Buy treasuries? Go long the dollar? Keep it in cash? I'm ignoring the stock market until I can get more clarity around alternative uses for capital.

Same here. I've got a massive cash pile burning a hole in my pocket and the question I keep coming back to is where to deploy it if we have a deflationary period. Buy treasuries? Go long the dollar? Keep it in cash? I'm ignoring the stock market until I can get more clarity around alternative uses for capital.

quote:

I'm starting to turn into a deflation pumper at this point. My entire opinion on M2, velocity and QE has changed since this thread started.

Posted on 9/2/20 at 12:11 pm to RedStickBR

I'll be putting money in TIPS and Treasuries. I'll probably find an ETP that I can use as a proxy so I can use leverage. Cash, vol, precious metals (for the time being) and technology equities are the only other exposure I'll have and currently do own.

I don't know why it took me so long to figure out what the Fed is actually doing with the PDs. They aren't increasing liquidity, they are reducing it because the banks aren't lending against their new reserves, and in fact are doing the opposite. Some guy I was listening to explained it like if your kid has a bank account in his name that you opened up for him. It's your money not the kids, so the PDs aren't getting flushed with cash in the transaction but instead the ability to lend.

Lacy's point on rising debt levels and decreasing marginal revenue product is so important in the deflation argument. One I've observed and I'm sure you have as our illustrious Congress spends our money to no end. One thing I disagree with him is that technological innovation probably won't be enough to offset the loss in productivity because the federal government appears to be choking that out with regulation and taxes just like Europe did. We don't have the culture in the U.S. anymore to encourage that kind of entrepeneurship and risk taking in the long run. We will continue to shift to a command and control economic model and not reverse that course this decade.

I don't know why it took me so long to figure out what the Fed is actually doing with the PDs. They aren't increasing liquidity, they are reducing it because the banks aren't lending against their new reserves, and in fact are doing the opposite. Some guy I was listening to explained it like if your kid has a bank account in his name that you opened up for him. It's your money not the kids, so the PDs aren't getting flushed with cash in the transaction but instead the ability to lend.

Lacy's point on rising debt levels and decreasing marginal revenue product is so important in the deflation argument. One I've observed and I'm sure you have as our illustrious Congress spends our money to no end. One thing I disagree with him is that technological innovation probably won't be enough to offset the loss in productivity because the federal government appears to be choking that out with regulation and taxes just like Europe did. We don't have the culture in the U.S. anymore to encourage that kind of entrepeneurship and risk taking in the long run. We will continue to shift to a command and control economic model and not reverse that course this decade.

Posted on 9/2/20 at 12:40 pm to wutangfinancial

I like your comments, Wutang.

Posted on 9/2/20 at 12:43 pm to wutangfinancial

Solid post. Everything you said. If you don't mind, I'd be interested in which vehicles you choose for TIPS and Treasuries.

I'm still working through what Lacy is getting at when he says things like, "When the Fed buys government securities, all that really happens is you switch to the government having a one-day liability which the banks are holding." In the below article, the MMTer, Stephanie Kelton, is said to agree and being cited as saying, "Printing money simply means that overnight central bank liabilities earning the central bank’s target rate replace, say, three-month government liabilities earning roughly the central bank’s target rate. And if the Fed doesn’t pay interest on these reserve balances, then that simply means it wants its target rate at zero."

I can't wrap my head around WTF that actually means

Longtime Bond Bull Lacy Hunt Sees One Huge Risk

Regarding your post about going long Treasuries, this is a must read:

On My Radar: Shilling & Rosenberg on Deflation

Gary Shilling on bonds:

David Rosenberg on bonds:

The potential play: Long cash, Long Treasuries as long as inflation fails to rear its head.

I'm still working through what Lacy is getting at when he says things like, "When the Fed buys government securities, all that really happens is you switch to the government having a one-day liability which the banks are holding." In the below article, the MMTer, Stephanie Kelton, is said to agree and being cited as saying, "Printing money simply means that overnight central bank liabilities earning the central bank’s target rate replace, say, three-month government liabilities earning roughly the central bank’s target rate. And if the Fed doesn’t pay interest on these reserve balances, then that simply means it wants its target rate at zero."

I can't wrap my head around WTF that actually means

Longtime Bond Bull Lacy Hunt Sees One Huge Risk

Regarding your post about going long Treasuries, this is a must read:

On My Radar: Shilling & Rosenberg on Deflation

Gary Shilling on bonds:

quote:

“People ask [Gary Shilling] if [he] would buy Treasurys today with long-term yields at ~1.40%.” His answer:

He doesn’t care what the yield is as long as it is going down. He buys Treasurys for the same reason people buy equities: for appreciation. He doesn’t think the rally is over. And because of convexity, with rates so low, the appreciable gain is even higher. Inflation vs. deflation is about supply and demand. Gary thinks we are heading for deflation. When you have excess supply around the world, you get deflation. Unless we cut off imports, we are going to continue to see excess supply, so he expects we may see another 100 bps decline in Treasurys. He thinks we are going to see further decline in yields. With deflation, you want to be long Treasury bonds.

David Rosenberg on bonds:

quote:

Gary and David are going to come to the same conclusion.

Here are some data points:

The guys on bubble vision at the end of last year would say, “What idiot would buy a 30-year bond on December 31, 2019 at a yield of 2.40%?”

David’s answer is that the idiot that wanted a 30% return due to the decline of rates from 2.40% to 1.25%. That’s the idiot that would buy.

The U.S. Treasury Bond yield at 1.25% is an absolute bargain.

The German long bond yields negative 0.08%.

The Netherlands long bond is negative 0.07%.

Switzerland, negative 0.39%.

He doesn’t believe Canada is a better credit than the U.S. The long Canadian bond yields 0.98%. France: 0.5%, UK: 0.62%.

Spain and Portugal are about 1% and those are triple B-rated bonds. The U.S. last he saw is still AAA.

quote:

So, what happens to the long-bond yield if the stock market goes down? Normally, they are inversely correlated. There will likely be a race to safety (more demand for bonds, lower yields).

The stock market is so concentrated that if these mega caps correct, the rest of the market will not be able to rally enough to offset it. Where does that take equities if the mega caps roll over?

Where do you think the flight to safety then takes Treasury yields? A lot lower.

quote:

If you are in the deflation camp, you’ve got to be long Treasurys.

The question is, Is monetary stimulus going to be so big that it will create inflation? The Great Financial Crisis affected just a few people. Mortgage and housing and took out a few big banks. This event is much greater than that. This will overwhelm everyone, everywhere. The monetary stimulus is small in terms of overall economic impact.

quote:

David mentioned the need for recurring stimulus. No doubt we are going to be seeing much more stimulus.

There is another $3.5 trillion fiscal plan proposed in the House and a $1 trillion plan proposed in the Senate, and there is no way to stop the Fed—they are full speed ahead.

We have an output gap of 7% between aggregate supply and aggregate demand.

This is very consistent with a depression.

How do you close that gap if you are an academic working at the Fed?

The Fed has to synthetically create a negative interest rate of -14%. David doesn’t believe the Fed can go to negative interest rates, so they will do this by printing money.

To do this, the Fed balance sheet has to go up to at least $11 trillion. So, call it another $4 trillion. Maybe we’ll just create asset bubbles the whole way through. That’s the side effect of what the Fed is trying to do for the greater good, which is to put a floor under deflation.

If they don’t eliminate the output gap, the deflation is not going to go away.

We have to figure out what that time frame might be.

To get to -14%, the Fed has to take the balance sheet to $14 trillion. Maybe we create asset bubbles even more…

quote:

There is risk of inflation on the other side of this, so we can’t be overly complacent.

The potential play: Long cash, Long Treasuries as long as inflation fails to rear its head.

Posted on 9/2/20 at 8:01 pm to RedStickBR

Have you ever listened to Stephanie Kelton? She's making the mistake all academics do and that's believing a theory works in reality.

Posted on 9/2/20 at 8:14 pm to wutangfinancial

I’ve never really given her a chance, TBH, because I feel very strongly I’ll disagree with the majority of what she says.

ETA: I cited her as agreeing with Lacy as an adverse witness of sorts. As if to say, “even SHE agrees with him, so he must be on to something.” It just hasn’t clicked for me yet what he’s really getting at, and I’ve seen him say it now in a few different places.

ETA: I cited her as agreeing with Lacy as an adverse witness of sorts. As if to say, “even SHE agrees with him, so he must be on to something.” It just hasn’t clicked for me yet what he’s really getting at, and I’ve seen him say it now in a few different places.

This post was edited on 9/2/20 at 8:17 pm

Posted on 9/3/20 at 10:25 am to RedStickBR

They think that the U.S. economy is a vacuum and that the deficit spending gap is the total benefit to tax payers

Lacy Hunt completely dodged a question about what the world would look like with Kelton as furer. She's just another hack academic that is trying to push Keynesian economic theory to it's logical conclusion. Like all radicals they just re-labeled it and everybody pretends it's a shiny new toy but it will yield the same results.

Lacy Hunt completely dodged a question about what the world would look like with Kelton as furer. She's just another hack academic that is trying to push Keynesian economic theory to it's logical conclusion. Like all radicals they just re-labeled it and everybody pretends it's a shiny new toy but it will yield the same results.

Posted on 9/3/20 at 10:58 am to wutangfinancial

That’s what I figured based on the title of her book alone  I may actually read it just so I can say I’ve given her crazy theory an honest chance.

I may actually read it just so I can say I’ve given her crazy theory an honest chance.

In a sense, I guess the deficit spending is a short-term benefit, unless and until it blows up the economy or future generations have to pick up the tab (either via taxes or inflation).

In a sense, I guess the deficit spending is a short-term benefit, unless and until it blows up the economy or future generations have to pick up the tab (either via taxes or inflation).

Posted on 9/4/20 at 12:59 pm to wutangfinancial

More on the inflation vs. deflation debate, as well as some interesting history within the first half of the article:

Murphy's Law Is Fed's Law, and Everything Is Wrong

One reason we know record low UE rates reported prior to the pandemic were artificial is because we never saw the one thing you'd expect in a "full" or even "beyond full" employment scenario: inflation. As the article says:

And the recent change in stance by the Fed embodied within their Grand Strategy Review is essentially an admission of that:

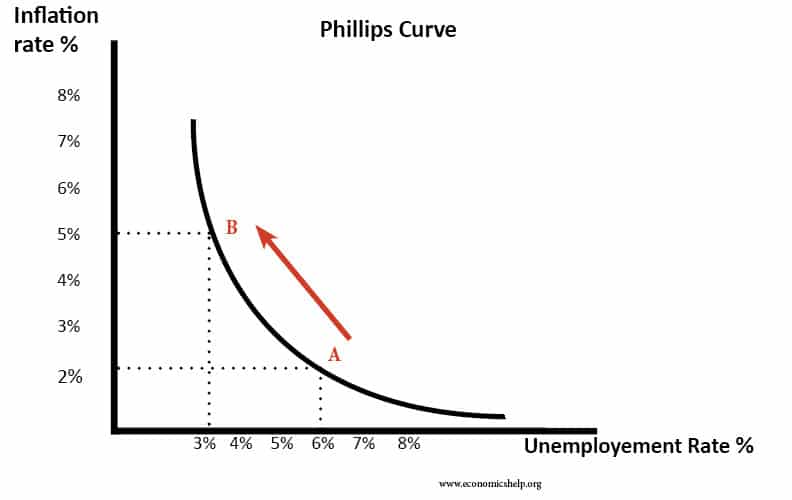

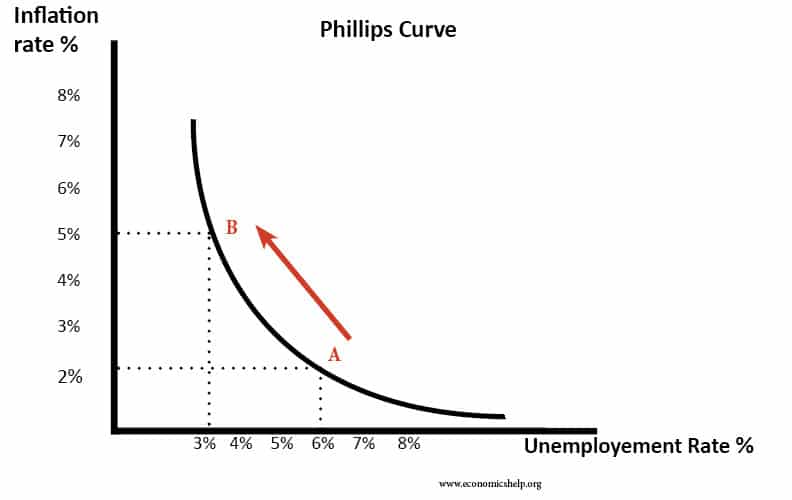

Why didn't it happen? Because employment wasn't really "full." Why wasn't employment really full? Because of the long-known "participation problem," which has been a hallmark of the economy since the Great Recession. In other words, the Phillips Curve didn't all of a sudden fail to hold true; rather, the unemployment rate was drastically understated, which explains why the inflation never showed up:

But the Fed didn't buy that initially, because that would require them to admit their QE programs had failed to achieve BOTH prongs of their mandate. Namely, employment was never full and inflation was never able to achieve their 2% target. So, what did the Fed do? Well, they rewrote the rules of the game rather than admit failure. Essentially, so their warped way of thinking goes, the Phillips Curve is no longer a curve at all; it's essentially a flat line. That means that though employment, in the Fed's view, was "full," inflation nonetheless stayed low. This also provided their justification for keeping rates low even though employment was "full." Namely, if there's no inflation at full employment, then you should also be able to justify lower interest rates at full employment (Fisher equation). But to buy this would be to abandon any relevance of supply and demand in the labor market - why didn't real wages increase if employment was so full?

To sum the Fed-think in a sentence:

Now, on to what QE has essentially done: it's increased the supply of money in the economy. But what is an oversupply of something supposed to do? It's supposed to decrease the per-unit value of said commodity being oversupplied. In other words: inflation. So how is it that the money supply in the economy has ballooned but we've never had any significant inflation? My understanding of how this author puts it is that "devaluation" assumes what is being devalued has any real "value" to begin with:

ETA: This is also worth a read, aimed more at those who already understand the underlying econ:

Exposed Inflation Bubble

Murphy's Law Is Fed's Law, and Everything Is Wrong

One reason we know record low UE rates reported prior to the pandemic were artificial is because we never saw the one thing you'd expect in a "full" or even "beyond full" employment scenario: inflation. As the article says:

quote:

If the unemployment rate had been correct, well below all prior estimates of full employment, wage rates would’ve accelerated sharply setting off sustained, broad consumer price increases as company after company desperately competing for the allegedly scarce marginal worker passed along the increased costs to their customer bases.

And the recent change in stance by the Fed embodied within their Grand Strategy Review is essentially an admission of that:

quote:

Implicit in the Fed’s Grand Strategy Review, therefore, is a full-blown admission that this never happened. Fed officials like Powell who charged into office as a hawk kept saying that it was going to happen, that it was beginning to happen, now years later to quietly, meekly accept the reality that it never once did.

Why didn't it happen? Because employment wasn't really "full." Why wasn't employment really full? Because of the long-known "participation problem," which has been a hallmark of the economy since the Great Recession. In other words, the Phillips Curve didn't all of a sudden fail to hold true; rather, the unemployment rate was drastically understated, which explains why the inflation never showed up:

But the Fed didn't buy that initially, because that would require them to admit their QE programs had failed to achieve BOTH prongs of their mandate. Namely, employment was never full and inflation was never able to achieve their 2% target. So, what did the Fed do? Well, they rewrote the rules of the game rather than admit failure. Essentially, so their warped way of thinking goes, the Phillips Curve is no longer a curve at all; it's essentially a flat line. That means that though employment, in the Fed's view, was "full," inflation nonetheless stayed low. This also provided their justification for keeping rates low even though employment was "full." Namely, if there's no inflation at full employment, then you should also be able to justify lower interest rates at full employment (Fisher equation). But to buy this would be to abandon any relevance of supply and demand in the labor market - why didn't real wages increase if employment was so full?

quote:

At nearly a level horizontal line, this would say no matter how large the increase in expectations for growth the result in inflation would be exceedingly small.

Like R*, though, this requires a fundamental rewriting and reordering of basic economic processes to get there. What would those have to be in order to flatten Dr. Phillips’ great legacy to such a huge degree that the 50-year low in unemployment couldn’t muster the slightest sustained elevation in consumer price advances?

Well, you see, they don’t really know. Several crude theories abound, of course, but what’s going on here is about as unscientific as it gets. The theory of monetary policy, that it led to robust economic circumstances, fitted to the data and evidence piled up against it.

To sum the Fed-think in a sentence:

quote:

Humans are as hardwired to cover for their failures, to any dubious lengths, as they are to honestly move forward toward the light of truth.

Now, on to what QE has essentially done: it's increased the supply of money in the economy. But what is an oversupply of something supposed to do? It's supposed to decrease the per-unit value of said commodity being oversupplied. In other words: inflation. So how is it that the money supply in the economy has ballooned but we've never had any significant inflation? My understanding of how this author puts it is that "devaluation" assumes what is being devalued has any real "value" to begin with:

quote:

The original failure, the Fed’s modern original sin it must forever cover up, is money itself. When central bankers and Economists realized they could no longer define it, and this was more than a half century ago, they came up with what they believed was progress.

quote:

August 2007 and thereafter was simply those consequences finally arriving. Contradicting also Keynes, in the long run someone really would have to pay for a system in which central banks are not central and don’t do money. As it turns out, the costs have been born by the whole global economy as it has been deprived for thirteen years of enough necessary monetary oxygen to make things work.

quote:

Nowadays, detached entirely from any accountability whatsoever, we are supposed to call Ben Bernanke, Janet Yellen, and Jay Powell heroes. For what? From the very start, these are all acts of intellectual cowardice, a bankrupt foundation so perverse it is an embarrassment to science itself; becoming ever more so with each additional stab at everything but the truth. Anything other than that.

They’ve perverted Murphy’s Law into a third version, a specific version. Fed’s Law is now this: monetary policy will never go wrong, so everything else will.

ETA: This is also worth a read, aimed more at those who already understand the underlying econ:

Exposed Inflation Bubble

quote:

Wait, wait, wait. Hold up. The Federal Reserve just concluded its near two-year long Grand Strategy Review. The purpose, in its most basic component, was to figure out why inflation hadn’t shown up in the manner everyone at the Federal Reserve spent years promising even though the unemployment tumbled to 50-year lows.

The labor market was so tight, inflation was guaranteed. Then it didn’t happen.

Behind the resulting monetary policy change (spoiler: not a change) to an average inflation target revealed last week first lies a flattened Phillips Curve.

This post was edited on 9/4/20 at 1:03 pm

Posted on 9/4/20 at 1:45 pm to RedStickBR

I'll check out your articles this afternoon and comment. Looks like they'll just make me mad

Posted on 9/5/20 at 11:20 am to wutangfinancial

quote:

George Gammon podcast with Steven Van Metre

Listened to this this morning. You have found the honey hole.

Not only does it answer many of the questions identified at the start of this thread, it also explains what was meant by the Lacy Hunt quote around QE simply transforming bank maturities and, as you mentioned in an earlier comment, it explains how QE actually removes liquidity from the system when the Fed buys pre-existing Treasuries from PDs.

Posted on 9/5/20 at 12:38 pm to RedStickBR

Pretty crazy I've gone full circle in less than a few years. At this point I'm trying to figure out if Congress pretends to be dumb about the monetary system and the dollar as the world reserve currency and the privilege it provides us as a country. If they do anything to weaken our position as the global hegemony then the end game begins. They can do it through weakening our military power and our reserve status. Funny how they've figured out a way to do both at the same time

Posted on 9/5/20 at 5:50 pm to wutangfinancial

quote:

They can do it through weakening our military power

Just going to leave this book recommendation here. Don’t read it if you’re looking for a pick me up

LINK

Also, it was good to hear Van Metre’s macro investing view is exactly in line with what I’d been thinking - long dollar and long government bond. Although both of those are probably minority views, so it’s still a bit scary to put my money where my mouth is.

Posted on 9/8/20 at 8:09 am to wutangfinancial

Putting a chunk in USDU today. Still thinking through how I want to play Treasuries.

This post was edited on 9/9/20 at 3:38 pm

Posted on 9/11/20 at 10:40 pm to wutangfinancial

New Mike Green stuff:

1. Mike Green on Real Vision (Geopolitics Discussion) Aug 22

2. Mike Green on George Gammon’s Show Sep 9

3. Mike Green on Macro Voices Sep 10

1. Mike Green on Real Vision (Geopolitics Discussion) Aug 22

2. Mike Green on George Gammon’s Show Sep 9

3. Mike Green on Macro Voices Sep 10

This post was edited on 9/21/20 at 1:18 pm

Posted on 9/21/20 at 1:27 pm to RedStickBR

quote:

New Mike Green stuff:

1. Mike Green on Real Vision (Geopolitics Discussion) Aug 22

2. Mike Green on George Gammon’s Show Sep 9

3. Mike Green on Macro Voices Sep 10

Listened to all 3 of these over the weekend.

1. was interesting, if for no other reason than that you get to hear Mike change gears and talk geopolitics and even a little politics. It's always good to hear other views from people, as it helps add perspective around the views that attracted you in the first place.

2. was also very good. A good compliment to his prior discussion on the End Game podcast. He discusses some of the same things but explains them in slightly different ways, which helped aid me in further understanding his positions. He also expands on why passive is more likely to result in higher prices than active (active comprised of activity at both the bid and the ask; passive comprised of activity almost exclusively at the ask; therefore, prices are bid up when passive = active but especially when passive > active) and then why we are seeing such an influx into passive vs. active (young vs. old paradigm, target date funds, corporations restricting 401k investments in active funds, etc., etc.). Last 20 minutes here had an incredible payoff for me.

3. was excellent, mostly because the host intentionally steered the discussion away from passive (given all Mike's coverage of that topic elsewhere) and more towards Fed / Macro.

This post was edited on 9/21/20 at 1:28 pm

Posted on 9/21/20 at 2:48 pm to RedStickBR

I really like the Macro Voices episode. I've listened to every interview he's been in since like 2018 and they were able to steer him from his usual angle.

If you want to hear him talk about a different topic. His interview with Ben Eifert who is one of the better vol traders in the world.

If you want to hear him talk about a different topic. His interview with Ben Eifert who is one of the better vol traders in the world.

Posted on 9/21/20 at 3:05 pm to RedStickBR

So I’m not well versed and young but I have profited nicely this year to the tune of approximately 40%.

I have started dabbling trying understand everything you all are discussing and I’ve even listened to the druckenmiller podcast and the first episode and a half of end game.

I just went all cash like 2 minutes ago, if the orders get filled before the bell rings.

The sentiments I’m drawing is that the we are poised for deflation rather than the inflation and the FED knows and is slightly concerned. All the rise in equity’s seems like it was forced by no where to turn rather than actual rise in value. However I know from these podcast so far that smart intelligent investing is not really working in this day and age with momentum.

I’ll try to figure out how to deploy everything into some of the things y’all are discussing but that will take me a minute to digest.

Was this a dumb idea?

I have started dabbling trying understand everything you all are discussing and I’ve even listened to the druckenmiller podcast and the first episode and a half of end game.

I just went all cash like 2 minutes ago, if the orders get filled before the bell rings.

The sentiments I’m drawing is that the we are poised for deflation rather than the inflation and the FED knows and is slightly concerned. All the rise in equity’s seems like it was forced by no where to turn rather than actual rise in value. However I know from these podcast so far that smart intelligent investing is not really working in this day and age with momentum.

I’ll try to figure out how to deploy everything into some of the things y’all are discussing but that will take me a minute to digest.

Was this a dumb idea?

This post was edited on 9/21/20 at 3:07 pm

Posted on 9/21/20 at 7:21 pm to CorkRockingham

quote:

Was this a dumb idea?

going to all cash in the early stages of a 3-5 year bull market?

probably

but who knows?

what I do know is that COVID 19 is an artificial obstacle that requires extraordinarily bold efforts to overcome. And that the reaction to that obstacle has greatly accelerated an inevitable permanent change in lifestyle, behavior and commerce. I’d rather see you invest accordingly with a bit more long term vision

Posted on 9/21/20 at 7:36 pm to CorkRockingham

Nothing in this thread should be construed as investment advice. I'd never recommend my current portfolio to others, unless I knew they were of similar mind. It is true that most people do better when they stay invested over long periods of time. "Time in the market" and all that. This thread has inspired some macro-based positioning that is less a play on the stock market than it is a play on the overall macro environment.

Back to top

1

1