- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Discussion of Fed Liquidity’s Impact on Equity Markets

Posted on 11/2/21 at 10:25 am to wutangfinancial

Posted on 11/2/21 at 10:25 am to wutangfinancial

Breakevens spiked temporarily but retraced back down. I was just reading about the CCP warning people, businesses, government agencies to hoard food for the winter. Something to keep an eye on. Xi DGAF right now and with demand slowing a Tawainesse invasion might be a tasty thing for a commie to do to cover up mass deleveraging in your commie economy.

Posted on 11/2/21 at 10:43 am to wutangfinancial

If you’re warning people to hoard food you definitely don’t have the resources to spare for an invasion. Xi’s going to need all the troops he can muster simply to hold the populace at home in check if their markets keep crashing. Unrest and riots are coming.

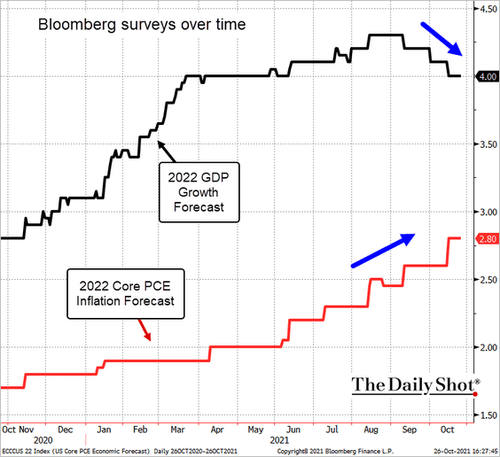

As an aside to the general markets: I don’t know how anyone can look at these ballooning energy/food prices and not be nervous. These are major downward pressures on consumption at a time when the markets need it most.

I’ve been saying it offline for a while now and I’ll say it here: this market is incredibly unstable and I would be deleveraging everything I could right now in preparation. If you want to leave some liquid assets in the market to keep inflation from melting them in the meanwhile by all means, but I’d make sure I was as self-sufficient as possible.

Don’t pick up pennies in front of a steamroller, folks.

As an aside to the general markets: I don’t know how anyone can look at these ballooning energy/food prices and not be nervous. These are major downward pressures on consumption at a time when the markets need it most.

I’ve been saying it offline for a while now and I’ll say it here: this market is incredibly unstable and I would be deleveraging everything I could right now in preparation. If you want to leave some liquid assets in the market to keep inflation from melting them in the meanwhile by all means, but I’d make sure I was as self-sufficient as possible.

Don’t pick up pennies in front of a steamroller, folks.

Posted on 11/2/21 at 10:56 am to Decisions

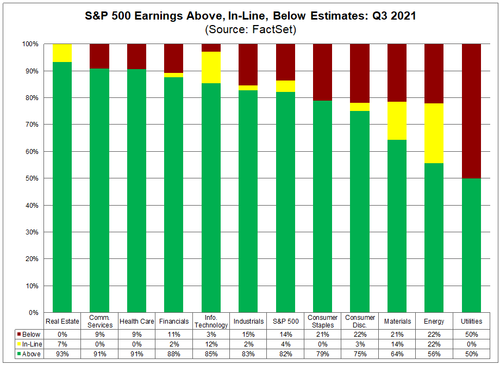

I agree. You’re leaving out top line and margin pressures as well. You can only do so much to manipulate revenue growth. Current market valuations are trading at 3x sales, an all time high. Pile on the great boomer resignation. Could be a fun few years.

Posted on 11/2/21 at 11:19 am to wutangfinancial

quote:

Could be a fun few years.

It reminds me of that old Chinese curse: May you live in interesting times.

If I were to bet on anything in the coming months it would be food/energy futures continuing their run. If things get really bad we’re going to see some governments shut down exports of them and those with insufficient stocks make serious moves.

If you haven’t watched Peter Zeihan’s presentations on the coming global disorder you might want to give them a look. Very interesting food for thought.

Posted on 11/2/21 at 11:45 am to Decisions

quote:

I’ve been saying it offline for a while now and I’ll say it here: this market is incredibly unstable and I would be deleveraging everything I could right now in preparation

meanwhile, dow hits another record high

Posted on 11/2/21 at 12:30 pm to rocket31

quote:

meanwhile, dow hits another record high

By all means ride the lightning, son.

My advice isn’t for those who already have nothing to lose.

Posted on 11/2/21 at 12:41 pm to Decisions

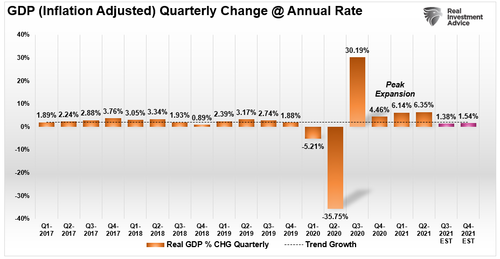

normalization of policy is completely impossible at this point imo so i do not see fed tightening at all

if they stop QE (taper/raise rates), stonks go to shite, dollar up, yields go up... then "the great reset"? maybe... but we are all completely fricked then

if they stop QE (taper/raise rates), stonks go to shite, dollar up, yields go up... then "the great reset"? maybe... but we are all completely fricked then

Posted on 11/2/21 at 12:56 pm to rocket31

They’re not going to stop QE, but that doesn’t matter. The market is going to blow up from pressures elsewhere regardless. At some point the inflation of inputs and reduction of demand is going to pop these heavily indebted companies like grapes. Unless the government forces banks to restructure loans or extend credit no one can save them.

The best a person can hope to do is protect their assets from the financial part of the collapse. Don’t be one of these sad saps who loses everything just as the fireworks start going off. If you survive that then try to negotiate from a position of power when everything else starts to play out. Either the government will be scrambling to prop up whoever is still standing or they’ll attempt go full command economy.

Even odds on that part.

The best a person can hope to do is protect their assets from the financial part of the collapse. Don’t be one of these sad saps who loses everything just as the fireworks start going off. If you survive that then try to negotiate from a position of power when everything else starts to play out. Either the government will be scrambling to prop up whoever is still standing or they’ll attempt go full command economy.

Even odds on that part.

Posted on 12/6/21 at 5:39 pm to Decisions

Eurodollar futures curve inverted I’m looking into this and will post more later but thought I’d get the party started again

For the lurkers this happened 6 months before "the banks are solvent" comments by tGOAT Treasury Secretary and signaled the Powell pivot.

For the lurkers this happened 6 months before "the banks are solvent" comments by tGOAT Treasury Secretary and signaled the Powell pivot.

This post was edited on 12/6/21 at 7:28 pm

Posted on 12/6/21 at 7:28 pm to wutangfinancial

maybe im coming around to the idea where they raise rates and immediately reverse course when the market upends itself? they did that in 2018 though, and it was a mistake so i dont see them doing it again

Posted on 12/6/21 at 7:37 pm to rocket31

That doesn't really make sense though because raising rates would essentially wipe out everything they've been doing for the past 3 years. I just assume you have some whipsawing between tapering/more QE and they don't mess with rates at all like we did from 2009-2016ish. I can't decide if the cycles will be faster or slower than after GFC. I lean towards faster.

More Treasury data:

More Treasury data:

Posted on 12/6/21 at 8:20 pm to wutangfinancial

interesting data

omicron seems to be the likely excuse to justify delaying any taper

omicron seems to be the likely excuse to justify delaying any taper

Posted on 12/7/21 at 10:59 am to rocket31

I don't think Omnicrom has any legs in the US. Globally, it's a massive concern. If we get global lockdowns ex US, the Fed will probably have to do a lot more easing to calm the Eurodollar market.

Popular

Back to top

1

1