- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

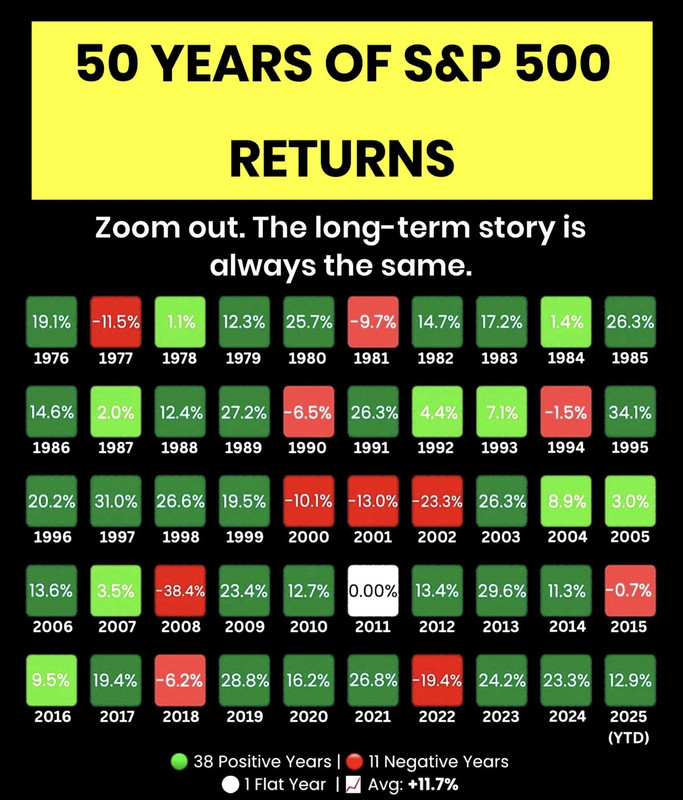

Cool illustration showing gains of the S&P over the last 50 years

Posted on 12/26/25 at 10:31 pm

Posted on 12/26/25 at 10:31 pm

Posted on 12/27/25 at 6:16 am to Arthur Bach

S&P 500 is the single greatest gift for investors no matter how much you put in provided you stay the course. It’s basically idiot proof.

Posted on 12/27/25 at 8:41 am to ronricks

The NASDAQ has an average of 14.95% annual return with 12 down years over the same timespan. The S&P 500 is really fricking solid and I’m a big fan, but I’m equally in love with the NASDAQ because it rewards risk with higher returns.

Posted on 12/27/25 at 8:45 am to Arthur Bach

I saved this yesterday. I am trying to teach my kids and grandkids about investing, and think this is a helpful view. It is a nice alternative to a graph.

Posted on 12/27/25 at 10:02 am to Arthur Bach

Nice exhibit

2000-2003 was rough

2000-2003 was rough

Posted on 12/27/25 at 10:09 am to SlidellCajun

quote:

2000-2003 was rough

The runup from 1995-99 was more than what was justified. Had to come back to normal.

Posted on 12/27/25 at 5:43 pm to Arthur Bach

S&P being down 3 years in a row . Fed will never let that happen again . Money printer go boom!

Posted on 12/27/25 at 9:41 pm to evil cockroach

Imagine being in your 60s and still fully in equities in 2000. Would have been a rough 3 years as you waited for the rebound.

Posted on 12/27/25 at 10:21 pm to SlidellCajun

quote:

Nice exhibit

2000-2003 was rough

Some of my best years ever.

Posted on 12/28/25 at 3:11 pm to PetroBabich

quote:so? You’d be 63 and have more money than when you were 60

Imagine being in your 60s and still fully in equities in 2000. Would have been a rough 3 years as you waited for the rebound.

Posted on 12/28/25 at 3:42 pm to cgrand

From 2000 to 2002? Maybe I don't understand what equities are but it looks like the stock market was pretty bad those 3 years. I guess some people made money investing but I assume most lost based off the OPs graphic.

Posted on 12/28/25 at 8:53 pm to SlidellCajun

quote:

2000-2003 was rough

Had a very good friend who’s wife was a Corporate Trainer for WorldCom. They were living the high life. Amazing home in ATL; another in SWFL. Vacationing like nobodies business. Only the nicest cars with an Au Pair from France raising their kids. Then the company went bust; her salary was gone and the vast majority of her savings was in company stock now worth nothing. They went from paper rich to fricking destitute practically overnight. Lost everything. She ended up losing her mind; became a “sovereign citizen”; at least that’s what she told the judge, with a newly developed drug habit and then lost custody of her kids. Wild times indeed. He now lives in a small apartment in Valdosta, GA. She’s off the grid. Even the kids can’t find her.

This post was edited on 12/28/25 at 8:54 pm

Posted on 12/28/25 at 9:20 pm to wiltznucs

one of my uncles is a worldcom multimillionaire. He got out and sold his stock about a year before the collapse.

Posted on 12/28/25 at 10:34 pm to wiltznucs

That is one hell of a story

Posted on 12/28/25 at 10:50 pm to PetroBabich

quote:only if they sold.

From 2000 to 2002? Maybe I don't understand what equities are but it looks like the stock market was pretty bad those 3 years. I guess some people made money investing but I assume most lost based off the OPs graphic.

Posted on 12/29/25 at 7:51 am to cgrand

quote:

one of my uncles is a worldcom multimillionaire. He got out and sold his stock about a year before the collapse.

Willing to bet that he knew her. Sad story. I was relatively fresh out of college and didn’t know shite about investing. Watched my entire 401K disappear when I got my quarterly updates. Finally got back on my feet only to watch half of my home equity disappear only a few years later. A portion of Gen X has had a rough go of it for sure.

Posted on 12/29/25 at 10:15 am to wiltznucs

probably so...he was a senior VP at MCI Worldcom

Posted on 12/29/25 at 10:26 am to PetroBabich

quote:

Imagine being in your 60s and still fully in equities in 2000. Would have been a rough 3 years as you waited for the rebound.

Sequence of returns risk is so difficult to account for....even the best plans can really take a beating on this alone. Difficult (costly) to hedge all risk out of a plan.

This post was edited on 12/29/25 at 10:27 am

Popular

Back to top

4

4