- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

U.S. Foreclosure Activity Increases Annually in Q3 2025. Up 17% YoY

Posted on 10/16/25 at 11:35 am

Posted on 10/16/25 at 11:35 am

quote:

ATTOM, a leading curator of land, property, and real estate data, today released its Q3 2025 U.S. Foreclosure Market Report, which shows a total of 101,513 U.S. properties with a foreclosure filings during the third quarter of 2025, up less than 1 percent from the previous quarter and up 17 percent from a year ago.

The report also shows a total of 35,602 U.S. properties with foreclosure filings in September 2025, down 0.3 percent from the previous month and up 20 percent from a year ago.

“In 2025, we’ve seen a consistent pattern of foreclosure activity trending higher, with both starts and completions posting year-over-year increases for consecutive quarters,” said Rob Barber, CEO at ATTOM. “While these figures remain within a historically reasonable range, the persistence of this trend could be an early indicator of emerging borrower strain in some areas.”

Foreclosure starts increase nationwide

A total of 72,317 U.S. properties started the foreclosure process in Q3 2025, up 2 percent from the previous quarter and up 16 percent from a year ago.

States that had the greatest number of foreclosure starts in third quarter of 2025 included: Texas (9,736 foreclosure starts); Florida (8,909 foreclosure starts); California (7,862 foreclosure starts); Illinois (3,515 foreclosure starts); and New York (3,234 foreclosure starts).

Those major metros with a population of 200,000 or more that had the greatest number of foreclosures starts in Q3 2025 included Houston, Texas (3,763 foreclosure starts); New York, New York (3,452 foreclosure starts); Chicago, Illinois (3,144 foreclosure starts); Miami, Florida (2,502 foreclosure starts); and Los Angeles, California (2,321 foreclosure starts).

Worst foreclosure rates in Florida, Nevada, and South Carolina

Nationwide one in every 1,402 housing units had a foreclosure filing in Q3 2025. States with the worst foreclosure rates were Florida (one in every 814 housing units with a foreclosure filing); Nevada (one in every 831 housing units); South Carolina (one in every 867 housing units); Illinois (one in every 944 housing units); and Delaware (one in every 974 housing units).

Among 225 metropolitan statistical areas with a population of at least 200,000, those with the worst foreclosure rates in Q3 2025 were Lakeland, Florida (one in every 470 housing units); Columbia, South Carolina (one in 506); Cape Coral, Florida (one in 589); Cleveland, Ohio (one in 593); and Ocala, Florida (one in 665).

Other major metros with a population of at least 1 million, including Cleveland at No. 4, and foreclosure rates in the top 20 worst nationwide, included Jacksonville, Florida at No.6; Las Vegas, Nevada at No.9; Houston, Texas at No. 14; and Orlando, Florida at No. 17.

Bank repossessions increase 33 percent from year ago

Lenders repossessed 11,723 U.S. properties through foreclosure (REO) in Q3 2025, up 4 percent from the previous quarter and up 33 percent from a year ago.

Those states that had the greatest number of REOs in Q3 2025 were Texas (1,288 REOs); California (1,132 REOs); Florida (762 REOs); Pennsylvania (708 REOs); and New York (644 REOs).

Average time to foreclose decreases 25 percent from last year

Properties foreclosed in Q3 2025 had been in the foreclosure process for an average of 608 days. This represents a 6 percent decrease from the previous quarter and a 25 percent decrease from the same time last year, continuing a downward trajectory observed since mid-2020.

States with the longest average foreclosure timelines for homes foreclosed in Q3 2025 were Louisiana (3,632 days); Nevada (2,667 days); Rhode Island (1,929 days); New York (1,867 days); and Hawaii (1,710 days).

States with the shortest average foreclosure timelines for homes foreclosed in Q3 2025 were West Virginia (135 days); Texas (154 days); Virginia (160 days); Wyoming (165 days); and Montana (174 days).

LINK

An average of nearly 10 years to foreclose on a home in Louisiana. It's not a lie. My business manages foreclosures in multiple states and in LA some homes I can have in my portfolio for years. We ended up getting paid more in repairs and maintenance than the home is worth in some cases.

Also, a reminder that the FHA moratorium ended on 9/30. In the next 60-90 days we should start seeing an uptick in FHA foreclosures and by Spring of next year a lot still under Covid forbearance will either be homeless, have a lot of catching up to do, or hope they can sell their home despite the nation seeing a record number of inventory for sale.

quote:

Key Points About the New FHA Loss Mitigation Rules (Effective October 1, 2025)

COVID-19 “Recovery” options expire September 30, 2025.

All pandemic-related and temporary options sunset at the end of September.

FHA-HAMP (the old modification program) is being discontinued as of September 30, 2025, except in rare title-transfer scenarios.

The new rules were originally scheduled to take effect in February 2026, but FHA moved the date up to October 1, 2025.

Borrowers will now be limited to one permanent home-retention option every 24 months.

Some previously planned incentive increases (like relocation assistance or “cash for keys” amounts) are being walked back, and the amounts will stay at earlier levels rather than rise.

Servicers must follow new rules for borrower contact, documentation, and disaster-related forbearance, including different Trial Payment Plan timelines for borrowers in imminent default.

The biggest change is a one-time retention and not able to stack multiple 18-month retention programs on top of one another like several FHA borrowers have done since CV. Some FHA loans were used to purchase homes during Covid and went straight into forbearance. The borrowers have only made like 6 payments but are still in the home due to stacking retention periods.

Posted on 10/16/25 at 11:40 am to stout

What's the market play for this? Whose arse do we need to short this time?

Posted on 10/16/25 at 11:40 am to stout

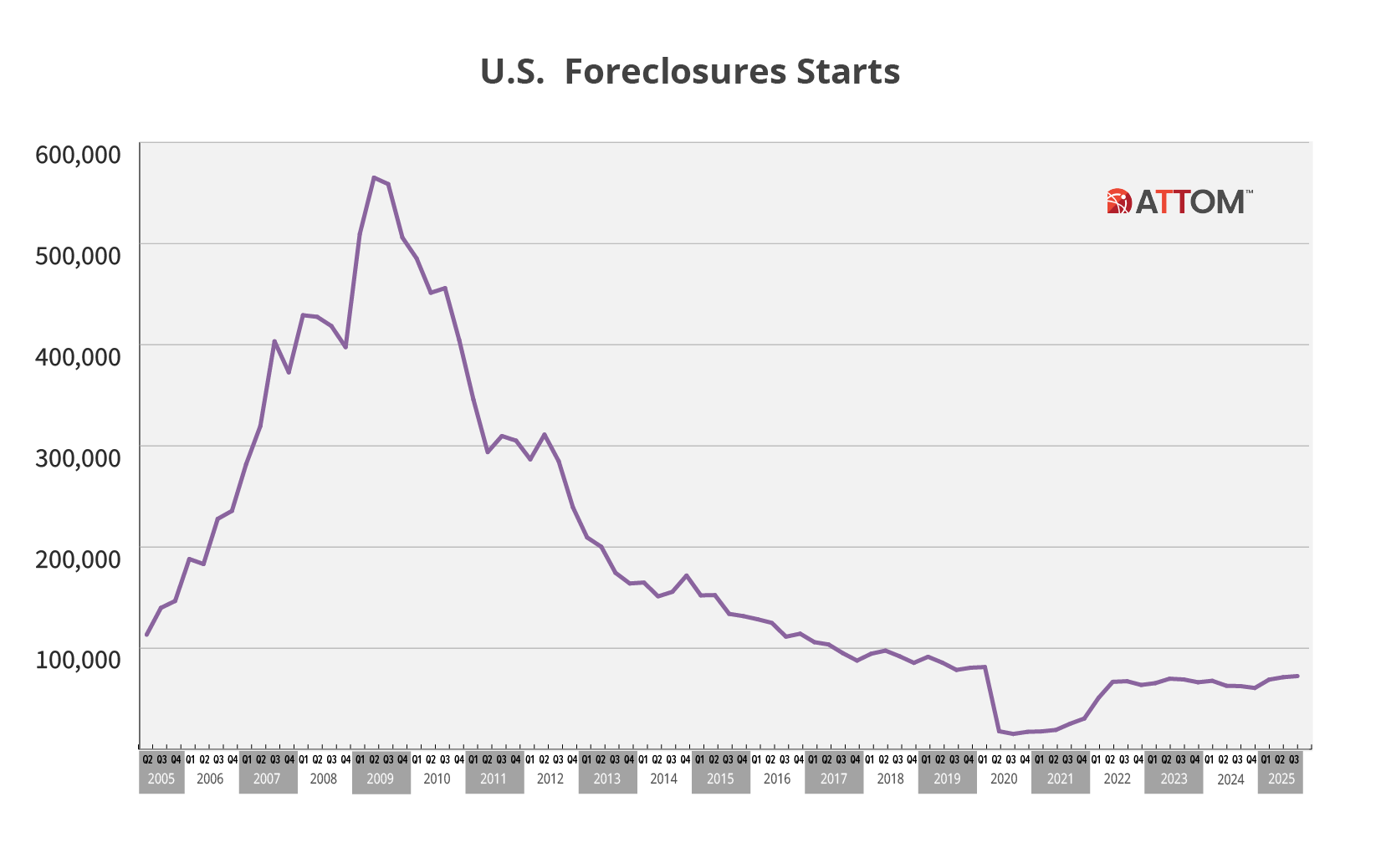

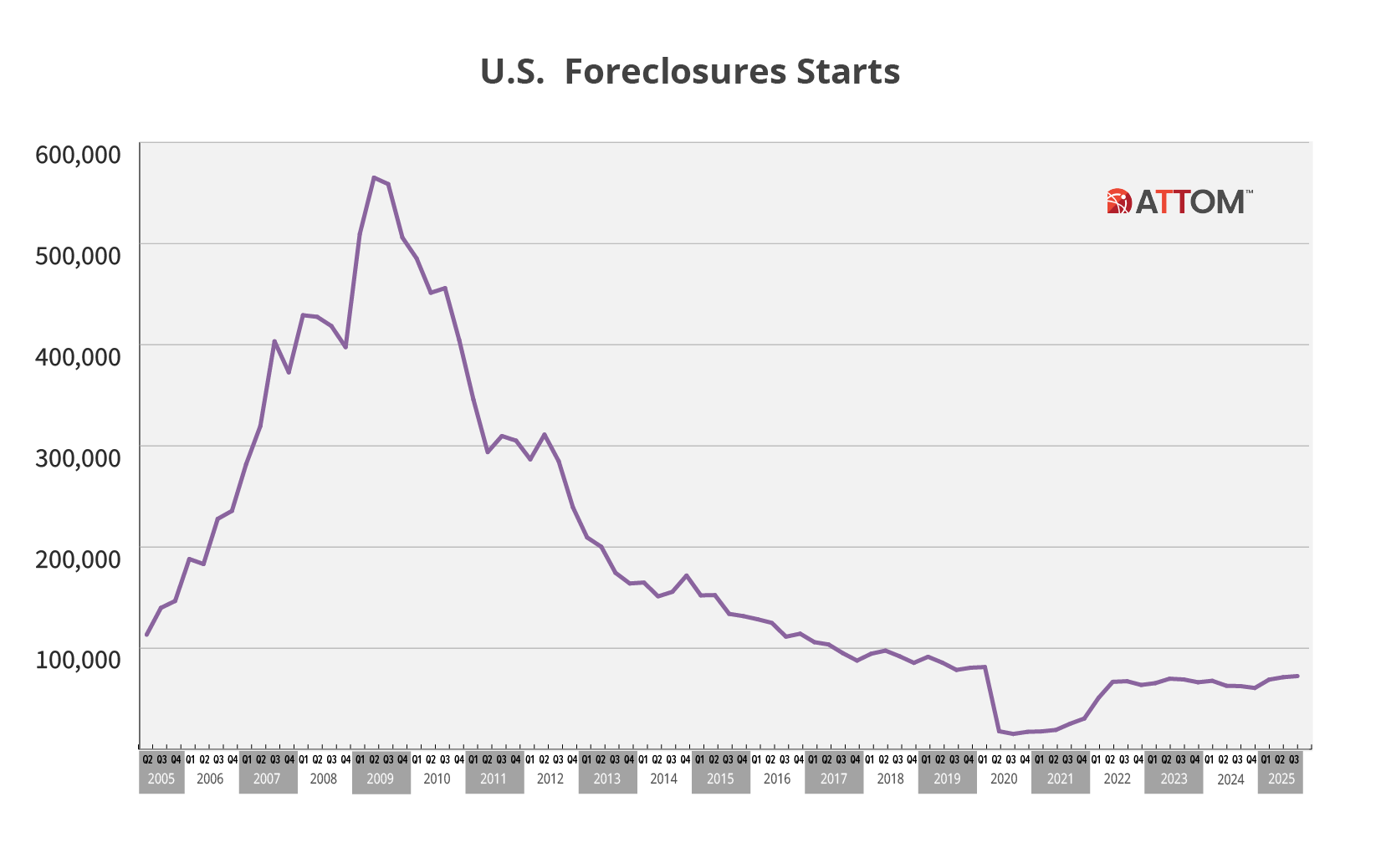

Starts are still near historic lows.

However, with the high debt load carried by many it wouldn't surprise me to see that spike if/when we get into a recession (rather than a slow increase).

However, with the high debt load carried by many it wouldn't surprise me to see that spike if/when we get into a recession (rather than a slow increase).

Posted on 10/16/25 at 11:43 am to Bard

I will say the Florida condo market is fricked

I almost bought a condo four years ago but I cannot see why anybody wants a own one of those in order at this time without a complete change in law

I almost bought a condo four years ago but I cannot see why anybody wants a own one of those in order at this time without a complete change in law

Posted on 10/16/25 at 11:45 am to stout

quote:

average foreclosure timelines for homes foreclosed in Q3 2025 were Louisiana (3,632 days);

Posted on 10/16/25 at 11:55 am to stout

What are the demographics of the homes being foreclosed, that is a key piece of information to understand the impact on the economy.

Posted on 10/16/25 at 11:57 am to Bard

quote:

Starts are still near historic lows.

Yes and they were dropping YoY every year since the 2010 peak

A lot of people in my industry don't even look at the CV data since it is junk and technically, we are still seeing CV data, considering Gov backed loans (VA too) were still being granted forbearance due to CV struggles. That being said, an uptick breaks a trend that was happening for nearly 10 years, and it's been a consistent increase, which is concerning. It was not an anomaly that just happened a few quarters.

Posted on 10/16/25 at 12:03 pm to DarthRebel

quote:

What are the demographics of the homes being foreclosed, that is a key piece of information to understand the impact on the economy.

I can only speak anecdotally, but keep in mind I operate in 14 states, and from what I see it's an every-class issue.

I know the local market the best and locally, we are foreclosing on less than 5-year-old track houses, established middle-class neighborhoods, mobile homes, rural houses on acreage, and a few higher-end houses in Greywood Estates.

Concerning the increase in activity, nationally, we are seeing an uptick in Illinois, but Connecticut volume has fallen off.

Posted on 10/16/25 at 12:12 pm to Taxing Authority

quote:

Seriously, WTF?

Napoleonic Law

quote:

How Napoleonic Law Plays a Role

Civil Law vs. Common Law: Louisiana’s legal system is based on codified statutes rather than case precedent like the rest of the U.S. That means foreclosure procedures must follow strict statutory steps with less flexibility or judicial discretion to shortcut the process.

Judicial Foreclosures Required: Unlike many states that allow non-judicial (out-of-court) foreclosures, Louisiana typically requires foreclosure to go through the courts. This stems from civil law traditions that emphasize formal judicial intervention when depriving someone of property.

Debtor Protections: Napoleonic-influenced law historically emphasizes protection of debtors, which leads to multiple notice requirements, delays, and opportunities for the borrower to contest or redeem property.

Posted on 10/16/25 at 12:15 pm to stout

quote:

Napoleonic Law

Posted on 10/16/25 at 12:23 pm to stout

Sales have really slowed in metro Atlanta the last two months. In my neighborhood, the average that a house has sat has increased from probably 15-20 to 60+.

There is definitely an adjustment headed this way. However, I still see new subdivisions popping up.

There is definitely an adjustment headed this way. However, I still see new subdivisions popping up.

Posted on 10/16/25 at 12:34 pm to stout

Yeah Napoleanic Law, and it’s crazy that we still follow same.

Many years ago I pursued and achieve my real estate license in a 2-week course in NOLA.

Mainly wanted my license at the time as I was buying and selling old tax properties in the city and wanted to save the commissions and wanted to tie into the industry a little bit to find deals.

And literally we had to learn “the rest of the countries real estate laws” and then there is Louisiana Napoleanic Law.

Still officially measuring in Arpents.

Disclaimer:

10% of legit Realtors make 90% of the money, the rest are broke and need to find another profession.

Most Realtors are a pain in the arse, know it all and don’t know jack shite about real estate law not houses and construction.

** but in the DEFENSE of the Realtors always getting beef, there are tons of deals that fall thru & everyone once in a while get a slam dunk with easy money, but the ones that fall thru far outweigh the easy ones.

And if there were less real estate agents involvement in the markets. There would be much more litigation between owner and sellers.

It’s not brain science to help someone buy or sell a home, but it is always one of the Top 3 most stressful things on the planet.

Death of a loved one

Marriage or divorce

Buying or selling a home

And the Realtors are sort of a buffer and know enough about the law to keep both parties within it.

That’s my .02 cents when I seen Napoleanic Law, reminded me of my 2-week course.

And like I said, I did it on the side for flipping houses, but got enough of a taste in my mouth dealing with some slapping agents

Many years ago I pursued and achieve my real estate license in a 2-week course in NOLA.

Mainly wanted my license at the time as I was buying and selling old tax properties in the city and wanted to save the commissions and wanted to tie into the industry a little bit to find deals.

And literally we had to learn “the rest of the countries real estate laws” and then there is Louisiana Napoleanic Law.

Still officially measuring in Arpents.

Disclaimer:

10% of legit Realtors make 90% of the money, the rest are broke and need to find another profession.

Most Realtors are a pain in the arse, know it all and don’t know jack shite about real estate law not houses and construction.

** but in the DEFENSE of the Realtors always getting beef, there are tons of deals that fall thru & everyone once in a while get a slam dunk with easy money, but the ones that fall thru far outweigh the easy ones.

And if there were less real estate agents involvement in the markets. There would be much more litigation between owner and sellers.

It’s not brain science to help someone buy or sell a home, but it is always one of the Top 3 most stressful things on the planet.

Death of a loved one

Marriage or divorce

Buying or selling a home

And the Realtors are sort of a buffer and know enough about the law to keep both parties within it.

That’s my .02 cents when I seen Napoleanic Law, reminded me of my 2-week course.

And like I said, I did it on the side for flipping houses, but got enough of a taste in my mouth dealing with some slapping agents

Posted on 10/16/25 at 12:37 pm to stout

Stout, Good info.

Something I wonder, some go straight from closure to forbearance, sounds like they had no intention of owning long term, just took advantage of covid nonsense to live rent free.

I also notice the top five cities are all hotbeds for illegals, and we know they were getting FHA loans. Its as if someone schooled them on how to take advantage of the regs that were put in place to benefit illegals just like them.

The number will definitely rise given the ending of covid nonsense, but its not a reflection of a down economy, these people never should have been "homeowners" to begin with.

Something I wonder, some go straight from closure to forbearance, sounds like they had no intention of owning long term, just took advantage of covid nonsense to live rent free.

I also notice the top five cities are all hotbeds for illegals, and we know they were getting FHA loans. Its as if someone schooled them on how to take advantage of the regs that were put in place to benefit illegals just like them.

The number will definitely rise given the ending of covid nonsense, but its not a reflection of a down economy, these people never should have been "homeowners" to begin with.

Posted on 10/16/25 at 1:04 pm to Bard

To add to consumer activity: Stolen from the OT

quote:

(NewsNation) — Americans are drowning in car debt, and the water’s rising fast.

Last quarter, 28% of trade-ins toward new car purchases were underwater, meaning the vehicles were worth less than what was owed on them, according to Edmunds. That’s the highest share in four years.

Borrowers with upside-down car loans also owed more than ever — an average of $6,905, up more than 60% from four years earlier.

Ivan Drury, Edmunds’ director of insights, said the amount of trade-in debt consumers are carrying should be a “wake-up call.”

“Much of this stems from shoppers trading out of vehicles too quickly, or carrying loans taken out during the pandemic car market frenzy, when prices were at record highs,” Drury said in a statement.

Those choices have led to more underwater car loans carrying significant debt, often over five figures. Edmunds said nearly 25% of trade-ins with negative equity had more than $10,000 in debt last quarter — a record share.

quote:

“Delinquencies, defaults, and repossessions have shot up in recent years and look alarmingly similar to trends that were apparent before the Great Recession,” the Consumer Federation of America warned in a September report.

Auto debt has overtaken student loans as the largest non-mortgage debt category, with Americans owing roughly $1.66 trillion on their vehicles.

quote:

This year, the share of subprime auto loans that are 60 days or more overdue on their payments hit a record of more than 6%, according to Fitch Ratings.

Average down payments are also down, plunging to the lowest level in nearly four years ($6,020), while new-car shoppers are taking on bigger loans than ever — financing an average of $42,647 last quarter, Edmunds data shows.

And there’s no sign that new car prices are coming down.

The average American new car buyer paid a record $50,080 in September, Kelley Blue Book reported this week. It’s the first time that figure has ever topped the $50,000 mark.

Back to top

6

6