- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Need financial advice

Posted on 9/22/25 at 7:55 pm

Posted on 9/22/25 at 7:55 pm

I’m about to come into 200k+ selling a piece of property. I’m pretty good with money, but far from a financial guru. I’m weighing some options:

Paying off mortgage (130k)

Building some apartments. Already have the land.

Investing

Moving to Mexico lol

Any advice?

Paying off mortgage (130k)

Building some apartments. Already have the land.

Investing

Moving to Mexico lol

Any advice?

Posted on 9/22/25 at 8:03 pm to tigereye1988

Is the 200k the net cash after closing costs and taxes?

Do you already have an emergency fund?

What do your retirement accounts look like?

How long until you plan on retiring?

What is the rate on your mortgage and how many payments do you have left on it?

Do you have other high interest debt like personal loans, vehicle loans, credit card balances?

Do you have kids that you want to help fund college accounts for?

I’m sure I’m missing a lot but asking for investment advice needs a lot more than what you’ve given

Do you already have an emergency fund?

What do your retirement accounts look like?

How long until you plan on retiring?

What is the rate on your mortgage and how many payments do you have left on it?

Do you have other high interest debt like personal loans, vehicle loans, credit card balances?

Do you have kids that you want to help fund college accounts for?

I’m sure I’m missing a lot but asking for investment advice needs a lot more than what you’ve given

Posted on 9/22/25 at 8:33 pm to horsesandbulls

Good on emergency fund

Retirement accounts are in good shape. Wife and I have been contributing for 15 years. Still young. Mid-late 30s

4.5% interest rate. 25 years left. We are using this as a rental house. Note is 1000 per month. Renting for 1500

No loans other than house note. Which is a new house. 6.5 percent rate

2 kids under 3. Which makes time for financial research tough to come by lol

Retirement accounts are in good shape. Wife and I have been contributing for 15 years. Still young. Mid-late 30s

4.5% interest rate. 25 years left. We are using this as a rental house. Note is 1000 per month. Renting for 1500

No loans other than house note. Which is a new house. 6.5 percent rate

2 kids under 3. Which makes time for financial research tough to come by lol

Posted on 9/23/25 at 7:09 am to tigereye1988

How old are you? Are you opposed to the boring, old, but effective strategy of DCA into broad index funds?

Posted on 9/23/25 at 7:43 am to WhiskeyThrottle

I’d pay off the mortgage. Crazy how much money you can save after becoming debt free. For me personally, I saved more money in my 50’s than all my years before combined. I contribute it to becoming debt free. Just sharing my experience. You do you.

Posted on 9/23/25 at 8:34 am to tigereye1988

I would second the paying off the mortgage. There is something psychological about being completely debt free, not to mention that life likes to throw wrenches at you non-stop and being completely and utterly debt-free relieves so much pressure when this happens. Once this happens, I would begin pouring your mortgage into either your children's college accounts or investments. Do not get accustomed to living on this extra income. It would be great if you could structure it so that you never really see this income hit your accounts. I will also make it moderately difficult to access it.

Posted on 9/23/25 at 10:23 am to WhiskeyThrottle

quote:

boring, old, but effective strategy of DCA into broad index funds?

DCA isnt applicable here. It would be better to lump sum. DCA is best for investing as you have $ available instead of waiting to accumulate a big lump sum. But DCA isnt meant to be used to gradually invest if you already have the large sum accumulated.

Posted on 9/23/25 at 11:13 am to tigereye1988

I can answer this easily

I have an account that I funded with $198,231.86. The account is about 2.5 years old now and my annualized return is sitting at 20.19%

I had a mortgage at that time around $100,000 @ 2.5%. I still have that mortgage.

Paying off a mortgage is a great mental decision, not a great financial decision.

As far as apartments go, $200,000 just going to offset the much higher cost to build and that is a long term investment option. You are going to need to recoup building loan and then make enough to offset maintenance. Not a bad idea, but you are looking at several years to profitability, unless there is a chance to flip it for profit within a few years.

I have an account that I funded with $198,231.86. The account is about 2.5 years old now and my annualized return is sitting at 20.19%

I had a mortgage at that time around $100,000 @ 2.5%. I still have that mortgage.

Paying off a mortgage is a great mental decision, not a great financial decision.

As far as apartments go, $200,000 just going to offset the much higher cost to build and that is a long term investment option. You are going to need to recoup building loan and then make enough to offset maintenance. Not a bad idea, but you are looking at several years to profitability, unless there is a chance to flip it for profit within a few years.

Posted on 9/23/25 at 11:17 am to DarthRebel

Adding to that, since you are in mid 30s

$200,000 in SPY following historical trends

Age 55 - $750,000ish

Age 65 - $1,500,000ish

Unless you are all in on property management, invest it and forget it. Do not pay off mortgage.

$200,000 in SPY following historical trends

Age 55 - $750,000ish

Age 65 - $1,500,000ish

Unless you are all in on property management, invest it and forget it. Do not pay off mortgage.

Posted on 9/23/25 at 3:37 pm to tigereye1988

quote:

4.5% interest rate. 25 years left. We are using this as a rental house. Note is 1000 per month. Renting for 1500

DONT Pay this off. I'm all for sleeping at night but this is financial leverage on an asset not, personal debt.

Posted on 9/23/25 at 3:48 pm to whodatigahbait

My father did this very thing that you and DarthRebel are suggesting and then the Dot Com bubble burst. He could not liquidate fast enough and lost his investment and eventually his home to foreclosure when he was laid off several months later. I know it makes no financial sense at all, but I always advocate for financial freedom.

Posted on 9/23/25 at 6:42 pm to MekaWarriors

Agree. Debt free house paid off mid 30’s is the route I would go.

Posted on 9/23/25 at 7:30 pm to tigereye1988

I would use $200k for the pre-construction costs on building apartments, if that is your plan for that land (and you somewhat know what you’re doing).

It’s hard to hit a Homerun when you’re trying to bunt. You have plenty more at bats if you strike out.

It’s hard to hit a Homerun when you’re trying to bunt. You have plenty more at bats if you strike out.

Posted on 9/23/25 at 8:11 pm to T-Jon

My first time posting on this board. Pleasantly surprised at the amount of thoughtful comments. Much different from to OT lol.

I know I’m in a good spot financially. Some of that is attributed to good decisions, some of it is luck. I’m leaning towards to safe play and paying off the mortgage. But part of me wants to take a big swing in construction. Thanks again for the comments.

I know I’m in a good spot financially. Some of that is attributed to good decisions, some of it is luck. I’m leaning towards to safe play and paying off the mortgage. But part of me wants to take a big swing in construction. Thanks again for the comments.

Posted on 9/23/25 at 9:06 pm to tigereye1988

You still never answered if the 200k was net of tax or if you’ll need to hold some of it for taxes.

Figure that out before you do anything else. Last thing you want is to make this decision then have to come up with 25-40k to cover the tax bill.

The numbers say put it back in the market and don’t pay the mortgage down but speaking as someone who doesn’t have a mortgage it’s pretty freeing.

If you do decide to go the market route, look up 3 fund portfolio and do that. Will be solid in 20 years.

Figure that out before you do anything else. Last thing you want is to make this decision then have to come up with 25-40k to cover the tax bill.

The numbers say put it back in the market and don’t pay the mortgage down but speaking as someone who doesn’t have a mortgage it’s pretty freeing.

If you do decide to go the market route, look up 3 fund portfolio and do that. Will be solid in 20 years.

Posted on 9/23/25 at 9:19 pm to MekaWarriors

quote:

My father did this very thing that you and DarthRebel are suggesting and then the Dot Com bubble burst. He could not liquidate fast enough and lost his investment and eventually his home to foreclosure when he was laid off several months later. I know it makes no financial sense at all, but I always advocate for financial freedom.

I get where you are coming from, and you have to be able to weather the storm. There is going to be another recession in all our lifetimes, plan accordingly.

In the OPs scenario, paying off the mortgage would be financially stupid, unless he takes the ~$700/month saved from no mortgage and invests it every month. After 25 years @ 7% annual returns, paying the mortgage off will come ahead of just investing by $100,000. If returns average 10% annually (historical average) investing all will come out ahead $200,000 vs. paying off mortgage.

At 10 years, investing is ahead roughly $200,000 over paying mortgage. This is because investing all is lump some and paying off mortgage requires you to keep contributing mortgage to investing and does not catch up till you get close to that 25 year mark.

He still has a $70,000 buffer between mortgage and $200,000. He would need to lose 35% of investment to not be able to pay off mortgage if needed.

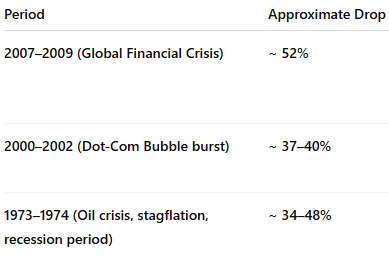

Going back to 70s, it looks like there were just 3 times it dropped more than 35%. It appears COVID crash was just 34%

This post was edited on 9/23/25 at 9:32 pm

Posted on 9/23/25 at 9:37 pm to tigereye1988

I had something similar with an inheritance. I wanted it for future opportunities or costs money so didn’t want to put too much at risk. Have it split 65% Fidelity MM at @ 4% and 35% split between value and growth Vanguard ETFs. It’s up 7% YTD and there if I need it.

Posted on 9/24/25 at 8:11 am to tigereye1988

Remember

Having money allows opportunity for more sin. It also offers the opportunity to do more good.

Having money allows opportunity for more sin. It also offers the opportunity to do more good.

Posted on 9/24/25 at 8:30 am to tigereye1988

quote:pay off your mortgage

No loans other than house note. Which is a new house. 6.5 percent rate

Posted on 9/24/25 at 9:38 am to tigereye1988

More facts needed to get more detailed advice. Your financial discipline is a factor. If you pay off mortgage, then allow the extra funds to whisper away by spending it frivolously, then you would be better off keeping the mortgage and investing the rest.

A consideration could be to pay your mortgage down partially to save on long term interest. You could also turn it into a 15 year mortgage vs a 30 year. These approaches lower your long term cost of the mortgage, yet keep some of the lump sum money available to you.

A consideration could be to pay your mortgage down partially to save on long term interest. You could also turn it into a 15 year mortgage vs a 30 year. These approaches lower your long term cost of the mortgage, yet keep some of the lump sum money available to you.

Popular

Back to top

7

7