- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Milton Friedman blames the Great Depression on the Federal Reserve. But there is a paradox

Posted on 7/23/25 at 10:31 am

Posted on 7/23/25 at 10:31 am

In short it the Great Depression occurred because the money supply during the years prior was dwindling which lead to bank runs.

Freidman says the Great Depression could have been averted by money creation and using that money to purchase U.S. treasuries (bills, notes and bonds).

During the 2008 Finical Crisis we called this Quantitative Easing but not only did the Federal Reserve create money to purchase U.S. Treasuries they purchased failing Mortgage Backed Securities.

Freidman's solution to avert future liquidity crisis is to implement his idea of the "k-percent rule". The k-percent rule is a rule that the Federal Reserve money supply would grow at a fixed rate.

Today the Federal Reserve implements a version of the k-percent rule. They supply enough money into the economy such that inflation grows at 2% per year. I think this has been Fed policy since the 1950s.

There are three main forces that impact prices:

1. Natural deflation due to increase supply and less demand.

2. Natural inflation due to population increase.

3. Inflation or deflation based on the supply of money.

The population growth is not sufficient enough change to overcome natural price deflation so the Federal Reserve messes with number 3, money supply.

But here is the paradox:

Milton Freidman hates inflation and especially hates government overspending and inefficiencies. But in order to implement the k-percent rule Congress is required to overspend and to overspend sufficiently enough to overcome natural deflation plus maintain inflation at 2%. In order to counter deflation and maintain 2% inflation congress forces the U.S. Treasury to sell debt.

But why go into debt. Why not just take money printing duties out of the Federal Reserve's hands and place money printing duties back into the U.S. Treasury's hands? The U.S. Treasury can implement the k-percent rule without selling debt.

If using the credit card is bad, stop using the credit card. You own the printing press, why use the credit card?

Freidman says the Great Depression could have been averted by money creation and using that money to purchase U.S. treasuries (bills, notes and bonds).

During the 2008 Finical Crisis we called this Quantitative Easing but not only did the Federal Reserve create money to purchase U.S. Treasuries they purchased failing Mortgage Backed Securities.

Freidman's solution to avert future liquidity crisis is to implement his idea of the "k-percent rule". The k-percent rule is a rule that the Federal Reserve money supply would grow at a fixed rate.

Today the Federal Reserve implements a version of the k-percent rule. They supply enough money into the economy such that inflation grows at 2% per year. I think this has been Fed policy since the 1950s.

There are three main forces that impact prices:

1. Natural deflation due to increase supply and less demand.

2. Natural inflation due to population increase.

3. Inflation or deflation based on the supply of money.

The population growth is not sufficient enough change to overcome natural price deflation so the Federal Reserve messes with number 3, money supply.

But here is the paradox:

Milton Freidman hates inflation and especially hates government overspending and inefficiencies. But in order to implement the k-percent rule Congress is required to overspend and to overspend sufficiently enough to overcome natural deflation plus maintain inflation at 2%. In order to counter deflation and maintain 2% inflation congress forces the U.S. Treasury to sell debt.

But why go into debt. Why not just take money printing duties out of the Federal Reserve's hands and place money printing duties back into the U.S. Treasury's hands? The U.S. Treasury can implement the k-percent rule without selling debt.

If using the credit card is bad, stop using the credit card. You own the printing press, why use the credit card?

This post was edited on 7/23/25 at 10:55 am

Posted on 7/23/25 at 10:36 am to GumboPot

That really is the question. Why does our govt allow a private bank to create our money??

Smells fishy

Smells fishy

Posted on 7/23/25 at 10:41 am to czechtiger

quote:

That really is the question. Why does our govt allow a private bank to create our money??

Smells fishy

Didn't happen prior to 1913. The U.S. Treasury Department handled those duties.

Posted on 7/23/25 at 11:22 am to GumboPot

Great lecture about causes of the Great Depression by one of my favorite living economist.

The federal reserve holds much of the blame for both the Great Depression and America’s entry into WW1.

Posted on 7/23/25 at 12:50 pm to Hayekian serf

I used to follow him until I saw him promoting the be your own bank movement with whole life insurance which is a scam. So now I do not watch or trust him even though he has a lot of good information surely. Because it tells me he will knowingly lie to people.

Posted on 7/23/25 at 12:52 pm to GumboPot

Deflation necessary sometimes and the 2% inflation goals stupid

Posted on 7/23/25 at 1:18 pm to czechtiger

LBJ physically assaulted the Fed chairman at his ranch in Texas

Posted on 7/23/25 at 1:46 pm to GumboPot

quote:Huh?? The Treasury Department bought and sold T-bills to manage interest rates and the U.S. money supply?

Didn't happen prior to 1913. The U.S. Treasury Department handled those duties.

I'd like to read about that if you can provide a link. Thanks.

Posted on 7/23/25 at 2:11 pm to LSURussian

quote:

Huh?? The Treasury Department bought and sold T-bills to manage interest rates and the U.S. money supply?

Well you are right. The U.S. Department of Treasury did not play a centralized role like the Federal Reserve does today however it did play a significant role in managing aspects of the nation's decentralized monetary system.

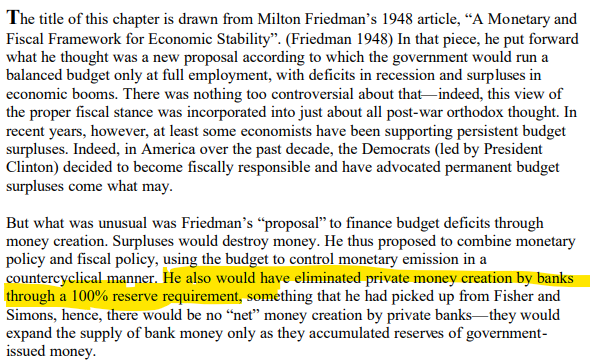

Freidman did appeal going back to the decentralized monetary system of the 19th century with one major caveated, 100% reserve requirement for banks.

LINK

Posted on 7/23/25 at 3:57 pm to GumboPot

quote:Don't you hate it when that happens??

Well you are right.

Posted on 7/23/25 at 4:02 pm to LSURussian

quote:

Don't you hate it when that happens??

Congrats on the victory. Would love to hear your opinion on the 2nd part of his post regarding Freidman suggesting going back to the decentralized monetary system of the 19th century with one major caveated, 100% reserve requirement for banks.

This post was edited on 7/23/25 at 4:03 pm

Posted on 7/23/25 at 4:33 pm to GumboPot

There are so many problems with this, I don’t know where to begin.

We issue debt when we print money so that we can preserve the value of the money and prevent hyperinflation.

Adding in money creation by the treasury would likely destabilize our monetary system. People don’t use treasury notes (or greenbacks as they were called under Lincoln), they use federal reserve notes. Are you suggesting we get people to adopt a new currency? What happens to the old currency?

The U.S. treasury is a political agency, so you’d get a brand new (and likely radically different) monetary policy every 8 years, causing even more confusion and uncertainty in the market.

The K percent rule still suffers from the same defects as our current system, namely that it doesn’t respond to market pressures and is monopolized by a government entity, so you’ve solved nothing really by implementing this.

A market based approach is to return money creation to private banks like what we had in the free banking era in the U.S. (still distorted by U.S. mandates) and in Scotland during the 1800s.

We issue debt when we print money so that we can preserve the value of the money and prevent hyperinflation.

Adding in money creation by the treasury would likely destabilize our monetary system. People don’t use treasury notes (or greenbacks as they were called under Lincoln), they use federal reserve notes. Are you suggesting we get people to adopt a new currency? What happens to the old currency?

The U.S. treasury is a political agency, so you’d get a brand new (and likely radically different) monetary policy every 8 years, causing even more confusion and uncertainty in the market.

The K percent rule still suffers from the same defects as our current system, namely that it doesn’t respond to market pressures and is monopolized by a government entity, so you’ve solved nothing really by implementing this.

A market based approach is to return money creation to private banks like what we had in the free banking era in the U.S. (still distorted by U.S. mandates) and in Scotland during the 1800s.

Posted on 7/26/25 at 7:55 pm to SlayTime

Sorry, I just saw your questions to me.

1) "the decentralized monetary system of the 19th century" - That was a lousy system in the 19th century so I don't know how it would be better in the 21st century.

On average, in the 19th century there was a major financial crises (they called them "panics" back then) every 10 years. There have been 3 financial crises in the 112 years since the Fed was created by congress, and only one of them, 1929-1930, was caused by monetary policies of the Fed.

2008/2009, was caused by congress mandating loans were required to be made to unqualified borrowers and the credit rating agencies going completely brain dead on assigning credit ratings to mortgage backed securities.

2020-2021, was caused by a pandemic and inept international governmental reaction to it.

2) "with one major caveated (sic), 100% reserve requirement for banks." - "100% reserve" of...WHAT? 100% of loans?? 100% of deposits??

If a bank has to reserve dollar for dollar for either deposits held or loans made, there will not be much funding available for making loans. Our economy would grind to a halt.

quote:

Would love to hear your opinion on the 2nd part of his post regarding Freidman suggesting going back to the decentralized monetary system of the 19th century with one major caveated (sic), 100% reserve requirement for banks.

1) "the decentralized monetary system of the 19th century" - That was a lousy system in the 19th century so I don't know how it would be better in the 21st century.

On average, in the 19th century there was a major financial crises (they called them "panics" back then) every 10 years. There have been 3 financial crises in the 112 years since the Fed was created by congress, and only one of them, 1929-1930, was caused by monetary policies of the Fed.

2008/2009, was caused by congress mandating loans were required to be made to unqualified borrowers and the credit rating agencies going completely brain dead on assigning credit ratings to mortgage backed securities.

2020-2021, was caused by a pandemic and inept international governmental reaction to it.

2) "with one major caveated (sic), 100% reserve requirement for banks." - "100% reserve" of...WHAT? 100% of loans?? 100% of deposits??

If a bank has to reserve dollar for dollar for either deposits held or loans made, there will not be much funding available for making loans. Our economy would grind to a halt.

This post was edited on 7/27/25 at 12:09 am

Posted on 7/26/25 at 8:11 pm to LSURussian

Woodrow Wilson was the worst president of all time

Posted on 7/26/25 at 8:56 pm to GumboPot

quote:You have to be careful to understand in addressing the pre-WWII (or pre-Nixonian) economy the nuances of a gold standard. The gold standard was a different animal for the Fed. FDR began uncoupling the USD and gold domestically in 1933 giving the Fed a bit more maneuverability. Prior to the FDR decoupling, the Fed was severely hamstrung. Expanding the money supply against a fixed gold reserve risked a run on US gold reserves, which Friedman discounts. He may be right, and with hindsight the move might fall into the "best of bad options" category, but even with hindsight, it's far from a slam dunk

But here is the paradox:

Posted on 7/26/25 at 9:03 pm to OWLFAN86

Woodrow Wilson was horrible but he looks at Joe Biden and says “he makes me look like George Washington”.

Posted on 7/26/25 at 9:19 pm to AllbyMyRelf

One caveat to consider …. unlike during the Great Depression, our currency is no longer backed by hard assets (gold, silver).

Instead, today’s currency is backed only by the “full faith and credit” of the US Treasury …. a credit rating that has been steadily eroding and has been downgraded twice in recent memory. This is obviously due to the monstrous size of the US Debt and the gross mismanagement of our Budget …. things that can be fixed, but not without considerable pain.

Excess money printing can be described in many different ways, but at its core is simply devaluing the currency. And as a result of devaluation, every fiat currency in history has eventually failed.

It’s time for the US to return to sound money … and I’m not convinced that either Congress or the Fed is capable of accomplishing a goal that will restrict their freewheeling ways. Just my dos centavos…

Instead, today’s currency is backed only by the “full faith and credit” of the US Treasury …. a credit rating that has been steadily eroding and has been downgraded twice in recent memory. This is obviously due to the monstrous size of the US Debt and the gross mismanagement of our Budget …. things that can be fixed, but not without considerable pain.

Excess money printing can be described in many different ways, but at its core is simply devaluing the currency. And as a result of devaluation, every fiat currency in history has eventually failed.

It’s time for the US to return to sound money … and I’m not convinced that either Congress or the Fed is capable of accomplishing a goal that will restrict their freewheeling ways. Just my dos centavos…

Posted on 7/26/25 at 9:23 pm to GumboPot

The problem was that the money supply was growing rapidly in the 1920s, such that when the supply started to tighten in the later part of the decade, overvalued assets were exposed and people lost a lot of money. This had happened in 1921, but the government did not actively get involved and the market recovered. Hoover was the Labor Secretary at this time, and had told people if he was President, he would immediately get involved in a recession. FDR actually ran against the New Deal before adopting it as his own.

Posted on 7/26/25 at 9:58 pm to AllbyMyRelf

quote:

People don’t use treasury notes (or greenbacks as they were called under Lincoln), they use federal reserve notes.

A U.S. Note is just as legal tender today as a Federal Reserve note. We stopped printing U.S. Notes in 1971. It was a series A $100 bill with a 1966 date. It’s still legal tender today.

Look the biggest objection to the current system is debt. We see threads and news reports every single day. The national debt is a talking point by every single politician.

So the solution for spending over revenue is to simply print the needed dollars in lieu of selling debt to get the dollars.

The objection to this method is inflation. But the counter argument is we have inflation now.

The antidote to inflation is stop overspending. But the issue with not overspending is deflation.

If you want to defend the current system you have to accept the consequences of debt. Debt is a feature of the current system not a flaw.

If you are adverse to debt stop selling it.

The main reason Congress overspends is to provide the fiscal side of monetary policy to maintain inflation at 2%. This keeps asset prices stable and slightly increasing. We have decided that this is the definition of a healthy economy.

But we can also maintain 2% inflation without incurring more debt.

Start abandoning Federal Reserve Notes and re-adopt US Notes.

Posted on 7/26/25 at 10:17 pm to LSURussian

quote:

On average, in the 19th century there was a major financial crises (they called them "panics" back then) every 10 years.

I used to have a chart of the U.S. economy starting in 1790 showing all the booms and bust in U.S. history. Those 19th century panics I’m sure hurt for the folks living in them at the time but they were relatively quick and hard. Malinvestment was worked out of the economy very quickly. Under the Federal Reserve system the bust were/are long and deep.

What I wanted to do with that chart was compare the area under the curve during the time period 1790-1913 to the time period 1914-current, annualize and report in constant and current dollars. Would be an interesting exercise.

Popular

Back to top

10

10