- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

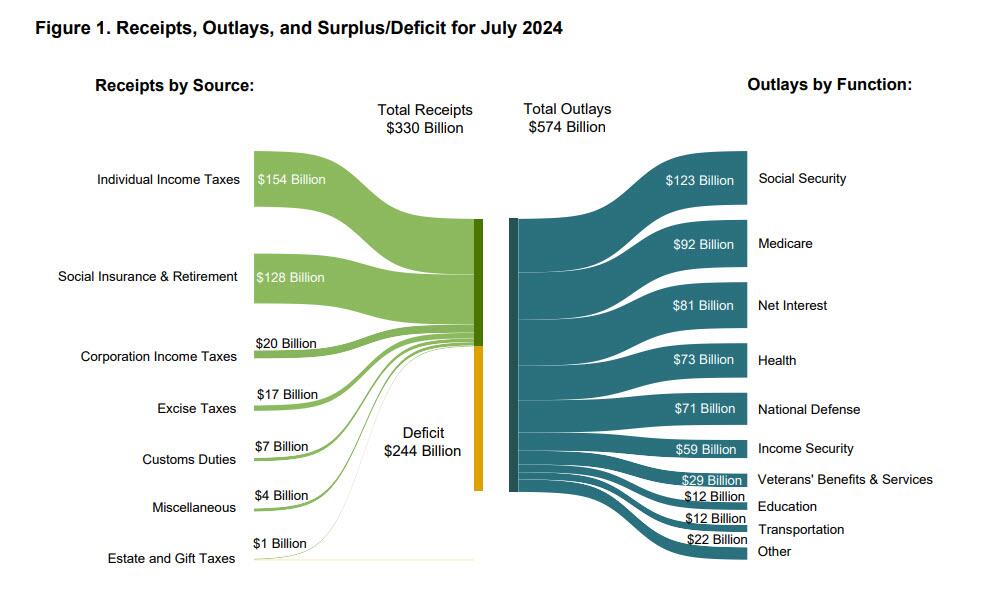

US Records 2nd Biggest July Deficit In History As 25% Of Tax Revenue Go To Pay Interest

Posted on 8/14/24 at 5:44 pm

Posted on 8/14/24 at 5:44 pm

quote:

While there was much more talk about the soaring US budget deficit earlier this year, when debt seemed to rise by $1 trillion every other month, lately it appears that the topic has become almost taboo perhaps because neither presidential candidate has any plan or clue how to normalize the trend which assures fiscal collapse for the US and the loss of dollar reserve status.

But while others may have conflicts of interest in reporting on this most important topic, we don't, and we are sad to inform our readers that July was another catastrophic month for US fiscal viability: that's because US tax revenue of $330.4BN (down sharply from the $466.3BN in June, if higher than the $276.2BN a year ago), was far below the $573.1BN in government outlays (which was materially above the $537.2BN in June and also the $496.9BN last July)...

.... resulting in a monthly deficit of $243.7BN, the second largest July budget deficit on record, surpassed only by the record post-covid print in July 2021.

July Budget Deficit - WOW!!

Posted on 8/14/24 at 5:59 pm to Timeoday

Politicians don't care as long as they can get their hair and nails did.

Posted on 8/14/24 at 6:08 pm to Timeoday

That percentage is a lot higher than what’s being reported

Posted on 8/14/24 at 6:10 pm to Timeoday

Veterans and Military are roles of federal goverment/Budget

everything else is an add on...

SS should be a 1 to 1 deal...

everything else is an add on...

SS should be a 1 to 1 deal...

Posted on 8/14/24 at 6:12 pm to TOPAL

quote:

But the stock market is up

Meh, large swaths of the stock market are flat or even lower than they were 4 years ago when you adjust for inflation. It’s funny to see people all excited about their “gains,” not realizing they are largely just inflationary.

This post was edited on 8/14/24 at 6:14 pm

Posted on 8/14/24 at 6:13 pm to Timeoday

Get the printing presses rolling. Spend, spend and spend. If we don’t cut, cut and cut. We are fricked, fricked and fricked.

Posted on 8/14/24 at 6:15 pm to Timeoday

That my friends is why the Fed needs to lower interest rates. Inflation isn’t anywhere close to being under control but the other option is a government default and total collapse of or monetary system

Posted on 8/14/24 at 6:18 pm to Timeoday

It doesn’t take long to print the difference, so what’s the harm?

Posted on 8/14/24 at 6:25 pm to bayoudude

quote:

That my friends is why the Fed needs to lower interest rates. Inflation isn’t anywhere close to being under control but the other option is a government default and total collapse of or monetary system

That can't be the answer though. Lowering rates right now on the basis on debt interest is just chasing symptoms. 12 month from now you'll be begging to raise rates again when annualized inflation is back up to 4 or 5%.

I'm not in here to be all preachy because I don't have an answer for this either other than a dramatic downsizing of the federal government without touching taxes - and that's not possible to do.

Every day I believe more and more that there is no way out of this. There are solutions, but none of them are possible in our government or society.

Posted on 8/14/24 at 6:27 pm to bayoudude

quote:

That my friends is why the Fed needs to lower interest rates. Inflation isn’t anywhere close to being under control but the other option is a government default and total collapse of or monetary system

Agreed. The government can’t even handle the relatively modest rates we have now. But here’s the question: Who in their right mind is going to buy our debt?

Posted on 8/14/24 at 6:33 pm to TigerFanatic99

They're probably going to light the dollar on fire instead going through a crushing multi-year recession.

Posted on 8/14/24 at 6:35 pm to SloaneRanger

quote:

Who in their right mind is going to buy our debt?

Posted on 8/14/24 at 6:37 pm to Timeoday

So when we say it’s going to interest, where is it actually going? Who are we paying the interest to?

Posted on 8/14/24 at 6:38 pm to Timeoday

I guess it could be funny, but it was a serious question. Shorter term debt I understand. But for long term debt you would have to be insane to sign up for that.

Popular

Back to top

8

8