- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

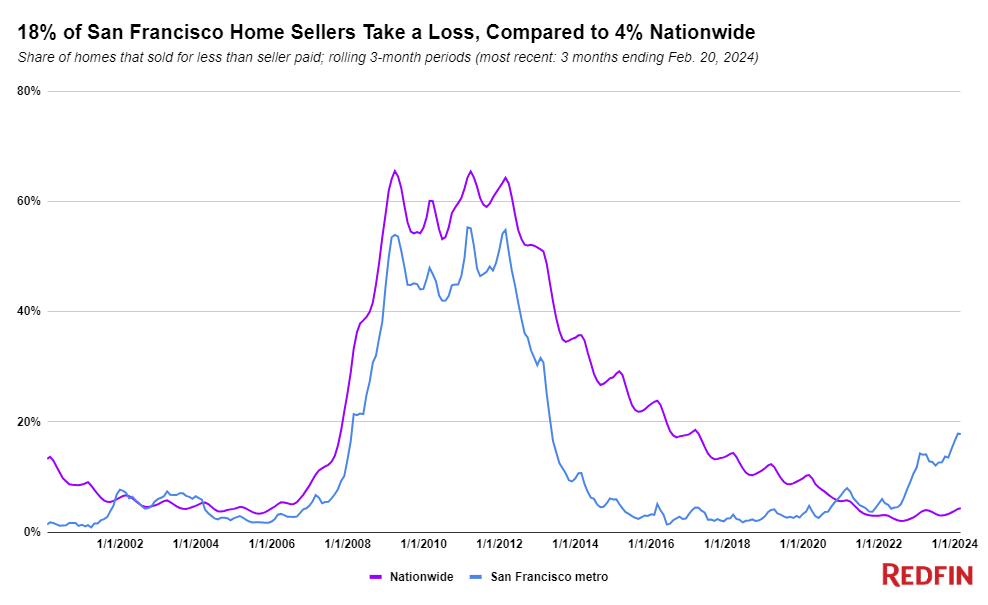

18% of sellers in San Francisco are taking a loss on their House

Posted on 4/24/24 at 9:43 am

Posted on 4/24/24 at 9:43 am

quote:

Nearly one of five (17.8%) homes that sold in San Francisco during the three months ending February 29 sold at a loss. That’s comparable with the 17.9% share hit during the three months ending January 31, which was the highest in 11 years.

That’s a higher share than any other metro, and it’s more than four times the national share of 4.3%. The national share of sellers taking a loss is the highest it has been since May 2021, but the share has been fairly stable over the past two years, hovering between 2% and 4.5%.

quote:

In San Francisco, the typical homeowner who sold at a loss parted with their home for $155,500 less than they bought it for, the largest dollar loss of any major metro. Nationwide, the median loss was $39,912.

This is according to a Redfin analysis of county records and MLS data across the 50 most populous U.S. metros. To be included in this analysis, a home must have been owned by the same party for at least nine months leading up to the sale. When we say “sold at a loss,”, we mean the seller sold the home for less than they bought it for.

quote:

San Francisco’s median sale price peaked at $1.66 million in April 2022, and has since fallen 15% ($250,000) to $1.41 million as of February. The typical person who bought in San Francisco at nearly any point in 2021 or 2022, when the housing market was red hot due to ultra-low mortgage rates, would have taken a loss if they sold during the first few months of this year.

https://www.redfin.com/news/san-francisco-home-sellers-lose-gain-money/

Posted on 4/24/24 at 9:45 am to Dire Wolf

When Cali real estate is selling for a loss, things are fricked.

Granted, I bet a huge number of the people buying are doing so as investments for the long term and think a short term loss is fine. Doesn’t work if the city itself becomes less desirable to live in and depopulates.

Granted, I bet a huge number of the people buying are doing so as investments for the long term and think a short term loss is fine. Doesn’t work if the city itself becomes less desirable to live in and depopulates.

Posted on 4/24/24 at 9:51 am to Dire Wolf

Is this verified loses or "potential loses" based on assumptions of when and how much a home was bought/sold for? In one reading it sounds like these are verified loses but in another paragraph they talk about average home prices and how they have declined.

This post was edited on 4/24/24 at 9:52 am

Posted on 4/24/24 at 9:51 am to Dire Wolf

quote:

Nearly one of five (17.8%) homes that sold in San Francisco during the three months ending February 29 sold at a loss

Checkmate, you moronic JP owners

Posted on 4/24/24 at 9:59 am to Dire Wolf

Ron should make a commercial about this.

Posted on 4/24/24 at 10:40 am to Dire Wolf

But homes with robotic pooper scoopers held their value.

Posted on 4/24/24 at 10:52 am to Dire Wolf

Got dayum sea monsta bringing down home prices again.

Posted on 4/24/24 at 11:00 am to Dire Wolf

quote:

$155,500 less than they bought it for, the largest dollar loss of any major metro. Nationwide, the median loss was $39,912.

Yikes to both, but the SF number is downright brutal.

Posted on 4/24/24 at 11:02 am to Dire Wolf

A lot of fired tech workers who can't afford their house payments, plus san fran is overflowing with dookie.

Posted on 4/24/24 at 11:14 am to Dire Wolf

quote:

The typical person who bought in San Francisco at nearly any point in 2021 or 2022, when the housing market was red hot due to ultra-low mortgage rates, would have taken a loss if they sold during the first few months of this year.

Exactly.

OP should read:

18% of sellers in San Fran over-paid for their home purchase

Posted on 4/24/24 at 11:21 am to Dire Wolf

Elections have consequences. Not just at the federal level, but at the local level the consequences are felt even faster.

When South Park tells you that your city has a problem, you really ought to listen to them.

When South Park tells you that your city has a problem, you really ought to listen to them.

Posted on 4/24/24 at 12:04 pm to Dire Wolf

And taking their shitty politics to another State

Posted on 4/24/24 at 12:21 pm to Dire Wolf

Is it really a loss if you get to leave SF?

Posted on 4/24/24 at 12:23 pm to Dire Wolf

I mean, I completely get your point, but it's 18%. 1 out of 5. Let's see if it increases or decreases because while 18% is not normal and cause to be worried, it's not cause to panic.

Posted on 4/24/24 at 12:34 pm to Dire Wolf

quote:

Nearly one of five (17.8%) homes that sold in San Francisco during the three months ending February 29 sold at a loss.

So that means that 4 out of 5 homes in San Francisco sold at a profit.

Doesn’t sound that dire to me.

Posted on 4/24/24 at 12:57 pm to Dire Wolf

Well, considering how over-inflated the housing prices are in that city, it is understandable they'd have to have a downturn at some time.

Combine that with higher interest rates and how that city is being turned into a shitshow with the amount of homeless setting up tents all over the city and it becomes a less attractive place to live and invest hard earned money into.

Combine that with higher interest rates and how that city is being turned into a shitshow with the amount of homeless setting up tents all over the city and it becomes a less attractive place to live and invest hard earned money into.

Popular

Back to top

15

15