- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

This seems significant. China, Saudi Arabia sign currency swap agreement.

Posted on 11/21/23 at 3:39 pm

Posted on 11/21/23 at 3:39 pm

quote:

BEIJING, Nov 20 (Reuters) - The People's Bank of China and the Saudi Central Bank recently signed a local currency swap agreement worth 50 billion yuan ($6.93 billion) or 26 billion Saudi riyals, both banks said on Monday, as bilateral relations continued to gather momentum.

Saudi Arabia, the world's top oil exporter, and China, the world's biggest energy consumer, have worked to take relations beyond hydrocarbon ties in recent years, expanding collaboration into areas such as security and technology.

The swap agreement, which will be valid for three years and can be extended by mutual agreement, "will help strengthen financial cooperation... expand the use of local currencies... and promote trade and investment," between Riyadh and Beijing, the statement from China's central bank said.

China imported $65 billion worth of Saudi crude in 2022, according to Chinese customs data, accounting for about 83% of the kingdom's total exports to the Asian giant.

Russia remained China's top oil supplier in October despite higher prices for Russian crude, with Saudi imports down 2.5% from the previous month as it continued to restrict supply.

Chinese President Xi Jinping told Gulf Arab leaders last December that China would work to buy oil and gas in yuan, but it has not yet used the currency for Saudi oil purchases, traders have said.

Beijing is thought to have the world's largest network of currency swap arrangements in place, with at least 40 countries, but seldom reveals the broader terms of its arrangements.

"China seems to be using swap lines in a very different way to the U.S.," said Weitseng Chen, associate professor at the National University of Singapore. "(China) uses it as a credit line, so it's on a constant basis, instead of a one-time, one-off thing during a financial crisis."

Argentina in October activated a currency swap line with China for the second time in three years to the tune of $6.5 billion to help increase its depleted foreign currency reserves in the midst of a major economic crisis, with annual inflation above 130% and central bank dollar reserves hitting negative levels.

LINK

Less demand for the dollar = not good.

This post was edited on 11/21/23 at 3:42 pm

Posted on 11/21/23 at 3:42 pm to GumboPot

I know Biden's amin has completely screwed our relations with SA and it's possibly the worst thing his admin has done, but China isn't going to guarantee SA's defense and take on the financial responsibility of doing so. SA can do these symbolic deals all day long but until they find someone else who can (and will) pay for their defense, they're going to support the petrodollar.

China neither can, nor will, do so.

China neither can, nor will, do so.

Posted on 11/21/23 at 3:42 pm to GumboPot

Yeh, our economy is about to crash……

…and they will blame Trump

…and they will blame Trump

Posted on 11/21/23 at 3:46 pm to SlowFlowPro

If enough countries replace the petrodollar our economy will be nuked. They are trying real hard to make this reality.

Posted on 11/21/23 at 4:03 pm to GumboPot

quote:

Less demand for the dollar = not good.

The uni-party has used the dollar as a weapon with sanctions, and will soon use it as a weapon here at home with the 87,000 irs agents the GOPe funded.

Stop voting GOPe.

Posted on 11/21/23 at 4:07 pm to SlowFlowPro

quote:

I know Biden's amin has completely screwed our relations with SA and it's possibly the worst thing his admin has done, but China isn't going to guarantee SA's defense and take on the financial responsibility of doing so. SA can do these symbolic deals all day long but until they find someone else who can (and will) pay for their defense, they're going to support the petrodollar.

Yeah, lets be SA's chump and keep borrowing money from China to pay for SA's defense. You went to public schools, right?

Posted on 11/21/23 at 4:10 pm to Warboo

quote:

If enough countries replace the petrodollar our economy will be nuked. They are trying real hard to make this reality.

Not saying they aren’t trying to do this, but they are all screwed if our economy is tanked. Not sure the motivation behind this.

Posted on 11/21/23 at 4:18 pm to Tandemjay

quote:

lets be SA's chump

Please show the math on how losing the petrodollar will be better for our economy and budget.

quote:

and keep borrowing money from China

...wut

quote:

You went to public schools, right?

Says the guy who thinks we're borrowing money from China in any significant amount

Posted on 11/21/23 at 4:18 pm to loogaroo

quote:

but they are all screwed if our economy is tanked

Everyone is, for a long, long while.

Posted on 11/21/23 at 4:26 pm to GBPackTigers

quote:

and they will blame Trump

Well...... He is partly to blame.

Posted on 11/21/23 at 4:37 pm to GumboPot

Don’t fool yourself as the dollar is crap obviously but break it and all the currencies are crap as well.

Posted on 11/21/23 at 4:44 pm to Warboo

quote:

If enough countries replace the petrodollar our economy will be nuked. They are trying real hard to make this reality

Obama's "fundamental transformation" was intended to bring the USA down to the level of all other countries. To lay the lone superpower low. Recall his statement against the concept of American exceptionalism

This post was edited on 11/22/23 at 3:43 pm

Posted on 11/21/23 at 5:54 pm to SlowFlowPro

quote:

Says the guy who thinks we're borrowing money from China in any significant amount to pay for SA's defense

You are the problem with the country.

Posted on 11/21/23 at 6:07 pm to GumboPot

Just 10 years ago, the mere suggestion that the greenback would one day face challenges as the world’s reserve currency was ridiculed as a fringe conspiracy theory.

Who is laughing now?

Who is laughing now?

Posted on 11/21/23 at 6:49 pm to GumboPot

What about Argentina’s dollarization???

Posted on 11/21/23 at 6:50 pm to Toomer Deplorable

quote:

Just 10 years ago, the mere suggestion that the greenback would one day face challenges as the world’s reserve currency was ridiculed as a fringe conspiracy theory.

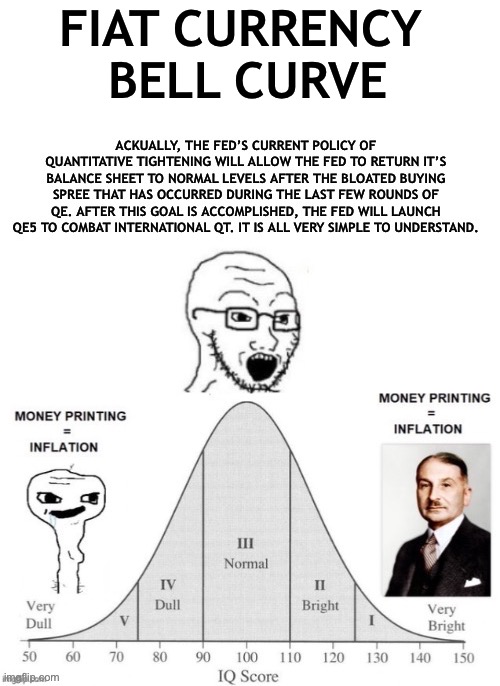

You’re still posting about money machines after 2+ years of quantitative tightening.

Posted on 11/21/23 at 6:51 pm to Toomer Deplorable

10 years? Folks have insinuated that this year, 2023.

Posted on 11/21/23 at 7:51 pm to SlowFlowPro

Yeah, I don't see the Saudis buying Chinese fighters or relying on a Chinese carrier. Plus let's see if that 7 billion yuan is still 7 billion when the Saudis try and use it to buy Chinese stuff.

Posted on 11/21/23 at 8:44 pm to cwill

quote:

You’re still posting about money machines after 2+ years of quantitative tightening.

And you still are posting drive-by comments with no detail or explication on what you genuinely believe.

Explain, in detail, exactly how a contractionary monetary policy has corrected the reality that the Fed prints money out of thin air?

This was asked of you in another thread and it received no response.

Posted on 11/21/23 at 8:55 pm to GumboPot

US and Canada could destroy both economies over night…..

Unfortunately, leadership is bought and paid for by both of those countries.

Unfortunately, leadership is bought and paid for by both of those countries.

Popular

Back to top

13

13