- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Will the FED hike rates today?

Posted on 9/20/23 at 7:31 am

Posted on 9/20/23 at 7:31 am

The rumor is a rate pause but open to the possibility of raising in the future.

I think rates have to be raised again soon as inflation is nowhere near being in control despite what the media tells us.

Then there is this:

LINK

The soft landing they have been trying for is doing more damage to the middle class vs just letting shite hit the fan and getting it over with. Just prolonging the misery

I think rates have to be raised again soon as inflation is nowhere near being in control despite what the media tells us.

Then there is this:

quote:

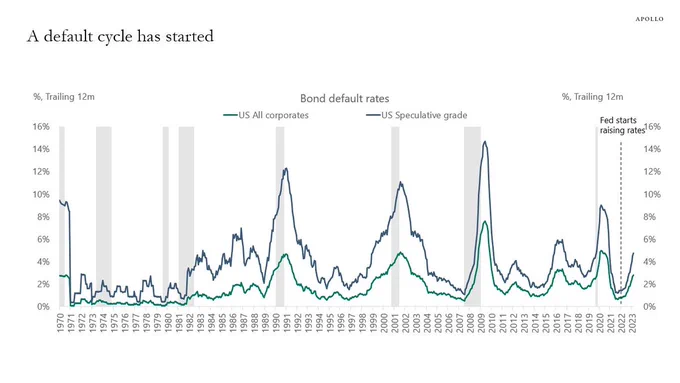

According to Apollo, a new default cycle has already started and default rates are skyrocketing.

Default rates on all US corporate bonds have nearly tripled from their lows of ~1% in 2021.

Since the Fed started raising rates, the default rate on all US corporate bonds is up to 3%.

On speculative-grade bonds, default rates have gone from 1.5% to 5% in just over a year.

If the Fed can avoid a recession here, it would be incredible.

History says a recession is due.

LINK

The soft landing they have been trying for is doing more damage to the middle class vs just letting shite hit the fan and getting it over with. Just prolonging the misery

Posted on 9/20/23 at 7:36 am to stout

quote:

The soft landing they have been trying for is doing more damage to the middle class vs just letting shite hit the fan and getting it over with. Just prolonging the misery

Yep. They should have ripped the band-aid off and jacked rates up to 12-14% in 2021, shocking the system, allow markets to adjust, and then incrementally raise or lower rates accordingly.

Posted on 9/20/23 at 7:36 am to stout

quote:

The soft landing they have been trying for is doing more damage to the middle class vs just letting shite hit the fan and getting it over with.

Oh yeah, but Joe’s reelection?

Posted on 9/20/23 at 7:37 am to stout

I think they hold steady and hope that July and August were anomalies (a continued pause is also the consensus among most economists). That said, if September numbers come out and they are anything like July/August, there's absolutely no way they don't hike another quarter-point at the October meeting.

I've said for a very long time now that a "soft landing" was likely impossible and that we would be lucky to get out of this with just stagflation. As deficit spending and Biden's desire to cripple the O&G industry for the sake of "green" initiatives, inflation is remaining too sticky for the rate hikes to work in the time period the Fed was hoping for.

Meanwhile... I've been listening to the increase of news stories subtly trying to bash "extreme right-wing" members of the House over the possible upcoming government shutdown (due to them wanting more spending cuts, WHICH IS WHAT IS frickING NEEDED). They are beginning to create fear narratives where they should be explaining why cuts are important to fight the inflation that's dragging the country down.

quote:

The soft landing they have been trying for is doing more damage to the middle class vs just letting shite hit the fan and getting it over with. Just prolonging the misery

I've said for a very long time now that a "soft landing" was likely impossible and that we would be lucky to get out of this with just stagflation. As deficit spending and Biden's desire to cripple the O&G industry for the sake of "green" initiatives, inflation is remaining too sticky for the rate hikes to work in the time period the Fed was hoping for.

Meanwhile... I've been listening to the increase of news stories subtly trying to bash "extreme right-wing" members of the House over the possible upcoming government shutdown (due to them wanting more spending cuts, WHICH IS WHAT IS frickING NEEDED). They are beginning to create fear narratives where they should be explaining why cuts are important to fight the inflation that's dragging the country down.

This post was edited on 9/20/23 at 7:44 am

Posted on 9/20/23 at 7:45 am to Ten Bears

quote:

They should have ripped the band-aid off and jacked rates up to 12-14% in 2021,

Powell didn't become Potato's officially nominated FOMC chairman till November 2021. Not sure how Powell would have accomplished that as the entire WH (Potato, Yellen, Peppermint Patty, Granholm, Rousse et al) had marching orders to claim everything was only transitory and temporary, no there there.

Posted on 9/20/23 at 7:48 am to Tomatocantender

You should feel good paying more since it means sending billion$ to Ukraine, Jack.

Posted on 9/20/23 at 7:52 am to stout

They put their liberal politics ahead of the economy. The question is can they raise rates once again without politically damaging their boy, Biden?

Posted on 9/20/23 at 7:58 am to stout

The Fed is facing a real reckoning and the odds the American people are about to get wrecked is increasing.

$33 trillion in US debt, $2 trillion annual deficits, $1 trillion annually to service the debt, inflation is ticking up.....the Fed has a problem because they were 100% complicit in allowing the Federal government to continue to fill a fiat money trough for the well connected and the American people are going to take the brunt of the pain.....as usual.

The farmer is the Federal Reserve, the bucket of slop is the fiat currency, the trough is the Federal government, the huge hogs are the well connected getting their cheap money before the masses and the little piggies are the American people.

$33 trillion in US debt, $2 trillion annual deficits, $1 trillion annually to service the debt, inflation is ticking up.....the Fed has a problem because they were 100% complicit in allowing the Federal government to continue to fill a fiat money trough for the well connected and the American people are going to take the brunt of the pain.....as usual.

The farmer is the Federal Reserve, the bucket of slop is the fiat currency, the trough is the Federal government, the huge hogs are the well connected getting their cheap money before the masses and the little piggies are the American people.

This post was edited on 9/20/23 at 8:04 am

Posted on 9/20/23 at 8:10 am to stout

They will pause and see where the cards fall. A lot of spending in the first and second quarter were people racking up credit card debt because they cant control themselves. Those cards are now maxed out and these people are paying the minimums.

This post was edited on 9/20/23 at 9:42 am

Posted on 9/20/23 at 8:16 am to Bard

quote:

As deficit spending and Biden's desire to cripple the O&G industry for the sake of "green" initiatives,

I'm sure he has wanted to do this, but it's not happening. We are producing at near record levels and may top the record soon for U.S. oil and gas production.

And what needs to happen in the big picture is that the middle and lower class needs to stop spending fcking money like a drunken sailor.

Posted on 9/20/23 at 8:19 am to stout

If the Fed hikes rates, does that mean that the payments on the National Debt go up accordingly?

Posted on 9/20/23 at 8:25 am to RCDfan1950

quote:

If the Fed hikes rates, does that mean that the payments on the National Debt go up accordingly?

I believe the Fed funds rate directly affects the debt service on the $33 trillion of US debt....but I don't have 6 years of university studies in banking and finance so I may be wrong.

Posted on 9/20/23 at 8:28 am to HubbaBubba

quote:

You should feel good paying more since it means sending billion$ to Ukraine, Jack.

You misread my post. I am saying the entire Biden WH and cabinet is responsible for the current runaway inflation because for the whole year of 2021, they irresponsibly lied about inflation/supply chains being temporary. What I stated was that Powell had his hands tied in the first 11 months of 2021 because Biden intentionally held up his nomination as FOMC chair.

This post was edited on 9/20/23 at 8:30 am

Posted on 9/20/23 at 8:30 am to stout

Dont think they hike but its gonna be all about what they say. They could set the bond market on fire

Posted on 9/20/23 at 9:22 am to notiger1997

quote:

I'm sure he has wanted to do this, but it's not happening. We are producing at near record levels and may top the record soon for U.S. oil and gas production.

Except that LINK ]it is happening. He's been shutting down access to swaths of federal territory (which drives price up through futures trading) and our refining capacity is still ~400-600 million barrels per day behind where we were pre-COVID (cost increase through supply vs demand).

Along with that, he's increased the ethanol mandate for gasoline by 50%, which is a net increase in cost due to ethanol having ~30% less energy than gasoline, and that's before the extra cost needed to produce ethanol and then blend it into gasoline (the cost can vary, based on the price of corn).

Gasoline and Ethanol prices:

Gasoline and Ethanol prices adjusted for energy content:

This is why you don't see corn farmers using ethanol to farm corn, it's a net money loser.

This post was edited on 9/20/23 at 9:24 am

Posted on 9/20/23 at 9:35 am to Bard

quote:

This is why you don't see corn farmers using ethanol to farm corn, it's a net money loser.

What does this mean?

Posted on 9/20/23 at 9:41 am to stout

What aggravates me is they tie all this shite to mortgage and bank companies.

Everyone ends up with similar interest rates. You can't really shop around.

We've been looking to move and have been banking with USAA for years. Paid off both vehicles through them and never missed a payment.

Seems like they should be able to charge us whatever interest rate they want and feel comfortable with risk wise based on my history of never missing a payment.

Instead of making some money from a loan they get nothing while we wait and see how the market goes.

Everyone ends up with similar interest rates. You can't really shop around.

We've been looking to move and have been banking with USAA for years. Paid off both vehicles through them and never missed a payment.

Seems like they should be able to charge us whatever interest rate they want and feel comfortable with risk wise based on my history of never missing a payment.

Instead of making some money from a loan they get nothing while we wait and see how the market goes.

Posted on 9/20/23 at 9:41 am to stout

quote:

I think rates have to be raised again soon as inflation is nowhere near being in control despite what the media tells us.

The Biden WH has already explained this. Inflation is way down. Except for the things that cost way more.

They are also pushing the excuse of 'poor messaging.' A journalist this morning on radio:

"The economy is doing great. But the polls say people rate Biden low on the economy. This is a disconnect between reality and public opinion. Biden needs to improve his messaging."

Posted on 9/20/23 at 9:44 am to JusTrollin

quote:

What does this mean?

It means exactly what it means. Ethanol doesn't have the BTUs to be a self-sustaining energy source for farming (meaning it doesn't produce enough energy for it to be profitable if farmers were to use 100% ethanol fuels for planting and harvesting). Any farmer trying to do so would quickly find themselves losing money as the cost of all that extra ethanol would use up any potential profits (and more).

Posted on 9/20/23 at 9:46 am to Bard

quote:

It means exactly what it means. Ethanol doesn't have the BTUs to be a self-sustaining energy source for farming (meaning it doesn't produce enough energy for it to be profitable if farmers were to use 100% ethanol fuels for planting and harvesting). Any farmer trying to do so would quickly find themselves losing money as the cost of all that extra ethanol would use up any potential profits (and more).

1. That's not how growing plants and farming works.

2. Large farm equipment runs on diesel.

I get what you are trying to say but it doesn't make sense.

Back to top

10

10