- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Trump Tax Windfall Going to Capex Way Faster Than Stock Buyback, largest capex in 7 years

Posted on 5/2/18 at 4:34 pm

Posted on 5/2/18 at 4:34 pm

quote:

Chalk up a win for capex.

After months of heated debate over whether companies would hand the biggest tax break in three decades back to shareholders or reinvest it in their businesses, there’s finally some hard data.

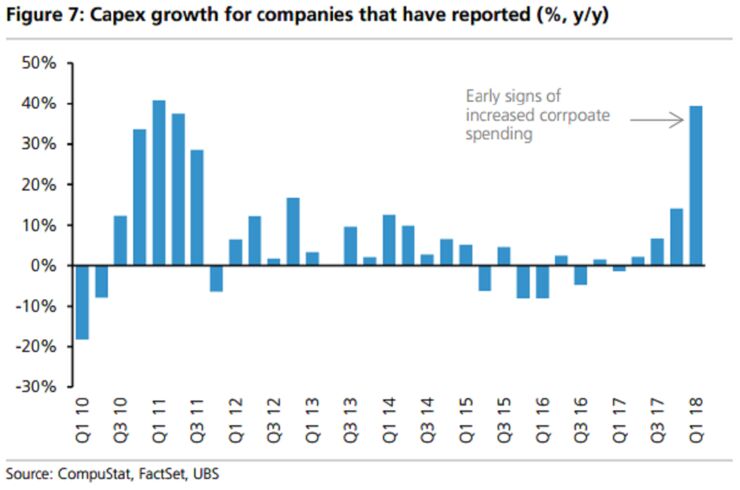

Among the 130 companies in the S&P 500 that have reported results in this earnings season, capital spending increased by 39 percent, the fastest rate in seven years, data compiled by UBS AG show. Meanwhile, returns to shareholders are growing at a much slower pace, with net buybacks rising 16 percent. Dividends saw an 11 percent boost.

quote:

The data is a fresh rebuttal to those who warned that hundreds of billions of dollars of tax relief will head directly to the stock market and be harvested by shareholders already fattened by a nine-year bull market. While buybacks indeed got a boost from the windfall, companies increased the rate at which they unleash cash for building factories and upgrading equipment, a strategy that’s preferred by investors for the benefit of future growth.

LINK

Posted on 5/2/18 at 4:37 pm to HailHailtoMichigan!

Yes but does this make up for the dead lining the streets as a result of tax cuts?

Posted on 5/2/18 at 4:37 pm to HailHailtoMichigan!

you mean they arent just putting it in a box and burying it like Losh said?

Posted on 5/2/18 at 4:38 pm to HailHailtoMichigan!

omg the winning must stop

Posted on 5/2/18 at 4:47 pm to HailHailtoMichigan!

this article only talks about percentage change in capex & buybacks/dividends, and not talk about the actual change in each?

i mean it doesn't even mention the starting point for each. don't we already know that investment has been low & profits high?

we need to see a spike in private domestic investment and/or wages. not only that, it needs to be sustained

this is not very helpful for informing the debate. it's only helpful for narrative purposes

i mean it doesn't even mention the starting point for each. don't we already know that investment has been low & profits high?

we need to see a spike in private domestic investment and/or wages. not only that, it needs to be sustained

this is not very helpful for informing the debate. it's only helpful for narrative purposes

Posted on 5/2/18 at 4:48 pm to HailHailtoMichigan!

quote:This was before Apple announced its massive buyback right?

with net buybacks rising 16 percent.

Posted on 5/2/18 at 4:51 pm to buckeye_vol

quote:

This was before Apple announced its massive buyback right?

sample includes:

quote:

Among the 130 companies in the S&P 500 that have reported results in this earnings season

we'll start seeing official data on private investment and wages soon enough

Posted on 5/2/18 at 4:53 pm to 90proofprofessional

quote:

this article only talks about percentage change in capex & buybacks/dividends, and not talk about the actual change in each?

using percentages is way to normalize across companies and across sectors.

you know that. why quibble? Are you angry?

Posted on 5/2/18 at 4:54 pm to HailHailtoMichigan!

Repatriation holidays = stock buybacks

Move to participation exemption = reinvest through capex spending

Move to participation exemption = reinvest through capex spending

Posted on 5/2/18 at 4:55 pm to Adam Banks

quote:

but does this make up for the dead lining the streets as a result of tax cuts?

how do I tell if Im stepping over dead bodies from tax cuts or net neutrality?

Posted on 5/2/18 at 4:57 pm to CptBengal

Probably angry. It’s hard to spin doom and gloom with reports like that. I am literally screaming at the sky right now

Posted on 5/2/18 at 4:57 pm to 90proofprofessional

quote:

90proofprofessional

Posted on 5/2/18 at 4:57 pm to CptBengal

quote:

using percentages is way to normalize across companies and across sectors.

we haven't been told anything about the relative baselines of capex vs these various forms of profit-taking

if the baselines are very different, "normalizing" does the opposite of informing one

you know that.

Posted on 5/2/18 at 4:58 pm to 90proofprofessional

What narrative do you buy? Are you upset that more tax money won't be going to government programs?

Posted on 5/2/18 at 4:58 pm to Mo Jeaux

quote:

You are such a curmudgeon on this board now.

I do bristle at undue cheerleading, it's true.

Posted on 5/2/18 at 4:59 pm to 90proofprofessional

quote:

we haven't been told anything about the relative baselines of capex vs these various forms of profit-taking

if the baselines are very different, "normalizing" does the opposite of informing one

the graph and data are clearly y/y. It says so. The baseline is an autoregressive one.

seriously, Trump winning broke you just as bad as VOR.

Posted on 5/2/18 at 5:00 pm to NIH

quote:

What narrative do you buy?

like i said, i'll see after investment & wage data has started rolling in

Posted on 5/2/18 at 5:01 pm to 90proofprofessional

quote:From April 26th.

sample includes:

Popular

Back to top

14

14