- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Trump calls on FED to cut rates; hints at Powell being fired soon

Posted on 4/17/25 at 11:40 am to Augustus516

Posted on 4/17/25 at 11:40 am to Augustus516

Trump nominated the cuck Powell.

Posted on 4/17/25 at 11:42 am to SDVTiger

quote:

UE rate increasing. Retail sales will be very low next month. Negative GDP

Things you were warned would happen due to Trumps tariffs.

Trump will do what he did last time. Beg the fed to continually bail him out.

Posted on 4/17/25 at 12:00 pm to RogerTheShrubber

quote:Why? Because we are not in a 4%+ FFR economy by recent standards.

Why should they be cut? Are things looking that badly?

Re: "Are things looking that badly?"

We're stuck with the deleterious effects of the past 5yrs, plus the need to shift domestic/global paradigms. You've forecasted terrible outlooks as a result.

Pocahontas was on CNBC this morning emanating her economic wisdom (/s). She berated Trump for suggesting the FFR was too high, and Powell was/is late to react. Not a minute later she said we're headed for recession, "if we aren't already in one."

Now you seem to be of the Warren mindset, so you tell me, are things looking that bad?

Posted on 4/17/25 at 12:03 pm to NC_Tigah

quote:

Then they'd be making a costly mistake, for several reasons.

The Fed’s mandate centers around inflation and unemployment. If both are near target, they have no reason to lower rates.

Posted on 4/17/25 at 12:03 pm to NC_Tigah

quote:

We're stuck with the deleterious effects of the past 5yrs, plus the need to shift domestic/global paradigms. You've forecasted terrible outlooks as a result.

Whats the unemployment rate? Inflation rate?

According to what I see, we're not there yet.

Posted on 4/17/25 at 12:06 pm to NC_Tigah

quote:

Why? Because we are not in a 4%+ FFR economy by recent standards.

Recent standards are the outlier, historically. We had cheap money from 2010-2023 despite a strong economy, and it resulted in extreme asset price growth (and now a housing affordability crisis in many areas) and ultimately severe inflation when faced with a shock to supply chains ignited further by stimulus.

Modern monetary theory has largely been discredited as a result.

This post was edited on 4/17/25 at 12:08 pm

Posted on 4/17/25 at 12:16 pm to Riverside

quote:

but the debt increases occurred primarily because of a virus intentionally created by the Chinese. We’re obtaining compensation for that now via the tariffs.

Do you think trump is the first politician to justify adding trillions of dollars to the national debt? They all have valid reasons. Just ask them.

Posted on 4/17/25 at 12:18 pm to PorkSammich

quote:

Trump nominated the cuck Powell.

SO!

Posted on 4/17/25 at 12:19 pm to Crowknowsbest

quote:

Modern monetary theory has largely been discredited as a result.

I sure hope so.

I remember when 5% was full employment (It still is in the real world) and now people panic if its over 4 and think something needs to be done.

Posted on 4/17/25 at 12:21 pm to SDVTiger

quote:That sounds horrible. What do you think caused the sudden downturn?

UE rate increasing. Retail sales will be very low next month. Negative GDP

Posted on 4/17/25 at 12:22 pm to BCreed1

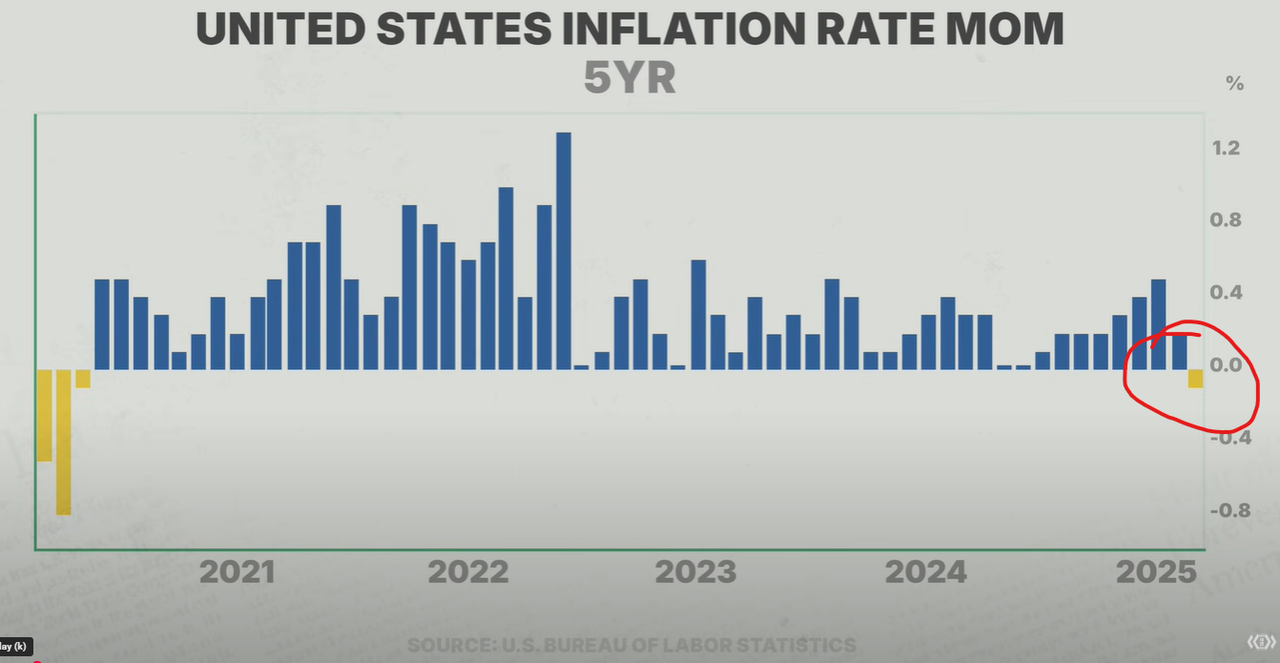

We are at 2.4%

Usually, they act when it falls under 2.

Usually, they act when it falls under 2.

Posted on 4/17/25 at 12:22 pm to Augustus516

Somebody may have already brought this up, but I don't think Trump can fire him, right? So, who can fire Powell?

Posted on 4/17/25 at 12:24 pm to mmcgrath

quote:

UE rate increasing. Retail sales will be very low next month. Negative GDP

That sounds horrible. What do you think caused the sudden downturn?

He will blame biden.

Posted on 4/17/25 at 12:26 pm to RogerTheShrubber

quote:

We are at 2.4%

Usually, they act when it falls under 2.

I see that you did not grasp what you saw.

Here it is again:

Posted on 4/17/25 at 12:29 pm to Augustus516

True or false, lower interest rates help long term investment like building new manufacturing plants in the US?

Posted on 4/17/25 at 12:29 pm to BCreed1

Damn, according to your chart, Joe Biden tamed Trumps inflation.

Damn.

Damn.

Posted on 4/17/25 at 12:29 pm to SDVTiger

We don't need this deranged old man having control over any more economic triggers. Dude is going to introduce the world to Recessflation if we're not careful.

Posted on 4/17/25 at 12:30 pm to Augustus516

I don't see how cutting rates will help anything right now. The dollar is trending down, bond prices may be about to trend down (bond yields higher), the news media is preaching recession. This would probably be a classic case of "pushing on a string" for the federal reserve, i.e., lowering short term rates would be ineffective and maybe counterproductive. Best to hold the line and if we get a recession, that alone could help reduce the trade deficit.

Unfortunately, using federal deficits to stimulate consumption may also be counterproductive and cause bond yields to rise faster. This is the quandary of our position, no more quick and easy solutions. Lower consumption is, in fact, part of the cure for our economy.

Unfortunately, using federal deficits to stimulate consumption may also be counterproductive and cause bond yields to rise faster. This is the quandary of our position, no more quick and easy solutions. Lower consumption is, in fact, part of the cure for our economy.

This post was edited on 4/17/25 at 12:34 pm

Posted on 4/17/25 at 12:31 pm to T-Mike

quote:I honestly don't know why- why would rates going down, not dramatically but somewhat knock us out?

Lowering interest rates now would be the a punch that knocks us out for a very long time. Anyone with basic economics 101 knowledge knows this.

Popular

Back to top

1

1