- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 5/28/25 at 12:38 pm to VoxDawg

quote:

Not sure how to break this to you, but ALL INCOME DOES NOT BELONG TO THE IMPERIAL FEDERAL GOVERNMENT.

Additionally - The Federal Government PRODUCES NOTHING

This has nothing to do with the actual discussion

The issue is not the tax cuts. The issue is a lack of spending cuts.

What happens when we collect less in taxes but keep spending like Biden? Does that increase or decrease the deficit?

Posted on 5/28/25 at 12:39 pm to Seldom Seen

quote:

Elon Musk is a bot now?

Posted on 5/28/25 at 12:44 pm to jbdawgs03

Our system of government finance is so complex it is nearly impossible to know what the truth is.

Posted on 5/28/25 at 12:45 pm to JimEverett

quote:And that $4 trillion is based on 1.8% growth; which is plausible... but still a guess.

The CBO says this bill will add an addition $3 trillion to the deficit. $4 trillion of that comes from keeping the status quo with respect to tax rates.

Therefore, the bill cuts some $1 trillion in spending over the next decade.

If growth is more than that then the $4 trillion (in deficit spending) goes down and the "spending number" goes down thus less added to the deficit.

Trumps request to Congress was based on 3% growth.

Posted on 5/28/25 at 12:47 pm to jbdawgs03

So the Big Beautiful Bill has actual decreases in spending?

Right?

Right?

Right?

Right?

Right?

Right?

Posted on 5/28/25 at 12:49 pm to JimEverett

quote:

Is what he saying incorrect?

In part.

At best, it’s a half-truth.

Posted on 5/28/25 at 12:51 pm to the808bass

What’s the actual truth?

Posted on 5/28/25 at 12:51 pm to I20goon

quote:

And that $4 trillion is based on 1.8% growth; which is plausible... but still a guess.

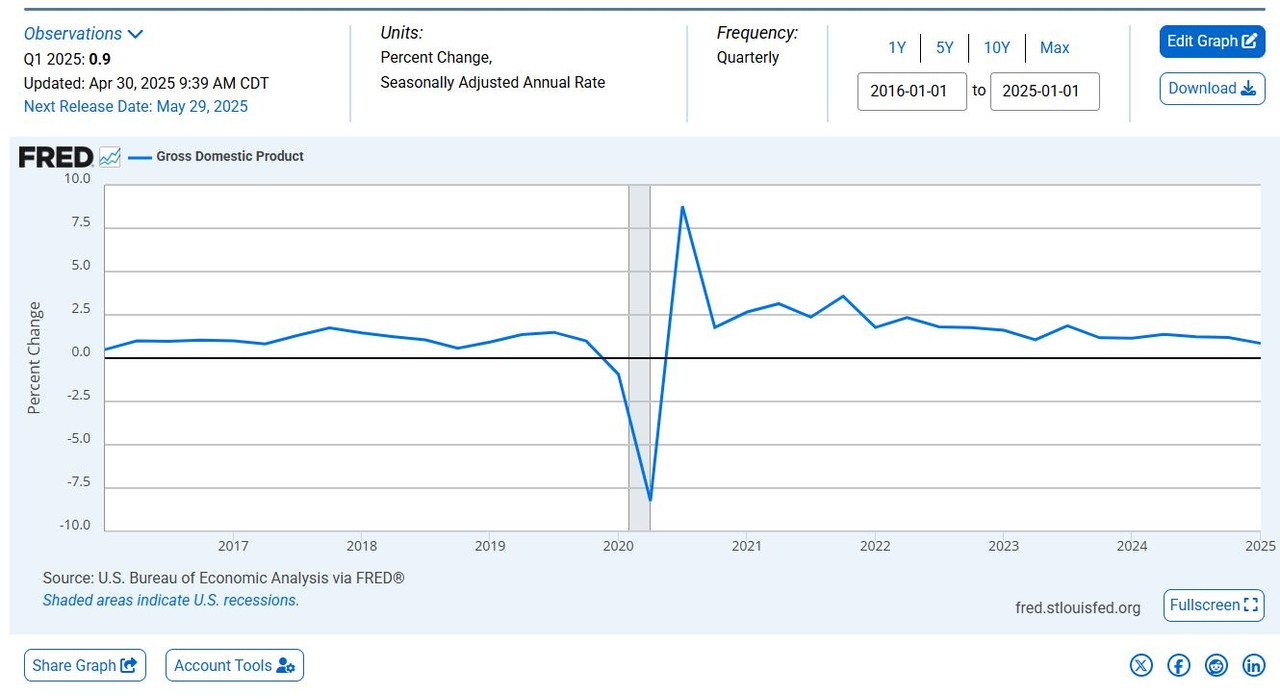

What was the pace before Covid and when did his first term tax cuts take effect?

Posted on 5/28/25 at 12:52 pm to SlowFlowPro

Sorry your candidate lost.

Posted on 5/28/25 at 12:56 pm to TrueTiger

quote:

Our system of government finance is so complex it is nearly impossible to know what the truth is.

That is a feature, not a flaw.

Posted on 5/28/25 at 12:58 pm to ReauxlTide222

quote:

What’s the actual truth?

Government is to big.

Saving a trillion over 10 years is chump change.

Sounds good though doesn't it.

Posted on 5/28/25 at 1:00 pm to RogerTheShrubber

quote:

Dudes turning into Trump's Goebbels.

A virtual spin factory

You would know. It is the primary function of the Democrat Party.

Posted on 5/28/25 at 1:07 pm to the808bass

It's part of the process.

DOGE cuts are to discretionary spending. (Eg the federal bureaucracy). Under senate budget rules, you cannot cut discretionary spending (only mandatory) in a reconciliation bill.

So DOGE cuts would have to be done through what is known as a rescissions package or an appropriations bill.

The Big Beautiful Bill is NOT an annual budget bill and does not fund the departments of government. It does not finance our agencies or federal programs. Instead, it includes the single largest welfare reform in American history. Along with the largest tax cut and reform in American history. The most aggressive energy exploration in American history. And the strongest border bill in American history. All while reducing the deficit.

DOGE cuts are to discretionary spending. (Eg the federal bureaucracy). Under senate budget rules, you cannot cut discretionary spending (only mandatory) in a reconciliation bill.

So DOGE cuts would have to be done through what is known as a rescissions package or an appropriations bill.

The Big Beautiful Bill is NOT an annual budget bill and does not fund the departments of government. It does not finance our agencies or federal programs. Instead, it includes the single largest welfare reform in American history. Along with the largest tax cut and reform in American history. The most aggressive energy exploration in American history. And the strongest border bill in American history. All while reducing the deficit.

Posted on 5/28/25 at 1:26 pm to RogerTheShrubber

quote:

A virtual spin factory

Are you legit retarded? For real question.

Posted on 5/28/25 at 1:31 pm to loogaroo

quote:1.8% is a better guess than 3%. The Inflation Reduction Act (i.e. green new deal) offset tax credits and spending with 6% growth, which was not even plausible, to show a deficit reduction.

What was the pace before Covid

quote:Jan 1, 2018

when did his first term tax cuts take effect?

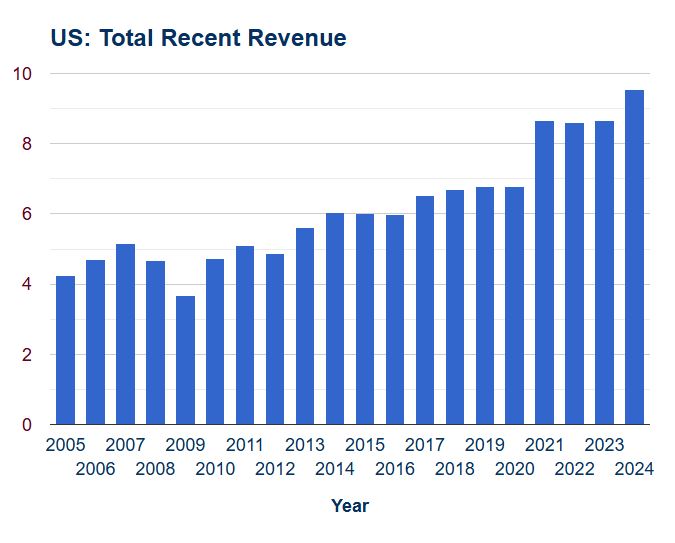

GDP didn't change much with tax breaks, but revenue didn't go down (up slightly) either. That wouldn't have affected the deficit by much, but did affect money in the private vs. public sector (slightly). Post Covid is a different story regarding revenues (as defecit increased). So yes, illustrative that we have a spending problem, which all know, but isn't 100% representative when you include the word "deficit". Spending in absolute dollars is the real problem.

Posted on 5/28/25 at 1:38 pm to jbdawgs03

Weird how I kept calling the bots/“conservatives”, libertarians. They all deny it. It’s either libertarians or liberals, they both use the same talking points. “Principled conservatives”

Posted on 5/28/25 at 1:38 pm to FATBOY TIGER

quote:No, not really.

Government is to big. Saving a trillion over 10 years is chump change. Sounds good though doesn't it.

Is the admin lying about the bill?

It shouldn’t be difficult at all to talk through what the bill actually does to the deficit and spending and “saving.”

We could do it in a thread here. If I have time this weekend I might give it a shot.

Posted on 5/28/25 at 1:39 pm to jbdawgs03

quote:That is entirely a lie.

This is based entirely on CBO claiming that extending the current tax rates (not raising them) will “cost” the government $4 trillion in revenue.

Estimates are the FY2026 budget will be $2T in the red. Even assuming Miller is right, the difference would be $400B/yr. So the FY2026 budget deficit would still be $1.6T. Unacceptable!

Popular

Back to top

2

2