- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

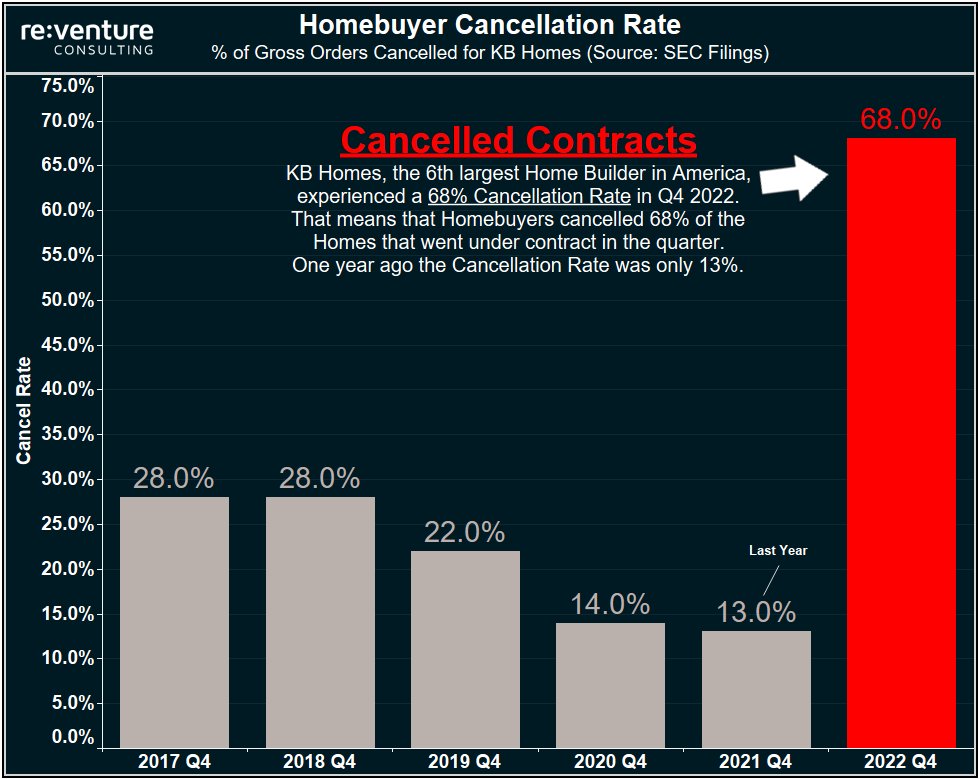

KB Homes just reported a 68% cancel rate. Their largest Q4 cancel rate in 6 years

Posted on 1/18/23 at 9:43 am

Posted on 1/18/23 at 9:43 am

2/3 of Homebuyers walked away from their contracts in the quarter leaving KB Homes with a massive pile-up of inventory. Q4 of 2021 the cancellation rate was only 13%

ETA: The cancel rate in 2008 peaked for many large builders at around 50%

Data from Zonda shows that National Quick Move-In Inventory is now around 32,000.

That's up 200% from one year ago.

And up 50% from pre-pandemic, 2019 level

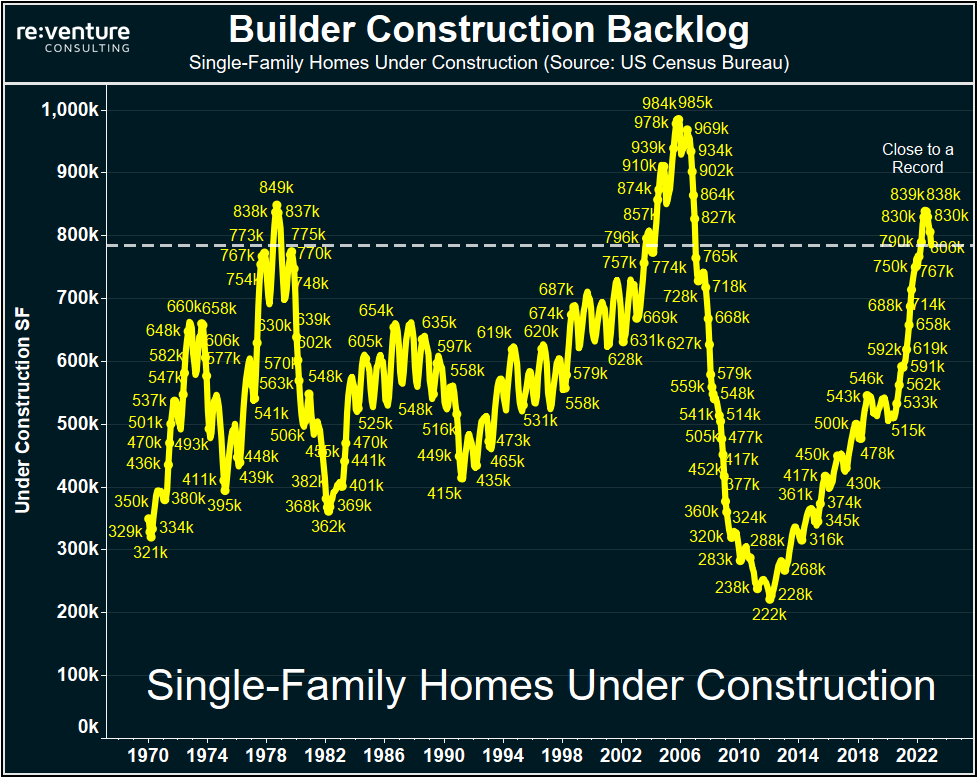

And there's even more New Homes coming in 2023.

Because even as builders have cut back on starts, they are still building nearly 800k single-family homes actively under construction.

Near the highest level of all-time. Many of which will hit the market in 2023.

In short, homebuyer demand is literally at its lowest levels since the 2008 crash and available inventory is only going to increase

ETA: The cancel rate in 2008 peaked for many large builders at around 50%

Data from Zonda shows that National Quick Move-In Inventory is now around 32,000.

That's up 200% from one year ago.

And up 50% from pre-pandemic, 2019 level

And there's even more New Homes coming in 2023.

Because even as builders have cut back on starts, they are still building nearly 800k single-family homes actively under construction.

Near the highest level of all-time. Many of which will hit the market in 2023.

In short, homebuyer demand is literally at its lowest levels since the 2008 crash and available inventory is only going to increase

This post was edited on 1/18/23 at 9:47 am

Posted on 1/18/23 at 9:47 am to stout

Supply and demand predicts that prices will drop. Let's watch and see.

Posted on 1/18/23 at 9:47 am to stout

What some don’t realize is even though their stock is up (DR Horton too), there is a 12 month or more lag in earnings. Current problems won’t hit books til later this year.

Posted on 1/18/23 at 9:47 am to stout

That’s a wild statistic!

Do you have a link?

I’d be interested to see if they’re reporting the (disaggregated) data by geographic locale.

Do you have a link?

I’d be interested to see if they’re reporting the (disaggregated) data by geographic locale.

Posted on 1/18/23 at 9:48 am to OU Guy

quote:

What some don’t realize is even though their stock is up (DR Horton too), there is a 12 month or more lag in earnings. Current problems won’t hit books til later this year.

Correct. Homebuilder stocks are still in a bubble off of the previous market demand. That will change within 6 months

Posted on 1/18/23 at 9:52 am to tokenBoiler

quote:

Supply and demand predicts that prices will drop. Let's watch and see.

i hope it goes to prepandemic prices...i shoulda built my house in 2019....ive been waiting for the crash because i knew it would happen

Posted on 1/18/23 at 9:56 am to stout

quote:They should have stuck with toys.

KB Homes

Posted on 1/18/23 at 9:58 am to stout

Thanks!

The data I was hoping to see don’t appear publicly available.

But KB’s website shows they’re located in the following states:

The data I was hoping to see don’t appear publicly available.

But KB’s website shows they’re located in the following states:

Posted on 1/18/23 at 10:04 am to stout

quote:

stout

Have you ever seen anybody measure bid-ask spreads on single family residential properties? I'm really curious as to what that looks like right now. Purchase market is dead.

Posted on 1/18/23 at 10:05 am to stout

Good, i've been needing home prices to drop.

Posted on 1/18/23 at 10:08 am to stout

I was told high prices were exclusively an inventory issue.

Posted on 1/18/23 at 10:12 am to stout

We've had the Fed set interest rates at zero for almost 20 yrs and QE for most of that time frame too. I'm not sure what's going to break and collapse, but real interest rates are going to break something.

Posted on 1/18/23 at 10:14 am to SlowFlowPro

quote:

I was told high prices were exclusively an inventory issue.

Real Estate is hyperlocal. In my market this would be correct but I can’t speak for other markets.

Posted on 1/18/23 at 10:40 am to stout

quote:

In short, homebuyer demand is literally at its lowest levels since the 2008 crash and available inventory is only going to increase

On a 30 year fixed mortgage ($240K loan), the total mortgage cost (payment through 30 years) at the lowest rate under Trump is $204,000 lower than at today's rate: $342K compared to $546K.

Monthly mortgage cost is nearly $600 more per month.

This post was edited on 1/18/23 at 10:44 am

Posted on 1/18/23 at 10:52 am to GoCrazyAuburn

Here in KC market the new homes are basically at a standstill on new homes. A boatload of new inventory. Resale homes are still in short supply and holding fairly strong. We bid on a home last month on the resale side. On the market 3 days.. I bid a few thousand over list with no contingencies. Not enough. 6 total bids. All over asking. They seem to be low on square footage price on the asking, and hoping to get people in the bidding war going upward. Seems to be the same interest as the past couple of years, the only difference is you may have 6 bids instead of 12.

Posted on 1/18/23 at 10:57 am to stout

shite. That’s even worse than I thought.

And I am a cynical a-hole.

And I am a cynical a-hole.

Posted on 1/18/23 at 10:58 am to KCkid

quote:

Resale homes are still in short supply and holding fairly strong

We have locked people into their affordable homes. Good luck to the buyers in 2022/2023. Their down payments are going to vanish without govy intervention.

Posted on 1/18/23 at 11:02 am to EKG

quote:

The data I was hoping to see don’t appear publicly available.

But KB’s website shows they’re located in the following states:

Yeah I imagine the cancellations are going to be much higher in markets that are almost entirely tourism based within the next 3-6 months as the consumer debt crisis starts to tighten discretionary spending.

Florida, Nevada and to a lesser extent California. And those baskets are where they’ve put a lot of their eggs. And those will get hit hard first when it comes to production homes.

This post was edited on 1/18/23 at 11:04 am

Popular

Back to top

23

23