- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

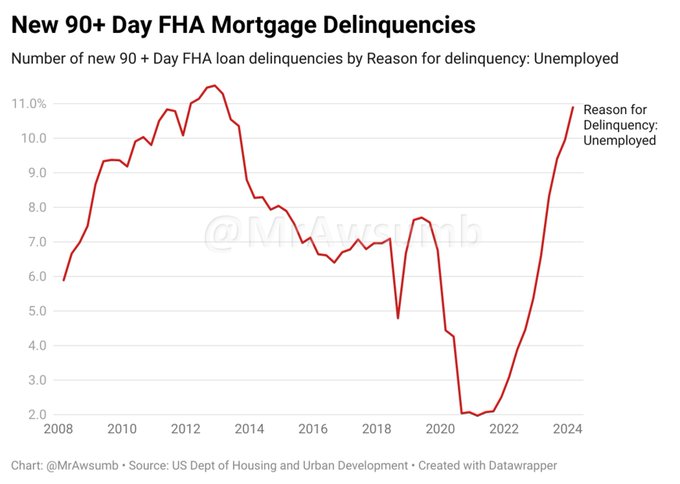

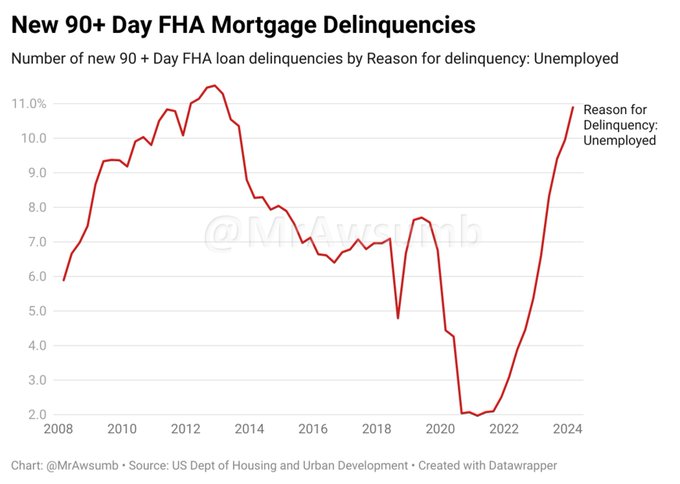

Is this bad? I was told no one was unemployed and the RE market was fine

Posted on 4/8/24 at 6:02 pm

Posted on 4/8/24 at 6:02 pm

Any day now the market will bounce back once rates drop!

Posted on 4/8/24 at 6:04 pm to stout

Hollywood people and RE agents are just skipping it and modifying

Posted on 4/8/24 at 6:11 pm to stout

We are in a recession. The government will not say it because they are funding credit to many to save their asses in government.

They figured that out under Obama during 2008-2009.

They figured that out under Obama during 2008-2009.

This post was edited on 4/8/24 at 6:15 pm

Posted on 4/8/24 at 6:12 pm to stout

But but the latest employment numbers.

Everything from this administration is a lie. I mean literally everything from every bureau.

Everything from this administration is a lie. I mean literally everything from every bureau.

Posted on 4/8/24 at 8:15 pm to chili pup

quote:

We are in a recession. The government will not say it because they are funding credit to many to save their asses in governme

They should get the word out to the millions of Americans living their best lives these days.

Posted on 4/8/24 at 10:21 pm to stout

quote:

I was told that no one was unemployed and the RE market was fine.

Democrats lie. The mainstream media spreads the lies. Only the naive and stupid believe them.

Posted on 4/8/24 at 11:52 pm to Motownsix

quote:

They should get the word out to the millions of Americans living their best lives these days.

This is the least affordable economic climate in my lifetime.

Posted on 4/9/24 at 1:13 am to stout

Don’t believe your lying eyes.

Posted on 4/9/24 at 1:18 am to Motownsix

quote:

They should get the word out to the millions of Americans living their best lives these days.

I am doing well, but in a different economic environment I would be living ridiculously well. I was talking with the wife that with our careers and positions in the past we would be affording a crazy luxurious lifestyle (like vacation properties, boats, rvs, etc.). Now the only people I know truly affording that are basically retired and had the items before the downturn.

Posted on 4/9/24 at 1:21 am to stout

What happened during 2016-2020 to make that rate plummet?

Oh, that’s right. Competency in office.

Oh, that’s right. Competency in office.

Posted on 4/9/24 at 2:34 am to stout

I don’t know if the economy is good, bad or otherwise, but that graph is not understood by the O.P. nor by most of the respondents. Mortgage delinquencies could be historically low and that graph still look that way, or they could be historically high.

That graph is just the percentage of delinquencies that are due to unemployment. The missing data is a graph showing the number of Delinquencies or the percentage of mortgages that are delinquent. If that is trending way up then it would be indicative of a bad economy.

That graph is just the percentage of delinquencies that are due to unemployment. The missing data is a graph showing the number of Delinquencies or the percentage of mortgages that are delinquent. If that is trending way up then it would be indicative of a bad economy.

Posted on 4/9/24 at 3:17 am to YipSkiddlyDooo

I wonder if that number included under employment where you are employed but not making enough to afford payments by now taking a lower paying job or working part time.

Another issue that is especially prevalent in the south and maybe even California your mortgage payments have increased due to increases in insurance (homeowners, flood, and earthquake) and property tax increases.

On top of the insurance increases, borrowing costs have doubled with interest rates increasing. Hopefully no one is dealing with an adjustable rate FHA loan or HELOC.

Also, how many borrowers are dealing with getting over extended with an increasing mortgage payment and they took on an overpriced auto payment for a new car or truck in the automotive shortage of 2021-2023.

Another issue that is especially prevalent in the south and maybe even California your mortgage payments have increased due to increases in insurance (homeowners, flood, and earthquake) and property tax increases.

On top of the insurance increases, borrowing costs have doubled with interest rates increasing. Hopefully no one is dealing with an adjustable rate FHA loan or HELOC.

Also, how many borrowers are dealing with getting over extended with an increasing mortgage payment and they took on an overpriced auto payment for a new car or truck in the automotive shortage of 2021-2023.

Posted on 4/9/24 at 4:20 am to stout

Just imagine how bad it would be if the government was not running trillion dollar deficits.

I blame Putin. *sarcasm*

I blame Putin. *sarcasm*

Posted on 4/9/24 at 7:13 am to stout

Actually, the rate of mortgages 90 days delinquent is lower now than during the Trump administration. Consumer financial Protection Bureau. What the OP’s graph shows is that one of the primary reasons for delinquency among the very small number that are delinquent is unemployment.

This is actually another sign of a very strong and healthy economy. Certainly better than the last administration.

This is actually another sign of a very strong and healthy economy. Certainly better than the last administration.

Posted on 4/9/24 at 7:20 am to chili pup

2008 was a real shite-show under Obama.

Posted on 4/9/24 at 7:22 am to TBoy

quote:

Actually, the rate of mortgages 90 days delinquent is lower now than during the Trump administration. Consumer financial Protection Bureau. What the OP’s graph shows is that one of the primary reasons for delinquency among the very small number that are delinquent is unemployment.

This is actually another sign of a very strong and healthy economy. Certainly better than the last administration

Leave it to you to rely upon an Obama/Dem created unconstitutional agency for rebuttal

Posted on 4/9/24 at 7:25 am to Colonel Flagg

quote:

that with our careers and positions in the past we would be affording a crazy luxurious lifestyle (like vacation properties, boats, rvs, etc.).

Man what a depressing thing to ponder

Posted on 4/9/24 at 7:31 am to Penrod

quote:

That graph is just the percentage of delinquencies that are due to unemployment. The missing data is a graph showing the number of Delinquencies or the percentage of mortgages that are delinquent. If that is trending way up then it would be indicative of a bad economy.

Oh you mean like this report showing that we are already way above pre CV levels and trending up monthly? Loss of income is the biggest reason given hence the chart in my OP. Your point is stupid though as that point alone has led to a significant increase in the 90-day late trend. This chart is FHA only FYI. No conventional loans are counted in it which is also trending up.

All of the data from 2020 is junk and should be thrown out. You have to compare to 2019 and prior to see the real trend. From about 2009 until 2019 foreclosures, 90 days later, etc were trending down yearly. That changed at the end of 2022

What's interesting is the amount of no contact has more than doubled. People aren't answering calls or the door when the bank sends a "mortgage inspector" out to try to make contact. The bank is trying to get these people into a loan modification program instead of foreclosing but people can't/won't even do that.

I do this for a living and I see it for all loan types. We are doing more evictions, initial secures, and final secures (meaning not even flippers are buying the house at auctions) than we were doing in 2017-2019. I didn't go back to check to see how much we were doing in 2016 and prior but I have been doing this since 2008 and I see the trends. I cover 14 states so my perspective is more than anecdotal.

LINK

This post was edited on 4/9/24 at 7:33 am

Posted on 4/9/24 at 7:32 am to chili pup

quote:

The government will not say it because they are funding credit to many to save their asses in government.

Been happening since 2009.

Posted on 4/9/24 at 7:33 am to TBoy

quote:

Actually, the rate of mortgages 90 days delinquent is lower now than during the Trump administration

You mean the junk data from 2020? You are a liar if you truly believe that.

It was all trending down yearly since about 2009. What happened in 2020 that changed that? Think really hard about it then get back to us, moron.

This post was edited on 4/9/24 at 7:34 am

Back to top

14

14