- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: In Matter of Days, Outlook Shifts From Solid Growth to Recession Risk

Posted on 4/6/25 at 8:26 am to roguetiger15

Posted on 4/6/25 at 8:26 am to roguetiger15

quote:

That jobs report says otherwise

So if the jobs report starts to show slumping numbers, is that a good indicator of a recession to you?

Posted on 4/6/25 at 8:41 am to theronswanson

when there is uncertainty companies/people stop spending. people have no idea what is going to happen with these tariffs. remember after 9/11, president bush told the people to go shopping. he even sent out tax rebates a few months later.

Posted on 4/6/25 at 9:45 am to dickkellog

quote:

i was sitting at a quotron on black monday in 1987 by 1989 we were setting new highs.

Posted on 4/6/25 at 9:47 am to CollegeFBRules

quote:

In order to avoid likely recession

What's the definition of this again?

Posted on 4/6/25 at 9:58 am to CollegeFBRules

if everything you quoted and linked were an image -

Posted on 4/6/25 at 10:07 am to CollegeFBRules

quote:

Outlook Shifts From Solid Growth to Recession Risk

quote:

JPMorgan’s head of economic research, Bruce Kasman, raised the probability of a global recession to 60% from 40%

So solid growth includes a 40% chance of recession even without tariffs?

Posted on 4/6/25 at 10:12 am to jrobic4

quote:

don't care if the market is down 10%, if my dollar gain 20% more purchasing power

You're going to be really upset when you find out part of the Trump plan is to weaken the dollar

Posted on 4/6/25 at 10:14 am to CollegeFBRules

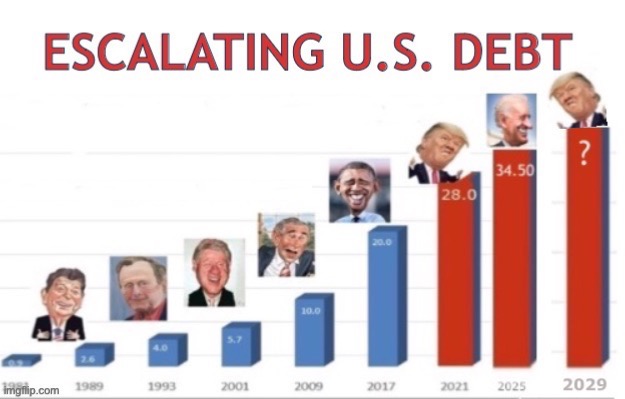

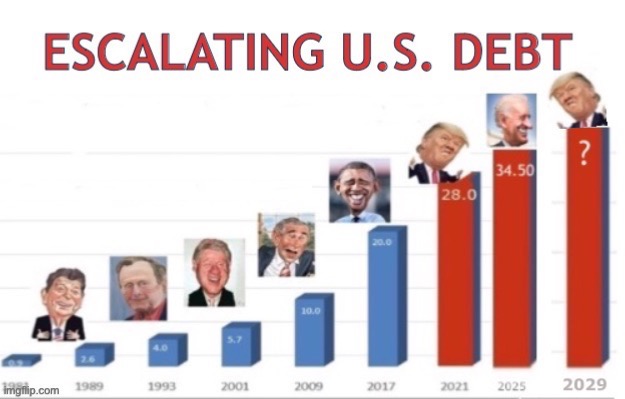

Sometime in 2024, our nation’s debt obligations exceeded defense expenditures. Regardless of your opinion on tariffs, the current trajectory is simply unsustainable:

Nothing — beyond a drastic course correction — can stop what is coming. Gravity will eventually take over and it will not be a soft landing for any of us.

Nothing — beyond a drastic course correction — can stop what is coming. Gravity will eventually take over and it will not be a soft landing for any of us.

This post was edited on 4/6/25 at 1:43 pm

Posted on 4/6/25 at 10:20 am to CollegeFBRules

quote:

vaporizing more than $6 trillion of wealth in two days.

So, fake wealth that never really existed. A Fugazi.

Posted on 4/6/25 at 10:22 am to CollegeFBRules

Our economy has been on a sugar high based on nonproductive government spending, waste, fraud and ideologically based blunders.

Posted on 4/6/25 at 10:27 am to CollegeFBRules

Good Lord, there are some dumb arse people in the forum now

Posted on 4/6/25 at 10:28 am to SECSolomonGrundy

quote:

Bunch of bullshite.

Solid argument and contribution

Posted on 4/6/25 at 2:10 pm to Auburn1968

quote:

Our economy has been on a sugar high based on nonproductive government spending, waste, fraud and ideologically based blunders.

And the most ideologically pernicious of these blunders is the historical fiction that printing money out of thin air is sustainable long term. Nothing fundamentally changes until we return to a sound monetary system — NOTHING.

Posted on 4/6/25 at 2:37 pm to Powerman

quote:Which part?

part of the Trump plan is to weaken the dollar

Posted on 4/6/25 at 2:51 pm to CollegeFBRules

No one is listening to you homosexuals any more.

You had your shot, and blew it. Pushed the pendulum waaaay too far.

America has rejected you and tuned you out.

You had your shot, and blew it. Pushed the pendulum waaaay too far.

America has rejected you and tuned you out.

Posted on 4/6/25 at 3:46 pm to Toomer Deplorable

quote:

And the most ideologically pernicious of these blunders is the historical fiction that printing money out of thin air is sustainable long term. Nothing fundamentally changes until we return to a sound monetary system — NOTHING.

But, but....tariffs bad and stuff.

Just keep kicking the can down the road. The road never ends. C'mon, man.

Popular

Back to top

1

1