- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: U.S. credit card debt stands at a record of nearly $1 trillion

Posted on 5/15/23 at 12:08 pm to BowDownToLSU

Posted on 5/15/23 at 12:08 pm to BowDownToLSU

quote:well thats not smart

Haven’t had one in over a decade.

Posted on 5/15/23 at 12:08 pm to WestCoastAg

quote:

well thats not smart

Maybe he doesnt like money

Hell ive gotten back like $1000 this year just from getting 4% cash on all restaurant and gas purchases

This post was edited on 5/15/23 at 12:11 pm

Posted on 5/15/23 at 12:14 pm to Corinthians420

I don't think that's what he had in mind. Nor did I

Posted on 5/15/23 at 12:20 pm to Bard

quote:

This is not the path to success.

Posted on 5/15/23 at 12:20 pm to Corinthians420

quote:

Hell ive gotten back like $1000 this year just from getting 4% cash on all restaurant and gas purchases

You seriously expect people to believe that you’ve spent $25K at restaurants and gas stations this year alone??

Well, this is The OT. Everyone has $100/person catered meals every night.

Posted on 5/15/23 at 12:21 pm to RLDSC FAN

Watch a documentary called Maxed Out

It’s crazy

It’s crazy

Posted on 5/15/23 at 12:28 pm to Dgarne2

quote:

Average balance of $5733 at over 20% APR. amazing

My 1st year of college I was living at home. VISA sends me a pre-approved card. Young, dumb and full of cum, I ran up 1500 on it and was paying the minimal $10/month.

My dad and I share the same name (Jr/Sr.) and parents mistakenly opened my credit card bill thinking it was their mail.

They sat me down and explained how it would be impossible to ever pay the card off by paying the minimal 10/month. They paid off the card and asked me to never use credit cards again.

That was 28 years ago and I have never owned a credit card since.

Posted on 5/15/23 at 12:33 pm to RLDSC FAN

My credit card debt is Zero

This post was edited on 5/16/23 at 11:41 am

Posted on 5/15/23 at 12:35 pm to Corinthians420

quote:

Gas isnt cheap

bullshite is free

Posted on 5/15/23 at 12:36 pm to RLDSC FAN

My balance is zero no credit card here

Posted on 5/15/23 at 12:37 pm to Corinthians420

quote:

Gas isnt cheap.

You driving a V12 400 miles every night to dinner?

Posted on 5/15/23 at 12:39 pm to carhartt

It isnt hard to spend $400 at a restaurant these days. Especially when you cover the check for multiple people. That is a bi-weekly expense

Posted on 5/15/23 at 12:40 pm to Double Oh

quote:

My balance is zero no credit card here

Why wouldn't you have one?

Posted on 5/15/23 at 12:45 pm to Mo Jeaux

I avoided them until I got wise. Paying it off every month and then banking points is a win in my book. Bills and groceries accrue them fast enough.

That said, can't be just one factor causing this problem. Inflation and medical bills I'm sure are creating hardship. The other issues I would imagine are ignorance and keeping up with a lifestyle. Both are fixable, but likely not changing until someone hits the wall.

That said, can't be just one factor causing this problem. Inflation and medical bills I'm sure are creating hardship. The other issues I would imagine are ignorance and keeping up with a lifestyle. Both are fixable, but likely not changing until someone hits the wall.

Posted on 5/15/23 at 12:50 pm to Corinthians420

quote:

Especially when you cover the check for multiple people. That is a bi-weekly expense

Why are you buying other people dinner twice a week at $400 a pop?

Posted on 5/15/23 at 12:54 pm to Weekend Warrior79

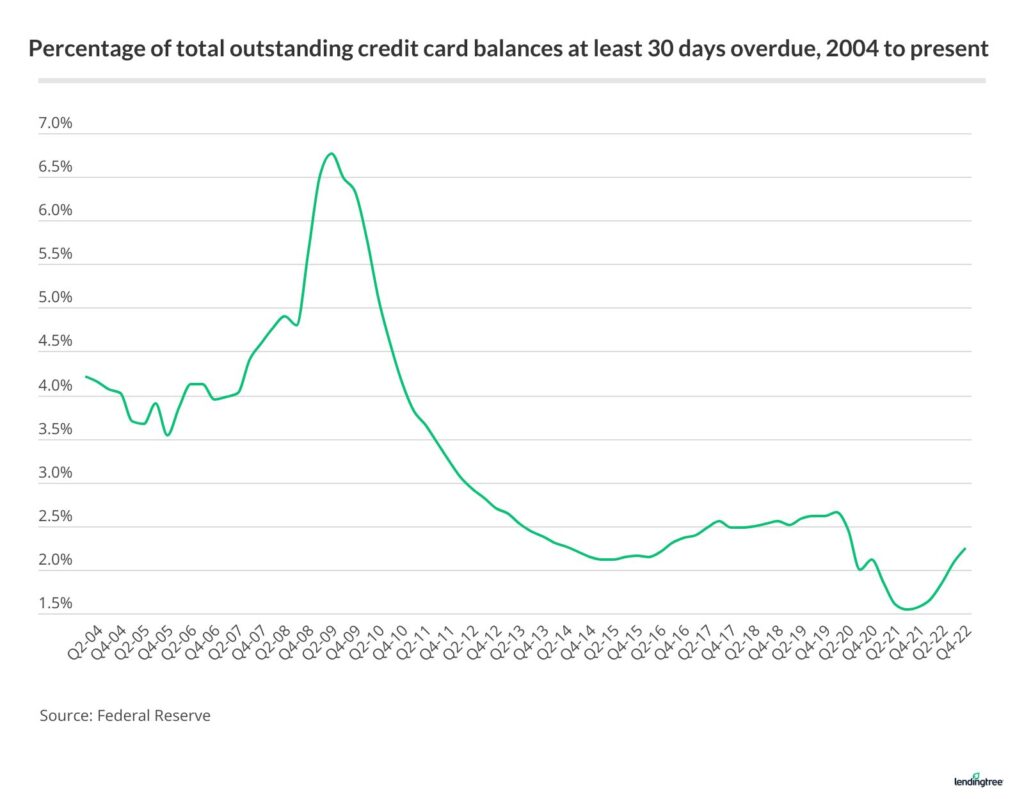

quote:

What the hell happened in 2010 that caused that jump?

No idea. Normally a spike like that is due to a change in how they compute the outcome. When that happens though they'll often end that series and start a whole new one (see: the old M1).

quote:

Any idea if this is carrying balance, or does it also factor in those that run up a couple grand on credit cards every month, then pay them off on the statement due date?

I think it's total balance (ie: both of your categories). Just from a quick glance at a few sites, it seems slightly over half of credit cards used carry a balance (thus, slightly less than half pay off their balance every month). That averaged carried balance (for FY2022) was ~$7,200.

Full disclosure: we're still below the historical average on past dues and defaults.

Posted on 5/15/23 at 12:57 pm to Bard

After seeing that graph whoever downvoted me sayin it was probably a hangover from the 08 collapse should be institutionalized.

Especially considering that people likely had some money saved up from the great economy we had experienced leading up to 2008.

Especially considering that people likely had some money saved up from the great economy we had experienced leading up to 2008.

Posted on 5/15/23 at 1:02 pm to Corinthians420

Went on vacation and paid everything on a Discover card that carries a 0% interest rate for a year and half. But that thing has a balance of $5300 right now. I could pay it all off tomorrow, but why bother with the zero interest?

Posted on 5/15/23 at 1:14 pm to DakIsNoLB

quote:

That said, can't be just one factor causing this problem. Inflation and medical bills I'm sure are creating hardship. The other issues I would imagine are ignorance and keeping up with a lifestyle. Both are fixable, but likely not changing until someone hits the wall.

Exactly. Inflation and wages not keeping up with it. Not everyone is OT rich.

Popular

Back to top

1

1