- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: The average monthly car payment is $745 for new cars and $521 for used

Posted on 6/10/25 at 6:34 am to NYNolaguy1

Posted on 6/10/25 at 6:34 am to NYNolaguy1

quote:

have never understood wanting to finance long term on a depreciating asset that has no deductible depreciation

What happens when your older car finally gives up the ghost and you don’t have $50k lying around to pay cash for a vehicle?

Posted on 6/10/25 at 6:35 am to Oilfieldbiology

You buy a beater, aka a car you can afford

Posted on 6/10/25 at 6:39 am to 777Tiger

quote:

udderly clueless

Probably lack of fat and protein in his diet from his lactose intolerance

Posted on 6/10/25 at 6:47 am to Weekend Warrior79

quote:

Imagine paying $750 a month for a car over 7 years.

That's only 63,000 for vehicle, tax and interest. That's sadly about what a family would pay for a decently equipped Toyota Highlander

Posted on 6/10/25 at 7:14 am to Cuz413

I guess I got a decent deal then.

I bought a new 2024 vw Tiguan that I pay 466 a month for with gap insurance and 1.9% interest

I’m also a single parent so I don’t need an additional vehicle

I bought a new 2024 vw Tiguan that I pay 466 a month for with gap insurance and 1.9% interest

I’m also a single parent so I don’t need an additional vehicle

Posted on 6/10/25 at 8:16 am to RLDSC FAN

I just take the bus or stay home

Posted on 6/10/25 at 8:19 am to CAD703X

Reverse mortgages are very similar

Posted on 6/10/25 at 8:55 am to Oilfieldbiology

quote:

What happens when your older car finally gives up the ghost and you don’t have $50k lying around to pay cash for a vehicle?

1. Most of the people paying cash for a car aren't buying $50k cars. That's one of the main reasons people pay cash for cars - it acts as a control or limit to impulsive spending and gets them what they need instead of what they want.

2. A lot of people who pay cash for cars put money aside in a separate "new car" account that earns interest/growth while they drive their current car. It's essentially just a different way of doing what the finance advocates do when they claim "why would I pay cash when that money could be earning more that the 1.9% APR well qualified financing promotion?" They're doing the same thing, just before not after and then not having to deal with the paperwork, hassle and interest fees.

Posted on 6/10/25 at 9:54 am to cubsfan5150

quote:

Must’ve been a single cab base model.

Probably not. Trucks were cheaper back then. They had cheaper feeling interiors but there wasn't an expectation that they were giant cowboy cadillacs either. It's not weird to see fancy pickup trucks - but the quantity of them is kind of astounding. It's rare to see the stripper models or even the mid tier trim levels around anymore. The $60,000+ models with a full leather interior, massive limo-like back seat, and 400 hosepower engines are starting to become the normal pickup truck found on American roads, not a rare exception.

This is going to sound preachy, but I'd probably be one of those people that is over leveraged and barely saves for retirement if not for a couple of big factors: My parents (and my dad in particular) are notoriously tight spenders to the point where it's potentially unhealthy. That's honestly the best inheritance I could get - the matra that fancy cars or boats are not really necessary in life. And at some point I read "The Richest Man in Babylon" and "Millionaire Next Door". They had an impact on me as well. I'm also lucky that my wife also shares this mantra.

For those of us that were not born with a huge chunk of land or trust fund to lean on....it's hard to build wealth if you are buying a new Range Rover every few years. Cars are wealth killers - the goal should be to buy something that will last and provide the least negative impact on the growth of your net worth while meeting your space, efficiency, and safety requirements. IMO practical, affordable cars like the Toyota Corolla, Chevrolet Colorado, and Honda Ridgeline should be more popular than they are - but they are outsold regularly by more expensive vehicles.

My wife and I are easily in the top 1% of earners in our area, but we drive fairly modest cars, live in a spacious but otherwise normal house, and we usually wear Wal Mart clothes. We are VERY price sensitive. We make blunders sometimes and I wish we had more time to allocate to even tighter budgeting. We've found that the "pay yourself first" method is a good way to control spending and apply psychological pressure to ourselves while also setting aside cash for other wealth-building opportunities.

To be 100% clear, I'm not criticizing people with different priorities from me even though it sounds like that. The whole "you only live once" thing is real, and you should not feel guilty about buying nice things if you want them after working hard for them. In fact I think terms like "mid life crisis" is total bullshite. If you want a boat, buy a boat.

But I am always surprised at the absolute lack of "low key" millionaires in my age group. They exist, but it's extremely rare. Very few people are low key about anything these days. That's been a trend everywhere we lived. And it's real for both men and women.

Posted on 6/10/25 at 9:56 am to mylsuhat

quote:

You buy a beater, aka a car you can afford

Yeah, I grew up fairly working class, I dont think I could ever accept a $750 car note.

I'd figure out another way to get where I needed to go. Beaters are fine if they get me to point B.

Posted on 6/10/25 at 10:00 am to BHM

quote:

That's only 63,000 for vehicle, tax and interest. That's sadly about what a family would pay for a decently equipped Toyota Highlander

What you just pointed out is throwing a wrench into one of my strategies to avoid overly expensive new vehicles: I try to keep my cars a long time, but I also want to try to avoid having my newer vehicles grow in size and cost over the old ones that they replace. So when my car does wear down and need to be replaced eventually, I'm highly likely to just buy the same make/model as I did before or a near-direct competitor.

I'm not interested in buying a new vehicle now, but the Toyota 4Runner I bought 5 years ago would cost $17k more if I got the exact same trim level, color, and options in a new one today. There is clearly a lot of inflation in the automotive sector in the past 3-4 years.

This post was edited on 6/10/25 at 10:24 am

Posted on 6/10/25 at 10:08 am to dewster

quote:

But I am always surprised at the absolute lack of "low key" millionaires in my age group.

Well, they are low key, you expect them to tell you their net worth?

Posted on 6/10/25 at 10:16 am to RLDSC FAN

quote:

The average monthly car loan payment in the U.S. is $745 for new vehicles and $521 for used ones originated in the first quarter of 2025, according to credit reporting agency Experian.

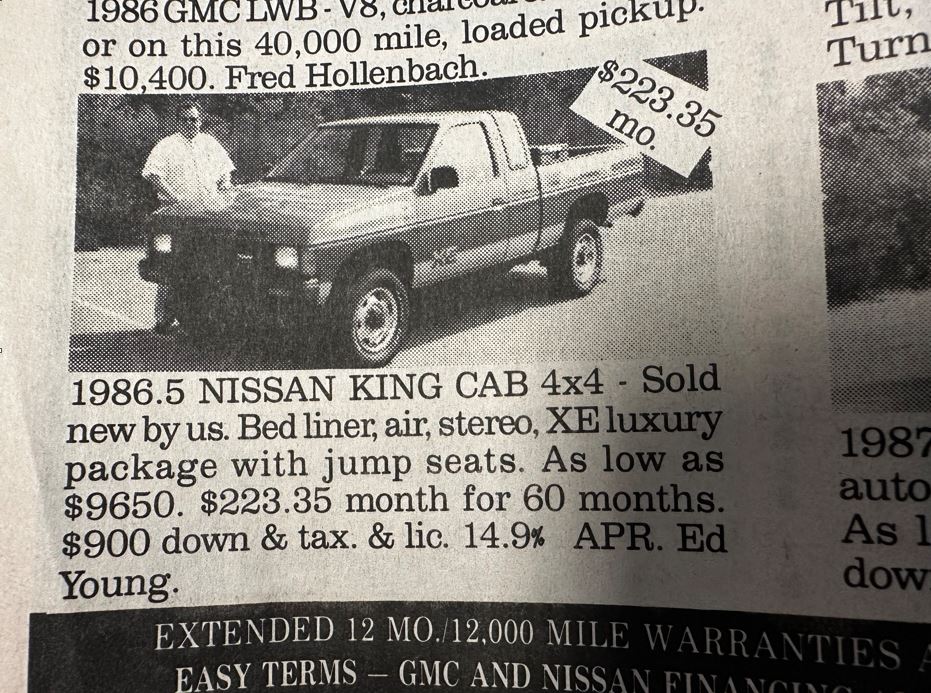

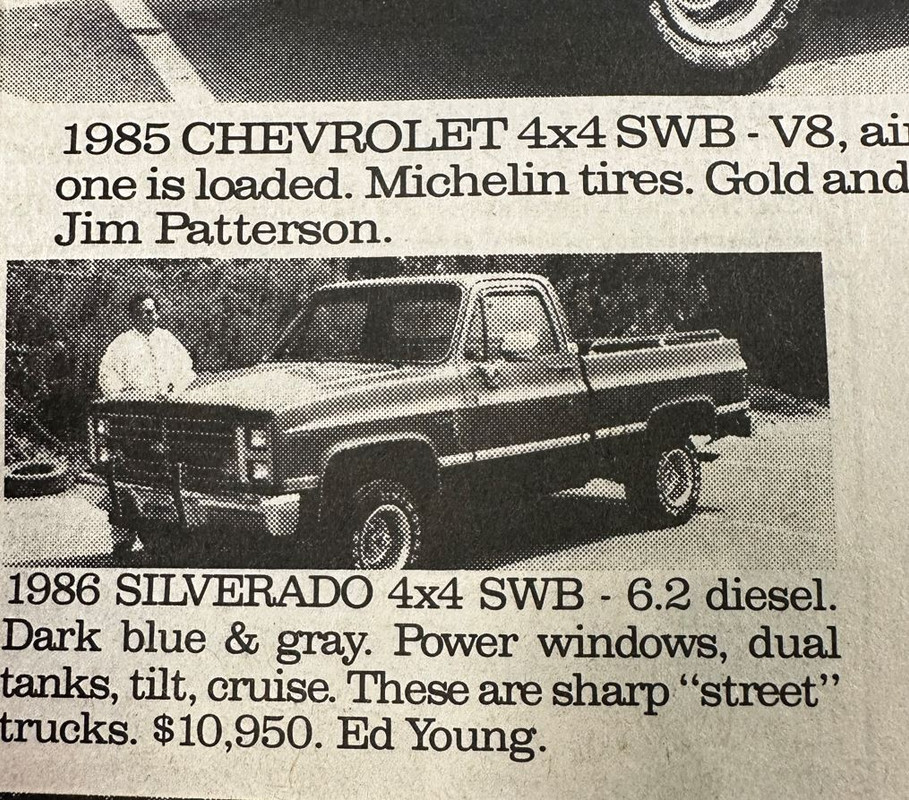

Still cheaper than 1988. That $223.35 in 1988 after adjusting for inflation is about $604. And check out the interest rate, 14.9% By the time you add the $900 down and the 60 payments, they made about $5000 profit over the asking price.

from this magazine I found at my parents house this past weekend.

and who remembers 1986 Silverado's with 6.2 diesel.

Posted on 6/10/25 at 10:20 am to DiamondDog

quote:

0% we pay financing it.

Finance the big purchases if you can get low rates. I absoultely do that if it's avaialble. It won't draw me into buying a new car when I don't want or need one, but it might influence my decision to buy a particular make/model over another.

I'm not in the market for a new car, but I'd be surprised if there were many aggressive financing deals out there right now like there were 4-5 years ago.

Are car sales down in general? Seems like financing costs going up from historic lows has impacted housing more than the car market, but I could be wrong.

This post was edited on 6/10/25 at 10:23 am

Posted on 6/10/25 at 11:27 am to ChestRockwell

quote:

Because idiots who make 30k a year

Who actually makes only 30k?

Posted on 6/10/25 at 11:30 am to AwgustaDawg

quote:

Insanity

Sure as hell is. What I wouldn't do for a thrifty, reliable no-frills jeep or truck.

Posted on 6/10/25 at 11:55 am to RLDSC FAN

$684/month for me 48 months left. Good thing my wife's (no pics) car is paid for.

Posted on 6/10/25 at 12:03 pm to bbarras85

A $750 car payment today is the same as a $400 car payment in the year 2000.

Posted on 6/10/25 at 12:03 pm to CAD703X

quote:These were common all over the country in early 2000's. You could get interest only mortgage, zero down, and a "no doc" closing. If your credit was decent, you were approved - no proof of income or anything else needed. No wonder the market collapsed.

Doesn't CA offer interest only mortgages where you never actually pay down the house?

Posted on 6/10/25 at 12:04 pm to DesScorp

Got a 2010 6cyl Wrangler 2-door, stick, hardtop, 29,000

No paintwork, garage-kept. AC, cruise, CD (lol).

It was used as a TOAD, so it may have 5K more miles on the rolling chassis. TOAD with engine off, obviously.

I intend to get top-dollat for it.

No paintwork, garage-kept. AC, cruise, CD (lol).

It was used as a TOAD, so it may have 5K more miles on the rolling chassis. TOAD with engine off, obviously.

I intend to get top-dollat for it.

Popular

Back to top

2

2