- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Salaries vs inflation

Posted on 6/3/25 at 10:37 am to LaLadyinTx

Posted on 6/3/25 at 10:37 am to LaLadyinTx

quote:

These are all in their 30s. In fact, most millennials are in their 30s. 29-44 to be exact. I knew all these millennials when they were in college because they are my kids age. The mostly were getting this stuff immediately after or before marriage. If they lived in an apartment it was when they were single and they still all looked like they had all the things. Upon marriage, they immediately bought the 4 bedroom house and went on 2 big vacations a year.

Nobody is in the pockets of an acquaintance more than the OT

Posted on 6/3/25 at 10:40 am to tiger rag 93

I said decent medical school. Tufts for example after residency the debt is roughly 500k in 2023. Your loans being only 160 says a LOT. You’re out of touch

Posted on 6/3/25 at 10:42 am to BabyTac

quote:

Moving all my assets to cash

Posted on 6/3/25 at 11:06 am to LaLadyinTx

quote:

Upon marriage, they immediately bought the 4 bedroom house

if they bought pre-2020, stretching the budget on the house was a fantastic decision. Probably the biggest mistake of my life was not jumping on a house that was 50k over my budget but in a great school zone and is now worth 400k more than what it was listed at. We obviously didn't see covid happening and opted for something smaller as a starter home

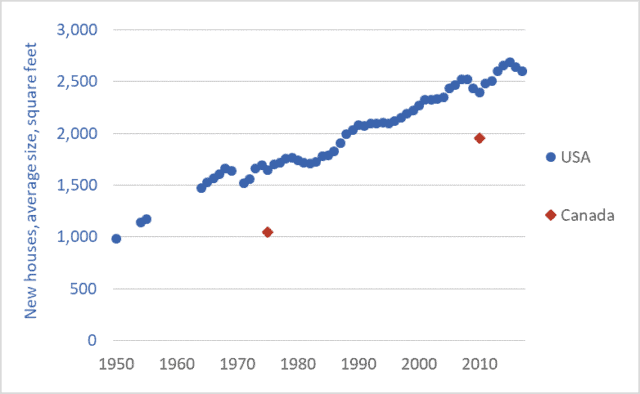

The vast majority of my millennial peers that I know personally started in 3/2 sub-2000 sq ft houses, even those pulling in $200,000+. Many of which, myself included, are locked into those properties due to rates and housing inflation.

Complain all you want about people "wanting a big house," but that is pretty much what is on the market. From the 80s on, we didn't build smaller houses. The smaller homes tend to be more per Sq ft because they are closer to city centers and jobs.

This post was edited on 6/3/25 at 11:07 am

Posted on 6/3/25 at 11:15 am to Dire Wolf

Smaller homes are more per sq ft because they cost more per sq ft to build, apples to apples.

Posted on 6/3/25 at 12:25 pm to fareplay

quote:

I said decent medical school. Tufts for example after residency the debt is roughly 500k in 2023. Your loans being only 160 says a LOT. You’re out of touch

You’re shaming people for the medical school that they went to? Your $500,000 doesn’t match Tufts’s disclosures (assuming they are accurate).

Posted on 6/3/25 at 12:29 pm to Scruffy

quote:

Wait, $200k (what it should be with inflation) is “comparable”, but only ~$35,000 less than what it actually is?

$35,000 is just a paltry sum of money.

I’m glad they are bringing the word “retard” back.

The guy said “around” $160,000. I’m also riffing on the difference between $235,000 and $500,000, which is the number everyone is focusing on in this thread. So, yeah, $35,000 isn’t much in comparison to the $265,000 difference. I’ll try to be more detailed for the retard, Scruffy, next time.

This post was edited on 6/3/25 at 12:30 pm

Posted on 6/3/25 at 12:54 pm to BabyTac

fricking boomers are the worst generation in the history of America, hell the history of civilization, and its not close.

Posted on 6/3/25 at 12:56 pm to BabyTac

quote:

Won a bass boat in a tourney, but price for signature Skeeter was $30k

El oh el

Posted on 6/3/25 at 1:01 pm to saintsfan1977

quote:

I didn't know welders, plumbers, and electricians needed a college degree. The more you know..

you don't think a lot of them are struggling as well?

Posted on 6/3/25 at 1:08 pm to Solo Cam

They’re not 20% but I get the gist of what you’re saying.

There has to be a minimal amount of interest applied to keep the government from losing money on interest but in no way should it be even a hundredth of a percent more than whatever the inflation rate is.

There has to be a minimal amount of interest applied to keep the government from losing money on interest but in no way should it be even a hundredth of a percent more than whatever the inflation rate is.

Posted on 6/3/25 at 1:08 pm to Loup

quote:

you don't think a lot of them are struggling as well?

I wouldn't think so. They all have job security.

Posted on 6/3/25 at 1:09 pm to Solo Cam

quote:

"whatever your initial principles on your student loan is what you should pay back, all interest to be cancelled and forgiven,

I'd be all for a compromise like that. One thing that drives me nuts about the student loan forgiveness sh*t is that they want to people's loans to disappear but nothing would get done about how the loans are given out in the first place. An 18 year old can't even rent a car but they can sign up for 100k in debt for a degree that has no demand. It's ridiculous.

Posted on 6/3/25 at 1:12 pm to jizzle6609

quote:

I found out later on in life my parents actually cared for us lol.

Didn’t realize most people’s parents cared more about their cars and shirts than their kids.

Yup, same here. My parents are amazing. My dad lived well below his means to not only be able to help us through college but also to have a decent retirement and enough money so that we never have to worry about supporting them.

Posted on 6/3/25 at 1:14 pm to pelicansfan123

quote:

I get a measly "cost of living raise" every year which doesn't come close to accounting for the ridiculous prices in the city where I'm employed. Not to mention my company is taking away perks, increasing micromanagement, and not listening to us ground-level employees actually doing the work on a day to day basis when making decisions. Not to mention the amount of administrative work I have to do has increased exponentially in the past year. And they wonder why people are burnt out and annoyed. It's like, seriously, I know we're not supposed to talk about salaries at work, but especially in 2025, I'm not getting paid enough to deal with this crap.

I hear you. But the cost of doing business has gone up. You should maybe open your own business. See what it’s like.

Admin? You can thank all the red tape. Rules and regulations.

Posted on 6/3/25 at 2:07 pm to Loup

quote:Hell I would’ve been all ears for some level of forgiveness (not complete forgiveness but partial) that came with an overhaul of the loan/college system. At least that way we’d be guaranteed to save money as a country down the road

I'd be all for a compromise like that. One thing that drives me nuts about the student loan forgiveness sh*t is that they want to people's loans to disappear but nothing would get done about how the loans are given out in the first place. An 18 year old can't even rent a car but they can sign up for 100k in debt for a degree that has no demand. It's ridiculous.

Posted on 6/3/25 at 3:00 pm to Mo Jeaux

quote:

You’re shaming people for the medical school that they went to? Your $500,000 doesn’t match Tufts’s disclosures (assuming they are accurate).

This is what he does around here. Makes ridiculous troll posts and takes idiotic stances. He purposefully picks one of the most expensive medical schools in the nation and then uses a number that’s nearly double their published average student loan debt for a graduating student ($259,000). He’s a terrible troll.

Posted on 6/3/25 at 4:32 pm to Loup

quote:

Yup, same here. My parents are amazing. My dad lived well below his means to not only be able to help us through college but also to have a decent retirement and enough money so that we never have to worry about supporting them.

Your dad is a beast brother. That’s a real man quite honestly.

I knew my parents were awesome but I didn’t know until I had conversations as an adult with friends on how disconnected families are.

Regarding money I think my dad just learned what not to do when he was young by watching his father and I think he was just blessed with wisdom especially in understanding the long game and the keeping up with the jones’s nonsense.

To be perfectly honest the one thing he said that has always stuck was he grew up poor with a dad that drank and gambled and sometimes food wasn’t guaranteed.”son I will tell you this, I will never go hungry, ever again. Ever. I mean that.”

Now he’s also traveled what world in the military and seen his share of misfortune so he probably doesn’t take anything for granted.

Posted on 6/3/25 at 4:34 pm to Frac the world

fricking boomers are the worst generation in the history of America, hell the history of civilization, and its not close.

100% agree, depending on what side of the boomer coin you got.

Many of us are thankful for them.

100% agree, depending on what side of the boomer coin you got.

Many of us are thankful for them.

Posted on 6/3/25 at 4:41 pm to Dadren

quote:

house twice the the size

Be nice to be able to buy something 1200-1400 sqft in a decent neighborhood. They might not want or need something huge.

quote:

feature packed

I don't have any interest in being able to plug my phone into a digital screen on my dashboard. I'd prefer to have a less expensive option.

Popular

Back to top

0

0